Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Top 8 Best Index Funds in Australia for 2024

Index funds are a useful tool for diversifying portfolios and making the most of investments. For investors in Australia, index funds offer many advantages. These include being relatively lower cost and offering broader market exposure through a long-term investment. In this comprehensive guide to the best index funds Australia, we’ve chosen 8 that stand out as exceptional investments.

Table of Contents

- TL;DR

- Criteria Breakdown Summary

- Vanguard Australian Shares Index ETF (VAS)

- iShares Core S&P/ASX 200 ETF (IOZ)

- SPDR S&P/ASX 200 Fund (STW)

- BetaShares NASDAQ 100 ETF (NDQ)

- iShares S&P 500 ETF (IVV)

- Vanguard MSCI Index International Shares ETF (VGS)

- BetaShares Australian Equities Strong Bear Hedge Fund (BBOZ)

- Global X Physical Gold ETF (GOLD)

- Notable Mentions

- Frequently Asked Questions

- Final Thoughts

TL;DR

- Vanguard Australian Shares Index ETF (VAS) offers the broadest Australian market exposure

- iShares Core S&P/ASX 200 ETF (IOZ) tracks Australia’s benchmark index with very low fees

- BetaShares NASDAQ 100 ETF (NDQ) provides access to top US tech companies

- iShares S&P 500 ETF (IVV) offers low-cost exposure to large US companies

- Vanguard MSCI Index International Shares ETF (VGS) provides global diversification ex-Australia

- Consider your investment goals, risk tolerance, and desired geographic exposure when choosing

- Pay attention to management fees, tracking error, and liquidity when evaluating index funds

- Regularly review and rebalance your portfolio to maintain your target asset allocation

Criteria Breakdown Summary

When evaluating the index funds on our list, we choose five criteria we feel are most important. With each criterion, we assessed each index fund on a scale of one to five, with five being the best. This offers a simplified way of comparing index funds and choosing the best option for individual investment needs and goals.

Tracking Error: This is a measure of how closely a fund is following its benchmark index. Simply put, tracking error is an overall expression of performance volatility between a specific fund and its index. Overall, we like to see a lower tracking error.

Expense Ratio: Index funds, which are long-term investments, are charged an annual fee. The expense ratio measures the amount of this fee as a percentage of the investment. This is an important number to know and understand as it directly impacts profitability.

Liquidity: This is a measure of how quickly or easily a fund’s shares can be bought or sold.

Diversification: This is a key factor for long-term investment. Diversification helps reduce the risk of volatility and potential profit loss. We look at how diversified each fund is and the level of market exposure it provides. Fund Size: This is a simple measurement of the amount of assets that fall under the fund’s management. Fund size can influence costs and tracking, with benefits coming from larger funds.

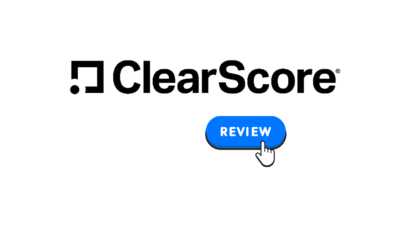

Vanguard Australian Shares Index ETF (VAS)

Best Known for Broad Market Coverage

First on our list of Australian best index funds is Vanguard Australian Shares Index ETF (VAS). This is widely regarded as the gold standard for investors seeking broad exposure in the Australian market. This option stands out for its extensive market coverage, tracking the S&P/ASX 300. For investors, we like that VAS offers low-cost exposure to the Australian equity market and has a high liquidity status. According to Vanguard, VAS is among the largest cash flows of Australian ETFs.

Features

CHESS Sponsored: VAS is CHESS sponsored. The Clearing House Electronic Subregister Systems ensures enhanced security. CHESS sponsorship means a broker holds and manages all VAS shares.

Dividend Reinvestment Option: Investors have the option to reinvest VAS dividends. This allows for compounded growth of investments over time.

Transparent Holdings Updated Daily: Vanguard prioritises daily transparent updates. Investors can simply visit the Vanguard website for index fund updates.

Pros

- Broadest exposure to the Australian market

- Extremely low management fee

- High liquidity for easy trading

- Strong track record of low tracking error

- Trusted Vanguard brand and infrastructure

Cons

- Limited to the Australian market only

- May have higher volatility due to including smaller companies

- Dividend yield may be lower than some competitors

- No currency diversification

Criteria Evaluation

Tracking Error: 4.5/5

VAS has a consistently low tracking error, making it one of Australia’s best index funds. We appreciate the effort Vanguard makes in educating investors on the importance of error tracking and offering transparent updates. Overall, VAS shows little deviation from the performance of the S&P/ASX 300 index.

Expense Ratio: 5/5

We feel Vanguard’s expense ratio is another standout feature. It offers one of the lowest management fees in the market. Cost-conscious investors will appreciate VAS’s price competitiveness.

Liquidity: 5/5

With Vanguard being a leader in index funds, its assets and trading volume are robust enough to offer impressive liquidity.

Diversification: 4.5/5

We measured Vanguard’s diversification and found it to be satisfactory, with representation among multiple sectors. However, VAS tends to lean heavily toward financial sectors, which marginally limits diversity.

Fund Size: 5/5

VAS offers billions of dollars under asset management. Compared to the market as a whole, we recognize VAS as one of the largest in the Australian market.

Community Reviews and Expert Recommendations

Australian investment experts praise VAS for offering extensive market coverage. Low management fees contributing to a good expense ratio are also seen as a strong positive for investors. While VAS is strongly focused on the financial sector, it also offers a means for investors to gain exposure to ASX blue-chip stocks. The one drawback we can think of is that while VAS offers broad Australian market exposure, it lacks global diversification. We recommend exploring global markets to improve portfolio diversification.

Price

The management fee for VAS is currently less than 0.10%. We recommend visiting Vanguard Australia for comprehensive investment information.

iShares Core S&P/ASX 200 ETF (IOZ)

Best Known for Low-Cost Benchmark Tracking

iShares Core S&P/ASX 200 ETF (IOZ) makes it onto our list for its affordability. IOZ offers low-cost access to 200 of the ASX’s largest companies. We rank this index fund high for new investors who might be apprehensive about entering the market at higher costs. IOZ has broad appeal for individual and institutional investors. Finally, before going any further, we want to mention that BlackRock, which is a world-leading asset manager, manages IOZ.

Features

BlackRock Risk Management System: Being managed by BlackRock means IOZ is protected under the Aladdin risk management system. Innovative risk analytics, additional oversight, and quality controlled data ensure investment protection.

Broad Sector Coverage: IOZ offers broad sector representation for investors. Much like Vanguard, IOZ is heavily weighted in financials, but there is sufficient sector coverage for diversity and risk management.

In-Kind Creation and Redemption: For authorised participants, IOZ promotes and manages liquidity through the creation and redemption of units directly with the fund.

Pros

- Very low management fee

- High liquidity and tight spreads

- Tracks the widely recognised benchmark index

- Backed by BlackRock’s global resources

- Good for tax-aware investing strategies

Cons

- Less diversified than broader market funds

- Heavily weighted towards financials and materials sectors

- No exposure to mid or small-cap companies

- Slightly higher tracking error than some competitors

Criteria Evaluation

Tracking Error: 4.5/5

Compared to other Australian index funds, IOZ offers a slightly higher tracking error, but this alone doesn’t tell the full story. We’ve seen IOZ remain consistent in effectively following the S&P/ASX 200 Index. We’re confident enough in this to provide iOZ with a near-perfect score in this category.

Expense Ratio: 4.5/5

With an expense ratio that falls below 0.10 %, iShares remains one of the most affordable options for investors.

Liquidity: 5/5

We feel it’s fair to award iShares the highest possible score for liquidity. With a large, fluid asset size and continual trading activity, buying and selling positions can be accomplished with minimal effort.

Diversification: 4/5

We’ve mentioned that iShares offers good sector diversification, specifically focusing on the top 200 companies. Still, it’s heavily leaning toward financials and lacks small-cap diversification.

Fund Size: 4.5/5

IOZ fund size currently exceeds $6,129 million. We view this as substantial enough to be a leading player for top ETFs in Australia.

Community Reviews and Expert Recommendations

When speaking with investment experts, IOZ is recognized as a strong choice for broad ASX exposure. A blend of cost-effectiveness and high liquidity add to its appeal. For those seeking S&P/ASX 200 index exposure, there are few options that compare with iShare’s costs and features.

Price

The management fee for IOZ is 0.09% per annum,; although this may vary. We recommend learning more by visiting BlackRock Australia.

SPDR S&P/ASX 200 Fund (STW)

Best Known for Long-Standing Track Record

Our experience with the Australian market has taught us that longevity and track records matter. This is why we’ve placed STW as our top choice for an exceptional, long-standing track record. STW was launched in 2001, with the distinction of being Australia’s first ETF. More than twenty years later, its track record is still performing strong.

Features

Global Management Expertise: STW is managed by State Street Global Advisors. While focused on the Australian Market, State Street brings expansive global expertise to the index fund management game.

Quarterly Rebalancing: STW goes through quarterly rebalancing. This allows trading assets to prevent the index fund from deviating too far from its core.

Longest Standing ETF Track Record in Australia: More than 20 years is an impressive benchmark for an Australian ETF track record. This is broad enough experience and longevity to make new or hesitant investors feel more comfortable.

Pros

- Long-standing track record and reputation

- High liquidity and tight spreads

- Tracks the widely recognised benchmark index

- Backed by State Street’s global expertise

- Popular with institutional investors

Cons

- Slightly higher management fee than some competitors

- Less diversified than broader market funds

- Heavily weighted towards financials and materials sectors

- No exposure to mid or small-cap companies

Criteria Evaluation

Tracking Error: 4.5/5

Throughout its track record, STW has maintained low tracking error with minimal deviation from the ASX 200 index.

Expense Ratio: 4/5

We’ve seen the management fee range from 0.05% to 013% over the years. When at its higher point, STW’s expense ratio is marginally higher than some of its competitors. However, we still consider this to be a cost-competitive option.

Liquidity: 5/5

STW offers exceptional liquidity. Trades can be made without having a significant impact on overall market performance.

Diversification: 4/5

As an index fund, STW covers the largest 200 companies per the ASX 200. This naturally leads to being weighed heavier in financials and materials. However, there is still broad enough diversification to earn STW a high score.

Fund Size: 4.5/5

Current assets under management top $5,636 M. This is a large enough asset base for stability when investing in Australian index funds.

Community Reviews and Expert Recommendations

Let’s look at a few ways STW stands out among financial experts. A long history and strong track record are almost always the first among mentions. High liquidity is another positive point that experts routinely point out. With all this, STW has managed to leverage economies of scale to maintain cost-effectiveness.

Overall, this remains a top choice for all levels of investors. New investors appreciate the cost-effectiveness and low-risk profile. Larger portfolios benefit from high liquidity and the fund consistency STW provides.

Price

The management fee for STW ranges from 0.05% to 0.13% per annum. On the lower end, we view this as extremely cost-beneficial. On the higher end, we feel STW remains competitive, even though fees are still a bit higher than most. You can find more information and invest in STW at State Street Global Advisors.

BetaShares NASDAQ 100 ETF (NDQ)

Best Known for US Tech Exposure

So far, the top ASX index funds on our list are heavily weighted toward financials, with materials coming in second. Now we turn toward index funds focusing on the tech sector, more specifically in the US. BetaShares NASDAQ 100 (NDQ) is our recommended choice for investing in index funds that extend beyond the financial sector. This top index fund leans heavily toward US tech firms, including Apple and Microsoft, Nvidia, Tesla, and Amazon, among others. .

Choosing NDQ offers Australian investors with an exceptional diversification opportunity, with exposure to companies not listed on the ASX

Features

Unhedged Exposure to USD: Through NDQ, investors can access unhedged exposure to US currency. Savvy investors recognize the potential here to benefit from currency fluctuations. This comes into sharper focus when the AUD is weaker compared to the USD.

International Diversification: Moving away from strictly ASX investments allows investors to better diversify portfolios and benefit from global exposure. We call this a win for Australian index fund investors.

Access to BetaShare’s Expertise: Finally, we don’t want to pass up the opportunity to praise the expertise of BetaShare. They are one of Australia’s leading ETF providers, hands down. Plus, they are top-notch when it comes to providing international exposure in the Aussie market.

Pros

- Exposure to leading global technology companies

- Diversification away from the Australian market

- Strong historical performance

- Liquid and easy to trade on ASX

- Unhedged for potential currency gains

Cons

- Higher management fee than broad market ETFs

- Concentrated in the technology sector

- Currency risk from USD exposure

- Potential for higher volatility

Criteria Evaluation

Tracking Error: 4/5

Overall, NDQ has exhibited a record of closely tracking the NASDAQ 100 index. There’s only one detail that prevents us from giving this index fund 5/5. NDQ exhibits a small degree of tracking error resulting from synthetic replication.

Expense Ratio: 4/5

With a management fee of 0.48%, NDQ’s fees are higher than most. However, unhedged exposure to US currencies and international tech sectors helps balance the equation.

Liquidity: 4.5/5

We’ve noted strong trading volumes with NDQ. The near-perfect score is reflective of the high liquidity potential this index fund offers.

Diversification: 3.5/5

Why not a perfect score for diversification? While it’s true that NDQ opens up investment doors to US tech sectors, it’s rather limited in other areas. A good approach would be to invest in NDQ as part of a broader diversification strategy.

Fund Size: 4/5

Current NDQ assets hover around $4,990,427,126 AUD, and growing. NDQ is gaining popularity among investors as a top Index fund in Australia.

Community Reviews and Expert Recommendations

Like any index fund, there are pros and cons, and the experts are here to tell us about them. First, financial experts point to NDQ’s robust performance, especially as the US tech sector has experienced significant growth. Still, it’s worth mentioning that there is a risk with NDQ being so tech-sector dependent. Diversification is the safest route, but NDQ remains a good option for investors looking to profit from global tech innovations.

Price

The NDQ management fee is higher than many other index funds. Currently, the fee is set at 0.48% per annum. To learn more, explore investing in NDQ at BetaShares.

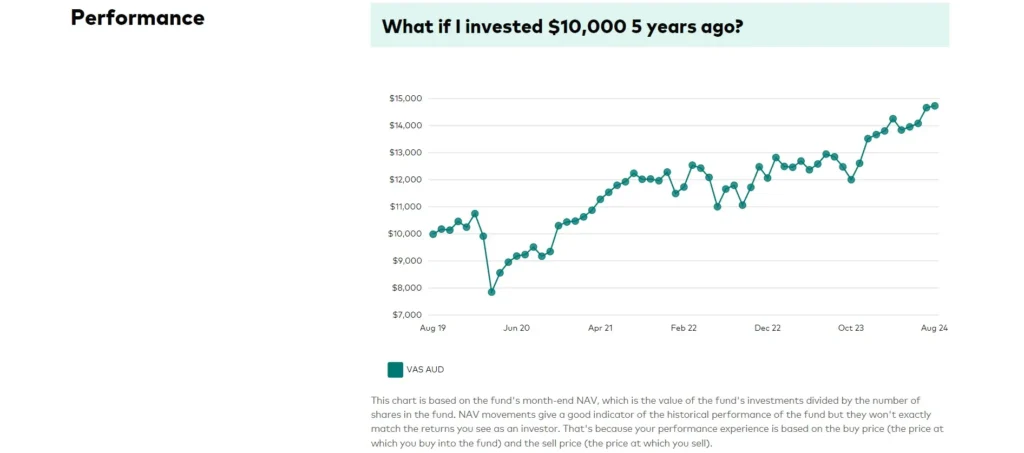

iShares S&P 500 ETF (IVV)

Best Known for Low-Cost US Market Exposure

Following on the tail of NDQ for US market exposure is the iShares S&P 500 ETF (IVV). One of the main differences between the two is that IVV is not so heavily weighted toward tech. About a third is weighted toward information technology, with many other sectors given space. Financials, healthcare, consumer discretionary, and communication are just a few of the prominent sectors.

To sweeten the opportunity, IVV is also one of the lower-cost index fund options we’ve seen. This is another index fund that’s managed by BlackRock, adding extra layers of investment security. When looking for an online broker to invest in IVV with, we recommend reading our comprehensive eToro review.

Features

Low-Cost US Market Entry: With management fees of only 0.04% per annum, IVV is one of the lowest-cost options for diversifying with the US market.

US Large Cap Exposure: Through IVV, investors gain exposure to some of the leading US large-cap companies.

Securities Lending: IVV is positioned to create additional income through securities lending. This is a feature with the potential to improve the bottom line on returns.

Pros

- Extremely low management fee

- Broad exposure to US large-cap stocks

- High liquidity and tight spreads

- Backed by BlackRock’s global resources

- Unhedged for potential currency gains

Cons

- Currency risk from USD exposure

- No exposure to US mid or small-cap companies

- Potentially high concentration in top holdings

- Might be less tax-efficient for Australian investors compared to local funds

Criteria Evaluation

Tracking Error: 4.5/5

We’ve noted IVV to have a very low tracking error. It is consistently aligned with the S&P 500 index.

Expense Ratio: 5/5

With a management fee of 0.04%, IVV offers one of the best expense ratios on our list.

Liquidity: 4.5/5

IVV liquidity is well above average, with a large asset base fueled by top US companies.

Diversification: 4.5/5

Multiple sectors are sufficiently represented with IVV, including members of the 500 largest US companies. If it weren’t for a lack of small-cap exposure, we would have given IVV 5/5 in this area.

Fund Size: 4.5/5

Net assets currently total $8,730,181,807 AUD. This is robust enough to label IVV as well-established and resilient in the market.

Community Reviews and Expert Recommendations

Financial experts are hard-pressed to find reasons to not invest in this top index fund. IVV has a high rating, with low fees and US market access being key benefits. This is a good index fund for beginning investors due to its cost and diversification. However, it’s also advised to expand portfolios by also investing in ASX-specific index funds for broader diversification.

Price

IVV’s management fee is an exceptionally low 0.04% per annum. To learn more about investing in IVV as a low-cost option, visit BlackRock Australia.

Vanguard MSCI Index International Shares ETF (VGS)

Best Known for Global Diversification

Next, we return to Vanguard for the MSCI Index International Shares ETF (VGS). In our opinion, this is among the best options for providing Australian investors broad exposure to global markets. With this ETF, investors gain exposure to more than 1,500 companies, located in over twenty developed markets. We want to point out that VGS excludes Australian markets.

Features

Vanguard Risk Management System: Investing with Vanguard comes with robust risk management and highly trusted investment expertise.

Global Equity: Access to 22 global markets provides portfolios with global equity. This includes both large-cap and mid-cap companies from around the world. Competitive Pricing: Management fees for VGS are set at a competitive 0.18% per annum.

Pros

- Broad global diversification in a single fund

- Competitive management fee for international exposure

- Access to companies not available on ASX

- Unhedged for potential currency diversification benefits

- Backed by Vanguard’s indexing expertise

Cons

- Currency risk from multiple foreign currency exposures

- Excludes emerging markets

- Higher management fee than some domestic-only funds

- Potential for higher tracking error due to time zone differences

Criteria Evaluation

Tracking Error: 4.5/5

As we’ve looked at VGS’s performance history, we’ve seen it consistently follow the market, leading to exceptional tracking error scores.

Expense Ratio: 4.5/5

VGS fees are competitive at 0.18% per annum. We see the combination of competitive fees and global equity as contributors to an excellent expense ratio score.

Liquidity: 4.5/5

This ETF is highly liquid, which is a trend that isn’t expected to change anytime soon.

Diversification: 5/5

With broad global exposure and over 1,500 companies, this is among the most diversified options on our list.

Fund Size: 4.5/5

Assets under this fund are expansive and continue to grow under Vanguard.

Community Reviews and Expert Recommendations

VGS is highly regarded among the financial expert community. The reasons why include all the features and benefits we’ve already outlined here. Global equity diversification, strong performance, low cost, and a range of sectors are just a few of the positives. Financial experts overall feel that VGS is a good investment option for both new and experienced index fund investors. However, VGS does not include Australia in its global market offerings. This makes it worth exploring Australian index funds to complement VGS.

Price

Management fee of VGS is 0.18% pa. For more information on VGS, we suggest visiting Vanguard Australia.

BetaShares Australian Equities Strong Bear Hedge Fund (BBOZ)

Best Known for Market Downturn Protection

News of a market downturn is something many investors are not keen on hearing. However, with investments in index funds like the BetaShares Australian Equities Strong Bear Hedge Fund (BBOZ), it’s possible to change the course of market downturns on investment portfolios. With BBOZ, it’s possible to actually profit or hedge against downward momentum in the Australian share market.

Before getting too excited, remember that the inverse performance is also true. Just as BBOZ can achieve returns in a market downturn, it may also cause losses in a rising market.

Features

Market Downturn Protection: The primary benefit and feature of this index fund is portfolio protection and potential market gain during Australian market downturns.

Optimised Returns: Being targeted at -2.0 to -2.75 times the daily returns offers investors robust inverse exposure.

Appeal for Advanced Traders: Investing in this index fund requires a complex strategy. It’s best suited for experienced investors who are comfortable with advanced techniques. This includes active monitoring, which deviates from the index fund investment norm.

Pros

- Potential to profit from market declines

- Can be used as a hedging tool

- Accessible way to gain short exposure

- No margin calls or shorting costs for investors

- Liquid and easy to trade on ASX

Cons

- High management fee

- Complex product with significant risks

- Potential for large losses in rising markets

- Not suitable for long-term buy-and-hold investing

- Requires active monitoring and management

Criteria Evaluation

Tracking Error: 3.5/5

Due to the nature of this fund, it makes sense that the tracking error is higher than the optimal. This is due largely to daily rebalancing and the effects of volatile markets. BBOZ isn’t the worst for tracking error. However, it is something to consider for investors looking to steer clear of higher risk investments.

Expense Ratio: 3/5

As mentioned, BBOZ requires complex management. This is reflected in higher than average management fees. Currently, we’ve seen the management fee range from 1.19% to 1.38%. These higher management fees have a somewhat negative impact on the BBOZ expense ratio.

Liquidity: 4/5

BBOZ enjoys positive liquidity status.

Diversification: 2/5

This fund is not the best for diversification. Its purpose is to provide inverse exposure to the Australian market. This means less diversification, especially in a globally diversified portfolio.

Fund Size: 3.5/5

Current net assets hover around $363,391,008 AUD. While we’re seeing growth in the popularity of BBOZ, it’s not as large as other, more traditional index funds.

Community Reviews and Expert Recommendations

Experts caution that there is a lot to consider before investing in BBOZ, considering it’s not the typical Australian index fund. For starters, where traditional index funds are a long-term investment strategy, BBOZ is not. BBOZ is a useful hedging tool against market downturns. Overall, this should appeal more to advanced, rather than beginning, investors. Experts stress the importance of understanding the complexity and mechanics, along with BBOZ risks, before investing.

Price

The BBOZ management fee is 1.38% pa. However, we have seen it as low as 1.19%. For up-to-date pricing, we recommend learning more about BBOZ at BetaShares.

Global X Physical Gold ETF (GOLD)

Best Known for Direct Gold Exposure

Finally, we couldn’t round out our list without including our choice for introducing gold exposure into investment portfolios. Global X Physical Gold ETF (GOLD) offers simple and direct gold exposure at a relatively low cost. This fund is backed by physical gold, which is stored in London in secured vaults.

Features

Fractional Gold Ownership: Rather than purchasing an entire gold bar, GOLD opens the door to fractional ownership. We see this as an excellent entry into precious metals for new investors.

Physically Backed: When investing in GOLD, each unit represents a portion of a real, physical gold bar. The gold is stored in one of the world’s leading gold storage centres, and undergoes regular audits.

Hedge Against Market Volatility: Gold is viewed as a safe, stable investment with minimal risk. This is an excellent portfolio addition for a little extra protection against market volatility, especially during times of economic uncertainty.

Pros

- Direct exposure to gold price movements

- No need to store or insure physical gold

- Liquid and easy to trade on ASX

- Competitive management fee for gold exposure

Cons

- No income generation (gold doesn’t pay dividends)

- Subject to gold price fluctuations

- May underperform in strong equity markets

- Currency risk as gold is priced in USD

- Potential tracking error due to fees and expenses

Criteria Evaluation

Tracking Error: 4/5

GOLD is relatively consistent in tracking the spot price of gold. We knocked a point off due to very minor deviations in tracking.

Expense Ratio: 4/5

GOLD offers a good expense ratio. At a 0.40% management fee, this is an attractive option for entry into precious metals and for cost-minded investors.

Liquidity: 4/5

GOLD is highly liquid and allows good trading flexibility.

Diversification: 3/5

GOLD is a good option for adding diversity to investment portfolios, but on its own doesn’t offer much in terms of diversification. The focus is solely on gold as a precious metal.

Fund Size: 4/5

Due to its low risk profile and hedging capabilities against volatile markets, GOLD currently has a strong investor base. This is a well-established fund, with significant assets.

Community Reviews and Expert Recommendations

We agree with the experts who encourage investors to add precious metal funds like GOLD to investment portfolios. It’s a good diversification strategy, but it’s also safe with low-cost entry. Historically, gold has held its value and is expected to continue doing so in the future. One word of caution by the experts is to not invest too heavily in GOLD. It’s best to diversify portfolios with multiple assets, sectors, and global markets. Relying too heavily on gold could affect portfolio performance.

Price

The management fee for GOLD is 0.40% per annum. You can find more information and invest in GOLD at Global X ETFs Australia.

Notable Mentions

BetaShares Geared Australian Equity Fund (GEAR)

GEAR is an exceptional equity fund for investors who can tolerate a bit of risk for the sake of maximising returns. This fund gives investors increased exposure to the Australian share market. The result is the potential to amplify returns. However, there’s also the potential for magnified losses. More information can be found at BetaShares GEAR.

BetaShares Crypto Innovators ETF (CRYP)

We recommend CRYP for investors wanting to dip a toe into the crypto and blockchain sectors. There is significant growth potential in these sectors, making CRYP a good option for additional portfolio diversification. Learn more at BetaShares CRYP.

Frequently Asked Questions

What are the tax implications of investing in index funds in Australia?

Tax implications when investing in Australian index funds are generally favourable. For example, consider how many index funds pay franking credits, where tax has already been paid by the companies. This is one way index funds can lower overall tax liability. Additional benefits, like capital gains tax discounts also help to protect the investor. For more information, we recommend reading our guide on how to invest in index funds.

How do index funds compare to actively managed funds?

When choosing between index funds and actively managed funds, we suggest first considering individual investment goals. Details like cost and performance will be factors that are best for achieving these goals.

The goal of index funds is to watch them, ideally, track a specific market as closely as possible. In contrast, actively managed funds want to outperform the overall market performance. From a cost and tax perspective, index funds are generally more favourable, and come with a lower risk profile. We break down all the details in our guide on managed funds vs indexed.

Can I use index funds to create a diversified portfolio?

Yes, we recommend index funds for building a diversified portfolio, especially index funds that cover a broad range of sectors. It’s important to understand which sectors are included in each index fund, and how those sectors are weighted. Additionally, an index fund with global assets is also beneficial for portfolio diversification. Keep in mind that many top ASX index funds are heavily weighted toward financials. In this case, it is important to consider complementary investments for broad portfolio diversification. To even further diversify portfolios, consider other options, such as commodity trading in Australia.

How often should I review and rebalance my index fund portfolio?

At the bare minimum, it’s recommended to review and rebalance an index fund portfolio annually. This allows investors to refocus and ensure target asset allocation is being met. In some cases, rebalancing might be done even more frequently.

Are there risks inherent in investing in index funds?

There are risks with any investment, but the risk is relatively low for index funds. Index funds with poor tracking errors are at a higher risk of financial loss than those that more closely follow the market. Choosing diversified index funds is a less risky investment than those that are more sector-specific. International index funds are great for diversification but come with a currency risk. Working with a great broker is the best way to understand index fund risks and how they can affect bottom-line profitability.

Final Thoughts

Index funds are a relatively low-risk and low-cost approach to diversified investment portfolios. Here, we’ve dug deep into the 8 best index funds in Australia. We’ve covered index fund options for every type of investor and investment goal.

In our review, we looked at the key factors in choosing the best Australian index fund. For example;

- Diversification is important for risk management. Consider both heavy sector weighted and broad sector index funds.

- Including ASX and global index funds is a smart strategy for portfolio diversification.

- Consider factors like tracking error, expense ratio, liquidity, diversification, and fund size.

- Remember that every investment carries a level of risk. However, index funds tend to be lower risk scale.

When choosing the best index funds in Australia, we’re your partner in finding the investment solutions that work for you.

At Privacy Australia, we’re dedicated to thorough, unbiased reviews and roundups on all areas of digital privacy such as VPNs, and investing.

For additional reading, we recommend our guides on how to start a shared portfolio and our beginner’s guide to derivatives.

Until next time, we wish you successful investing adventures and security in everything you do in the digital world.