Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Forex Trading Apps in Australia

Today, this market is worth over an estimated $2.400 quadrillion globally…

This goes to show how far the principles of currency trading have come since the slow, financial stone age (pre-forex began way back in 1894 BCE and used precious metals).

Today, we trade in milliseconds via numbers and networks faster than Spock; modern forex markets show us, at a glance on-screen, how much of a winner a thing is, proportionate to the mammoth pool of funds mentioned above.

We touch on this history of forex markets below.

But without further ado, first, in this guide, we’re going to cover the best forex trading apps.

Table of Contents:

- How We Choose Our Platforms

- Best Broker: Copy Trading Australia – Our Reviews

- Buying Guide

- Subcategories of Forex traders

- What Is a Forex Broker

- FAQs

How We Choose Our Platforms 📚

The following brokers were hand-picked by our team.

Whatever service you end up with, remember that it’s often the user and not the tool, so take time to know your strategy, adapt to your chosen service, and, as always, use good financial common sense! 🖖🏻

1. Plus500

Key Features:

- Regulated by the ASIC in Australia

- $200 minimum deposit

- $10 inactivity fee after 3 months

- No deposit or withdrawal fees

For more detailed information visit: https://www.plus500.com/Help/FeesCharges

CFDs are a leveraged product and can result in the loss of your entire balance. Trading CFDs may not be suitable for you. Please consider whether you fall within Plus500’s Target Market Determination available in their Terms and Agreements. Please ensure you fully understand the risks involved.

Pros

- Connects to tons of markets and currencies

- No fees on withdrawals or deposits

- Good tools for planning your next move

Cons

- Not very friendly to newcomers

If you are trading foreign currency, then you are trading for the future. Plus500 has the most methods of trading foreign currency, from the tools to execute trades to the different trades you can make. Please note that all the instruments offered are available for trading only through CFDs.

The Right Tools

With Plus500 you can set up what you are trading, when you are trading it, and even the conditions under which it gets traded. This means you do not have to be staring at the app all the time. It also gives you graphing tools for making these plans more effectively.

A Huge Variety of Trades

One of the greatest assets afforded to you by Plus500 is its diversity. Diversity does not mean you can always find a big payday. What it means is that you can always find stability, even if you wander onto unstable ground. This is critical for foreign currency, where instability usually means a big loss.

Drawbacks

Of course, almost everything we just mentioned can be a drawback as well as an advantage. The reason being that most people are not going to show up knowing how to use these tools, navigate these forex pairs, or analyse these markets. They will be able to do some of these things, but rarely all of them.

This means that Plus500 might be highly versatile, but it will take some time before you are able to make use of that versatility. When do you, however, it will be worth it. However, you must be aware that there are also significant risks which could not be avoided and there are losses related to trading.

2. Pepperstone

Key Features:

- Account minimum: AUD$200

- More than 1200 securities: shorts, EFTs, crypto, CFDs, forex

- Number of indices: 23

- Myfxbook social trading

- Most-traded pairs: EURUSD

- Availability of crypto coins: 24

Pros

- One of the largest FX brokers

- Both ASIC and FCA regulated (one of the two top regulatory bodies for retail forex)

- Fast execution across upgraded trading platform

Cons

- Pretty high fund minimum needed to begin investing

- Has commissions

📓 Reputation

A strong range of tradable markets, with strong research quality, as well as integrated support for copy social trading across multiple platforms. They’ve been around since 2010, with two tier-one jurisdictions, which means this is a highly regulated solution (i.e. low-risk) for trading CFDs as well as forex.

They also offer both Copy Trader and MetaTrader, which are best-in-class trading Interfaces. Pepperstone provides numerous add-on features and tools to fine-tune and improve the MetaTrader experience.

Overall, their research is superior to the industry average, although IG Markets is a cut above them. And while the social-copy trading is expansive in its integrations, it is nowhere near as consumer-tailored. So a blend of both, but not the best in either arena.

3. IG Markets

Key Features:

- Commission (for CFDs)

- Assets include: Forex, crypto, penny, EFTs, CFDs

- Indexes available: 22

- IG community hub

- Around since 2006

- 200,000 active users

Pros

- Offers good exposure such as forex, CFDs/EFTs, shorts, crypto, and commodities

- Most Traded Stocks include: Tesla (number 1), Amazon, Apple, Netflix, with US_500 as the most traded index; gold is the biggest commodity

- Strong social trading

- Up-to-the-minute social news feed

Cons

- $250 is needed to start trading

📓 Reputation

IG markets were launched in 1999, becoming a market leader, particularly in Contracts For Differences (CFD). Market exposure is extensive, with 24/7 trading on forex, as well as a wide section of the stock indexes around the globe (meaning that there are round-the-clock opportunities).

Regulated by the FSA, Financial Services Authority; they’re also a member of the London Stock Exchange (LSE). As well as being regulated by the Australian Securities and Investments Commission (ASIC) for their Australian operations.

So if you’re looking for a forex powerhouse with extensive financial derivatives and a strong reputation (over 200,000 users), then it’s difficult to find fault in their services regarding the necessities of bog-standard trading – whether it’s scalping, day trading, long positions, or in-between.

Other mentions are mobile trading 24/7, free educational tools, and free-phone customer service. That said, they’re probably not the best for complete beginners.

4. AvaTrade

Key Features:

- Commission & spreads (from 0.03)

- Minimum to trade: $100

- Zulutrade: Follow and copy seasoned traders

- More than 1250 securities: shorts, EFTs, crypto, CFDs, forex

- Indexes currently tradable: 22

Pros

- AvaSocial: Learn from tutorials and videos

- Does it all from forex & short-selling to CFDs & EFTs

- Strong social trading

Cons

- $100 needed to start trading

- Charges commissions

- Only 20 cryptocurrencies

📓 Reputation

AvaTrade is known for its copy trading, mobile optimisations, and good pricing against the industry. Get extensive exposure to the CFD and forex markets. Its social-oriented trading background makes it one of the more beginner-friendly trading tools out there.

They’re also not lax on the regulatory front. Since they were founded in 2006, they’ve accomplished three tier-one jurisdictions and three tier-two jurisdictions, which makes them low-risk broker trading CFDs and forex.

In terms of offerings, choose MetaTrader or their proprietary WebTrader which has its special additions. Overall, access 44 forex options, as well as over a thousand CFDs.

5. Forex.com

Key Features:

- 80+ FX pairs, including gold and silver

- Live Market analysis

- Cash back rewards on FX trades

- Registered with FCM, RFED, CFTC, and NFA

- Voted Best Forex Broker in 2021

- Top-notch technology

- Low pricing for trades

Pros

- Easy to understand and use, making it ideal for newcomers

- Created by a very reliable and trusted company, Forex.com

- You can use the mobile app and then easily transition to the desktop version without skipping a beat

- Incredibly fast, making it easy to stay up to date

Cons

- Some would consider this app too simple

📓 Reputation

You would think with a name like Forex.com that this site would provide users with one of the best apps for trading. And you would be right.

Forex.com has long been one of the most beloved forex traders for years now and their budding trading app has only gotten better with time. It gives people some of the lowest spreads around and its performance is second-to-none when compared with other apps. Plus, it is available on both iOS and Android so it doesn’t matter what type of phone you use, Forex.com has you covered.

The Forex.com app does more than let you make your trades and look at the current market. It also has full sections that give you charts and news, so you can stay plugged in beyond simply numbers and statistics.

It is one of the most reliable and well-made apps and has an easy learning curve, which makes this one of the better apps for newcomers who are just starting their journey into forex trading. Fast, reliable, easy to navigate and use, there is no reason why people shouldn’t take a chance with Forex.com’s app.

6. Thinkorswim Mobile

Key Features:

- Supports multiple trader needs

- Streamlined web interface

- Web, desktop, or mobile

- Voted #1 platform and tools

- Up to the minute news & analysis

- Sophisticated data and options

- Full service with assets like Forex, crypto, futures, EFTs, stocks, etc

Pros

- Filled with great features that will keep users busy for days

- Live-streaming of CNBC

Cons

- Only useable for TD Ameritrade clients

- Somewhat difficult to navigate and figure out for newcomers

📓 Reputation

Thinkorswim Mobile comes to use from TD Ameritrade, which is a very well known and well respected company. That’s the first sign that you should take thinkorswim Mobile seriously.

This app gives you a full service platform, as long as you’re a TD Ameritrade customer. You can trade forex, options, futures, and other stocks at the same time. The interface is easy to understand and use and the app is filled sith streaming charts, technical indicators, and so much more. You can even create your own charts and make study tools for yourself.

Better yet, those who use thinkorswim Mobile can stream CNBC live through the app. This will give you insight into the business world and up-to-the-minute updates that will influence your standing in the market and your next move in forex.

TD Ameritrade has put a lot of effort into building a community on their app. That has led to the community feature, that lets people communicate with other users and talk strategies, options, and so much more.

With thinkorswim Mobile, users can spend hours exploring the market. There is so much to dig into with this app that it might take some time to touch upon it all. But it’s a smart, worthy investment for those looking to take forex seriously.

7. Oanda

Key Features:

- World class execution

- More than 70 currency pairs

- Discounted spreads for high volumes

- Customizable platform

- Voted best forex broker 2020

- Fully automated trading platform

- Mobile or web platforms

- MT4 charting & analysis

Pros

- Simple to use, easy to navigate

- Comes with two-step authorization, meaning no one will be able to use your account without your knowing

- You can customise the charts in the app

Cons

- Doesn’t come with face scanning or fingerprint tech, missing out on that extra layer of security

📓 Reputation

Over the years, Oanda has become one of the most beloved and most-used apps for forex trading all over the world.

There are many reasons for that. Firstly, the app uses multiple languages. In fact, it’s accessible from practically any country in the world, which is paramount and important when you are exploring the forex market. The app is available not only in English but also German, Chinese, Russian, Japanese, Arabic, and more. That means that users from all over the globe can enjoy the app and trade their respective currencies.

Oanda is also easy to use, and that’s a huge help, especially if you’re new to forex. It can be intimidating to start trading and some people don’t know where to start. The joy of Oanda is that you never feel like you’re making the wrong step or headed down the wrong path.

But perhaps what makes this app so incredibly special for forex users is its security features. It’s probably the safest and most reliable forex app on the market, which gives all users peace of mind, which is downright priceless for those in the forex market.

In fact, the only downside of Oanda is that the app doesn’t go far enough with its safety features. But the hope is that future updates to the app will make it even more secure.

8. FXTM

Key Features:

- International CFD and Forex broker

- Low trading fees class

- Supports 4 base currencies

- Assets such as Forex, CFD, Crypto, and stocks

- Fully digital account open process

- $50 minimum deposit

- Customizable trading platform

- Trading based technical tools

Pros

- Easy to master and takes little effort

- Allows users to use many different languages

- Terrific customer support

Cons

- A lack of safety features

📓 Reputation

There are many people who want to get into forex trading but are too afraid to because of how overwhelming it might seem. That’s where FXTM comes in handy because it is ideal for any newcomers and is practically made for those looking to dive headfirst into forex.

The thing that makes FXTM so easy to use is that it is intuitive. In fact, it feels like it knows what you’re thinking and looking for before you even search for it. But speaking of searching, the FXTM app has a great search function which allows you to find practically any currency within just seconds.

The app also comes with great customer support, another feature that makes it ideal for people who haven’t traded before. If you happen to come across a problem, you can rest assured that it’ll be handled by a team of professionals who are eager to give you the very best experience with the app.

From its multiple languages, to its intuitive features, to its easy to use search engine, FXTM has so much. That’s why its lack of security features is such a bummer. But thankfully that is something that can be changed and enhanced over the years so it’s not enough to count this app out.

9. SuperForex

Key Features:

- Easy deposit bonus for signing up

- 300+ trading instruments

- Deposit protection

- Forex copy trading services

- Integrated with MT4

- Supports more than 20 payment systems

- Vast education platform

- Highly secured database

- Top mobile app provider in the industry

Pros

- User-friendly app

- MT4 app is also available

- Accounts with STP and ECN are available

- Deposits start at just $1

Cons

- A bit of a steep learning curve, meaning it’s not ideal for newcomers

📓 Reputation

Hailing from South Africa, SuperForex is one of the most in-depth and complex Forex apps on the market. Therefore, it’s got a lot to offer. It’s sleek and easy to use but if you’re just getting into the forex market, you might be a little confused by SuperForex.

Depositors can start their forex journey by putting just $1 into the market. People who make larger deposits might qualify for a 50% deposit match welcome bonus too, so there is something offered to newcomers who are just getting their feet wet in forex.

The app comes with basic chartering and analysis and is sleek and fast too. That means it’s perfect for people who want to pick up the app, trade quickly, and be done in just a short amount of time.

The biggest downside to SuperForex is that it’s not very easy for people who haven’t had a lot of experience with forex or trading apps. It’s designed for more advanced traders. At the same time, while it does have many features, some people think it could be even more in-depth and more rich with helpful features.

All in all, SuperForex is a fun app that could be your favourite if you’ve done some trading. And while it’s $1 entry is easy to swallow, it might not be the best choice if you’re a newcomer.

Buying Guide

History of Forex Trading 📜

In 1894, the basic pre-forex trading system became used to exchange currencies, in Babylon. Most of the time, the system involved the exchange of gold for provisions of practical goods, less precious metals like silver were also integrated into the transaction system a little after.

Jumping ahead to between 1696 and 1812, the increasing complexity of political systems inspired the adoption of native currencies and coins; especially as gold became limited in use as a practical trading medium. This introduced the “gold standard”, which tied national currencies to the worth of gold.

Around the time of the 1930s Great Depression, however, and the banking systems collapse, the public became frightened about gold hoarding, leading to the abandonment of the gold standard formally by the UK in 1931 and the US following suit two years after.

‘Bretton Woods’ System, 1944

The gold standard was substituted for the “Bretton Woods” system in 1944, with an eye on the governing of global fiscal relations. In short, international currencies globally were pegged to the value of the US dollar, which itself was reducible to the value of gold; and this became the world’s most popular reverse currency.

Later dissatisfaction with the Prioritisation of the USD, in the early 70s, happened as the forex market developed. While the US dollar is still the leading currency and global reserve, forex markets now determine currency exchange rates and the plethora of greater macroeconomic factors.

With time, technological innovations increased forex accessibility into consumer markets, with advancements needing to take on over 170 currencies and spoke day-to-day trading volumes of $6.6 trillion internationally.

Technological developments and the explosion of online brokerage sites and apps certainly opened up the market to part-time traders, emerging markets, and a raft of wide-ranging small and exotic currencies as additional options trading.

Development of Forex Apps 📱

The 1990s saw a rapid growth of forex markets. As the Internet improved, the world became closer together and currency markets more sophisticated.

Beforehand, the currency markets were for the most part available to institutions and big banks. This suddenly expanded to include retail traders, who could speculate and even trade from home.

During this period, the nature of forex trading altered forever. And the early 2000s saw further telecommunication hardware and internet-speed spike, expanding forex markets further to new traders. In order to service the multitude of new people discovering forex markets, new tools and services were created.

Forex brokers became more convenient, streamlined for cost, and advanced; offering more forex pairs available to trade. For instance, one of the most-used trading platforms, MetaTrader, started in 2002. While the first trading apps were developed all the way back in the 1990s.

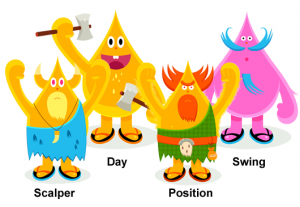

Three Types of Forex Traders

Making money (be aware of the risks involved and the possibility of capital losses too) on the forex market happens in different ways. Throughout the decades, the differing approaches have stood out into 3 categorizations:

☑️ Day Trading

Anyone who doesn’t leave their positions overnight is day trading. The trading itself can look different because the timeframe for analysis can be chopped up several times over. Day traders who focus on fast trades and tiny wins are called “scalpers”. Whereas day traders make acquisitions that are larger and made in fewer positions, all still inside of a single day.

The biggest boon to day trading is limiting risk (each trade ends in one session) and reducing costs because brokerage commissions and other fees do not roll over (no overnight fees).

☑️ Swing Trading

This is when positions are held between 2 days and anywhere up to a few weeks. Also, traders typically rely on technical analysis, also ‘reading the tea-leaves’ according to calendar rhythms which can be possible from volatility spikes after news events. Commonly used swing trading strategies include indicators such as moving averages, Bollinger Bands, Fibonacci retracement, and more.

The biggest boon to swing trading is the more moderate pace which better fits part-time traders with less time to continuously monitor the positions and less time overall. The biggest drawback to this approach is incurring greater costs due to rollover fees and expanded risks from longer exposure to the markets.

☑️ Position Trading

Position trading ranks as the most strategic of approaches to trading and is reserved for people with the greatest amount of time and resources to conduct accurate research. A position trader might not even make more than 10 trades a year. But each is hyper-focused on longer-term price changes, combining foundational technical factors.

Once again, the cornerstone is research, with chart technical tools as pin-pointers of optimal entry and exit points – to shave off costs and maximise profits.

For research, data is drawn from large timeframes, typically daily or weekly charts. Their motivation is to work out the market’s direction of movement before anyone else, and then watch as the world catches up. This strategy depends on knowledge, patience, and usually a substantial account for it to be worthwhile.

As for the “face” of position trading, that would be Warren Buffett!

Subcategories of Forex traders 📁

Scalpers

As mentioned above, these are day traders who trade in the smallest timeframes. Strategies normally draw from one-minute and five-minute charts and tiny trade durations.

This dynamic approach is well suited to traders who thrive on adrenaline. Scalpers prefer tons of small wins over large big ones.

News Traders

Not for the fainthearted. News trading centres on leveraging key news events, on a regular basis, in order to use the volatility to opportunistically profit. These traders search out big event-driven movements such as non-farm payrolls, rate decisions, and more.

Trading the news is not advisable for those still learning.

Algorithmic traders

This final subcategory has become popularised as a result of the influence of high-frequency algorithmic trades in totally transforming the professional and trading landscape.

In short, algorithmic trading centres on computer software automatically open or close a position once preset criteria are met. Therefore, this approach to trading can be quasi or totally automated. Whereas some algorithmic traders prefer creating their own systems independently, others purchase turnkey black box algorithmic systems that frequently result in unimpressive results.

What Is a Forex Broker?

The word “Forex” is a blend of two words: for(eign) and ex(change). While the word “broker” means to act as an agent for another; negotiating purchases, contracts, or sales in return for a commission or fee.

Therefore forex brokers are financial services firms that give traders access to the platforms used for exchanging foreign currencies.

By necessity, the foreign exchange market is international and 24-hour. Clients of forex brokers will include retail currency traders who use forex platforms in order to speculate on currency movements. But other clients include big financial services companies who deal on behalf of investment banks and other clients.

Any single forex broker company will negotiate only a tiny fraction of the full transaction volume of the forex exchange market.

Day-to-Day Activities of a Forex Broker ⚙️

Most brokers facilitate trades from one currency to another and will incorporate emerging market currencies.

For instance, an overview of typical steps:

- A trader signs up with a forex brokerage account.

- Using this forex broker, the trader opens a trade by purchasing a currency pair, at one exchange rate. (For instance, the trader buys the USD/AUD pair.)

- *This would mean the trader exchanged Australian dollars for U.S. dollars. This is the equivalent of buying U.S. dollars using Australian dollars

- The trade is ended by selling this same USD/AUD pair At the same rate, or the different rate, according to the market value.

- *Once closing the deal, this is the equivalent of buying Australian dollars with U.S. dollars.

- In the normal way of trading, if the exchange rate appreciates to higher by the time the trader closes the trade, compared to when they opened it, a profit is made. If not, then a loss is made.

FAQs

What is Forex Trading?

☑️ Day Traders – these never leave any open positions overnight. There are two types. The first focuses on quick trades that have incremental wins and so are known as “scalpers”. But the standard type of day trader makes larger acquisitions that are made using fewer positions.

Either way, all decisions are opened and ended inside of a single day. The biggest perk to boon to day trading is less risk (traders don’t drag on to the next day, and there were no overnight fees)

☑️ Swing Trading is where positions are held between 2 days and up to a few weeks. They’re reliant on technical analysis, peering into probabilities according to calendar rhythms which can be possible from volatility spikes after news stories.

The biggest perk to swing trading is a slower pace which best suits part-time traders (i.e. the ones who are being copied) with less time to continuously monitor positions. The biggest downside is a few higher fees and more risks from prolonged exposure to the markets.

☑️ Position Trading – If you look if you have come across the term HODL Related to cryptocurrency, this is the Training mentality where you choose investments where you are likely to hold on and not sell for long periods of time. You ignore short-term market fluctuations, as long as they do not affect the longer-term patterns. This is what position trading is, in forex.

Position trading is the most strategic of approaches to trading and is chosen by people with the greatest amount of time and resources to conduct accurate research. If you are copying a trader uses this approach; they are drawing from research data that uses large timeframes, typically daily or weekly charts.

Their motivation is to work out the market’s direction of movement before anyone else, and then watch as the world catches up. This strategy depends on knowledge, patience, and usually a substantial account for it to be worthwhile. Basically the closest thing to Warren Buffet.

Who Can Trade Forex?

Professionals trade the forex for profit. But most nonprofessionals do not. These will be the tourists exchanging money while traveling abroad. These exchanges are not speculative but pragmatic, and high spreads mean it is nearly impossible to profit.

Only a slim margin of independent forex traders make a profit, representing roughly 6% of the market ($360 billion daily in volume). Therefore, the majority of forex trading is a relationship between the institutions, who oftentimes play as both buyer, seller, and intermediary.

What Are Currency Pairs?

Currency pairs are national currencies from two nations that have been coupled in order to exchange their values on the foreign exchange (FX) marketplaces. The position possible will be based on the current real-time exchange rate between the two. And all trading on the forex market, whether trading, buying, or selling, takes place via currency pairs.

Most transactions occurring on the FX markets are between currency pairs of the 10 nations making up the G10. These countries and their currencies include the Euro (EUR), the US dollar (USD), the British Pound sterling (GBP), the Australian dollar (AUD), the Japanese yen (JPY), the New Zealand dollar (NZD), the Canadian dollar (CAD), the Swiss franc (CHF).

You Might Also Like: