Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

ATC Brokers Review: Navigating the Forex Waters with a Seasoned Captain

You’ve probably heard inspiring stories about people who could make thousands of dollars overnight while trading. Now, you think it’s time you give it a shot and all your financial dreams might come true, right?

Not so fast, mate. Because of the high volatility and margin risks associated with forex trading, diving headfirst into the market won’t lead to your happily ever after. This is why reviewing brokers like ATC Brokers is crucial.

Today, the size of the forex trading market is almost $6.6 trillion. Can you imagine the limitless opportunities it offers?

However, accessing these profitable investments is only possible when you work with a trustworthy broker.

Forex brokers like ATC Brokers act as an intermediate between traders like you and the market. They provide access to different trading tools, insights, and trends to help you make the right investment decision.

A trustworthy forex broker should secure a safe trading environment, offer competitive spreads, and execute action fast. So, does ATC Brokers have it? Is it the right forex broker for you? In this post, we’re going to find out the answer to those questions and more. So stick around as we investigate ATC Brokers:

TL;DR

- ATC Brokers is a reliable and safe forex and CFD broker that works for those interested in trading currency pairs with a focus on ECN pricing.

- Thanks to the strong regulatory oversight from FCA, NFA, and CIMA, traders can safely trade knowing their transactions are secure.

- It offers MT4 and MT Pro platforms to appeal to different users.

- Many users appreciate the competitive spreads and commissions, but the high minimum deposit can deter budget-conscious traders.

- This broker offers a limited range of tradable assets and educational resources, making it less appealing to beginners.

Criteria Breakdown

How do you judge a forex broker? Well, not based on your intuition—that’s for sure.

Having a solid foundation of preset criteria to help you compare this broker to the other players on the market is essential.

Does it provide a secure trading environment? What tradable assets does it offer? What fees does this platform charge?

Many other factors should be considered to give you a clear view of how this forex broker really performs.

In our ATC Brokers review, we’ve listed scores that range from 1 to 5 to reflect the nature of your experience with ATC Brokers. Scoring five means it can’t get any better, while one means that you look elsewhere if this factor matters to you.

Overall, these criteria and their scores can help you answer this question: is ATC Brokers legit?

ATC Brokers: What Sets It Apart?

Best Known For

ATC Brokers is a multi-asset broker founded in 2005. It specialises in trading forex as well as CFDs and other tradable assets.

This broker is famous for its ECN pricing and variable spreads, making it an appealing option for traders of different levels and budgets.

Ever since it was launched, ATC Brokers has been committed to enhancing the trading experience of its users, providing them with better tools and resources to help them make the right trading decisions for maximum gains.

It currently has headquarters in the UK and the US to address the global needs of traders and investors.

So, a question arises: is ATC Brokers secure? The good news is that this broker is governed and overseen not by one but by three financial authorities to guarantee your peace of mind. It offers more than 100 tradable instruments and US customers can access 40, including 38 currency pairs and two metals.

But evaluating a broker based on its instruments and regulatory measures isn’t enough, though. You should also assess its user experience and the tools it offers to facilitate trading.

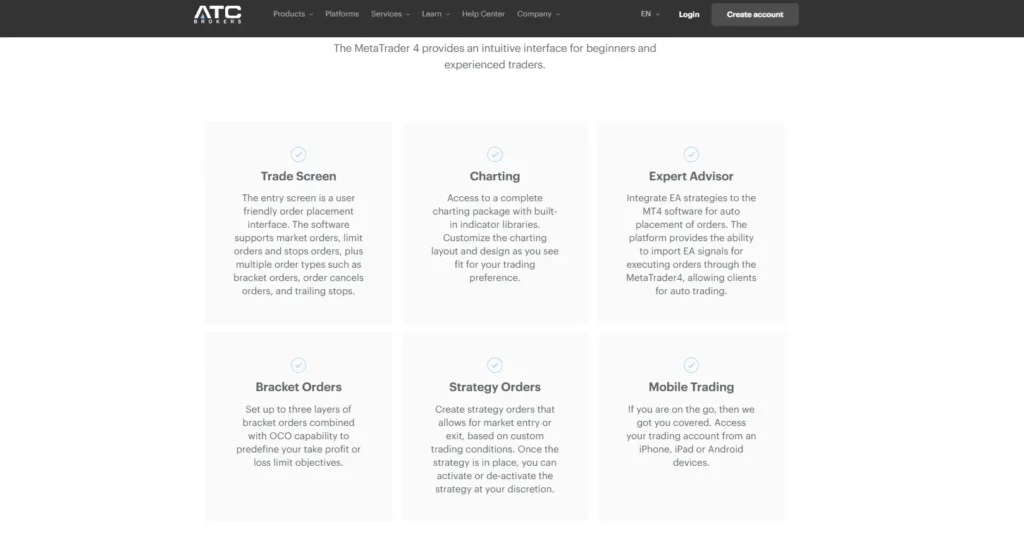

Luckily, ATC Brokers offers the industry-standard MT4 platform, which presents valuable information and insights. But that’s not all. Several ATC Brokers reviews highlight its proprietary MT Pro, as it allows access to exclusive charting options and expert advice for auto-trading, trade orders, and bracket orders.

Finally, you can access ATC Brokers’ mobile trading platform whenever you want to trade on the go. It’s reliable and easy to use, and you can easily download it to any smart device.

Since 2005, ATC Brokers has been specialising in forex, CFDs, and other tradable assets.

Features

So, what exactly makes ATC Brokers unique? Here are the features that stand out:

ECN Execution

With ATC Brokers you gain access to the latest ECN technology which guarantees tight spreads and quick execution of your investments. If you’ve ever experienced delays in executing your trading orders, you probably know how frustrating this can be.

With ATC Brokers, you can trade several instruments with no dealing desk intervention. This electronic network provides access to orders, facilitating their execution. Thanks to ECN technology, you can navigate forex trading easily as ATC offers direct access to liquidity providers.

Variable Spreads

ATC Brokers provides access to many currency pairs, allowing you to diversify your portfolio and experiment with different tradable instruments.

Spreads start as low as 0.3 pips for currency pairs, which results in lower transaction costs. As a beginner or high-frequency trader, these lower spreads speed up the entry and exit.

ATC Brokers includes the popular fx trading platform MT4 and provides additional features.

MT4 and MT Pro Platforms

Having access to the latest market trends and data is crucial for successful trading. ATC Brokers supports MetaTrader4—the most popular forex trading platform. It analyses financial markets and provides expert advice to help traders make the right investment decisions.

But that’s not all. ATC Brokers also has its native MT Pro platform, which offers more advanced options. Both platforms support multiple order types that can be automatically executed to save time and maximise your gains.

ATC Brokers offers MT Pro to provide traders with valuable insights.

Segregated Client Funds

This feature adds an additional layer of safety while trading your money with ATC Brokers. It separates your cash from the company’s funds at renowned banks. This means your money will be safe if the company’s capital or funds suffer an unexpected loss.

Multiple Account Types

ATC Brokers allows traders to open individual, joint, or corporate account types. An individual account has a minimum deposit of $2,000 for global clients. However, UK clients should deposit at least £/$/€5,000. Joint and corporate accounts have a minimum deposit of $10,000.

The leverage you can enjoy with these different accounts differs according to your location. For example, in the UK you can leverage up to 1:200, allowing traders to enjoy more flexibility with higher capital. Nevertheless, the limit decreases to 1:30 in the EU.

Each account has its pros and cons. For example, with an individual account, you can trade multiple currencies. A joint account allows two or more people to share the responsibility, while corporate accounts offer different trading tools and dedicated customer support and account management.

However, for American clients, forex trading rules are more strict. This affects the leverage they can enjoy with these account types.

But the good news is that you can easily open a demo account. Using this demo account you can try trading in a risk-free controlled environment to refine your trading practices and learn from your mistakes.

Cryptocurrency CFDs

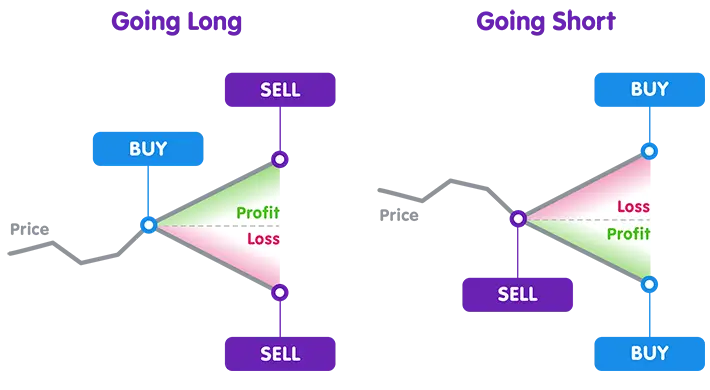

Instead of dealing with the market volatility directly, ATC Brokers allow for CFDs, which involve engaging in a contract between the trader and broker. CFDs allow traders to track long and short positions and increase the traders’ flexibility to use leverage.

Cryptocurrency CFDs offer many benefits to traders, as they can have more control over their trading leverage without paying actual money. The position remains open until the trader closes it or closes by an automated action previously set.

Having a reliable broker like ATC Brokers to back you up gives you an advantage if you’re on a tight budget. CFDs can provide fast transaction times, which prove to be highly helpful in the cryptocurrencies’ volatile market.

Reliable Mobile App

ATC Brokers has a user-friendly mobile app that allows traders to view all the live quotes of the tradable assets and follow up on the execution of their orders whenever and wherever they are.

Users can install the app on any Android or iOS device, and it has an easy-to-use interface that doesn’t confuse beginners. Moreover, the mobile app is useful for providing insights about the latest market trends as the news section is updated several times a day.

Pros

So, what sets ATC Brokers apart from other forex brokers? Here are some of its amazing features.

Robust Regulatory Oversight

Unlike other brokers on the market, ATC Brokers’ operations are overseen by CIMA, FCA, and NFA. It’s also a member of the US Commodity Futures Trading Commission.

This intense oversight guarantees the safety and security of your money and trading transactions. It offers new and professional traders with peace of mind.

Competitive Pricing Structure

Compared to other brokers, ATC Brokers offers a competitive pricing structure. For those interested in forex trading, ATC Brokers provides tight spreads, which reduce the trading costs and increase potential profits.

Moreover, the trading fees are as low as $1 on forex trades. This benefits traders who look for transparent pricing.

ATC Brokers doesn’t charge any trading fees on CFD trading, as all the trading costs are built into the spreads. This again allows traders to calculate their costs accurately. Moreover, ATC Brokers has low non-trading fees compared to its rivals, except for the inactivity fees.

Fast Execution Speeds

Having reliable MT4 and MT Pro platforms allows traders to maximise their profits and mitigate the volatility of forex trading. ATC Brokers Australia is an efficient broker that executes transactions fast at the requested order price.

As prices change rapidly, using ATC Brokers helps traders avoid delays. Such delays can significantly lead to exceptional losses.

Segregated Client Funds

ATC Brokers Australia offers segregated client funds, which build trust in the broker and encourage even the least experienced traders to trade their money. Traders and investors know that their money is safe, even if the company suffers losses or struggles to maintain its status in the market.

Moreover, the segregated client funds allow the company to easily manage funds.

ATC Brokers allows traders to trade many currency pairs.

Cons

Despite these amazing features, a few drawbacks should be considered before choosing ATC Brokers as your broker.

High Minimum Deposit

Compared to other brokers, ATC Brokers has a higher minimum deposit, even for its individual account. Although opening an account is easy, the minimum deposit represents an obstacle to traders on a low budget.

As a result, some beginners prefer to consider another alternative.

Limited Range of Tradable Assets

With ATC Brokers you can trade about 100 currency pairs and CFDs. But the number drops down to 40 if you’re in the US. Other platforms offer users more options to diversify their portfolios and decrease their trading risks.

Unlike other brokers, ATC doesn’t allow stock, ETF, index, cryptocurrency, and option trading. Such constraint makes it less versatile.

Inactivity Fees

ATC Brokers charges different non-trading fees that eventually add to the cost of using the platform. Inactivity fees, in particular, represent a big deterrent to those looking to trade with this broker.

If your account is inactive for six months, ATC brokers will charge you $50 monthly in inactivity fees. Although other brokers do the same, ATC Brokers’ fees are on the higher end. As a result, some users would be surprised to find their funds depleted in a few months if they don’t trade.

Limited Educational Resources

Unfortunately, ATC Brokers doesn’t offer as many comprehensive educational resources. These educational resources are important, especially for new and less experienced traders, as they teach them about the latest market strategies.

The learning centre contains some material on forex and CFD trading and the MT4 platform can provide some market insights. However, they aren’t enough as traders should learn about the latest trading trends and the best trading tools to succeed.

Criteria Evaluation

Now, it’s the moment of truth. We gave ATC Brokers a well-earned score in every criterion used to judge other brokers on the market. So, how did it perform?

Regulation and Safety: 4/5

ATC Brokers is a secure and safe platform as it’s overseen and regulated by the FCA in the UK, NFA in the US, and CIMA in the Cayman Islands. Moreover, clients’ funds are segregated, which adds another layer of security.

Since trading in a safe environment is paramount, ATC Brokers is considered a safe broker for beginner and more seasoned traders.

Trading Platforms: 3/5

Using ATC Brokers you can access MT4 and MT Pro trading platforms. These two provide insights into trading trends and the latest technology to allow traders to execute their orders efficiently.

However, more professional traders might feel unsatisfied due to the absence of the MT5 platform. It offers more trading tools that address the needs of expert traders who might find ATC Brokers a bit limited.

Financial Instruments: 3/5

The limited offering of financial tradable instruments is probably one of the main reasons ATC Brokers experienced a massive loss in 2019.

While other brokers offer many types of instruments that help traders to diversify their portfolios, ATC Brokers limits their choices to currency pairs and CFDs.

As a result, trading with this broker is suitable for a few people. Some traders would eventually consider switching to other platforms for more versatility and flexibility.

ATC Brokers is a good choice for trading CFDs.

Fees and Commissions: 4/5

ATC Brokers charges different types of trading and non-trading fees. The fixed commission fee is $1 for 10,000 lot-size contracts and $10 for 100,000 lot-size contracts. Having predetermined fees gives traders an idea of the overall pricing structure to trade confidently.

This broker doesn’t charge deposit fees, and withdrawal fees differ by method. For example, bank transfers are free but Skrill withdrawals are subject to a 2.9% commission. ATC Brokers also charges currency conversion fees that differ according to the market conditions.

Although ATC Brokers offers favourable trading fees, its inactivity fees are considered high. Users are charged $50 monthly after six months of inactivity, so their funds can be depleted fast.

Customer Support: 4/5

ATC Brokers offers multiple customer support channels, ensuring that traders receive all the help they need. Their live chat option is available 24/5 and traders can also fill in a feedback form.

Moreover, you can contact this broker via email or phone, depending on the urgency of your issue. The customer support team is made up of experienced professionals who have the needed knowledge about different financial markets and trading practices. As a result, they’ll answer all your questions promptly and accurately.

Deposit and Withdrawal: 3/5

First, your account should be verified before you can deposit or withdraw any amount. You should provide a government-issued ID, a bank statement, and a utility bill. This can delay some transactions until ATC Brokers verifies your account.

Despite not charging deposit fees, ATC Brokers scores less in this arena because it has limited deposit options. It allows traders to deposit funds using bank transfers, cards, and Skrill wallets, but other payment options aren’t supported.

This also applies to withdrawal transactions, which are charged different fees depending on the account type. Moreover, many traders believe that ATC Brokers’ withdrawal fees are high compared to other brokerages. Additionally, some users reported that their withdrawal transactions were delayed.

Educational Resources: 2/5

Although ATC Brokers offers some educational resources, they don’t provide enough information to professional traders who need more insights into the market’s conditions.

You can find some articles about forex trading but nothing that addresses the latest news and issues that traders might encounter.

As a result, as traders become more involved with the trading world, they might feel they need another broker to provide them with the knowledge needed to trade successfully.

User Experience: 3/5

Overall, ATC Brokers provides a good user experience if you’re into trading currency pairs or CFDs. Traders appreciate the strong regulatory oversight that guarantees a safe trading environment, and different account types give more flexibility. Moreover, the high execution speed makes it one of the most sought-after brokers.

However, many traders wish there were more tradable assets available to allow them to diversify their portfolios.

The platform charges different trading and non-trading fees that might deter some traders on a budget. Plus, some reported that the platform experienced downtime during volatile market conditions. However, most users appreciate the reliable customer support representatives and their responsiveness.

Community Reviews and Expert Recommendations

So, what are ATC Brokers’ reviews? Well, the best way to describe them is that they’re mixed.

Some users share positive experiences with this platform like this trader on Forex Peace Army who says, “Their execution is lightning fast. I’ve never experienced slippage with them.” This review can make less experienced traders feel safer knowing they can secure the best deals.

Other reviewers also highlight the responsive customer support department. A reviewer on Trustpilot notes, “Their support team is responsive and knowledgeable. They’ve helped me out of a few tight spots.”

However, some traders have negative experiences with ATC Brokers. Facing withdrawal issues is quite common as one reviewer stated on ForexBrokerReport, “The withdrawal process took longer than expected, and I had to follow up multiple times.” Nevertheless, it’s worth mentioning that this isn’t always the case.

Many users reported no issues with the interface. However, some experienced some platform downtime.

Trading experts believe ATC Brokers is a good choice for professional traders who appreciate ECN execution. The minimum deposit makes this broker less accessible to beginner traders who might be put off by the smaller number of tradable assets and the lack of educational resources.

So, what does this mean for you? It’s hard to label ATC Brokers as a good or bad broker, as it has its distinctive pros and cons. This is why it’s crucial to do your homework and see if this platform can provide you with what you need.

Price

ATC Brokers offers a competitive pricing structure with predetermined commission of $1 on forex trading and a commission of $6 per round turn for standard lots.

It charges different withdrawal fees depending on the method you’re using and the account type. Moreover, currency conversion fees and wallet transfer commissions should be taken into consideration.

But that’s not all. You should also consider the non-trading fees, like the inactivity fees of $50 charged monthly. Finally, the high deposit requirement adds to the overall cost of using the platform.

Alternatives to ATC Brokers

Not satisfied with ATC Brokers? Here are other options to consider:

eToro

eToro is a multi-asset trading platform that offers social and copy trading to help traders learn about the basics of forex trading. Users can practise using a virtual portfolio until they’re confident enough to use their hard-earned money. For more information on this broker, be sure to check out our eToro review.

Zengo Wallet

Zengo is a non-custodial cryptocurrency wallet that allows you to control all your digital assets. It’s a user-friendly wallet, trusted by more than 1,000,000 users. You can learn more about this non-custodial wallet through our Zengo Wallet review.

Pepperstone

Pepperstone is a reputable Australian-based broker, known for its fast execution speeds and competitive pricing. It’s a good choice for experienced and beginner traders who need a secure and reliable brokerage. If you want to know more about this broker, a great place to start is our Pepperstone review.

Pocket Option

Pocket Option is an excellent platform to trade binary options. It offers social trading to help beginner traders learn from trading experts, but its limited regulatory oversight makes it a bit questionable. To find out more about this platform, take a look at our Pocket Option review first.

FAQs

Are ATC Brokers safe to use?

We can confidently say that ATC Brokers is one of the safest options out there. It’s regulated by three reputable financial authorities—the FCA, NFA, and CIMA, providing maximum protection and peace of mind while trading currency pairs and CFDs.

Moreover, the company’s funds are separate from clients’ money for extra safety and better account management. However, remember even the safest broker can’t 100% shield you from the inevitable risks of trading.

What trading platforms does ATC Brokers offer?

ATC Brokers offers two trading platforms—MT4 and MT Pro. MetaTrader 4 is an industry-standard platform that offers essential insights and charting options that allow traders to make the right decisions.

Nevertheless, those looking for additional features will appreciate MT Pro, designed to cater to the needs of more professional users. Personally, I believe that the reliability of MT4 makes it a good choice for beginners, while MT Pro is more suitable for seasoned traders who need access to certain tools and data.

What are the minimum deposit requirements for ATC Brokers?

The minimum deposit for an individual account is $2000 for global clients but increases to $5000 if you’re in the UK. Joint and corporate accounts have a minimum deposit of $10,000 with access to unique perks and better features.

Due to the high minimum deposits, ATC Brokers is more suitable for experienced traders interested in ECN trading and who don’t mind paying the higher minimum. Other options will suit you better if you’re a beginner trader on a limited budget.

Do ATC Brokers offer demo accounts?

ATC Brokers offers demo accounts to help first-time and less experienced traders experiment with the trading world and decide what is best for them. Having demo accounts is an excellent feature as it gives traders some confidence before they start using real money.

Nevertheless, weighing the risks of your trading decisions before you move on to the real thing is paramount. No demo account will predict the actual market conditions and how they can lead to profits or losses once you start trading.

What customer support options does ATC Brokers provide?

Trading specialists are available as customer support representatives at ATC Brokers 24/5. They will promptly respond to your inquiries in the live chat and provide you with the needed assistance. You can also contact the platform via email, phone, or a feedback form.

Having a platform that is not available 24/7 might be a little inconvenient, especially if you’re trading in a different time zone. So, I’d recommend checking their support hours to guarantee you’re covered before you begin trading.

ATC Brokers is a good choice for more professional traders.

Final Thoughts: Are ATC Brokers Your Ticket to Trading Success?

As we reach the end of our honest and detailed ATC Brokers review Australia, it’s time to answer the question that has been weighing on your mind since the beginning—is ATC Brokers the right broker for you?

You already know this isn’t a yes or no question and the answer depends on several factors. For example, if you’re interested in trading currency pairs and CFDs, don’t mind paying the high minimum deposit, and appreciate access to ECN pricing and tight spreads, the answer will be a definite yes.

ATC Brokers allows for leverage that can benefit experienced traders and the regulatory oversight creates a pleasant trading experience.

But, this won’t be the case for someone starting their trading journey. The lack of multiple instruments like options, stocks, and ETFs, means that this broker’s transactions involve a higher risk. Moreover, the high minimum deposit and limited educational resources can be a big obstacle.

Additionally, if you spend long periods without trading, you might find all your funds depleted due to the platform’s inactivity fees. Finally, you must ensure you’re trading at a time when customer support representatives are available if you aren’t that experienced.

But don’t worry because there are other good alternatives out there if ATC Brokers isn’t the one.

So, who is this broker for? ATC Brokers suits more experienced traders who appreciate fast execution times. Thanks to the leverage options, you can achieve substantial gains and your trading transactions will always be safe.

Privacy Australia: Helping Australians Protect their Digital Sovereignty

Speaking of safety, I want to remind you that your privacy and safety are of utmost importance whether you’re online trading or checking your social media accounts. Protecting your personal and financial information is our mission at Privacy Australia. We’re a trusted source for resources that aim to help you protect yourself and personal data online.

Whether you trade with ATC Brokers or any other broker, we can help you learn the best ways to secure all your data for smooth sailing. Check our website for VPN reviews, secure browser recommendations, and much more to safeguard your online presence no matter what.

With your online data secure, you can place full focus on your trading decisions and aim for a more successful trading future.

With expert opinions and comprehensive coverage, BitRise is your destination for staying informed and ahead of the curve in the ever-evolving world of technology. Although the Certified Refurbished Amazon Fire HD 8 Plus Tablet is not the most sophisticated model on this list, there are many reasons to choose this tablet.