Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

What Are Government Bonds?

Governments take out debt as government bonds.

You become a lender, once you take out a bond. Your loan helps the government to raise money for new projects or infrastructure… Buyers received a set amount of money upon the bond’s maturity, in return.

But there are other reasons that you might loan your government money, maybe even to fight wars! Today, we explore these reasons and answer the question, ‘What are government bonds?’

Table of Contents:

- 🏴 Explanation

- 🗽 History lesson: “Lest I perish”

- 🏳️ What Affects Prices

- 🏳️ Relationship with Treasuries

- 🏳️ How to Buy AU Government Bonds

- 🏳️ Using Bonds in a Portfolio

- 🏳️ FAQs

Explained: What Are Government Bonds? 🇦🇺

The main use of government bonds is to raise money for a country’s treasury. Governments need money to run the country, such as for schools, hospitals, and other services, and also to invest in new projects.

If they don’t have enough money to do these things, then they are likely to have less growth, which can affect everyone who uses those services or has to work in those industries. With lower spending, less growth, and fewer jobs, it is harder for everyone.

Having money to invest, like in bonds, can help a country’s economy grow faster by investing that money and getting a return. This means that the government has more money to spend on services such as schools and hospitals or build useful infrastructure. A country with a healthy economy has more demand for goods and services, so prices stay higher and are less likely to drop.

In summary:

- ⌛ When you purchase a government bond, you lend the government a set amount of money for a set period of time. The government then returns to you a set amount of interest at regular intervals, called the coupon. Bonds were traditionally known as a secure, low-risk investment (although there are reasons why this may no longer be true).

- 🗓️ When a bond expires, the original investment amount – the principal – is returned to you. The day when you receive the principal is known as the maturity date. Bonds might come with a variety of maturity dates – some might mature in less than a year, while others might mature in 30 years or more.

All Bonds

So governments, corporations, and municipalities use bonds to raise money. The bondholder, or bond purchaser, makes a loan to the bond issuer in exchange for a bond.

Bonds are issued when capital is required. If an investor purchases a government bond, the government is essentially borrowing money. If an investor purchases a corporate bond, likewise, the corporation is borrowing money. Like a loan, a bond pays periodic interest and repays the principal at a definite time known as maturity. You are in effect giving a loan to that entity.

Let’s say a corporation wishing to construct a new manufacturing facility for $1 million needs to raise $1 million via a bond sale. Each bond worth $1,000 has a “face value” of $1,000. If a corporation issues a bond worth $1,000, it is said to have a “face value” of $1,000. The corporation, as the bond issuer, sets a desired annual interest rate, also known as the coupon, as well as a time frame for repayment of the principal, or $1 million.

When setting coupons on similar bonds, issuers consider the current interest rate environment to ensure that the coupons are competitive and attractive to investors. Five-year bonds with an annual coupon of 5% might be issued.

When the bond reaches maturity (after five years, in this example), the corporation pays off the $1,000 face value and reimburses the bondholders. The amount of risk and the profits an investor can expect can depend on the length it takes for the bond to mature.

It is believed that a $1 million bond repaid over five years is less risky than the same bond repaid over thirty years because many more factors may negatively impact an issuer’s ability to pay bondholders over a thirty-year period than they do over a five-year period.

An issuer pays a higher interest rate for a long-term bond due to there being more risk with more time and, therefore, an investor will potentially earn higher returns on long-term bonds. But in return for that, the investor incurs additional risk.

Rating systems

Investors use credit ratings from independent credit rating services to estimate the risk of an issuer defaulting before purchasing individual bonds. The risk of an issuer defaulting, or credit risk, is assessed by these services and rated.

Investors can profit from purchasing bonds with low credit ratings, but they must also accept the additional risk of default by the issuer. Lower interest rates can be charged by an issuer with a high credit rating, as compared to an issuer with a low credit rating.

Bond Terms 📙

- 🏁 Maturity: The length of time until a bond expires and makes its final payment is the bond’s maturity.

- 🏁 Principal: When a bond matures or expires, the principal, also known as the bond’s face value, is the amount that the bond promises to pay its holder, excluding coupons. This is typically paid as a lump sum.

- 🏁 Bond cost: In theory, the issue price of a bond should equal the bond’s face value, since this is the full amount of the loan. However, the price of a bond on the secondary market can change significantly based on a variety of factors after it has been issued.

- 🏁 Date of coupon: There are four common payment frequencies for bonds: annually, semiannually, quarterly, and monthly. These frequencies are specified in the bond agreement, but as a matter of course, bonds pay coupons annually.

- 🏁 Rate of coupon: The coupon rate of a bond is the percentage of the bond’s principal amount that is paid as a coupon, expressed as a percentage of the coupon payments. For example, if the face value of a bond is $1k, and it pays an annual coupon of $25, the coupon rate is 2.5 per cent annually. Coupon rates are usually annualised, so two payments of $12.50 will provide that coupon rate as well.

- 🏁 Fixed-Income Securities: These are unsecured debt investments, where the interest rate is fixed for the entire period of the bond. The interest rate is usually somewhere between 6 and 8 per cent.

- 🏁 Hybrid Securities: These are a combination of fixed income and equity. A hybrid bond is usually a lower-risk investment, in which the interest rate is lower than that of fixed income security. Hybrid bonds are middle-of-the-road investments and have some equity to balance out their lower interest rate. Hybrid bonds can either be on an interest rate or a redemption schedule, with the redemption period being the length of time you have to redeem the investment.

- 🏁 Callable Securities: These are bonds that can be redeemed without any notice at any time. If you buy a callable bond, you are expecting the interest rate to fall, so you can sell the bond to the buyer at a higher rate.

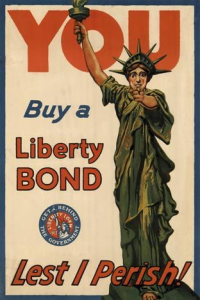

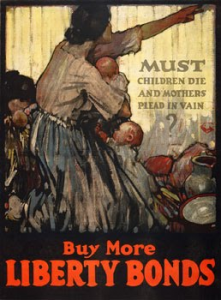

📜 History of Government Bonds 🧐🎩 “Lest I perish” 🗽

Government bonds have been around since the early 1600s, issued as a way to finance ventures, but also as a cry to the people to get behind them for serious situations such as supporting the WW1 effort.

Did you know, the first government bonds were issued by the British government in 1694? Then in 1701, a French government bond was issued. In 1804, the United States passed a law that required all state governments to issue bonds to raise money for their own treasuries. Then, in 1842, another law required all state governments to issue bonds to help finance the construction of public works.

Government bonds were first issued in Australia in 1871. The Australian government issued bonds to raise money to build the first rail line between Melbourne and Sydney. In 1887, the government issued a bond for $2 million which was sold to raise money for the construction of Sydney’s first bridge over the Hawkesbury River.

In 1900, the government created a new bond issue for $1 million which was sold to raise money for a new railway line between Sydney and Brisbane. In 1901, this issue was followed by another M of bonds that were sold to fund the construction of the Great Northern Railway from Sydney to Newcastle.

The Australian Government Bonds Act 1902 created a scheme under which Australian Government Bonds could be purchased by investors around the world. This scheme was known as “Australian Government Bonds” or “Aussie Bonds” because it was designed with Australia in mind. The scheme lasted until 1969 when it was replaced by an official system known as “Australian Securities and Investments Commission (ASIC)” (later renamed ASIC).

Government bonds are issued by many other countries. In fact, the United Kingdom and Canada have their own government bonds that are widely used in their respective countries. The most common type of government bond is called a Treasury Bond. These types of bonds are issued by the government and sold to investors who want to invest in them.

Rates

The interest rate on these bonds is usually fixed and is usually higher than that on other types of investments such as stocks or real estate. Government bonds can be bought with cash or through an investment company like Goldman Sachs, which offers investors a variety of different types of government bond investments such as Treasury Bonds and Corporate Bonds.

Investment companies like Goldman Sachs or Morgan Stanley offer a wide variety of different types of investments such as Treasury Bonds and Corporate Bonds. These companies will tell you how much money you need for your investment so you can choose the right type for you based on your goals and risk tolerance level.

What Affects the Prices of Government Bonds?

The price of a new bond is affected by several factors when it becomes available.

After a bond is issued, it may be bought and sold in the “secondary market.” Most bonds, however, are traded over-the-counter (OTC) between large brokers dealing for their clients or themselves.

The purchase price of a bond and its yield are what determine its value in the secondary market. Of course, a bond must have a market price at which it can be bought and sold (see the section below for more information), and so the bond’s ‘yield’ is the annualised ROI investors can expect to receive if their bond reached maturity. Yield is therefore based on the price of the bond and the coupon.

The price of a bond goes up when the bond’s yield falls. A bond’s price is equal to the amount of dividends the bond pays over the course of a year. When interest rates are low, older bonds of all kinds become more desirable because they were offered at higher interest rates. These bonds may be sold at a ‘premium’ in the secondary market. When rates rise, these bonds are less attractive because they will earn less money, and they will be offered at a ‘discount.’

When new securities are issued, the U.S. Treasury holds open auctions to set the initial price and interest rate. Primary dealers, who are usually large traders, then distribute the bonds to secondary, over-the-counter markets.

Investors participating in an auction may bid on bonds at their face value, or they may choose to pay the par value. However, if the yield on a bond is attractive in comparison to other investments or if there is higher demand for it than there is supply, bidders might bid up the price and pay more than face value. On the other hand, if there is an overabundance of supply or if there are better alternatives elsewhere, investors may seek to pay less than par.

- 📖 Interest rates: Demand for a bond is likely to increase if interest rates are lower than the bond’s coupon rate. Demand for a bond is likely to decrease if interest rates are higher than the coupon rate.

- 📖 Maturation: A bond’s price nears par as it approaches maturity, reflecting the current interest rate. In the middle of a bond’s term, the price is more likely to change in response to prevailing conditions. Newly issued government bonds reflect current interest rates and trade close to par.

- 📖 Inflation: When inflation is on the rise, bondholders who are bound to fixed payments suffer. Central banks frequently raise interest rates in order to quell inflation. As a result, bonds lose value as investors seek alternative investment opportunities, resulting in higher bond prices. When rates are lowered, bonds become more popular and consequently more expensive.

Understanding the pricing of bonds

When bond prices are quoted in the market, it’s simplest to understand bond prices by adding a zero to the price. For example, if a bond is listed at 99 in the marketplace, it costs $990 for every $1,000 of its face value and it is selling for a discount.

If a bond is trading at 101, it costs $1,010 for every $1,000 of face value, and it’s known as a premium. When a bond is par, it costs $1,000 for every $1,000 of face value. Par value is the cost to buy a bond if it is sold at 100. If the bond is trading at 100, it is known as par value. When a bond is issued slightly below par, it may be sold for more or less than par, depending on factors like interest rates, creditworthiness, and so on.

When interest rates are going up, new bonds will pay investors higher rates than old ones, causing old bonds to lose value. Conversely, as interest rates decline, older bonds pay higher interest rates than new bonds, causing them to be more expensive.

In the long run, the value of a bond portfolio may decrease if interest rates rise, but the opposite is true when rates fall. In addition, bonds may produce higher yields if interest rates rise in the long run by reinvesting the maturing money in higher-yielding bonds. On the other hand, if interest rates fall, new bonds paying smaller rates may be required to maintain the same return, lowering the long-term return.

Risk management and length ♎

The relationship between price and yield is critical to understanding bond value. You must also be able to forecast how much a bond’s value will change when interest rates rise in order to properly evaluate its value.

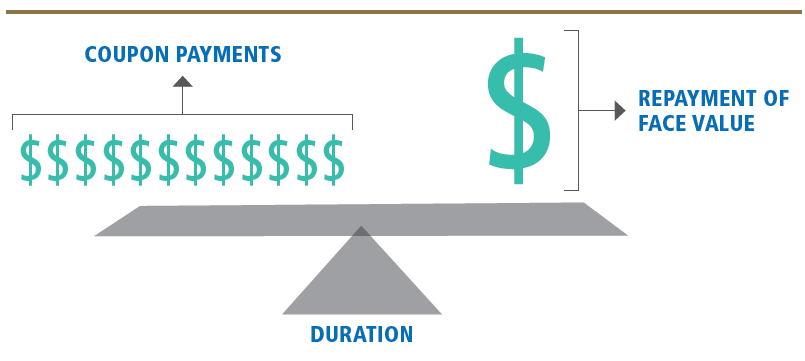

Duration, which is a measure of how sensitive a bond’s price is to interest rate changes, is based on the cash flows of a bond, which include regular coupon payments followed by larger payments at the end of the bond’s life when the principal is paid back. The illustration below shows how duration is calculated.

As the diagram demonstrates, the maturity of a bond is typically less than its duration. The regular coupon payments and the bond’s price matter for duration. Because there are no coupon payments on a zero-coupon bond, its maturity and duration are equivalent. Therefore, as the interest rate changes, zero-coupon bonds tend to be the most volatile for a given change, which may make investors attracted to zero-coupon bonds eager for a decrease in interest rates.

Duration, which is unique to each bond, determines the end result of the duration calculation, which is used to compare bonds of differing maturities, coupons, and face values. Using duration, investors compare bonds of diverse maturities, coupons, and face values, even though an apples-to-apples comparison is performed. When rates change by 100 basis points, this represents a one-percentage-point change. For example, a two-year bond will rise 2% will cause a five-year-duration bond to rise 5%.

Corporate vs. Government Bonds

Government bonds are often compared to corporate bonds. “Corporates,” as they are known in the financial sector, are one of the largest segments of the U.S. fixed-income market. Because bonds allow a company to borrow from investors rather than issue stock, which dilutes equity and surrenders control, the stock is diluted and control is surrendered.

These have distinct advantages over corporates and other bonds, including being:

☑️ More stable: Because of their lower volatility, the prices of Treasuries and other offerings are less volatile than corporates.

☑️ Non-taxed: State and local taxes are usually not imposed on Treasuries, but corporations are taxed on them at the federal level. Corporate bonds do not come with tax exemptions.

☑️ Less risk: U.S. government bonds have much less risk of credit, liquidity, or default issues. Certain other bonds like corporate, on the other hand, are seen as riskier.

☑️ More liquid: The market for government bonds is very large and liquid. Corporate bonds, on the other hand, are traded infrequently.

Government bonds also have disadvantages over corporates and other bonds. These include:

❎ Less ROI: The lower risk of government bonds is usually compensated for by lower returns. The effective yield for top-rated corporate bonds was over 3.3% in the middle of April 2022, while the 10-year Treasury yield was around 2.8%.

❎ Because government bonds have lower, and fixed, interest rates, inflation increases hurt them.

❎ Government bonds fund a perhaps too-broad range of projects, such as infrastructure. Corporate bonds allow investors to pick which industry or sector they want to invest in as well as which company’s credit quality matches their risk tolerance.

Relationship with Treasuries 🔑

Treasuries are the management of an organisation’s cash flow. The Federal Reserve purchases Treasury bonds to spur economic growth through this injection of money into the economy.

Bond prices rise as central banks must pay enough to entice owners to sell. Alternatively, the opposite occurs when the Fed buys bonds to increase the money supply: the supply of bonds decreases and their prices rise

Other bonds do not play as important a role as Treasuries in the economy. Treasuries are the most liquid form of debt and the most popular investment amongst international investors. Their price is therefore affected by their unique significance. They are also considered to be safe investments compared to investments in corporations.

Treasury bonds are issued by central banks, which means they have a fixed maturity date and can be held indefinitely. This is important because bond prices tend to rise when interest rates fall and fall when interest rates rise.

The Australian Government Bond is issued by the Reserve Bank of Australia (RBA), which means it has a fixed maturity date of 10 years (although it can be extended for an additional five years). As well as being very liquid and easily traded, this makes it an extremely popular investment among international investors because it has a fixed maturity date and no risk associated with it.

Why Do Treasuries Matter?

Other interest rates are determined by the 10-year Treasury note, also known as the T-note.

Treasury securities act as a benchmark for mortgage rates, corporate bond yields, and other financial calculations. Investors look to the 10-year Treasury note when they want to assess investor confidence.

When investor confidence is high, bond prices drop and yields increase as investors seek higher returns in other securities. When investor confidence is low, bond prices increase and yields decrease as safe, government-backed securities become more popular.

How to Buy AU Government Bonds? 💼

‘Mum and dad’ investors tend to purchase and sell Australian government bonds on the ASX rather than on the primary and secondary markets, where institutional investors do so.

Government bonds can be purchased through your broker, a financial professional or an online version of either. These exchange-listed bonds can be handled on the ASX like shares. The ASX lists the available government bonds. $100 is equivalent to one unit of a bond on the ASX. Exchange-available bonds are listed on the ASX in two types:

- Treasury: A coupon rate is used for mid-to-long term debt securities, the same as for treasury bonds as discussed above.

- Indexed treasury: An indexed bond is a medium- to long-term bond in which the capital value gets adjusted for changes in the Consumer Price Index (CPI). The fixed-rate interest gets charged quarterly.

You can buy them through a broker, who acts as a middleman between you and the seller, or directly from the issuer. When buying directly from the issuer, be wary of any fees that they charge. There are other ways to buy government bonds, but they are more complicated and risky.

Using Bonds in a Portfolio

When you hear Russia decrying the inability of Americans to understand that their money won’t warm them in winter, there’s much truth to that. Traditionally, however, bonds can be a key component in a diversified portfolio. Usually as a ‘defence’ portion.

Governments issued more bonds and created the modern bond market in the early twentieth century, prompting investors to invest in bonds. Investors may invest in bonds for a variety of reasons, including capital preservation, income, diversification, and hedge against economic weakness or deflation.

Price increases, price, and capital, as well as trading bond, are among the benefits. Investors began buying bonds in the 1970s and 1980s, as a result of their increased and more frequent price changes. Bond investing is also used for these reasons.

✅ Holding capital value: Investors who don’t want to risk losing money can select bonds as a profitable investment option thanks to their guaranteed principal and interest repayments at a set date in the future. In addition, short-term savings rates may be higher than what bonds provide.

✅ Income stream: When issuing a bond, an issuer promises to pay an investor a specific amount of interest on a predetermined schedule, such as quarterly, twice a year, or annually. In addition to interest payments, stock issuers may also pay dividends to investors, but dividend payments are generally smaller than interest payments. With a stock, an issuer is not required to make coupon payments.

✅Growing capital: When interest rates fall, the value of a bond increases as issuer creditworthiness improves. The price of a bond approaches 100 at maturity, preventing price gains over the life of the bond. Investors can, however, realize capital gains known as capital appreciation by selling bonds before they mature—before they reenter the market. By capturing these capital gains on bonds, investors can increase the return on their bonds in addition to collecting income. Total return investing, one of the most popular bond investment strategies over the last 40 years, has become one of the most popular investment strategies.

✅ Diversifying: An investment portfolio may be diversified by including bonds. Many investors diversify among a variety of assets, including stocks and bonds, commodities and alternative investments, in order to limit the risk of low or even negative returns.

✅ Hedging against economic instability: Because a bond’s price depends on how much investors value its future income, bonds act as a safeguard against economic slowdowns. As the prices of goods and services rise, a bond’s constant income becomes less attractive as it buys fewer goods and services. When inflation occurs, bond payments become less attractive because that income can now purchase fewer items and services. In contrast, economic expansion usually causes demand for goods and services to rise, which usually causes inflation. Slower economic expansion usually leads to higher inflation, which makes bond payments more attractive. Return on bond investments is usually caused by economic slowdowns, which makes those payments more attractive.

When consumer demand for goods and services drops and deflation sets in, bond interest becomes even more attractive because bondholders can now purchase more goods and services (because prices have dropped) with the same amount of bond interest. As bond prices go up, bondholders’ profits increase.

FAQs 📙 – What Are Government Bonds?

What Are Government Bonds?

Government bonds are debt issued by governments or other government-backed entities. They are generally considered to be the safest form of debt, as they are issued by governments and not the private sector. They typically mature in a number of years and can be traded in the secondary market. The main types of government bonds include:

- ✔️ Treasury bills – These are bills that pay interest at a set rate for a fixed period of time. They can be bought and sold like any other bond, but their maturity is usually longer than that of other bonds (around 10 years).

- ✔️ Notes – These are bills that pay interest only once per year, but their maturity is usually shorter than Treasury bills (around 3 years). They can also be bought and sold like any other bond, but they have no fixed maturity date.

- ✔️ Bonds – These are debt instruments issued by governments or other government-backed entities (like pension funds) with fixed maturities (usually around 5 years). They can also be bought and sold like any other bond, but they have no fixed maturity date.

Why Does the AU Government Issue Bonds?

Borrowing money is how governments and corporations finance their operations. You are giving the issuer a loan by purchasing a bond, and they promise to repay you the face value on a certain date as well as periodic interest payments throughout the course of the loan.

The main reason for issuing government bonds is to raise money. Governments issue a bond to investors, some of whom are willing to buy the bonds at a set interest rate.

The bond issuer is then responsible for paying the bondholder the agreed interest rate, which is known as the coupon and is returned at regular intervals. The main advantage of this is that a government can borrow money at a very low-interest rate, which is good as it saves money.

It also means that investors are willing to put their money in the hands of the government, which is not always easy to do. A few news stories that make it difficult to trust the stability of governments particularly in western (including the AU) and certain other unstable regions:

- Events signaling possible global war

- Failing value of money in favour of direct resources

- Shift of global power

If you are the government and you have a deficit, because the government has to find money to pay for things like schools and hospitals, it can’t always just raise taxes. It needs to sell bonds on the market. It can’t always just print money, because then it could cause inflation or a downward spiral of money printing.

In such a way, if a country has a large deficit and needs more money in order to run its economy well, then it can borrow from other countries through bonds. If the country has a large surplus and wants to spend more on projects such as infrastructure or schools, then it can sell more bonds on the market.

Of course, many countries, particularly the UK, EU, AU and US haven’t been running their economies well, so this may undermine bonds as a stable investment.

What Are the Advantages of Government Bonds?

Government bond issues have historically had some advantages for investors although some of these advantages may wane if the economy crashes hard enough:

- They provide an easy way for governments to raise money without having an impact on their own economies

- If a country is too big or small for its economy, using bonds may be better than raising taxes

- The interest rate paid will not change over time (for example, if interest rates go up); you’ll, for instance, often see governments offering fixed rates

- Borrowing from other countries may help reduce trade barriers between countries (such as tariffs) which affect trade between countries that use different currencies

- Bond issues are easily tradable internationally, so anyone who wants to buy them can do so

More advantages of government bonds:

☑️ 1. Investing in governments can be more secure than in corporations.

The risk you face as a bondholder is that the entity that issued the bond might default on its obligation. If this occurs, you will not receive coupon payments or the bond maturity payment. Governments are thought to be safer bets than corporations when it comes to bonds. When an agency fails to pay on its debt, bondholders are at risk of default. Even local governments are unlikely to default on bonds, much less the federal government. Corporations, on the other hand, may declare bankruptcy and not fulfil their obligations at any time.

☑️ 2. People who want to keep their money in their home state or region.

Investors who favour funding government projects over anonymous companies may value the notion that their money will be used to improve their local community and generate jobs. Municipal bonds, in particular, finance important initiatives that benefit the local community. Because of this, buying municipal bonds is an attractive option for investors who want to keep their money in their state or local community.

☑️ 3. Bonds offer tax advantages.

If you earn interest from a bond, you must pay state and federal income taxes. Federal, as well as some state, taxes may be withheld from some bonds. For example, a taxpayer with $4,000 of interest in the 35% tax bracket can save $1,400 by investing in a municipal bond rather than a taxable investment because some U.S. and A.U. savings bonds may also be exempt from federal taxation.

What Are the Disadvantages of Government Bonds?

There are disadvantages to keep in mind:

- The government cannot control the interest rate on the bonds, which vary according to the economy

- If a country has a budget surplus, it may want to spend more than it earns.

- Spending more than it earns can cause inflation and damage the economy.

- If a government is unstable enough, it is hard to predict how this might impact bond investments.

More disadvantages of government bonds:

❌ 1. Possible lower rates of return than stocks.

There is an inverse relationship between risk and return when investing. Government bonds currently yield about 3.33 per cent, regardless of their default risk, because the risk and return are inversely proportional. Even if the bond isn’t an inflation-protected security, it might not even beat inflation. In contrast, the historical return on investing in the stock market is much higher.

❌ 2. Rising interest rates are undesirable.

You can’t sell your bond before maturity without potentially accepting a lower market price, since it pays a set interest rate for a long period of time (10, 20, or 30 years). In the case of interest rates climbing, if you hold your bond to maturity, it will not go for as much if you try to sell it on a bond market before maturity because the interest rate is lower than the market value. When interest rates rise significantly, you are stuck with an investment that pays an interest rate below market value.

❌ 3. Unprecedented changes to the economy and instability in governments.

Debt is issued on the assumption that it will eventually be paid back. But we are seeing unprecedented levels of instability in Australian and western governments. It is difficult to know how this might impact government bonds.

Conclusion 🌞

Here are 5 key takeaway:

- ✔️ Government bonds are bonds issued by governments and purchased by investors to support government spending.

- ✔️ Government bonds that pay periodic interest payments are available. Other government bonds are sold at a discount instead, and don’t pay coupons.

- ✔️ Governments back them, so they’re considered a low-risk investment.

- ✔️ The bonds issued by the U.S. Treasury are considered among the most secure in the world.

- ✔️ Government bonds typically pay low-interest rates because they are relatively riskless.

Governments of all sizes utilize bonds to finance daily operations and long-term projects, including roads and schools. The U.S. Treasury issues Treasuries, which come in various maturities and are used to finance the federal government’s daily operation costs.

Treasuries have been considered a low-risk investment, although their prices may rise and fall with changes in interest rates and inflation. Treasuries’ additional function is to refinance the federal government’s existing debt and manage the U.S. money supply. Corporate and other bonds generally offer higher interest rates than those of Treasuries.

That said, with the enormous economic instability today, it’s unclear how stable bonds will be in the future.

You Might Also Like: