Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Top 10 Best Trading Platforms for Beginners in 2024

Entering the world of trading is an exciting venture. It can also feel a bit intimidating with all the different platforms available. To help cut through the confusion, we’ve assessed the best online trading platforms for beginners. Our list includes leading global brokers, like eToro, Pepperstone, and AvaTrade, among others. Whether it’s forex, crypto, or ETFs, these ten best trading platforms for beginners have it covered.

Let’s first look at the criteria we used to assess each of the trading platforms. Then, next, we’ll dive into what makes each of them great for beginners.

TL;DR

- eToro offers a user-friendly platform with social and copy trading features.

- Pepperstone specialises in forex and CFD trading with low spreads and fast execution.

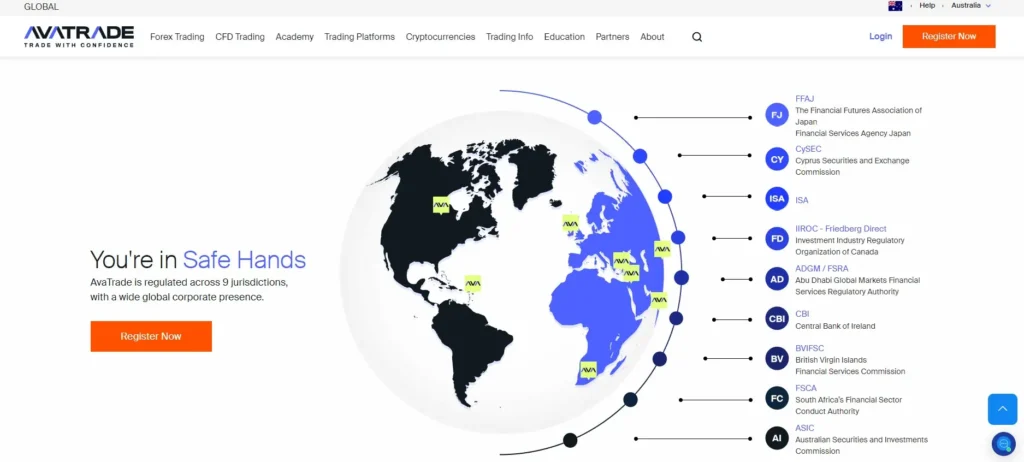

- AvaTrade offers forex and CFD trading with advanced tools and educational resources.

- Interactive Brokers provides advanced tools and low fees for more experienced beginners.

- Sharesies allows low minimum investments and easy access to Australian and US markets.

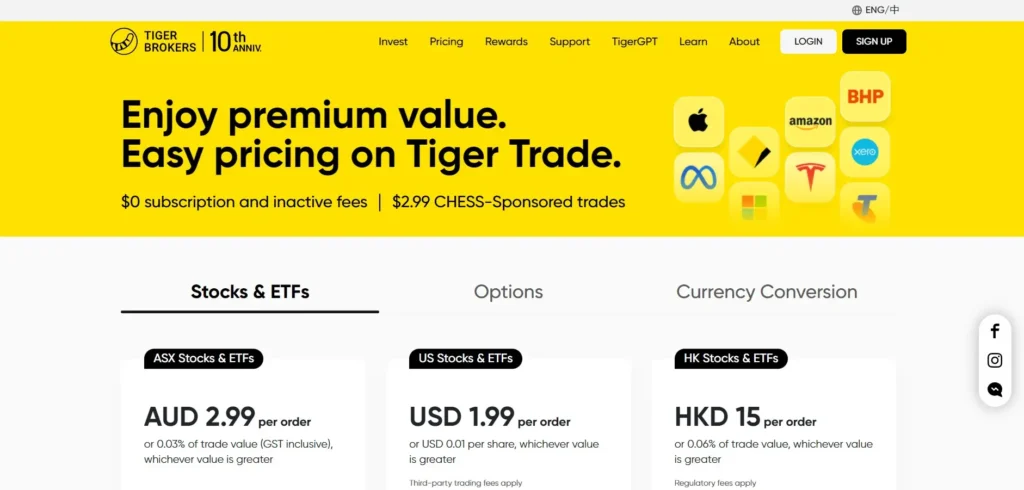

- Tiger Brokers offers competitive fees and a user-friendly mobile app.

- Stake specialises in commission-free access to US stocks and ETFs.

- Selfwealth offers a flat-fee structure and CHESS sponsorship.

- Superhero provides low-cost trading on Australian shares and ETFs.

- Pearler focuses on long-term, passive investing with automated investing plans.

Criteria Breakdown Summary

We’ve reviewed quite a few online trading platforms and can confirm there are a number of excellent options. However, a reputation of excellence doesn’t necessarily make a broker compatible with a beginning trader. To narrow down the options, we looked at eight key criteria that matter most for those new traders.

- User-Friendliness: The best trading platforms for beginners all have user-friendliness in common. It’s important that the platform is easy to navigate and that excess clutter or complex interfaces are avoided. The more streamlined, the better, for beginning traders.

- Educational Resources: Almost every trading platform offers educational resources, but there is a significant range in quality and what they cover. We considered platforms with the most comprehensive and beginner-friendly educational resources.

- Low Fees: There are fees associated with trading, but new traders will want to minimise these as much as possible. Once more confident in trading, absorbing fees to enhance profitability is less of an issue.

- Range of Assets: A trading platform that offers a range of assets provides more opportunities to learn. Beginning traders might find their trading journey takes a different path than initially anticipated.

- Customer Support: Having the backup of a professional, attentive customer support team is key for all traders, especially those just starting out. We looked at how easy it is to contact customer support and what level of surface they provide.

- Demo Account: Opening a demo account allows new traders the opportunity to learn the ropes without risking any real funds. Consider a demo account as a practice account that allows the opportunity to become familiar with the platform.

- Mobile App: Is this a necessity for beginning traders? No, it isn’t, but it is a nice feature to have. Mobile app options let you track accounts and make trades from anywhere.

- Research Tools: A robust collection of research tools allows for the most informed trading decisions. For beginning traders, research tools can provide insights and learning opportunities.

eToro

Best Known for Social and Copy Trading

eToro is Australia’s leading copy trading platform that is among the best investment platforms for beginners.

Of all the trading platforms we’ve reviewed, eToro seems like the most fitting one to begin our roundup with. In our opinion, eToro is one of the easiest investment platforms for beginning trading in Australia. eToro’s claim to fame is in its social and copy-trading capabilities.

For those just entering the world of investment trading, this is akin to having a pro guiding every step. eToro is great, but it’s not entirely perfect. Even the pros have off days, and copy trading doesn’t guarantee success. Our eToro review provides all the deep-dive details.

Features

- Copy Top Investors: eToro is one of the best copy trading platforms. We’ll talk more about how eToro stands out in this area in a bit, but this is an area where eToro shines.

- Regulatory Oversight: eToro is regulated by top-tier global regulators. This includes ASIC in Australia, This is an important feature for a stock trading platform, regardless of experience in trading.

- Social Feed: As a component of eToro’s social trading, the social feed is a great opportunity to keep up with industry news. The social feed also helps beginning traders keep in touch with what the pros are doing.

Pros

- Easy to use for beginners

- Copy trading allows learning from experienced traders

- No commission on stock trades

Cons

- Higher non-trading fees

- Limited advanced charting tools

Criteria Evaluation

User-friendliness: 5/5

We have no problem awarding eToro the highest possible score in this field. eToro’s social/copy trading platform is clean, intuitive, and easy to use. eToro is aware that its social trading feature attracts new traders. In our opinion, they have gone above and beyond to make the trading experience comfortable for them.

Educational resources: 4/5

eToro doesn’t just offer your average educational resources. They offer clients an entire eToro academy. Within the academy are guides, courses, and tutorials for all levels of trading.

Low fees: 3/5

One area that might turn beginning traders off from eToro is the fee structure. Commissions are generally low and spreads are tight. However, the currency conversion fee is a bit much compared to other brokers. Currency conversion fees depend on the type of asset and payment method.

Range of assets: 4/5

New traders might not initially be concerned with a range of assets. However, as confidence is gained, this is a key feature for portfolio diversification. eToro offers a great range, including forex, stocks, indices, crypto, and commodities.

Customer support: 3/5

eToro’s level of customer service falls in the middle of the spectrum. Live chat is the quickest way to contact customer support, as phone support isn’t readily available. Support can also be reached by submitting a support ticket. This can be the best option for more complex issues, but resolution can also take longer.

Demo account: 5/5

eToro offers a great demo account feature offering a glimpse of the platform’s full offerings. We strongly encourage anyone new to eToro to sign up with a demo account first.

Mobile app: 4/5

This trading platform offers a mobile app, which is a feature we always look for when recommending a broker. The eToro’s usability and robust features show up in the app and the rest of its trading platforms.

Research tools: 3/5

While eToro’s educational resources are robust, its research tools don’t quite measure up at the same level. Beginning traders might find that they need to consult additional research tools to complement what’s offered with eToro.

Community Reviews and Expert Recommendations

eToro has earned above-average reviews across the board, both by the user community and experts. The usability, social trading, and low spreads and commissions are high points. Experts tend to mimic what the community has to say. However, conversion fees are a sore point, and customer service can be hit or miss.

Here is an example of one eToro review we found on TrustPilot:

“I’ve only got good things to say about this platform. I have no problems with deposits, buying or selling and I find the app relatively easy to use.

My account manager, Mark, has also been very helpful. He regularly communicates with me and makes me aware of any services I’m entitled to that I may not have known about or been using. He’s very knowledgeable and is always available to answer any questions or fix any problems I might have.” – Trustpilot review.

Price

In terms of commissions and spreads, eToro is a competitive broker for beginning traders. Most transactions have zero commissions, which is a plus. The exception is crypto with a 1% fee. Our word of caution is to keep an eye on conversion fees, as these can be a bit high.

Pepperstone

Best Known for Low-Cost Trading and Fast Execution

Pepperstone is among the top trading platforms for beginners that offers low spreads and trading costs to new traders.

Next on our list is Pepperstone, an investment platform that offers traders of all levels the tools needed to be successful. We especially like Pepperstone for beginning traders due to the low costs of using the trading platform and the super fast execution of transactions.

Both these features make trading a more satisfying experience. Plus, fast execution in volatile markets is key, especially for beginners who might not anticipate the consequences of just a few seconds. Here we provide a snapshot, but we encourage you to also read our full Pepperstone review.

Features

- Low Spreads and Fees: Pepperstone is known for its low spreads and fees. Tight spreads and minimal fees make this an appealing choice for new traders.

- Range of Trading Platforms: Pepperstone offers an impressive range of trading platforms. These include MetaTrader 4 and 5, but also more intuitive options, like cTrader and Pepperstone’s proprietary platform.

- Speed: The speed of execution is definitely a standout feature with Pepperstone. They’re one of the best trading platforms for beginners due to not needing to navigate slow trades in volatile markets.

- Regulatory Compliance: Pepperstone is highly regulated, ensuring safety and transparency as a stock trading platform. For beginning traders located in Australia, ASIC regulates Pepperstone. Globally, SCB also regulates them. FCA, DFSA, CySEC, and BaFin.

Pros

- Low-cost trading with competitive spreads

- Fast execution speeds

- Multiple trading platforms to choose from

Cons

- Limited range of asset types compared to other brokers

- Advanced tools may overwhelm beginners

Criteria Evaluation

User-friendliness: 4/5

Pepperstone’s interface is designed to be user-friendly. In our opinion, this is an important feature for trading platforms for beginners. A complicated interface comes with a steeper learning curve and isn’t where a new trader wants to spend their energy. With Pepperstone’s platform options, we suggest exploring the options and finding the one that feels the most comfortable and intuitive.

Educational resources: 4/5

Pepperstone offers educational articles and webinars, with enough to set a good foundation for trading. The range of educational resources isn’t as expansive as we’ve seen with some other investment platforms. However, in addition to covering the basics, these resources address many less-commonly covered topics. For example, an article on which currencies are most impacted by gold and oil prices.

Low fees: 5/5

When assessing whether Pepperstone is a good fit for beginning traders, its fee structure caught our attention. Spreads are as low as 0.0 with the Razor minimum spread, and as low as 1.0 pips with the Standard spread. Commissions are only charged on certain transactions. This includes forex CFDs on Razor accounts. Otherwise, there are zero commission fees with Pepperstone.

Range of assets: 3.5/5

Beginning traders will find a decent range of access to explore with Pepperstone. The range of assets includes forex, commodities, indices, crypto, shares, and ETFs.

Customer support: 4.5/5

The level of customer support from Pepperstone is helpful and reliable. The support team can be reached via phone or through submitting a message on the Pepperstone site. If we could improve customer support, it would be for Pepperstone to offer a live chat option.

Demo account: 4/5

It’s easy to sign up for a Pepperstone demo account. With the demo account, clients are able to access WebTrader and can have up to five standard demo accounts. The demo accounts expire after thirty days, but for most, this is sufficient time to get a feel for the platform.

Mobile app: 4/5

Pepperstone offers a mobile app for its cTrader platform. This mobile app has good functionality, but there are a few areas that need improvement. For example, new traders might find that the speed doesn’t match what’s available from the web-based platforms.

Research tools: 3/5

There are research tools available with Pepperstone, but they are more advanced, which can cause some frustration. Pepperstone’s research tools include SmartTrader tools for MetaTrader, cTrader Automate, Autochartist, and API Trading.

Community Reviews and Expert Recommendations

Pepperstone is well-liked among the user community and respected by experts. Its reputation shines in the areas of fast execution and low-fee trading. Many in the user community are also happy that withdrawals have been hassle-free.

Here’s an example of a current user review:

“I’ve been trading with Pepperstone for over 6 months now, and I must say my experience has been nothing short of fantastic. The platform is user-friendly, making it easy for beginners and experienced traders to navigate. The range of trading instruments available is impressive, from Forex to CFDs and commodities…” – TrustPilot review.

Experts also recommend Pepperstone for its low fees, regulatory status, and wide range of assets. The one downside mentioned repeatedly is that not all assets are available in every location.

Price

With low or zero commission and tight spreads, Pepperstone emerges as one of the best low-fee investing platforms for beginners. This investment platform doesn’t charge deposit or withdrawal fees on most payment methods, meaning new investors can keep more of their profits.

AvaTrade

Best Known for Extensive Range of Assets and Risk Management Tools

AvaTrade is among the best trading platforms for beginners and offers robust safety and risk management tools.

AvaTrade is a global investment platform that brings versatility to the world of online trading. For beginning traders, the range of assets offers options for learning and profitability. With such a diverse range of assets also comes the opportunity to make a few mistakes while learning the ropes.

This leads us to another reason we think AvaTrade is one of the good trading platforms for beginners – its risk management tools. Features like AvaProtect offer a safeguard for new investors.

To learn more about everything AvaTrader offers, check out our comprehensive AvaTrade review.

Features

- AvaProtect: This is one of the most advanced risk management tools we’ve seen. AvaProtect helps protect investor funds from losses up to $1 million.

- AvaOptions: This is AvaTrade’s proprietary stock trading platform. For beginning traders, AvaOptions is a good platform with robust tools and risk management features.

- CopyTrading: Socal trading is a good option for anyone in the early stages of their trading adventures. AvaTrade’s AvaSocial feature allows users to copy expert traders, benefiting from their experience and knowledge.

Pros

- Extensive range of assets to choose from

- AvaProtect helps manage risk for beginners

- Well-rounded educational resources

Cons

- Spreads can be higher than some competitors

- Mobile app may lack advanced features

Criteria Evaluation

User-friendliness: 4.5/5

AvaTrade has built a platform that tailors to every type of trader and their needs. With a range of trading platforms, new traders can find one that is intuitive to them, while meeting trading needs. At last count, AvaTrade offers the MetaTrader platforms, along with WebTrader, AvaOptions, AvaSocial, and DupliTrade for automated trading.

Educational resources: 5/5

While AvaTrade doesn’t offer the most extensive educational library among investment platforms, we still give it top scores. The range and depth of educational resources are impressive, and it’s presented in a format that beginning investors can easily digest.

Low fees: 3.5/5

In our opinion, AvaTrade’s pricing structure is about average for the industry as a whole. No commission trading is a plus, and fees on some trades are built in. This can be confusing to new traders who might think the transaction is free of fees when it actually isn’t.

Range of assets: 5/5

In our full AvaTrade review, we awarded the investment platform a slightly lower score in this area. However, for new traders, we feel the range of assets offered is ideal. This broker is focused mainly on forex and CFDs. We want to stress the importance of caution with CFDs, as they can be a risky investment. All combined, AvaTrade offers 1,200+ trading instruments.

Customer support: 4/5

There are multiple channels through which clients can access AvaTrade’s customer support team. These include live chat, phone, email, and WhatsApp.

Demo account: 4.5/5

The demo account available through AvaTrade is robust enough for beginners to get a good feel for the platform. However, it’s not overwhelming. This is a great option for practising forex trading through AvaTrade.

Mobile app: 3.5/5

AvaTrade offers a mobile app for its proprietary platform. The convenience of mobile trading is a feature we value. However, there are still some performance issues with the app. We’d like to see these worked out before giving it a full thumbs up for new traders.

Research tools: 4/5

This broker’s research tools include fundamental, technical, and sentimental analysis. This is a solid foundation of research tools, especially when combined with Trading Central, which AvaTrade also offers.

Community Reviews and Expert Recommendations

Considering that AvaTrade has over 400,000 registered users worldwide, its community reviews are overwhelmingly positive. Details like platform options and social trading stand out among the AvaTrade community.

From the experts, AvaTrade’s strong regulatory status and risk management features earn the broker a solid nod of approval.

This review sums of the general sentiment from AvaTrade reviews:

“AvaTrade company has got all the tools needed for everyone who wants to start trading, providing educational and efficient trading platforms as well as many other helpful services. Moreover, I would like to thank Thomas Magen, a senior account manager from AvaTrade, with his experienced guidance and several online meetings I was able to get better in my trading journey after I almost wanted to quit. He has the patience to mentor everyone who wants to learn.” – Trustpilot review.

Price

AvaTrade offers what we consider to be competitive spreads, but this is balanced by some higher-than-average fees. Minimum deposits can be a bit high from a beginner standpoint, which is a detail that should be considered.

Interactive Brokers

Best Known for Advanced Trading Tools

Interactive Brokers offers advanced trading tools for beginners.

Next in our choices of best online brokers for beginners is Interactive Brokers, also called IBKR. We place this broker as a good option for beginners who want to stick with the same trading platform once the training wheels come off.

IBKR is built for experienced traders, but there are enough features and tools suitable for beginners as well. There is a bit of a learning curve with Interactive Brokers, however this is a platform that new investors can grow with.

Features

- Trading Tools to Grow With: To say that IBKR’s lineup of trading tools is robust would be an understatement. Tools include the IBLR GlobalAnalyst, PortfolioAnalyst, Trader’s Insights, and more.

- Range of Account Options: This is where we feel IBKR really gives its clients room to grow. For beginners, these include Individual, Joint, Trust, IRA, and UGMA/UTMA accounts. However, the options expand well beyond this and venture into both non-professional and professional accounts.

- IBKR Campus: The centre of IBKR’s educational platform is the IBKR campus. We encourage you to explore the resources highlighting the expanse of learning opportunities offered by this online stock broker.

Pros

- Access to global markets

- Comprehensive educational resources

- Low trading fees

Cons

- A complex platform may be overwhelming for some beginners

- Higher account minimum for some features

Criteria Evaluation

User-friendliness: 3/5

Interactive brokers excel in many areas, but user-friendliness isn’t one of them. In the end, this platform was designed for advanced traders. That means starters will have a learning curve to navigate. However, once effectively using the platform is mastered, this online broker has a lot to offer for traders of all levels.

Educational resources: 5/5

The educational materials offered by this trading platform are excellent. There are courses, news, webinars, podcasts, asset classes education, and more. Resources also include TradersAcademy, TradersInsight, IBKR Quant, and a StudentTrading Lab.

Low fees: 5/5

This broker is known for low fees and commissions. Commissions are based on either a fixed or tiered structure and change based on the asset. However, overall the fees associated with IBKR are lower than many other brokers we’ve reviewed.

Range of assets: 5/5

Again, IBKR shines in this field. The range of assets offered includes stocks, options, ETFs, futures, forex, mutual funds, and crypto. There is plenty here to explore and discover which types of trades are most enjoyable.

Customer support: 4/5

IBKR customer support can be reached by phone, email, and live chat. This broker suggests that answers can often be found without a phone call by browsing the informational resources offered. There is also a community forum, which can be helpful for answering new client questions.

Demo account: 5/5

New clients can take IBKR for a spin by signing up for a free trial. This is this broker’s version of a demo account. The demo account comes with access to both desktop and mobile platforms, market data, trading tools, and more.

Mobile app: 4/5

IBKR’s mobile app is an option for trading on the go and from anywhere. With the app, users have access to the full range of investment products, research, and a large number of tools. The app does not provide access to portfolio management tools and many other features.

Research tools: 5/5

Traders, from beginning to advanced, will find all the research tools they need with IBKR. Analysis, market research, insights, and more are offered.

Community Reviews and Expert Recommendations

IBKR has had some mixed reviews, however, this is common for many brokerage platforms. High points include diverse offerings, research tools, low fees, and robust platforms. Experts in the field tend to share the thoughts of the community at large when it comes to IBKR. Overall, there are more positives, than negatives, earning this broker respect in the industry.

Of the complaints, it’s common to see mention of the learning curve for new users. This broker offers a range of advanced tools, and with those often come more complex interfaces.

Here’s an example of one review we came across:

“My experience is that IBK is the most trustworthy online brokerage. The only reason I don’t give the 5th star is that I am not a huge fan of their platform. It’s not so friendly for not senior traders. Actually, a significant amount of (past or present) institutional traders have personal portfolios in this firm.” – Trustpilot review.

Price

In our assessment, IBKR ranks among the top brokers for low fees. With low commissions, starting from zero on some stocks, this is a viable option for beginning traders.

Sharesies

Best Known for Low Minimum Investment

Sharesies requires a low minimum investment from its customers and is one of the top investing platforms for new investors.

Sharesies is a great investing platform for new investors who are truly just starting out in the world of trading. This platform checks off the boxes of being user-friendly, approachable, and helpful.

We’re confident in recommending this best trading account to fellow Aussies who want a simple platform, without sacrificing investment opportunities. Another feature we rank this platform high in is the low minimum investment required. This is an important feature, especially for new investors.

Features

- Caters to the Australian Market: This is one of the best places to buy stocks for beginning traders in Australia. Sharesies specifically targets the Australian and New Zealand markets. This lends a feeling of familiarity that can be important for newcomers.

- Kid-Friendly Platform: This is a feature we rarely see, but Sharesies offers a Kids Account. This is a great idea for starting the discussion of investment and financial health early.

- KiwiSaver: Sharesies’ KiwiSaver plan is a good starting ground for long-term investing, and offers more flexibility than other options.

Pros

- Very low entry barrier to investing

- User-friendly platform

- Auto-invest feature for regular investing

Cons

- Limited range of markets compared to some competitors

- Basic research tools

Criteria Evaluation

User-friendliness: 5/5

When reviewing investment platforms for this review, Sharesies stood out as the simplest, most intuitive platform to use. Attention to usability is evident when exploring the platform. Sharesies seems to truly understand what novice investors want and need in a platform to succeed.

Educational resources: 3/5

With Sharesies, the learning options are mostly articles covering a range of topics. The articles are thorough. However, it’s surprising that the educational resources aren’t more extensive given this platform’s appeal to beginners.

Low fees: 4/5

Comparatively, Sharesies fees are low, but its fee structure seems to have undergone a few changes in recent years. Currently, Sharesies users do pay a monthly fee based on account type. This can be as low as $3 per month, up to $15 a month. Transaction fees vary based on account type, but average 1.9%.

Range of assets: 3/5

The range of assets isn’t Sharesies strongest point, but then, this isn’t the focus. We assessed that Sharesies offers company stocks, ETFs, and managed funds.

Customer support: 4/5

Questions and issues can be addressed by contacting the Sharesies customer support team via email or chat. It appears that phone support is limited, which can be problematic for more pressing issues.

Demo account: 3/5

We weren’t able to access a Sharesies demo account from the client side. This investment platform does offer a demo account for companies. However, signing up for the pay as you go plan isn’t a bad option for exploring what Sharesies offers without any investment.

Mobile app: 4/5

The Sharesies platform is available in a mobile app, which offers almost all the same functionality as the desktop version. A few glitches, especially with setup, have been noted. However, the app’s overall performance is more than satisfactory.

Research tools: 3/5

We don’t feel the research tools offered by Sharies are the best. We’d like to see more advanced options available, as this would allow more growth for users within the platform.

Community Reviews and Expert Recommendations

Community reviews for Sharesies are really mixed. First, Sharesies are seen as a great tool for entering the investment market. Customers only need to be 16 to have their own account, so it’s also great for young investors. The overall low fee structure is also an appealing aspect for the community.

On the opposite end of the spectrum are lags in service and customer support that are lacking. For starting small, Sharesies is good, but a decent number of clients move on to a different investment platform over time.

Here is an example of one a Sharesies 3-star review:

“Want to note my frustration. In 2022 I did a few trades and things worked well. Fees were fair and low and once I sold shares it became available for withdrawal immediately. After making a trade recently after a few months of not using sharesies I noticed a few things.

1. Fees have gone up for small trades. For a $700usd trade I paid $3usd. My most recent trade was $5usd for a $500usd trade. It is capped at $5usd for smaller amounts but it is still an increase for small traders who want to learn with small investments.

2. After selling my shares I noticed I cannot withdraw what is available in my wallet? It used to be that I can withdraw immediately after sale. Now I have to wait 2 days for it to clear.

3. I also noticed the actual withdrawal processing time has gone from up to 3 days (if i remember correctly) to now up to 5 days.” – Trustpilot review

Price

There is a 1.9% fee attached to most transactions. However, there is also a transaction cap put into place. Sharesies charges a monthly fee, with four plan options. This includes a pay-as-you-go plan without a monthly commitment.

Tiger Brokers

Best Known for Competitive Fees

Tiger Brokers offers the most competitive fees for Australian traders and is one of the best trading platforms for beginners.

At Privacy Australia, we always support low-fee trading, as long as there isn’t a negative tradeoff. With Tiger Brokers, we can say with confidence that nothing is sacrificed for low-fees.

Comparing Tiger Brokers to platforms like Commsec and CMC Markets, this platform for traders offers fees that are significantly less. Low fees aren’t the only attractive feature. Let’s take a closer look at why Tiger Brokers is one of the best trading websites for beginners.

Features

- Low-Cost Multi-Market Access: It doesn’t matter which market, fees are low across the board with Tiger Brokers. This isn’t exactly one of the trading platforms for free, but it’s pretty close.

- TigerGPT: AI as a best buddy trading assistant? Tiger Brokers has introduced TigerGPT that assists traders with investment research, learning, and more. This is an intriguing feature that allows new traders to ask every question they have.

- All-in-One Platform: Unlike other investment platforms, Tiger Brokers offers a single all-in-one platform with a full range of capabilities. For new investors, this lessens the burden of sorting through platforms to choose the best.

Pros

- Competitive fees

- User-friendly mobile app

- Access to international markets

Cons

- Limited educational resources

- Customer support could be improved

Criteria Evaluation

User-friendliness: 4/5

The fact that Tiger Brokers has one main proprietary platform lends to its user-friendliness. The platform has been intuitive for investors. However, there is still a learning curve. Plus, the single platform might be seen as limiting by some.

Educational resources: 3/5

While there are plenty of articles within Tiger Broker’s learning resources, we would like to see more targeted specifically to clients that have zero background in trading. It would also be helpful if the resources were organised in a learning path format for new clients.

Low fees: 5/5

As mentioned, this is Tiger Broker’s forte. As an example of Tiger Broker’s pricing structure, ASX stocks are $2.99 per order or 0.03% of the trade value.

Range of assets: 4/5

There’s a decent range of options offered by Tiger Brokers. ASX stocks and ETFs are a focus. US stocks, options, and fractional shares are also available. US stocks are available to trade 24 hours a day.

Customer support: 3/5

Customer support is available via phone, email, and chat. Clients can also access Tiger Brokers on social media. However, although this broker makes it easy to contact them, we give them 3-stars due to mixed customer service reviews.

Demo account: 4/5

The Tiger Brokers demo account offers $100,000 in virtual spending money to learn with. This also provides a good opportunity to learn how to navigate the proprietary Tiger Trade platform.

Mobile app: 5/5

The Tiger Trade platform is offered in a mobile app form. This is a robust app that offers nearly full capabilities and is easy to use.

Research tools: 4/5

Of Tiger Brokers’s research tool, it’s TigerGPT that stands out. This is a trusted AI tool that excels at answering questions and assisting with trading insights. However, beyond that, there are limited research tools.

Community Reviews and Expert Recommendations

Community reviews speak mostly positively about Tiger Brokers. There are some insights into issues with slow trades and areas of lack in customer service. Positive remarks from the community centre on usability, robust community features, and low fees.

Here’s a community review from Australia:

“As a customer of Tiger Brokers in Australia, I think their APP interface is very neat, and the Australian stock commission is very low, which meets my trading needs. Notably, it also has the options trading function of US stocks, which is better than CBA Bank’s products in Australia in terms of fees and rates. Completely easy to use” – Trustpilot review.

Experts speak to this platform’s easy-to-use interface, competitive brokerage, and unique sign up bonuses.

Price

On ASX stocks, fees are $2.99 per order, which is less than some of its leading competitors. No fees are charged on withdrawals. There is also no account management fee for auto-trading.

Stake

Best Known for Commission-Free US Trading

Stake is the top choice trading platform for commission free trading on US stocks.

Beginning traders might experience a bit of sticker shock when it comes to commission fees for US trading. Stake solves this problem with commission-free trades on US stocks, allowing for more expansive trading options without breaking the bank. In our books, this makes Stake one of the best trading platforms for stocks, especially for beginners.

Not interested in US stocks when entering the trading world? For ASX stock brokerage, CHESS-sponsored trades up to $30,000 have brokerage fees of $3.

Features

- Transparent Fees: We like that Stake is known for transparency in fees and costs. This is important for all traders, but especially beginners who might not otherwise be aware of associated costs.

- Premium Stake Black Membership: For beginners who choose to stay with Stake for their online stock brokerage, they offer the Stake Black membership. This is a monthly subscription that includes advanced features for more experienced traders.

- First Funding Award: Stake offers a small first funding award with a deposit of at least $50. We appreciate the minimum deposit to take advantage of this is only $50. The reward is relatively small, but it’s a nice perk for new traders.

Pros

- No commissions on US trades

- Easy to use platform

- Access to fractional shares

Cons

- Limited to US markets

- Basic research tools

Criteria Evaluation

User-friendliness: 4/5

Stake’s user-friendliness is top of the line. The platform is intuitive and easy-to-use. However, this level of user-friendliness comes with fewer advanced features than other platforms.

Educational resources: 3/5

Stake offers some educational resources. For example, they offer the Stake Academy, however these resources are mostly in the form of blog content.

Low fees: 5/5

Stake fees are low and straightforward. Brokerage fees are $3 per trade on ASX listed stocks, ETFs, and hybrid securities.

Range of assets: 3/5

While the transparent fee structure is great for new traders, the range of assets isn’t Stake’s strong point. Options include stocks, ETFs, exchange-traded bonds, and hybrid securities.

Customer support: 3/5

From our research, the main route of reaching Stake customer support is via phone. Phone support is a good route for new traders. However, with this being the primary contact method, the hours are only 9:30 am until 4:30 pm.

Demo account: 1/5

Unfortunately, at this time Stake Australia doesn’t offer a demo account.

Mobile app: 4/5

We noticed that Stake’s mobile app has received exceptional reviews. The app offers the full functionality of the web platforms, and allows for easy trading from anywhere.

Research tools: 3/5

We would like to see more research tools available for standard Stake users. These tools are so important for trading, yet the most robust options are only available with the Stake Black membership.

Community Reviews and Expert Recommendations

In our opinion, Stake’s community reviews are worthy of respect. Some in the community have gone as far to say it has been a game changer for their investment strategy. This type of praise is hard to argue with, and speaks well for Stake’s reliability for new investors.

Here’s a sample review:

“So far it’s been a great experience working on the platform and dealing with customer service. I am still early in with a couple of investments, however, the Setup process is very straightforward. Very clear guides and easy to use and navigate on both the website and iOS app. I hope they keep growing with their offerings and keep up the good work.” – Trustpilot review

We also noted several experts suggesting Stake for new investors due to the platform’s usability and simple account opening process. Downsides from the experts include limited investment options and lack of educational resources.

Price

The pricing structure is straightforward with a $3 flat fee on most transactions. There are no withdrawal fees, but currency conversion fees can be a bit high when trading in US stocks.

Selfwealth

Best Known for Flat-Fee Structure

Selfwealth flat fees take the guesswork out of trading costs as one of the best trading platforms for beginners.

When looking at the best trading platforms for beginners, fee structure is an important consideration. Fees can be all over the board, with great fluctuations based on asset, account type, etc. This corresponds to just one more detail a beginning trader needs to navigate when learning about trading.

A feature that makes Selfwealth one of the best brokerage accounts for beginners is its flat-fee structure. There are no surprise charges or complicated fee charts to follow. This is a big part of why Selfwealth currently has over 128,000 Australian investors.

Features

- Your SafetyRating: This is an excellent feature in brokerage accounts for beginners in the trading world. Your SafetyRating measures portfolios based on diversification and risk. This can help beginners create a more balanced, profitable portfolio.

- Range of Account Types: Selfwealth offers several different account types, which we feel are well-designed for beginners. This includes both individual and joint accounts, which are beneficial for sharing the trading journey with a spouse or partner.

- Trading Options for Minors: These are not necessarily intended to help kids learn how to trade. Instead, with these accounts, a minor can be named the beneficiary. This is a good option for parents and caregivers setting up educational accounts for their children’s future.

Pros

- Simple, transparent fee structure

- CHESS sponsorship for ASX trades

- User-friendly platform

Cons

- Limited range of markets

- Basic research tools

Criteria Evaluation

User-friendliness: 4/5

We give Selfwealth a high score in user-friendliness for beginners. Its platform is easy to use, and they’ve put in the work to keep things as streamlined as possible.

Educational resources: 3/5

With this broker for beginners, there isn’t a comprehensive collection of learning resources. What it does offer are a number of helpful articles for beginners. Examples include, “How to Build a Portfolio from Scratch”, and “How to Value Shares”.

Low fees: 4/5

Fees are currently a flat $9.50 per brokerage trade. This includes trades valued up to at least $50,000. As a comparison, a $5,000 trade from Selfwealth has a $9.50 fee. Its three top competitors charge $19.95 for the same transaction. Other brokerage platforms work off a moving fee scale, where fees rise directly with the value of the trade. In some instances, a competitor like CommSec charges $60, where the same trade would cost only $9.50 with SelWEath.

Range of assets: 3/5

Selfwealth deals primarily with shares and ETFs. These are good assets for learning, but users may eventually look for a brokerage platform with more options.

Customer support: 4/5

Reaching customer support at Selfwealth can be done via live chat, email, phone, or by submitting a support ticket. Customer support is available Mon-Fri 10 am to 6 pm. Support tickets may take up to two days to receive a response. The support team isn’t available on Major Australian holidays.

Demo account: 2/5

Selfwealth doesn’t currently offer a demo account for new users. In some cases they do offer a 90-day free trial where fees are waived. New traders should still use caution, as real trades can cause real losses.

Mobile app: 4/5

The mobile app from Selfwealth offers robust capabilities, comparable to the web based platform. Overall, reviews for the mobile app are overwhelmingly positive, especially for usability.

Research tools: 3/5

Much like Selfwealth’s educational resources, the research tools are less robust compared to some competitors. They do offer tools for spotting market trends, and recommendations from Refinitiv’s analysts. This broker also offers a premium account option. Premium members have access to more tools and perks, but this does come with a fee of $29 per month.

Community Reviews and Expert Recommendations

We noticed quite a few inconsistencies with reviews for Selfwealth. Some community reviews speak very highly of the platform, mentioning usability and flat fees. On the other hand, there are more than a few not so friendly reviews that focus mainly on customer support.

Here is an example of a review that speaks of the broker’s usefulness, but turns sour when concerning customer support:

“I was a BIG supporter of this trading platform when it first started a few years ago. I worked for a sell-side institution myself and supported the platform providing affordable trading to retail investors.

I used it myself for years but the service has dropped immensely in recent months.

When your account gets locked with a renewed W8BEN and you re-submit the form, they take weeks to unblock your account and don’t respond to queries on the support email.

The support chat bot is useless. You go around in circles with Windows 95 software on the bot with no help.” – Trustpilot review

Experts praise the broker’s flat fee, usability, and the fact that its CHESS sponsored. There is also numerous mention of accounts for minors and the importance of setting children up for financial success.

Price

Pricing doesn’t get much simpler than this. A $9.50 flat fee is applied to all transactions. The exception to this is for HK trading, which is significantly higher, but this is to be expected. There are no withdrawal or account maintenance fees.

Superhero

Best Known for Low-Cost ASX Trading

Low cost-ASX trading is what Superhero is known for as one of the best trading platforms for beginners.

So far, we’ve covered some of the best brokerage accounts for beginners. Now we come to Superhero, which stands out for its focus on cost-friendly ASX trading. We like this for beginners in the Australian market.

Being cost-conscious as a new investor is a smart strategy. Superhero Australia appeals to this, and is one of the best stock trading platforms for low cost ASX shares.

Features

- Access to ASX and US Shares: Focusing on ASX and US shares is a good place to start for beginning investors. While Superhero’s options aren’t expansive, this offering is very well suited for new investors.

- Auto Invest Option: This isn’t a common feature we’ve considered when looking at the best stock brokers for beginners. However, we feel there is some value in Superhero’s auto invest option. Not every new investor wants to spend time and resources perfecting a craft. The auto invest options allows traders to be actively involved, but with Superhero doing most of the heavy lifting.

- Retirement Support: We know that individuals are drawn to trading for a range of reasons, one of which is preparing for retirement. Superhero offers retirement specific support, helping to guide new traders toward the best investment decisions.

Pros

- Very low fees

- User-friendly interface

- No account keeping fees

Cons

- Limited range of markets

- Basic research tools

Criteria Evaluation

User-friendliness: 5/5

In our opinion, Superhero has user-friendliness mastered. The interface is simple and intuitive to use, but is loaded with the most important features for smart, effective trading.

Educational resources: 3/5

Superhero offers a section of learning articles in its blog, along with multiple how-to guides. This isn’t the most extensive learning library, but it is sufficient for covering the basics.

Low fees: 5/5

Fees with Superhero are super low. They charge only a $2 brokerage fee for transactions up to $20,000. This explains why Superhero has been voted Best Value Share Trading Platform.

Range of assets: 3/5

Superheroes’ range of assets is relatively limited. Options include Australian and US stocks, and ETFs.

Customer support: 4/5

Superhero customer support can be reached via phone, email, or live chat. The focus seems to be on encouraging clients to use the FAQs and chat feature whenever possible.

Demo account: 1/5

Currently, Superhero doesn’t offer a demo account for new users.

Mobile app: 4/5

We tried Superhero’s mobile app, and found it to be satisfactory for both new and advanced traders. Like many investment apps, there are a few glitches that become frustrating. However, overall performance meets acceptable standards.

Research tools: 3/5

Research tools are basics in our opinion, and Superhero provides a base level of tools for clients to use. We weren’t overly impressed with the offering, but they are robust enough for new traders to keep up with basic insights.

Community Reviews and Expert Recommendations

The consensus among the Superhero community is that the platform is for small, frequent transactions. These are almost always the types of transactions new investors begin with. The $10 minimum trade amount is also an attractive feature for beginners.

Here’s an example of a few of the reviews we read:

“Great trading site, easy to use, not sure on my why all the whining on here from others.

Selling trades and obtaining funds the same as for Comsec from which I transferred to Superhero, except for much lower fees on this site.

App very easy to use and the documentation easily downloaded from the site for taxation etc.

Staff has handled any queries very promptly via email. Try it, nothing but praise for the creators of same.” – Trustpilot review

Some praise that we’ve heard from the experts include low fees, automatic investing, access to ASX and US stocks, and usability.

Price

Brokerage fees begin as low as $2 for up to $20,000 in trades. Superhero does a good job of being transparent in their pricing and steering clear of hidden fees.

Pearler

Best Known for Long-Term Investing Focus

Pearler is a top choice trading platform for beginners as it offers simplified, long-term investments.

The last of the beginner trading platforms on our list is Pearler. This is the go-to when the focus is on long-term investing. This is a platform that helps investors reach long-term financial goals, and feel confident in their financial strategy.

There’s nothing flashy about this platform. Instead, clients receive solid investment guidance and opportunity, making this one of our favourite online brokers for growth-minded investors.

Features

Pearler Exchange: We’re a fan of Pearler’s social network. This is where Pearler clients can ask questions, answer questions, and engage with the community, including expert traders.

Diverse Investment Tools: Considering Pearler’s focus on long-term investing, it’s important it offers the right tools. Micro, headstart, and automate are just a few of the options to enable investors to grow and diversify portfolios.

Follower Community: Once part of the Pearler community, it’s possible to follow other experts on the platform. This includes monitoring their investment portfolios, strategies, and recent moves. This is all part of what makes Pearler one of the best places to buy stocks for beginners.

Pros

- Great for long-term, passive investors

- User-friendly interface

- No inactivity fees

Cons

- Limited to ASX-listed shares and ETFs

- Basic research tools

Criteria Evaluation

User-friendliness: 5/5

The Pearler platform was designed to set it and forget it. This means no hassle investing that doesn’t need to be constantly monitored. Pearler’s idea is to be boring, and in this case, boring is good. The Pearler platform is one of the easiest to use, with no complex tools cluttering the interface. This is a good platform for beginners who just want a simple, stress-free option.

Educational resources: 4/5

Pearler offers a First Time Investors Guide, which covers all the basics, plus a glossary of terms. This isn’t the most extensive learning resource, but it does a good job of covering Pearler’s offerings. Additionally, clients can access a collection of blogs, covering a diverse range of investment topics.

Low fees: 4/5

There are no deposit or withdrawal fees with Pearler, and brokerage fees are reasonable. The brokerage fees aren’t as low as some of the other brokers we’ve reviewed here, but they aren’t cost-prohibitive either.

Range of assets: 3/5

With Pearler, clients can access ASX and US shares, along with ETFs. All ASX shares and ETFs are CHESS sponsored.

Customer support: 4/5

Pearler’s customer support team can be reached via phone, chat, and email. Phone hours are Monday thru Friday, from 9 am until 5 pm.

Demo account: 1/5

Currently, Pearler does not offer a demo account.

Mobile app: 4/5

The Pearler mobile app offers full on-to-go capabilities. This includes managing autoinvest strategies, and following the platforms “finfluencers”. Overall, the functionality of the Pearler app has received solid ratings.

Research tools: 3/5

Pearler’s research tools would be better if they were more robust. Clients can access a range of calculators and Perler podcasts, along with the blog. The platform itself offers basic investment tools.

Community Reviews and Expert Recommendations

Pearler is a relatively new investment platform, at least compared to brokerage platforms that have been around for a decade or two. Because of this, they haven’t yet built up an incredibly vocal community base. Community reviews are sparse, but the overall sentiment is that Pearler is a good choice for long-term, passive investing. The platform is easy to use and the fees are reasonable.

Here’s a review that sums up Pearler perfectly:

“Smooth experience. Easy to understand for automated long-term investment.” – Trustpilot review

Experts appreciate the low costs and that Pearler is a CHESS sponsored broker. The fact that Pearler is focused on long-term investing also earns them points from the experts. However, the one downside noted is that the platform doesn’t encourage frequent trading, which is a negative for new traders needing practice.

Price

Let’s start with some basic charges. Pearler doesn’t charge any type of account or inactivity fees. This also includes zero deposit and withdrawal fees. There’s a flat rate of $6.50 applied to all ASX and US share transactions. Additionally, there’s a 0.5% fee on FX conversions between AUD and USD.

Notable Mentions

IG

IG Markets offers excellent learning materials for beginning traders, and the platform is relatively intuitive. IG Markets claims traders created its platform for traders. A really nice range of assets are also offered.

So why did IG Markets not make our top ten? Honestly, we feel the platform is a bit “much” for those new to trading. There’s a notable focus on CFDs, which are notoriously risky. New traders might prefer to go with a platform that offers more beginner-friendly options.

nabtrade

Nabtrade is an Australian brokerage platform with a global presence. Clients can access trades in the US, UK, Hong Kong, and Germany. This broker also offers a well-designed mobile app. The downside here is that nabtrade pricing is higher than the brokers in our top ten list.

CMC Markets is a comprehensive investment platform that offers all the tools, assets, and learning resources needed for investing. Beginning traders looking for a platform with all the bells and whistles will likely be fond of CMC Markets. Our only hesitation is this platform was designed for serious traders and might be unnecessarily complex for beginners.

FAQ

What should I look for in a trading platform as a beginner?

Trading platforms can be complex. While this isn’t a bad thing for experienced traders, it can be frustrating and confusing for those just starting out. When looking for a trading platform for beginners, consider user-friendliness primarily. Without this, chances are a beginner will walk away before truly getting started.

Next up are features like safety and regulation, learning materials, fees, and a good range of assets. Finally, consider the broker’s customer service reputation. It really does matter and can make all the difference in the trading experience.

Are these platforms safe to use?

Every platform that has made it into our top ten and notable mentions list is safe to use. Security and safety are key for trading. When considering platforms, look at details like regulatory status. For example, the Australian Securities and Investment Commission (ASIC) should regulate Australian platforms. Additional details to consider include bank-level encryption, and two-factor authentication.

Also, keep in mind that there are inherent risks in trading. Even the safest platform cannot fully protect investors from significant losses.

How much money do I need to start trading?

The good news here is that it doesn’t cost much to start trading or for starting a shares portfolio. Certain platforms will allow investors to begin trading with as little as $1, however, most have higher minimums. It’s not uncommon to see a minimum of $500 for a first trade. Even though it’s possible to begin with $1, it doesn’t mean that it’s a good strategy. That doesn’t mean a life’s savings must be invested. Starting with the average cost of a night on the town instead of $1 is a good, happy medium.

Can I use these platforms on my phone?

Absolutely! These best trading platforms all offer mobile apps. This is not only convenient, but honestly expected, in today’s mobile-focused world. With most trading apps in Australia, it’s possible to access all account features and full trading and investment capabilities.

Still, we want to express a word of caution when making trades on mobile devices. Ensure the mobile device is secure and not at risk of being compromised.

What’s the difference between a broker and a trading platform?

Simply put, a trading platform is the tool used to make trades. Meanwhile, a broker is like the person in the middle facilitating the trades. Brokers help investors navigate the complex world of trading, offering insights and advice. Often, the terms are used interchangeably, despite the subtle differences. Honestly, when starting out, the difference doesn’t really matter. Many investment platforms operate with a combination of brokerage and platform capabilities.

Final Thoughts

Well, we just covered a lot of territory on the best trading platforms for beginners. These top ten each have unique features to appeal to those just entering the world of trading.

Here is a roundup of a few key takeaways:

- User-friendliness was one of the first details we considered. This is absolutely essential for helping beginning traders master the learning curve.

- Price matters. This is especially true in the early stages when profits are taking some time to roll in.

- Educational resources are important. We encourage anyone just starting to read, listen, and watch to all the credible materials available.

- We have a strong preference toward good trading platforms that offer a demo account for beginners. However, this was a deal breaker for including a platform in our list.

Feeling comfortable and confident is important for trading. Our goal is to provide beginning traders with the resources to find a platform they feel good about.

At Privacy Australia, we dive in and do deep research, on everything from privacy and VPNs to trading platforms. We encourage beginning traders to start with the basics. Then as skills and knowledge are gained, consider more advanced materials, like our beginner’s guide to derivatives.

Finally, trading should be enjoyable and profitable. We invite you to check in with us often for more insights, reviews, and information.

You Might Also Like: