Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

The Comprehensive eToro Australia Review: Fees, Features, and Everything You Need to Know

If you’re new to the world of investing and trading and you want a platform that makes it easy, eToro is the place to go. To simplify, eToro is an investment platform based in Australia and is used across the globe. With plenty of features to make life easier, it’s no surprise that eToro is as popular as it is.

One of the biggest reasons for this popularity is the platform’s easy-to-use interface and social features. Whether you’re a beginner or a more experienced trader, this platform is a great place to explore and see if it’s the right fit for you. Of course, you’ll need to do your homework first, and in this eToro Australia review, we’ll tell you everything you need to know. From there, you can make your decision and look toward a future of profitable trades and investments.

TL;DR

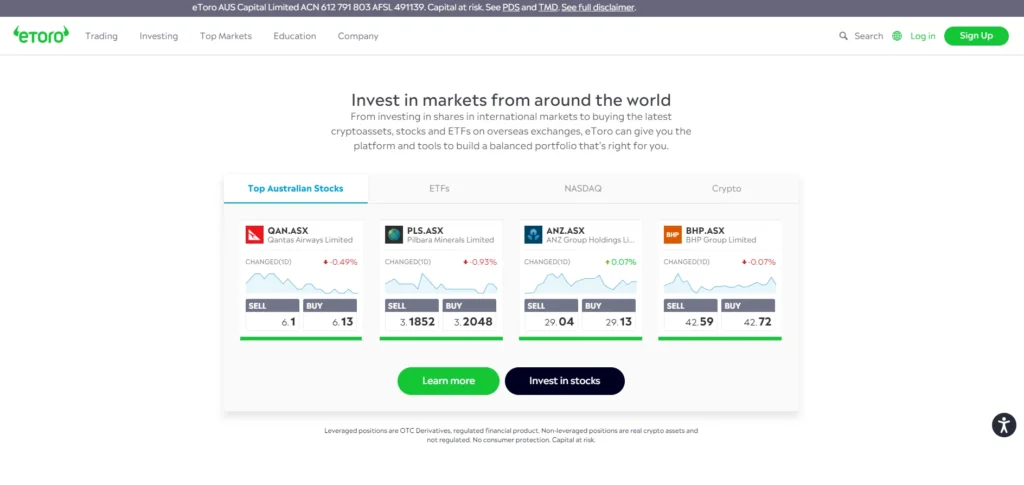

- The eToro Australia platform is a multi-asset investment site which offers ETFs, stocks, forex, cryptocurrencies and a whole lot more.

- The most popular feature is social trading, which helps users imitate the tactics and trades of top investors.

- eToro Australia has a very user-friendly design and also includes a range of resources to help educate beginner investors.

- The biggest downside is the eToro fees. These can be substantial, especially for accounts not in USD. You have charges for currency conversion to thank for that.

- eToro brings peace of mind as it is regulated by the highest quality authorities, including ASIC in Australia.

Criteria Breakdown

Before deciding whether to use eToro Australia, it’s important to assess its key features alongside stringent criteria. In doing so, you can be sure that the platform suits your needs and investment goals. Ultimately, you need to be sure that you’re using a site that not only gives you an opportunity to profit, but one that also prioritises your online safety.

To help you out, let’s explore the critical factors that make eToro what it is, and explore its suitability for different investors and traders. As you read through, bear in mind your own goals and expectations.

What is eToro Australia?

What is eToro Best Known For?

eToro has gained recognition worldwide and it’s mostly down to its social and copy trading features which are highly innovative and very easy to use. Users are able to first watch and learn from successful investors and then copy their tactics for their own gains. Of course, this entire strategy helps beginners to learn from the best, therefore standing them in good stead in their future investment endeavours.

Additionally, eToro is renowned as a tool for beginners to learn from. The eToro Academy will help even total novices grow into successful traders.

Features

The eToro platform offers a huge range of different features and these are useful for both beginners and more experienced traders. It’s important to assess the features before making a decision, to ensure they fit with your financial goals and aspirations. The standout features include:

- CopyTrader: This feature replicates trades carried out by successful investors and eToro brokers, leading to future profitability.

- Multi-Asset Trading: Allows users to trade with different assets, from ETFs to stocks, forex to cryptocurrencies, and even commodities. This flexible approach is particularly beneficial for beginners.

- Social Feed: eToro’s social aspects are impressive and the newsfeed is one of them. Here, users can stay up-to-date with market moves and insights, while also learning from the trading strategies of other users.

- Virtual portfolio: To cut down on risk, this feature allows users to practice their strategies with a virtual portfolio. It’s basically a trial run that has zero risk and helps to boost confidence along the way.

- eToro Academy: The eToro app offers a huge range of resources including webinars and tutorials, enabling beginners to learn and add new skills to their trading and investment armoury.

Pros

User-Friendly Interface

The first standout advantage is the easy-to-use interface that is compatible with the use of a VPN. Making your first moves in the trading and investing world can be confusing, but the platform makes it easy for beginners to get started. The entire layout is clear and it doesn’t take long to understand the key features by moving around the site with ease. There is also a distinct lack of complicated language throughout the site, which is ideal for anyone who is just finding their feet in the investment world.

Innovative Social Trading

Social and copy trading are two of eToro’s biggest features and this is what makes the platform different from other brokers you’ll come across online. Beginners can easily connect with more experienced traders and copy their strategies. As a result, new users not only set themselves on the path to future profit, but they also learn as they go, increasing their potential.

Extensive Educational Resources

A huge part of investments and trading is learning the ropes and the eToro Academy is a fantastic collection of resources for beginners. This includes guides, webinars, and tutorials on a range of key subjects. While more experienced traders may not benefit from these resources, those with less experience can top up their knowledge and keep abreast of new developments.

Cons

High Currency Conversion Fees

Perhaps the biggest disadvantage of using eToro is the high fees for currency conversion. Commissions aren’t charged on ETFs and stock trades, but for those with accounts not in US dollars, the currency fee can be quite hefty, therefore cutting into potential profits. Nobody enjoys paying fees for no particular reason, so this is certainly one of the biggest issues with the eToro platform.

Limited Customer Support

eToro offers customer support but its range is quite limited, with no phone support on offer. There is a live chat feature but this isn’t available 24 hours a day, meaning those with issues may have to wait until later to have their problems resolved. In the fast moving world of trading and investments, a slow approach could be the difference between profit and nothing at all.

Criteria Evaluation

Asset Variety 4/5

The platform offers a range of different assets that users can trade in, including commodities, ETFs, stocks, and cryptocurrencies. However, this isn’t the most extensive range of assets on the market and some more experienced traders may prefer to opt for a site that gives them a wider choice. For beginners, however, the assets on offer are more than sufficient.

Fees and Commissions 3/5

This is where we have good and bad. As we mentioned earlier, there are no commission charges on ETF and stock trades, which is a positive. However, there are quite high conversion fees on non-US dollar accounts. This also extends to other assets such as cryptocurrencies and forex.

This is a problem for some and not for others, so it really depends on your individual situation and your bank account.

Trading Platform 4/5

The platform itself is very easy to use and extremely intuitive so beginners will be able to explore the site without feeling overwhelmed. The downside is that more experienced traders may prefer other platforms that offer more features and customisation ability. Again, this may bother some people and not others, so it’s a personal preference.

Educational Resources 4/5

The range of available educational resources on offer is where eToro really stands out head and shoulders above the rest. For beginners who want to learn and expand their skills, the eToro Academy is a fantastic place to start. This part of the platform is packed with resources like video guides and webinars. Of course, this is ideal for beginners but those with prior knowledge may not find them useful, and therefore of no value.

Social/Copy Trading 5/5

Two of eToro’s top features include its social trading and copy trading functions. Within this, users can connect with more experienced traders and learn from them by copying their strategies and learning new moves. These functions are what really make eToro stand above the competition, and again, it’s a useful learning tool for new users.

Customer Support 3/5

It’s true that eToro’s customer service availability could be better. If everything is going well, this isn’t an issue, but if you experience a problem, you might find the lack of options frustrating. There is no phone support on offer, making it impossible to speak directly to a person, and the live chat feature has limited working hours. If you have an issue outside of these times, you simply have to wait until the chat function opens the following day.

Regulation and Security 4/5

There is plenty of peace of mind. The eToro platform boasts total regulation from ASIC in Australia and other regulatory bodies. As a result, users are protected and the site is secure. Despite that, some more experienced traders may prefer platforms which have even more robust security and insurance measures in place, especially when making high value moves.

Community Reviews and Expert Recommendations

As with any platform, eToro has received plenty of reviews on either side of the spectrum. When choosing whether to use a platform, it’s vital to take both negative and positive reviews into consideration. Don’t assume that one negative review means the platform isn’t for you; it’s about balance and understanding what is important to you versus what isn’t.

The most positive praise focuses heavily on the interface, which is easy-to-use, friendly, and intuitive. With a layout that isn’t confusing and makes it easy to find what you’re looking for, beginners can start their investment journey without confusion. Praise is also given to the huge range of resources for beginners in the eToro Academy. This is something which many other platforms simply don’t offer and helps to mould the next generation of traders and investors.

The negative comments are mainly focused on the high fees for non-US dollar accounts, which can easily affect profits and become an issue over time. The other downside noted is the lack of person-to-person customer support and limited opening hours for the live chat function.

While reading both positive and negative reviews on eToro in Australia, it’s always a good idea to do your own research and see which features call out to you. You should also consult with financial advisors before making any investment decisions, especially when you’re just starting out. Take on board all advice and move slowly. By doing that, you can look forward to a more profitable and enjoyable experience.

Price

eToro charges fees for specific actions and the entire structure can be a little complicated at first. To help make things easier, here is a general rundown of eToro’s fees for various actions:

- Cryptocurrencies: Fees apply to spreads and some overnight fees may also be incurred.

- ETFs and Stocks: No commission fees are charged for stocks and ETFs but non-US dollar accounts will incur a currency conversion fee.

- CFDs and Forex: Fees apply to spreads and overnight fees are also incurred.

- Inactivity: There is a fee of $10 per month which applies after one year of inactivity.

- Withdrawals: A charge of $5 for each withdrawal.

Where to Find eToro Australia

eToro Australia can be found online and in both the Android and App Stores. Therefore, you can use the platform either on your desktop, tablet, or on your mobile device. Here are the links you need to get started:

Alternatives to eToro Australia

eToro Australia is certainly a positive choice but it may be that some users prefer to look for other options besides. Let’s explore a few alternatives to give you a broader picture. From there, you can make an informed decision and find the best fit for you.

Interactive Brokers

Interactive Brokers is a firm that offers many trading options and advanced tools. It has been around for a long time, which gives peace of mind, and it is renowned for low fees. The firm also offers plenty of research options, which are quite attractive for more advanced traders looking to take their investments to a higher level.

Stake

Stake is another trading platform in Australia and it’s a good choice for beginner investors, especially those looking to invest in the US. Trading is commission-fee on ETFs and US stocks, and the site is very easy to use and navigate. In many ways, Stake is a close fit with eToro but those looking for an alternative may find benefits here.

Superhero

This very popular app is another top choice for beginners. This is mainly thanks to its easy to use interface and commission-free trading options in both US stocks and ASX. Of course, being an app, Superhero is easy to use on the go, which is another plus for those with busy lives.

These suggestions prove that even though one size doesn’t fit all, there are plenty of options out there for beginners and experienced traders alike. However, it’s important to do your research and compare each platform or app, to find one that suits your needs and your long-term investment goals. Don’t be too quick to jump in; read everything you can, compare, and make your own choice based on what you want to achieve in your trading and investing endeavours.

FAQs

Is eToro available in Australia?

Yes! eToro is available in Australia. Additionally, the platform is regulated by the ASIC (Australian Securities and Investments Commission), giving extra peace of mind. Traders will find the platform easy to navigate and it’s possible to trade different assets, including forex, commodities, ETFs and cryptocurrencies, all in one place.

Is eToro suitable for beginners?

eToro is suitable for all levels of traders, but it has some fantastic features that are particularly beneficial to beginners. This includes eToro Academy and its huge range of learning resources to help take on board new knowledge and develop skills. It’s very easy to use the platform and with social trading options, it’s possible to learn from the best and utilise that information for future success.

How does copy trading work on eToro?

Copy trading is one of eToro’s best features and this is another fantastic perk for beginners, or anyone who simply wants to improve. This feature allows users to look at successful trades made on the platform and copy those strategies. It’s easy to look through a list of the best performing traders, look at the moves they’ve made and how they’ve performed in the past. From there, users can dedicate a percentage of their portfolio and replicate what those traders did.

Does eToro charge any fees for copy trading?

There are no fees incurred for the copy trading tool itself. Users can take advantage of this tool and create a more profitable outlook. However, there are other fees charged for specific trades, including currency conversion fees in some cases, overnight fees, and spreads. For that reason, it’s important to have a thorough understanding of what eToro’s fee structure looks like, so you won’t be caught out with unexpected charges.

Is eToro regulated in Australia?

Yes, it is. For total peace of mind, eToro is regulated by ASIC (Australian Securities and Investments Commision). This ensures that eToro complies with Australian regulations and offers investors a high level of protection. This is a vital element in building trust with traders and investors while keeping everyone safe during transactions.

Regardless of whether you choose eToro or not, always make sure that the platform you do choose complies with regulations to the highest level.

Final Thoughts

There are many trading platforms on the market these days, but eToro Australia has certainly done a lot to establish itself as a leader within the investment and trading world. The platform is ideal for beginners, but also has a lot to offer more experienced traders too.

Social trading and copy trading are certainly two of the most popular features on offer, but eToro Academy is a valuable library of resources for beginners and those who want to extend their skills. As a pleasant side note, the site itself is very easy to use and extremely intuitive, making it even easier to navigate over time.

When deciding whether or not to use eToro, it’s important to consider positives and negatives. While these features are a plus point, high currency conversion fees and a lack of customer support are two big downsides. For that reason, weigh up what is most important for you before making a final choice. It’s true that more experienced traders may find eToro lacking in advanced features. However, for anyone looking for social experience in trading, simplicity, and a range of learning options, it’s certainly a high quality platform to look into. In the end, anyone looking into eToro should consider their goals, experience level, and preferences before taking the leap. It’s equally as important to consult with a financial advisor before choosing to invest or trade for the first time.

Additionally, if you’re looking for a platform that prioritises online privacy and security, Privacy Australia is the place to go. Their focus is on helping Australians understand how their digital footprint impacts their lives, and providing important information on protection against online threats. Head to their website to discover in-depth guides, research findings, and recommendations from top experts.