Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

FP Markets Review (2024)

The basics:

- FP Markets is a foreign currency and CFD broker based in Australia.

- They offer low commission fees and spreads on their foreign currencies and trades.

- Their headquarters are located in Australia, while they have offices in Cyprus as well.

- Foreign currency and CFDs are the extent of their securities. They do not trade in shares, commodities, cryptocurrencies, bonds, options, or futures.

Table of Contents:

- What is FP Markets

- What is the Deal with FP Markets’ Commissions

- Why do People Like Risk

- What Kind of Accounts Does FP Markets Offer

- Who is FP Markets For

What is FP Markets?

FP Markets is an Australian broker with limited connections and a tight specialization. Their focused is on providing the lowest cost foreign currency and CFD trading on the Australian market.

On that front, they technically deliver. But the manner and means of their delivery are worthy of scrutiny.

Though many traders do not wish to admit it, commission fees, and the fees associated with trading in general, exist for a reason. So, how and why does FP Markets forgo them?

What is the Deal with FP Markets’ Commissions?

Well to begin with, while FP Markets does not have foreign currency commission fees, it does have “spreads”. A spread is a fee associated with buying an amount of foreign currency.

There is no set price for spreads. Spreads are always calculated by the difference between the value of a foreign currency and what you are actually paying for it. The closer you pay to the actual cost of the currency, the less you have to spend on the spread. If you pay 1-to-1, there is no spread then.

Why does this system exist? Well, it is a security feature. When you use a broker, you are actually trading through them. That means that you are giving them your money to make the trades you specify.

That means that the broker is partially liable for the trades you make. Spreads (and commission fees as well) serve the purpose of mitigating the risk the broker takes on by taking part in these trades.

FP Markets has spreads to cover itself but charges no commission fees because the risk of the transactions is put on you. If you make a bad trade, the seller of the bad trade will not have paid a commission fee to FP Markets either, meaning you will get no compensation for the loss.

This means that FP Markets is a broker that deals in riskier territory than most. Many people are willing to accept this. In fact, many people would not trade with FP Markets if it was not risky.

Why do People Like Risk?

It is easy to get into a hyper-conservative mindset when it comes to trading. Most guides on retail investment (that is, investment that gives you passive income but does not pay your bills) focus on low-risk growth investments. That means investments in large, reliable companies that grow over ten years.

This is not bad advice. This is definitely the advice that most people should be taking. But at the same time, it is not the advice that most people want. Because the truth is that people like a little risk.

When a person is offered a choice between an 80% chance of getting $5 or a 50% chance of getting $15, most people are going to take the 50% chance. It is only 30% more risk for triple the money, after all.

The same thing applies to risky markets like those that FP Markets deals in. FP Markets deals in foreign currency and CFDs. And further, they do so without commission fees. That means that you have a good chance of running into new traders and automated trading bots during your trades.

This environment also allows for scam artists as well. But while the possibility of scams presents huge risks, new traders can be tricked, and automated trading bots can be exploited. That means that while you can be exploited in a highly volatile market, you can also be the one doing the exploiting.

That makes risky markets appealing to those who figure they can get rich quick off of them.

It might not be good or stable trading, but it is trading that is intuitive to many people’s understandings of the market. After all, if given a choice between that and a broker that throws a novel-length contract detailing their fees at them, the customer is likely to choose the one that requires less thought.

What Kind of Accounts Does FP Markets Offer?

FP Markets offers several accounts that most other brokers do not offer at all. This is uncommon, and as you will see once we go over the accounts, a major selling point for many people.

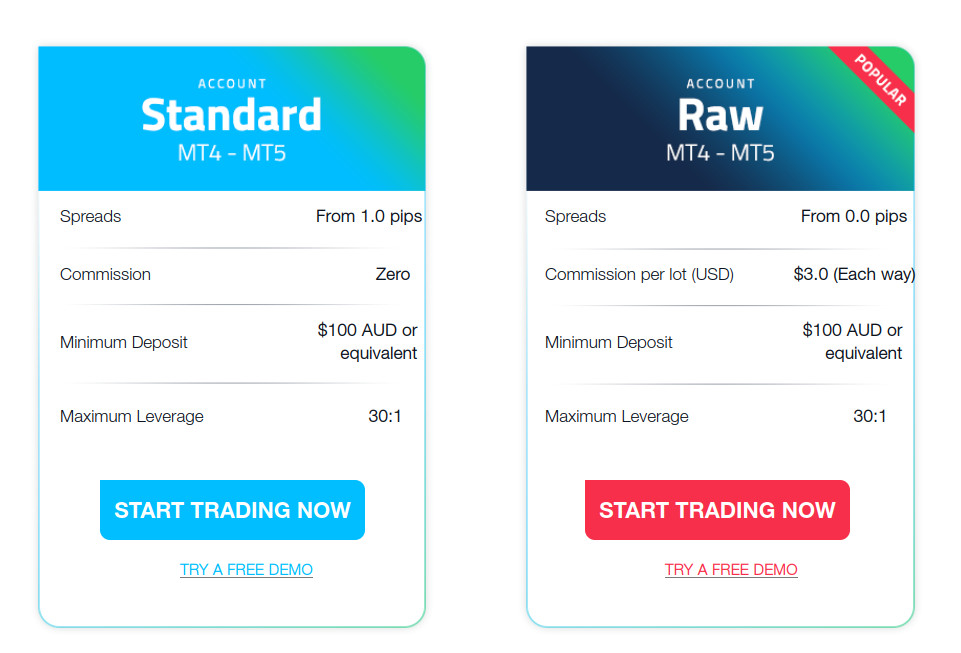

Standard and “Raw” Accounts

The standard and Raw accounts are the usual fair when it comes to trading accounts that a broker offers. But because this broker is so heavily focused on foreign currency, keep in mind that these are foreign currency focused accounts. To begin with, one of the main features is the difference in spread.

With a standard account, spreads will be calculated to the nearest whole number, rounded up. Compare this with a Raw account, where the spreads will be calculated to the nearest decimal point.

That means that spreads will always be calculated more generously with the Raw account. This does not mean that the Raw account is automatically better, however. After all, spreads might be calculated to decimal points, but only if there actually is a decimal point’s worth of difference.

If you consistently trade foreign currency that is exactly one pip apart, then a standard account is going to be better for you. In fact, there are some traders who trade in foreign currency in exactly this way for exactly this reason. It is aided by the fact that Raw accounts also pay more in commission.

Raw accounts only pay slightly more per commission, but it is noticeable if you are trading more frequently. Essentially, standard accounts are better for automated trades and easy trades.

Standard accounts have a less generous way of calculating spread fees, but the lack of commission fees per trade means that you can trade more frequently and the cost will not add up.

If you are not sure which is best for you, or how you wish to trade, then both types of account have a free demo available for you to try. Make use of it, as it is best to go in with an idea of how you’ll trade.

Iress Accounts

FP Markets also offers “Iress Accounts”, which are accounts for the Iress trading platform. These accounts are higher yield, can trade in CFDs, and are much more complicated than forex accounts.

To begin with, there are three types of Iress accounts and the differences between them are huge.

The standard Iress account features:

- A minimum balance of $1000

- Minimum $10 brokerage rate, and then .1% after that

- A $55 trading fee, though this is waived if you pay more than $150 in commissions a month

- An Australian Securities Exchange Live Data Fee of $22

- Free ASX delayed data

- Trading on margin

That is a lot to take in, and not all of it is going to appeal to everyone. The new traders that are looking to hit the market fast and hard are going to dislike the $1000 minimum, while more experienced traders are going to chafe at the brokerage rate and live data fee. At least the commission fees are low.

Above that is the “Platinum” account. With this account you get:

- A minimum balance of $25,000

- Minimum $9 brokerage rate, and then .09% after that

- The same $55 trading fee, waived at $150 of commissions in a month again

- The same $22 live data fee from the ASX

- Free ASX delayed data

- Lower commissions and interest rates on margin

Clearly the Platinum account is better, but only slightly for a much larger initial investment. This is the most popular account, but it really only sells to investors that show up with a very clear plan.

A good way of comparing the standard account to the Platinum account is by not thinking of the Platinum account as “better standard” but thinking of the standard account as “worse platinum”.

The Platinum account is what you actually want. All the features and pricing of the Platinum account were designed for the Platinum account. All of the features and pricing of the standard account are just worse versions of the features and pricings of those offered by the Platinum account.

In short, if all you can afford (or if all you are willing to risk) is the standard account, then you are better off not getting an account at all. Keep in mind though that this is just the accounts FP Markets offers for the Iress trading platform. There is still a good chance their normal accounts have something for you.

The last of the Iress accounts is the Premiere Iress account. Its features are:

- Minimum balance of $50,000

- No minimum brokerage rate, but .08%

- No platform fee

- ASX live fee is waived

- Free ASX delayed data

- No commissions and best interest rates on margin

Obviously, this is the account for either a professional trader who has most of their holdings in Iress, or a business that it wants to trade at least partially on Iress. While the kind of person to whom this account type caters is exceedingly rare, if you happen to be that kind of person then will need this account type.

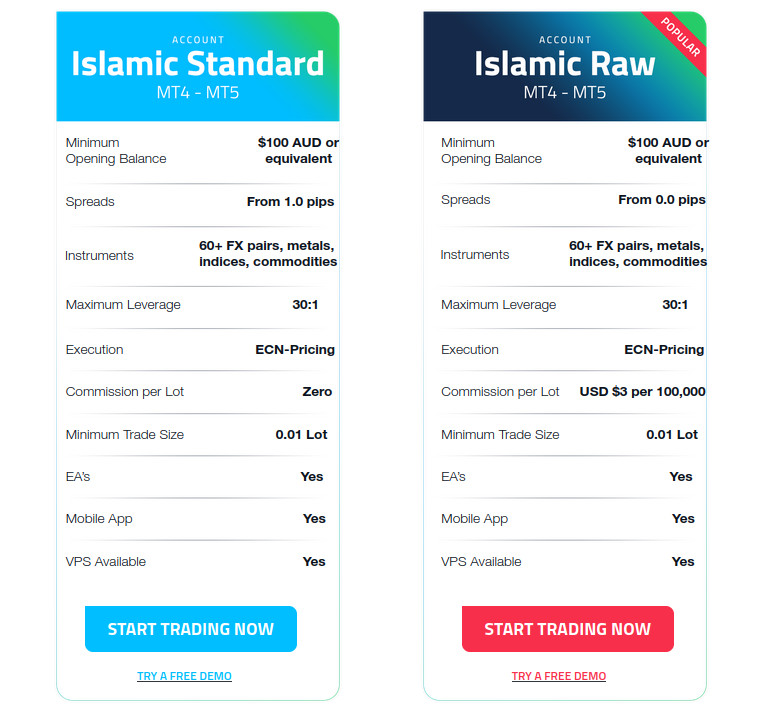

Islamic Account

The last of FP Markets’ account types is the “Islamic account”. This sounds like a euphemism, but it actually is not: An Islamic account is an account meant for Islamic clientele.

In certain interpretations of the Qur’an, passive income is outlawed. Therefore, if someone makes their money trading foreign currency and CFDs, they can only keep the money if they got it from the trade itself. That means that Islamic accounts are accounts that forgo swap fees and overnight interest.

This might make Islamic accounts sound disproportionally good, but remember that swap fees work both ways. You will likely lose money to swap fees, but it is also possible to make money off of swap fees in some cases. Lacking overnight interest means that Islamic accounts miss out on the cheapest interest.

Of course, avoiding these things is not necessarily bad either. People rarely make money off of swap fees on purpose, and if your debt repayment strategy is reliant on overnight interest, then your strategy has a serious problem. It really does come down to whether or not you believe in those financial tools.

Due to what they disallow, you cannot have an Islamic account on Iress. FP Markets does, however, offer Islamic accounts for all their other trade platforms, such as MetaTraders.

You can secure an Islamic account by emailing the onboarding team at FP Markets and asking for one. Generally, they grant people these accounts just for asking. No need to prove your Islamic faith.

Who is FP Markets For?

FP Markets is a specialized brokerage firm that caters to a niche market, focusing on high-risk foreign currency and CFD trades that can yield potentially high returns. While the company does welcome new traders, it is important to note that those with prior experience can maximize the benefits offered by the platform. However, it looks like their knowledgebase currently lacks the comprehensive substance required to effectively educate individuals of all skill levels.

That does not mean you cannot learn a lot from FP Markets, however. Because they are niche and high risk, you will be guaranteed to deal with lots of different kinds of traders. In some ways it can be more educational to try and play it safe in a risky environment than playing it safe in a safe environment.

Conclusion

FP Markets is hardly the best or most expansive broker. But it is cheap, lacking withdrawal fees and having fees when it does have them.

It has an easy account creation process that means you will have no trouble getting started, and the narrow market means you always know how to use it.

Be careful with a broker like this, as its securities are naturally risky enough. But if you know what you are getting into and do not bet big, there is nothing holding you back from making money with them.

You Might Also Like: