Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Top 10 Best Credit Cards in Australia for 2024

It can be hard to find the best credit cards in Australia, mainly because there are so many. But it’s important to focus and find the right fit because the wrong choice can make or break our financial picture.

For that reason, I’ve spent hours reviewing the best credit cards in Australia and narrowed my choice down to ten. I’ve looked at the fees, perks, advantages, disadvantages, and everything in-between. After all, an informed decision is the best decision.

Table of Contents

- TL;DR

- Criteria Breakdown Summary

- American Express Platinum Card

- Citi Premier Credit Card

- NAB Rewards Signature Card

- Westpac Altitude Black

- ANZ Frequent Flyer Black

- St.George Amplify Signature

- Qantas Premier Platinum Mastercard

- American Express Velocity Platinum Card

- Commonwealth Bank Ultimate Awards

- HSBC Platinum Qantas Credit Card

- Notable Mentions

- Frequently Asked Questions

- Final Thoughts

TL;DR

- The American Express Platinum Card offers unmatched travel perks and a flexible rewards program. However, it comes with a hefty annual fee.

- Citi Premier Credit Card provides a strong sign-up bonus and versatile rewards for a moderate annual fee.

- NAB Rewards Signature Card stands out for its high points earn rate and no foreign transaction fees.

- Westpac Altitude Black is ideal for Qantas frequent flyers with its high Qantas Points earn rate.

- ANZ Frequent Flyer Black offers excellent Qantas benefits but has a high annual fee.

- Consider your spending habits, travel frequency, and budget when choosing a credit card.

- Look beyond flashy sign-up bonuses and evaluate ongoing value and perks.

- Always pay your balance in full each month to avoid high interest charges.

Comparison Table

Criteria Breakdown Summary

While evaluating the popular credit cards for this roundup, I focused on several key criteria. I feel these are the most important points for Australian consumers. This criteria includes annual fees, interest rates, rewards programs, sign-up bonuses, travel perks, foreign transaction fees, additional benefits, and credit score requirements.

However, it’s important to remember that what I deem to be the best option may not fit everyone’s needs perfectly. For that reason, it’s vital to assess your own requirements before making a final decision.

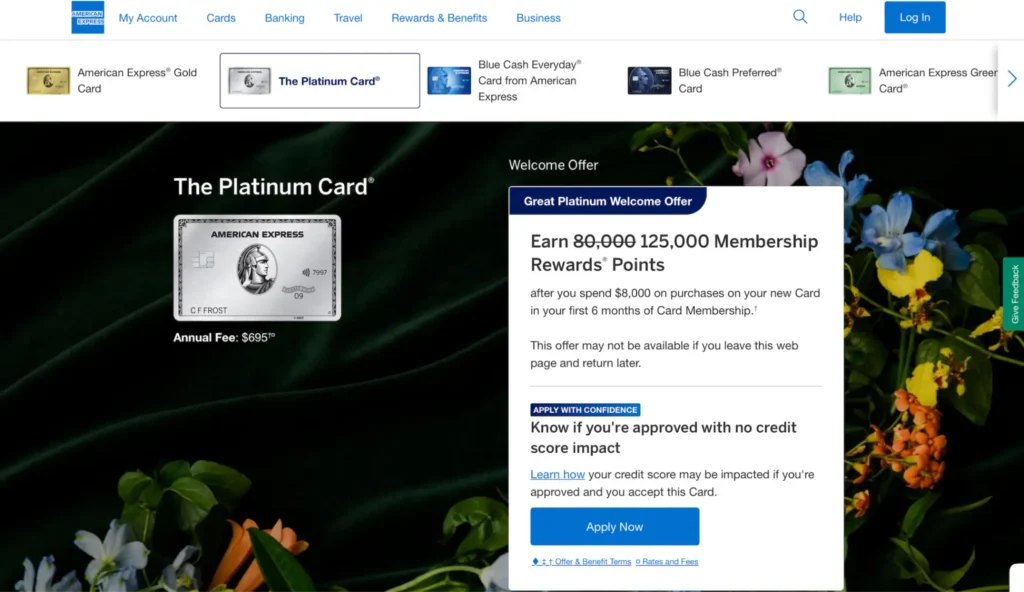

American Express Platinum Card

Best Known for Luxury Travel Benefits

The American Express Platinum Card is one of the best frequent flyer credit cards. It’s designed for high income earners and frequent travellers, but the perks are more than worth it. The travel benefits are very impressive, including a Membership Rewards points system that can be transferred to 10 airlines and three hotel loyalty programs. It also offers free access to more than 1200 hotel lounges worldwide and $450 annual travel credit. I could keep going; the features are extensive and offer good value for money.

As one of the best credit cards, the American Express Platinum Card has countless travel benefits.

Features

This frequent flyer credit card is a sound choice that is packed with features. They also go a long way to justify the price. For every $1 spent on eligible purchases, it’s possible to earn 2.25 points. There is also no chap on the number of points that can be earned. Along with the countless travel benefits I mentioned earlier, this is a flyer credit card that makes travel very luxurious. Additionally, there is a 200,000 points sign-up bonus when you spend $4000 in the first three months. It’s worth noting that this is worth up to $1000 in travel.

Another benefit I appreciate is the free travel insurance up to $3 million in medical cover. It certainly gives peace of mind.

Pros

- Exceptional travel perks and lounge access

- Flexible rewards program with valuable transfer partners

- High points earn rate on all spending

- Comprehensive travel insurance

- No foreign transaction fees

Cons

- High annual fee of $1,450

- Requires excellent credit for approval

- Limited acceptance compared to Visa/Mastercard

- High minimum income requirement ($100,000+)

Criteria Evaluation

Annual Fee: 2/5 (High fee of $1,450)

Interest Rate: N/A (Charge card)

Rewards Program: 5/5

Sign-up Bonus: 5/5

Travel Perks: 5/5

Foreign Transaction Fees: 5/5 (No fees)

Additional Benefits: 5/5

Credit Score Requirements: 3/5 (Excellent credit required)

Community Reviews and Expert Recommendations

Overall, the American Express Platinum Card receives high praise from users and industry experts. Most particularly enjoy the number of features available, however the high cost is mentioned several times.

“Has been having a lot of issues with online shopping, bills and needing to call various customer service lately. American Express has been helping me sort out those problems. And the customer service is the easiest to deal with, no long waiting time and very friendly people.” – Wakalin via Product Review Australia

“It’s expensive but if you travel a lot you get your annual fee back and more. The best thing about it is the fantastic Chubb travel insurance which is amazing!” – Paul S via Product Review Australia

Industry experts agree this is one of the best frequent flyer cards. It is recommended by The Points Guy as the “Best Premium Travel Rewards Card.” Experts agree it is a very feature-rich travel card. However, some users have mentioned that it has limited acceptance at smaller merchants, and experts highlight this as a downside.

Price

The American Express Platinum Card comes with an annual fee of $1,450.

You can apply for the American Express Platinum Card here.

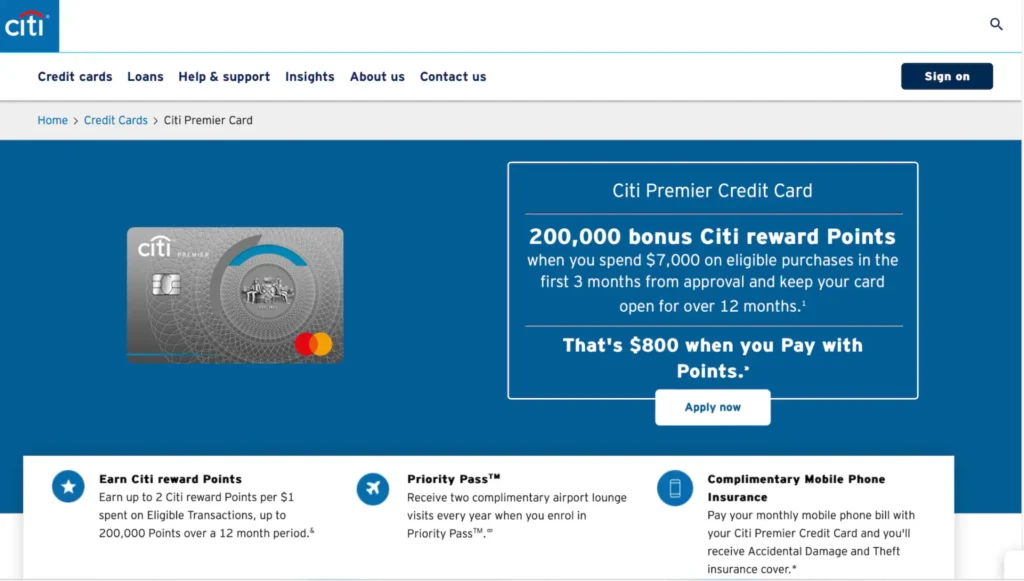

Citi Premier Credit Card

Best Known for Versatile Rewards

Citi is a recognisable name and that gives peace of mind from the start. I believe this is a solid choice for anyone who wants a balance between rewards and low fees. It offers a competitive points earning rate on everyday spending and a flexible rewards program. These points can be used on various airline partners, so it’s one of the best credit cards for Australia in that regard. However, it’s also useful for occasional travellers, thanks to the many travel benefits.

Rewards points can be used on eight airline partners, including Emirates Skywards and Singapore Airlines KrisFLyer. There is also free international travel insurance when the card is used to pay for a trip. This is always a feature I look for when doing a credit card comparison.

The other useful point to mention is that it offers 0% p.a. on balance transfers for 15 months, although a2% balance transfer fee applies.

Citi Premier Credit Card is a high-quality option for travellers and one of the best credit cards to use in Australia.

Features

The large number of features available with the Citi Premier Credit Card makes it an attractive choice. There is a 110,000 points reward for new users on sign-up with a minimum spend. As mentioned, the free travel insurance is a big advantage, and extended warranty cover.

The Citi Prestige Concierge service is a great bonus here, which helps with travel bookings, restaurant reservations, and more.

This card rewards 1 point per $1 spent, and offers purchase protection insurance for 90 days on eligible purchases. There is also access to the Citi World Privileges for dining and shopping offers. Overall, this is a strong choice and certainly a popular credit card.

Pros

- Flexible rewards program with multiple airline transfer partners

- Generous sign-up bonus

- Complimentary travel insurance

- No points cap on everyday spending

- Citi Prestige Concierge service

Cons

- Annual fee of $395 ($195 first year)

- Foreign transaction fee of 3.4%

- High interest rate of 21.49% p.a.

- Lower points earn rate compared to some premium cards

Criteria Evaluation

Annual Fee: 3/5 ($395, first year $195)

Interest Rate: 2/5 (21.49% p.a.)

Rewards Program: 4/5

Sign-up Bonus: 5/5

Travel Perks: 4/5

Foreign Transaction Fees: 3/5 (3.4%)

Additional Benefits: 4/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

Overall, the Citi Premier Credit Card enjoys positive praise from users. It is also recommended by Finder.com.au as the “Best for Flexible Rewards.” Most users praise the balance transfer option and enjoy the purchase protection. However, some users report problems when redeeming points for high-value rewards.

“Customer service is good. For the annual fee, there are better points earners especially if you are into collecting airline points. Our card only earns 0.5 points per dollar whereas others give you 1 for 1. Security is good as well, and the app is easy to use although not the most technically up to date.” – JC via Product Review Australia

“I haven’t used the card overseas but have tried balance transfer before. It is really easy to set up the balance transfer. With this card, I also got free Priority Pass membership that gives me access to two lounges every year. I use this card mainly to accumulate points to transfer it to Kris Flyer / Velocity.” – Feliana via Product Review Australia

Industry experts agree this is one of the best credit cards for Australia. They particularly rate the balance transfer and purchase protection features.

Price

The Citi Premier Credit Card has an annual fee of $395, discounted to $195 for the first year.

You can apply for the Citi Premier Credit Card here.

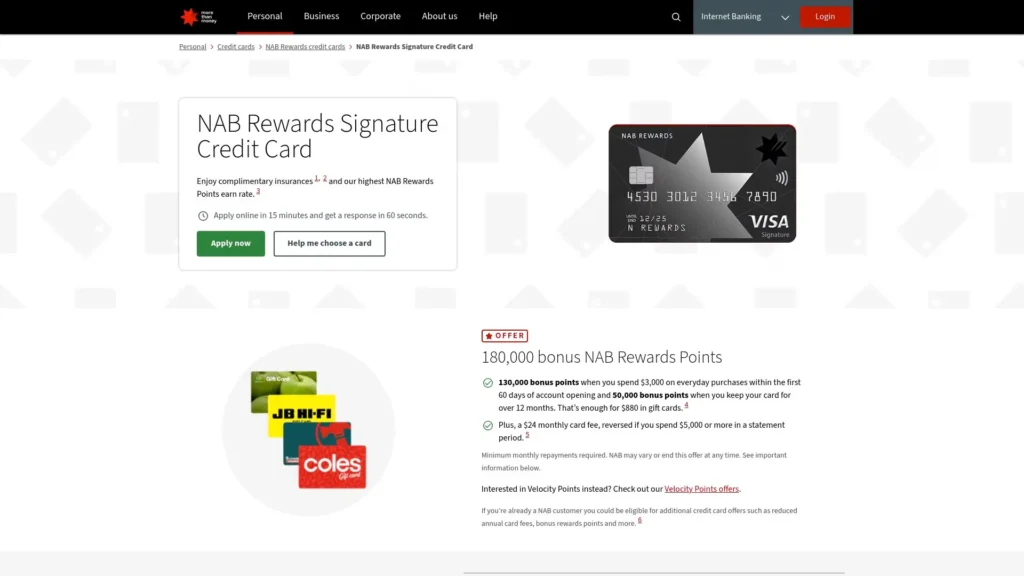

NAB Rewards Signature Card

Best Known for High Points Earn Rate

The NAB Rewards Signature Card is one of the best points earning credit cards in my opinion. It’s ideal for anyone looking to maximise the points they earn on everyday items. It also has one of the highest uncapped earn rates in the country, so it’s a good choice for big spenders too.

This card has no foreign transaction fees, which I’ve found to be a rare feature. This is particularly useful for those who travel a lot or shop online internationally.

As for points, this card earns up to 1.25 NAB Rewards points for every $1 spent. Those points can be used on Velocity Frequent Flyer, Asia Miles, or Air New Zealand Airpoints. There is also free travel insurance when the card is used to pay for a trip, and purchase protection available.

The NAB Rewards Signature Card is a quality point earning credit card, and why it lands a spot on our list of the best credit cards.

Features

I rate the NAB Rewards Signature Card for regular spenders and travellers. I particularly appreciate the lack of foreign transaction fees, which is something I haven’t noticed with many other cards. There is also a large sign-up bonus of 180,000 NAB Rewards points when minimum requirements are met. Then, after a year, another 60,000 points are rewarded.

The number of travel features is extensive, including two complimentary lounge passes per year, and a 24/7 concierge service. Additionally, there are several insurance coverage options available.

Pros

- High points earn rate on everyday spending

- No foreign transaction fees

- Generous sign-up bonus

- Complimentary lounge passes

- Comprehensive insurance coverage

Cons

- High annual fee of $395

- Points earning rate reduces after $5,000 monthly spend

- High interest rate of 20.99% p.a.

- Limited airline transfer partners compared to some competitors

Criteria Evaluation

Annual Fee: 3/5 ($395)

Interest Rate: 2/5 (20.99% p.a.)

Rewards Program: 4/5

Sign-up Bonus: 4/5

Travel Perks: 3/5

Foreign Transaction Fees: 5/5 (No fees)

Additional Benefits: 4/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

The NAB Rewards Signature Card enjoys positive feedback from users. Most appreciate the high points earning rate and the lack of foreign transaction fees. However, some users have mentioned frustration with redeeming points for high-value rewards.

“Long interest free period. No annual fee. Have had the card for a very long time and wont change it in the near future. Easy to use in Aus and overseas.” – Kyrogi54 via Product Review Australia

“The Nab experience overall experience was not so bad. It is easy to accumulate points and redeem points is a bit high.” – Jazon Z via Product Review Australia

This card is recommended by Mozo.com.au for “Best Overseas Spending.” Experts agree that this is a good card for frequent travellers and big spenders. They also mention that it’s possible to offset the annual fee with the number of benefits and rewards. .

Price

The NAB Rewards Signature Card has an annual fee of $395.

You can apply for the NAB Rewards Signature Card here.

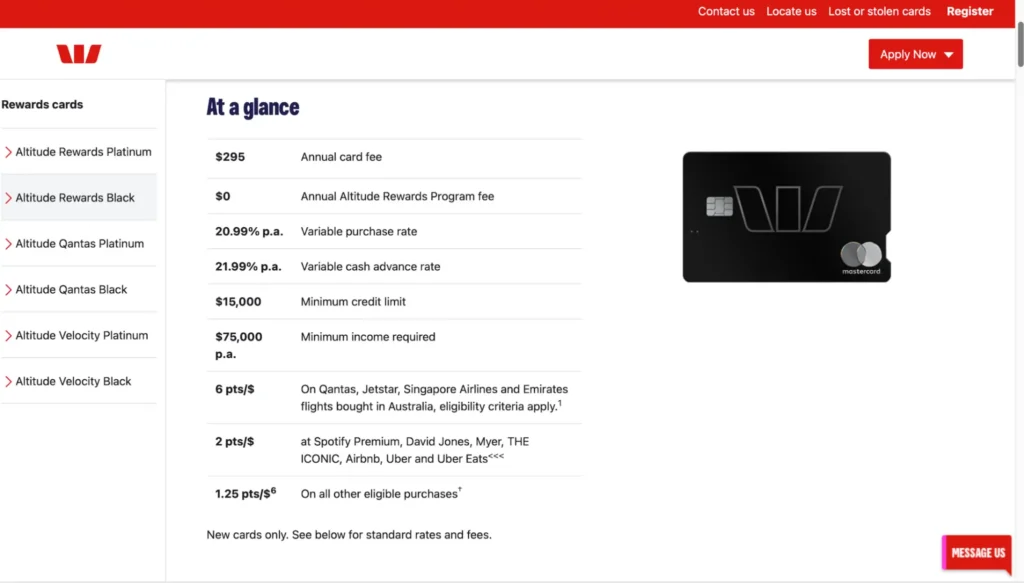

Westpac Altitude Black

Best Known for Qantas Points Earning

Anyone looking for Qantas credit cards should certainly consider the Westpac Altitude Black card. This offers some of the highest Qantas points on the market. Of course, that makes it ideal for anyone who regularly flies with the airline or its partners. It also has various other travel perks, including insurance coverage and lounge invitations.

This card offers 1.25 Qantas points per $1 spent on selected products, so it’s easy to see how those points will quickly add up. Additionally, the points are uncapped and never expire.

The Westpac Altitude Black card is ideal for regular Qantas flyers and makes our list for best credit cards in Australia.

Features

The Westpac Altitude Black is one of the best frequent flyer credit cards around, particularly for Qantas customers. New cardholders get a very pleasing sign-up bonus of 150,000 points, which converts to 75,000 Qantas points. Minimal spending applies here, of course. The card also provides Priority Pass membership and within that, there are free lounge visits per year. Another pleasing feature is free travel insurance, along with extended warranty on purchases. There is also access to the Westpac Concierge services.

One small advantage I find very useful is the digital card. This is issued immediately after approval, and can be used until (and after) the physical card arrives.

Pros

- High Qantas Points earn rate

- Generous sign-up bonus

- Complimentary Qantas Club lounge invitations

- Comprehensive travel insurance

- Priority Pass membership

Cons

- High annual fee of $400 ($200 first year)

- Foreign transaction fee of 3%

- High interest rate of 20.49% p.a.

- Limited value for non-Qantas flyers

Criteria Evaluation

Annual Fee: 3/5 ($400, first year $200)

Interest Rate: 2/5 (20.49% p.a.)

Rewards Program: 4/5

Sign-up Bonus: 4/5

Travel Perks: 4/5

Foreign Transaction Fees: 2/5 (3%)

Additional Benefits: 4/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

The Westpac Altitude Black Card is a popular option and enjoys generally positive reviews. This is mostly from frequent Qantas fliers and regular travellers in general. Most appreciate the Qantas points, and the other features, like lounge passes and insurance.

“Qantas lounge passes are a nice bonus. It’s easy to earn and use points. Must have income of $75,000+. Should not have such a high annual fee based on this criteria. Happy with card in general.” – James via Product Review Australia

“It is very simple to use, Tap and Go. Pay with Apple and Android Pay. Points are easily redeemable and ongoing promotion of 80,000 Qantas Frequent Flyer available for people who spend at least $4,000 in the first 3 months. The rewards can be used in the Qantas Store and ongoing frequent flyer points.” – N.I. via Product Review Australia

Experts rate this card for frequent Qantas flyers in particular and those who can make the most of the features. However, for those who don’t fly with Qantas, most feel it’s not the best choice. This card was recommended by Point Hacks as the “Best for Qantas Frequent Flyers.”

Price

The Westpac Altitude Black has a $400 annual fee, discounted to $200 for the first year.

You can apply for the Westpac Altitude Black here.

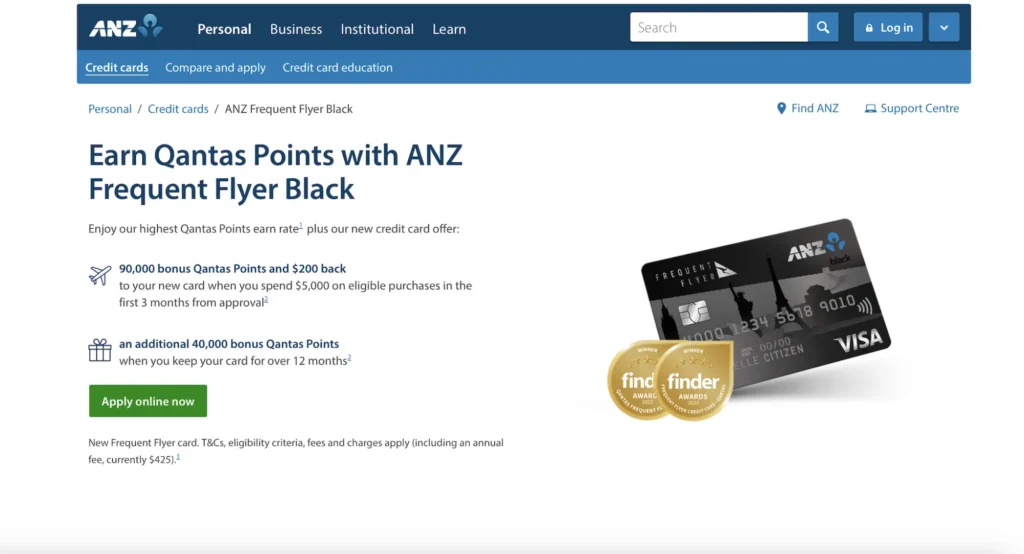

ANZ Frequent Flyer Black

Best Known for Qantas Frequent Flyer Benefits

Another credit card for Qantas lovers is the ANZ Frequent Flyer Black card. Finding the best credit card can be difficult for specific needs, but anyone who regularly flies with this airline will find use here. Not only is it easy to build points but it also has many premium travel perks within it. It offers high Qantas points and has a range of airline specific perks.

For every $1 spent on eligible purchases, 1 Qantas point is earned. Another perk is free travel insurance and Qantas Frequent Flyer membership. This in itself saves almost a $100 joining fee. Two lounge invitations per year are also included in the list of perks.

ANZ Frequent Flyer Black is a quality card for regular travellers and makes our list for top credit cards.

Features

As one of the best frequent flyer cards, this option is packed with features that Qantas loyalists will love. Upon sign-up, 130,000 Qantas Points are awarded, which is quite significant. Additionally, another 40,000 points become available after your first anniversary with the card. There’s more – $425 Qantas Travel Credit is awarded every year along with two Qantas Club lounge invitations. It’s basically a feast for Qantas fans.

The ANZ 24/7 concierge service rounds up the travel benefits, making this one of the best cards of its kind on the market. The high Qantas points rate is certainly the main feature of this card, so I’d recommend it for regular flyers with the airline.

Pros

- High Qantas Points earn rate

- Generous sign-up bonus

- Annual Qantas Travel Credit

- Complimentary Qantas Club lounge invitations

- Comprehensive travel insurance

Cons

- High annual fee of $425

- Foreign transaction fee of 3%

- High interest rate of 20.24% p.a.

- Limited value for non-Qantas flyers

Criteria Evaluation

Annual Fee: 3/5 ($425)

Interest Rate: 2/5 (20.24% p.a.)

Rewards Program: 4/5

Sign-up Bonus: 4/5

Travel Perks: 4/5

Foreign Transaction Fees: 2/5 (3%)

Additional Benefits: 4/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

Overall, the ANZ Frequent Flyer Black Card is well received by users, especially for the high number of Qantas points. The travel credit is also frequently mentioned as it allows users to offset the annual fee against benefits. The only mentioned downside is less-than-ideal customer support, which could be improved.

“I joined for the bonus Qantas points offer which was definitely worthwhile and easy to qualify for. The credit card also comes with an AMEX which has higher points per dollar. It was one of the first cards to use Apple Pay too, so very convenient.” – GRPK via Product Review Australia.

“We are using our card in Australia only. Approval was very quick. However we had lots of issues to physically get the card, and the customer service (based out of India I guess) was neither responsive nor competent. It took them 3 weeks to figure out that the card was sent to a wrong address.” – Loic via Product Review Australia

Industry experts rate this card as a good option for frequent travellers. Finder.com.au rate is as the “Best for Qantas Frequent Flyers.”

Price

The ANZ Frequent Flyer Black card has an annual fee of $425.

You can apply for the ANZ Frequent Flyer Black card here.

St.George Amplify Signature

Best Known for Flexible Rewards and Birthday Bonus Points

When comparing credit cards, I found the St. George Amplify Signature Card. This offers a flexible rewards program and it’s ideal for earning points on everyday spending. Then, those points can be transferred to different airline partners. There are plenty of travel perks with this card, including two free Priority Pass lounge visits annually and access to Visa’s Luxury Hotel Collection for upgrades.

As far as points goes, 1.5 Amplify points are awarded for $1 spent. However, the standout of this card is the birthday bonus points, available annually.

The St. George Amplify Signature Card gives you a good boost of extra points along with free travel insurance, making it one of the best credit cards in Australia.

Features

I feel this card offers a good mix of both travel and general features. The birthday points bonus is a real perk and gives a good boost of extra points that can be used for various means.

Along with the aforementioned lounge visits, this card also gives free travel insurance. There is also an extended warranty on purchases for extra peace of mind. Overall, this card offers a great blend of everyday use and travel features, which make it useful for a wider range of customers.

As with some of the other cards I reviewed, this option also makes a digital card instantly available upon approval.

Pros

- Flexible rewards program with multiple airline transfer partners

- Generous sign-up bonus

- Unique birthday bonus points feature

- Complimentary lounge visits

- Comprehensive travel insurance

Cons

- Annual fee of $279 ($139 first year)

- Foreign transaction fee of 3%

- High interest rate of 19.74% p.a.

- Lower points earn rate compared to some premium cards

Criteria Evaluation

Annual Fee: 3/5 ($279, first year $139)

Interest Rate: 2/5 (19.74% p.a.)

Rewards Program: 4/5

Sign-up Bonus: 4/5

Travel Perks: 3/5

Foreign Transaction Fees: 2/5 (3%)

Additional Benefits: 4/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

The St. George Amplify Signature Card was named “Best for Flexible Rewards” by Points Hack. It has generally positive reviews from users, who mostly appreciate its flexibility. The birthday bonus points are well-received along with the chance to transfer points to airline partners.

However, some users mention that the customer support quality could be improved.

“Decided to go for the Amplify Signature Credit Card after doing a major home loan refinance to St. George. The application and approval process was hassle free, easy and most importantly, quick. I literally got my card in just over a week after I applied and any questions I had were promptly answered by both the call centre and branch I visited. They even waived the yearly card fee because I am on a home loan package, so I basically earn all those points for free. It’s so nice to get a good deal from a bank!!! I’ll be with St. George for the long run I reckon.” – Marz Drive via Product Review Australia

“This is a decent black level VISA card which I would rate slightly superior to the Westpac Altitude Black Qantas MasterCard.” – J Harvey via Product Review Australia

Overall, industry experts agree that this card is a good choice, particularly mentioning its reliability and the birthday bonus points.

Price

The St.George Amplify Signature card has an annual fee of $279, discounted to $139 for the first year.

You can apply for the St.George Amplify Signature card here.

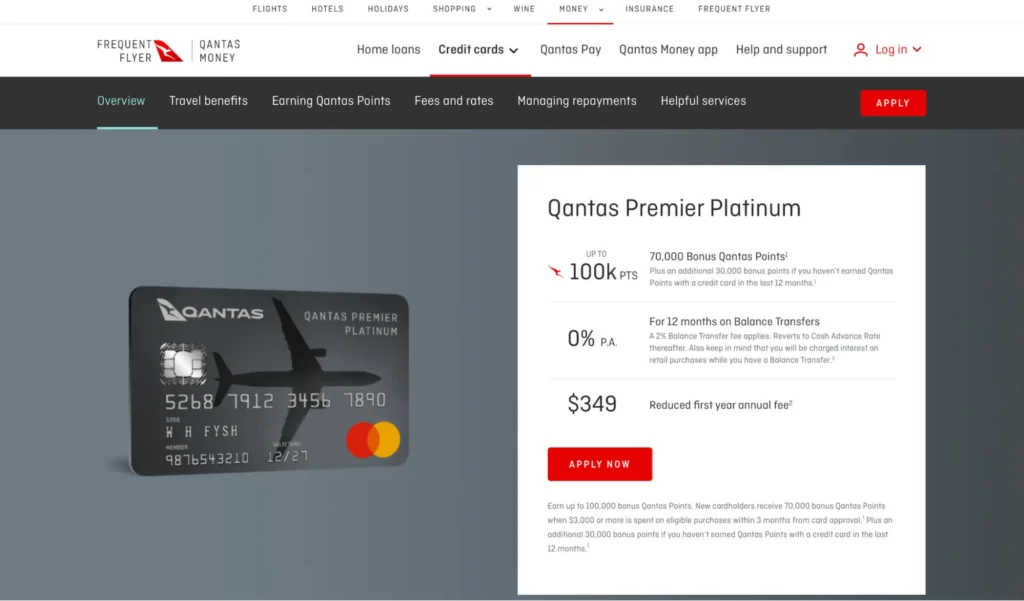

Qantas Premier Platinum Mastercard

Best Known for Qantas Points Earning and Travel Benefits

When looking to find the best credit card, the Qantas Premier Platinum Mastercard should be amongst the mix. This card is best for customers who regularly fly with Qantas and want to maximise their points and benefits. Additionally, it has a very competitive points earn rate and many unique features.

However, this isn’t the best card in terms of features for anyone who doesn’t regularly fly with the airline. In that case, I feel many of the benefits would be wasted. Yet, with 1 Qantas Points for every $1 spent, it’s a good points card to build perks.

The other unique side of this card is that it also offers discounted rates for companions. This isn’t the case with some other cards.

The Qantas Premier Platinum Credit Card offers many features as a top credit card.

Features

The Qantas Premier Platinum Mastercard has many features for Qantas travellers. There is a sign-up bonus of 100,000 Qantas Points, and two Club Lounge invitations per year. Another 30,000 points are awarded on the cardholder’s first anniversary. As I mentioned, there are also discounts for companion fares, up to 20%.

The perks don’t end there. This card also features free comprehensive travel insurance for peace of mind. Additionally, there is access to the Qantas Concierge service, and extended warranty insurance.

Overall, this is one of the best credit cards for points, and one that has many useful features.

Pros

- High Qantas Points earn rate

- Generous sign-up bonus

- Discounted companion fares

- Complimentary Qantas Club lounge invitations

- Comprehensive travel insurance

Cons

- Annual fee of $299 ($199 first year)

- Foreign transaction fee of 3%

- High interest rate of 19.99% p.a.

- Limited value for non-Qantas flyers

Criteria Evaluation

Annual Fee: 3/5 ($299, first year $199)

Interest Rate: 2/5 (19.99% p.a.)

Rewards Program: 4/5

Sign-up Bonus: 4/5

Travel Perks: 3/5

Foreign Transaction Fees: 2/5 (3%)

Additional Benefits: 3/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

Generally, the Qantas Premier Platinum Mastercard has positive feedback from reviewers. Most users enjoy the high points earn rate and the benefits that are airline specific. Discounted companion fare is especially welcome. However, some users report occasional difficulty in redeeming points.

“Had this credit card for a few months now, collecting lots of points for flights, great phone app provided by the credit card company to keep tab on balance etc.” – Will via Product Review Australia

“I chose the Qantas Premier Platinum credit card for the large amount of bonus points on offer in the first 6 months of use and am glad I chose to use the product. I found the portal useful for checking the credit card balance and did not have any issues with any assistance I needed. I am happy with the product.” – Billy via Product Review Australia

This card was recommended as the “Best for Qantas Frequent Flyers” by Finder.com.au. Industry experts find this card beneficial and rate it for its number of features. However, they do mention the high foreign transaction fees.

Price

The Qantas Premier Platinum Mastercard has an annual fee of $299, discounted to $199 for the first year.

You can apply for the Qantas Premier Platinum Mastercard here.

American Express Velocity Platinum Card

Best Known for Velocity Points Earning and Virgin Australia Benefits

American Express is a big name and I’ve already reviewed one of their cards already. However, the Velocity Platinum Card stands out as it’s tailored specifically for Virgin Australia frequent flyers. This is one of the best credit cards for points in terms of travel benefits for Australian customers.

The points earn return rate is competitive, and it also offers unique features, such as a free domestic return flight yearly. On eligible purchases, 1.25 Velocity Points are awarded per $1 spent. Alongside this, two free virgin Australia lounge passes are also offered.

This card is a useful extra for regular flyers with the company and has a competitive set of rates to go alongside it.

The American Express Velocity Platinum Card is ideal for regular Virgin Australia customers.

Features

I highly recommend the American Express Velocity Platinum Card for regular Virgin Australia customers in particular. The range of features is extremely beneficial, with a good amount of points earned on sign-up. The free domestic return flight once per year is a real stand-out feature, something that many other cards don’t offer.

Aside from travel perks, the purchase protection and refund protection insurance really stand out. In addition, customers have access to American Express Experiences events too.

Pros

- High Velocity Points earn rate

- Complimentary domestic return flight each year

- Virgin Australia lounge passes

- Comprehensive travel insurance

- No foreign transaction fees

Cons

- High annual fee of $375

- Limited acceptance compared to Visa/Mastercard

- No interest-free days (charge card)

- Limited value for non-Virgin Australia flyers

Criteria Evaluation

Annual Fee: 3/5 ($375)

Interest Rate: N/A (Charge card)

Rewards Program: 4/5

Sign-up Bonus: 4/5

Travel Perks: 4/5

Foreign Transaction Fees: 5/5 (No fees)

Additional Benefits: 4/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

Customer reviews for the American Express Velocity Platinum Card are generally positive. In particular, frequent Virgin Australia customers find the features beneficial. Most talk about the complimentary domestic flight per year and lounge access.

“I have had a number of cards in the past and found most apps or services lacked in some way. Not American Express, easy and great to deal with by phone or app. The flight included is great value as well.” – Ctvam via Product Review Australia

“If you use the domestic flight each year then it can really be worth it. Even more so if you get a decent point earn. The Local Champions program is good too and Amex is slowly being accepted in more locations. It would be better if the foreign transaction fee was lower.” Nturnerphotos via Product Review Australia

Industry experts rate this card very highly, and Point Hacks named it the “Best for Virgin Australia Frequent Flyers.” However, experts do mention the high interest rate as a concern and something to weigh up before making a choice.

Price

The American Express Velocity Platinum Card has an annual fee of $375.

You can apply for the American Express Velocity Platinum Card here.

Commonwealth Bank Ultimate Awards

Best Known for Travel Benefits and No Foreign Transaction Fees

When I compare credit cards, the Commonwealth Bank Ultimate Awards certainly takes my attention. This is a premium rewards card that has many travel benefits. The other perk is that there are no foreign transaction fees. Again, that’s something that’s quite rare in Australia credit cards. This feature makes it a good choice for regular international travellers and those who spend overseas.

Additionally, this card has a useful flexible rewards program and it allows transfer of points to airline partners. As with many other travel-related cards, this one also allows free travel insurance and lounge membership – in this case it’s LoungeKey. Additionally, this card provides access to Commonwealth Bank’s Ultimate Awards Travel service. This offers money and exclusive offers.

The Commonwealth Bank Ultimate Awards is ideal for travellers and general use as one of the best credit cards in Australia.

Features

The Commonwealth Bank Ultimate Awards card has many features that are ideal for frequent travellers. There is no traditional sign-up bonus with this card, but there is a reduced annual fee for the first year for new users. The big plus is LoungeKey membership, including two visits per year. On top of that, this card offers free travel insurance and extended warranty on purchases. For this reason, I would recommend this card for regular use as much as for travel.

Another plus point with this card is bonus points on selected retailers through the effective CommBank Rewards Program. As far as points go, this card offers 1.5 awards per $1 spent, and there are no foreign transaction fees. A unique feature is the ability to split eligible purchases into fixed monthly instalments without added interest.

Pros

- No foreign transaction fees

- Flexible rewards program with multiple airline transfer partners

- Complimentary lounge visits

- Comprehensive travel insurance

- Bonus points offers through CommBank Rewards

Cons

- High annual fee of $420

- High interest rate of 20.24% p.a.

- No traditional sign-up bonus

- Lower points earn rate compared to some premium cards

Criteria Evaluation

Annual Fee: 2/5 ($420)

Interest Rate: 2/5 (20.24% p.a.)

Rewards Program: 4/5

Sign-up Bonus: 3/5

Travel Perks: 4/5

Foreign Transaction Fees: 5/5 (No fees)

Additional Benefits: 4/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

The Commonwealth Bank Ultimate Awards card gets mixed reviews. Most really appreciate the lack of foreign transaction fees and the flexible rewards program. This saves a lot of money when travelling in particular.

“I have been using the CBA card since 2013. It’s quick in transferring money to this credit card and the customer service is impeccable. It’s a decent card to have.” – Dabas via Product Review Australia

“Satisfied with the customer service (answered all my queries), convenience with Commonwealth bank (branches nearby), getting rewarded for using it and claiming the awards made easy. It is easy to accumulate points and simple to redeem them.” – Ivanna via Product Review Australia

Industry experts recommend this card for regular international travellers, especially for the no transaction fees when overseas. However, they do mention that the points earn rate could be higher in consideration of the annual fee.

Price

The Commonwealth Bank Ultimate Awards card has an annual fee of $420.

You can apply for the Commonwealth Bank Ultimate Awards card here.

HSBC Platinum Qantas Credit Card

Best Known for Affordable Qantas Points Earning

The final credit card comparison I made was the HSBC Platinum Qantas Credit Card. This is an affordable card for those who want to earn Qantas points. The main point here is that there is no premium annual fee, which makes it more accessible to all. The Qantas Points earn rate is reasonable and it also offers some travel perks.

I’d recommend this card for occasional travellers who want to build points while spending on a daily basis. It awards 1 Qantas Point for every $1 spent and also offers purchase protection up to 90 days on eligible items.

The HSBC Platinum Qantas Credit Card offers an affordable solution to building points as a top credit card choice.

Features

The HSBC Platinum Qantas Credit Card offers value and it comes at a lower price than some of the other cards I’ve reviewed. Upon sign-up, 20,000 Qantas Points are awarded, along with 1 Qantas Point per every $1 spent.

Other useful features include free travel insurance and purchase protection on eligible items. This card doesn’t offer lounge passes, which is a disadvantage but it does give access to the Home & Away program. This gives global dining and retail discounts. Plus, it’s possible to add up to four additional cardholders without paying any extra.

Pros

- Lower annual fee compared to premium Qantas cards

- Decent Qantas Points earn rate for the fee

- Complimentary travel insurance

- Purchase protection insurance

- No fee for additional cardholders

Cons

- Annual fee of $99

- Foreign transaction fee of 3%

- High interest rate of 19.99% p.a.

- Lower points cap compared to premium cards

Criteria Evaluation

Annual Fee: 4/5 ($99)

Interest Rate: 3/5 (19.99% p.a.)

Rewards Program: 3/5

Sign-up Bonus: 3/5

Travel Perks: 3/5

Foreign Transaction Fees: 2/5 (3%)

Additional Benefits: 3/5

Credit Score Requirements: 4/5 (Good to excellent)

Community Reviews and Expert Recommendations

Overall, the HSBC Platinum Qantas Card enjoys positive reviews. Most mention the low annual fee and the chance to earn Qantas Points. However, some users mention that customer support could be faster.

“I just applied for the HSBC card to take advantage of 35,000 bonus Qantas FF points and the 6 months interest free on balance transfer. The application process is more complicated than many of my other applications.” – VAG_newbie via Product Review Australia

Industry experts generally rate this card, and Finder.com.au rated it the “Best Budget Qantas Points Earner.”

Price

The HSBC Platinum Qantas Credit Card has an annual fee of $99.

You can apply for the HSBC Platinum Qantas Credit Card here.

Notable Mentions

While the ten credit card details I’ve reviewed are certainly high quality, these also deserve a notable mention.

American Express Qantas Discovery Card

The American Express Qantas Discovery Card is a great option for earning Qantas Points. It’s a good choice for occasional travellers and for those who are new to reward cards.

Learn more about the American Express Qantas Discovery Card

NAB Low Rate Card

The NAB Low Rate Card offers no annual fees, which is ideal for keeping costs low. This card is a good choice for people who carry a balance only occasionally, not on a regular basis.

Learn more about the NAB Low Rate Card

Bankwest Qantas World Mastercard

The Bankwest Qantas World Mastercard is a great card for earning points. It offers a lower annual fee than some other comparable options.

Learn more about the Bankwest Qantas World Mastercard

BOQ Specialist Velocity Signature Card

BOQ Specialist Velocity Signature Card is a high-earning Velocity points card. It is particularly useful for medical professionals as it has many unique features tailored to that niche.

Learn more about the BOQ Specialist Velocity Signature Card

Frequently Asked Questions

What factors should I consider when choosing a credit card?

When looking for the best rewards card, it’s important to consider your options carefully. Look at your spending habits, goals, and lifestyle first. Then, consider the annual fee, interest rate, sign-up bonus, rewards program, and any other additional features.

It’s important to consider whether or not you’ll carry a balance, as a low interest rate is vital in that case. Rewards are more valuable for those who will pay their balance in full every month. Of course, credit scores also come into play in terms of what cards you’re eligible for.

How do I maximise the value of my credit card rewards?

It’s important to choose the best purchase credit cards that work alongside your spending habits. The first step is to use your card for all eligible purchases and avoid overspending. Pay off your balance monthly if you can. In terms of travel rewards, look for higher-value options like business class flights or even hotel stays. You can also take advantage of any special promotions. A final option is to use multiple cards to spread rewards across different categories of spending.

See our article on the best cashback credit cards for more tips.

Are premium credit cards worth the high annual fees?

Premium credit cards aren’t the right choice for everyone. In that case, it’s important to assess the annual fee first. That way, you can work out whether it’s reasonable or not. Such cards often have many luxurious perks that won’t be suitable for everyone, so assess whether they’re worth it. Once you know the potential value, you can understand and compare it to the annual fee.

How does my credit score affect my credit card options?

Your credit score is a vital part of the puzzle when determining which credit cards you’re eligible for. Premium reward cards tend to go to people with excellent credit scores, normally 700 or above. Credit cards that have lower fees or offer basic features are usually accessible to lower credit scores, around 620-679.

A low credit score means you might only qualify for a secured credit card or those designed specifically for credit building. A high credit score increases your odds of being approved and being offered better interest rates and higher credit limits. Our Clearscore review provides more information on credit scores. Of course, to ensure that only you use your card, it’s vital to know how to avoid credit card fraud too.

What should I do if my credit card application is declined?

It’s important not to panic if your credit card application is rejected. You can first ask the reason, which the issuer must give. Common reasons include a low credit score, low income, or too many applications recently. Once you know why, you can address the problem. This could mean improving your credit score, paying an existing debt, or simply waiting a while. You could also consider applying for a secured credit card to build your credit.

Final Thoughts

There is no right answer for everyone when it comes to the best credit card in Australia. Everyone has different needs, and it’s important to assess your financial situation, spending habits, and lifestyle first. Then weigh these against the pros and cons of each card.

Premium cards offer excellent travel perks but they usually have heavy annual fees as the pay-off. There are some mid-range options, like the Citi Premier Credit Card. These types of cards offer a good balance of the two. There are even basic cards, like the HSBC Platinum Qantas Credit Card, that offer benefits without high fees.

The most important thing to remember is to shop around and once you get a card, to use it responsibly. Always pay your balance in full to avoid interest charges and don’t overspend just to get rewards. Keeping an eye on your spending is key to ensuring a safe and secure credit card experience. At Privacy Australia, we’re committed to helping you stay safe online and make informed financial decisions. Whether you’re looking for student credit cards, virtual credit cards, or balance transfer credit, we’ve got you covered. We even have in-depth reviews of business credit cards. By carefully assessing your options and covering your bases, like using a VPN, you’ll have a safe and secure experience.

You Might Also Like: