Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

How to Invest in US Stocks from Australia: Unlocking Wall Street

Did you know that according to a 2023 ASX study, only 16% of Australian investors held international stocks, compared to 58% of Australian shares? Moreover, 73% of Australian investors held Australian shares in self-managed super funds compared to only 23% of international shares.

Since 51% of adult Australians hold shares, it makes you wonder: why are Australians withholding from dipping their toes into the world of US shares?

I remember when I first entered the US market. It was an exciting and overwhelming experience.

Understanding the New York Stock Exchange on Wall Street, which represents the largest stock exchange in terms of global market capitalization wasn’t an easy ride. But today, I decided to share my knowledge with you and teach you how to invest in US stocks from Australia.

So, if you’re looking for a safe way to diversify your portfolio, you’ve come to the right place. I will explain the ins and outs of the US market and how to use reliable brokers like eToro to explore the unlimited opportunities available. Let’s get started:

TL;DR: Your Quick Guide to US Stock Investing

- The US stock market is promising for Australian investors.

- Picking the right broker and properly setting up your account is the first step.

- Do your homework to understand tax implications before investing in US stocks.

- Consider ETFs and sector exposure to diversify your portfolio.

- Currency fluctuations and other market-specific factors represent massive risks but can be managed.

- Monitor market trends and regulations that affect foreign investments.

- Short selling and options trading are advanced strategies that work for you as you gain experience.

- Depend on fundamental and technical analysis techniques to evaluate US stocks.

- Mix US and Australian investments for a balanced portfolio.

- Follow up on emerging trends like fintech innovations and ESG investing

Understanding the US Stock Market

A recent study showed that the size of the US stock market is equal to over $46.2 trillion in market capitalization. Knowing that the ASX equals about $2.6 trillion gives you an idea of the difference.

But don’t let the numbers scare you, OK? Remember that you don’t have to be physically present in the US to access its endless possibilities. The following section will break down this massive market and tell you everything you need to know about becoming successful at trading international securities.

Major US Stock Exchanges

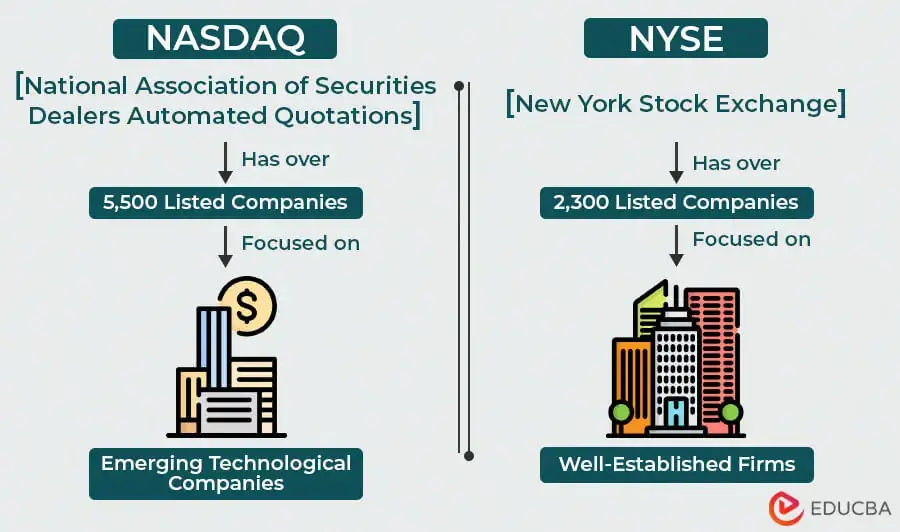

The New York Stock Exchange or NYSE and NASDAQ are major players in the US stock market. The NYSE is the largest stock exchange in the world with a value nearing $28 trillion in March 2024. It was founded in 1790 and it’s where traders can trade most blue-chip companies.

The National Association of Securities Dealers founded NASDAQ in 1971 and it’s more tech-heavy. It has a value of $40.22 billion.

Other exchanges include the Boston Stock Exchange, Chicago Stock Exchange, Miami Stock Exchange, Cboe Options Exchange, and Philadelphia Stock Exchange.

Understanding the difference between the US market’s major players will help you as you trade international stocks for the first time.

NYSE and NASDAQ include different types of stocks that appeal to foreign investors.

Trading Hours and Time Differences

Aussies’ first challenge comes from the trading hours in the US. Wall Street operates from 9:30 AM to 4:00 PM Eastern Time—11:30 PM to 6:00 AM AEST.

As someone based in Australia, I know this can be a big obstacle. Yes, it’s always possible to stay up late to trade at the time the exchange is operating. But it’s more important to work with a reliable broker who can support you 24/7.

Key US Market Indices

The major key indices are the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, followed by media and investors’ indices.

The S&P 500 is an index that reflects the top 500 American companies according to market capitalization. However, its committee also considers other factors including the sector classification, liquidity, public float, financial viability, and trading history.

DJIA or The Dow Jones Industrial Average includes the stocks of 30 of the most influential American companies. It lists the US’s best blue-chip companies with consistent dividends.

The NASDAQ Composite Index is a weighted index of all stocks traded on NASDAQ by market capitalization. It includes companies based outside the US and covers several industries like semiconductors, biotech, and software.

Comparison with ASX Indices

I hear you asking: how do these American indices compare to our good old ASX indices?

Our ASX 200 Index is the benchmark institutional investable stock market index in Australia. It measures the performance of the top 200 companies with index-eligible stocks listed in the ASX.

This index is regularly rebalanced and adjusted to meet the eligibility criteria. It’s heavily dominated by the largest 10 stocks listed, which represent 46% of the index.

So, how can these US indices benefit an Australian trader?

Let’s take the S&P 500 as an example. According to “The Fool.com.au”, the S&P 500 has returned 79.54% over the last 5 years, compared to the ASX 200’s more modest performance.

The S&P 500 is highly diversified among sectors, with no single sector representing more than 20% of the index. The IT sector represents 19%, while financials represent 16%, and health care represents 13%. So, yes, diversification is the biggest plus.

But that’s not all. Members of the S&P 500 are also more liquid.

Moreover, its leading companies have a huge impact on the world’s global equity market capitalization. They are industry leaders with massive negotiation power and low operating costs that allow them to sell their products and services at premium prices with higher margins.

US Market Regulations and Investor Protection

So, how safe can your investments be in the US market?

Do you know how the Australian Securities and Investments Commission or ASIC regulates and oversees the operations of all Australian companies, financial markets, and financial services? The US Securities and Exchange Commission or SEC does this better.

The SEC and ASIC aim to protect investors and maintain a fair and orderly market.

While it’s paramount to protect your investment accounts, the SEC goes the extra mile with more regulations that involve more paperwork. However, it guarantees a safer playing field for all traders and investors, regardless of their trading volume and experience.

Setting Up to Invest in US Stocks

So are you ready to trade US stocks? Before setting up your trading account, there are a few things you need to know. Don’t worry because this section will walk you through the process step-by-step, teaching you how to buy US shares, choose a reliable broker, set up an account, and so much more.

Choosing a Suitable Broker

Selecting a reliable broker is the first and probably the most significant step before trading in the US market. It can make or break your experience.

So, how do you choose a broker?

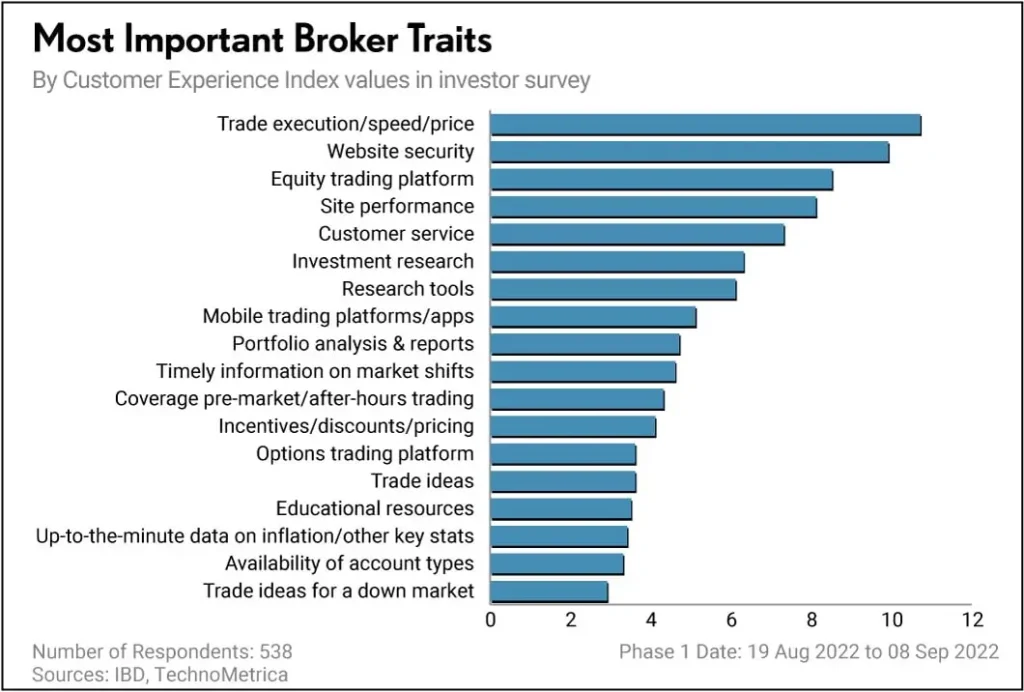

First, you should consider its trading history, reliability in the market, user-friendliness of the platform, customer support, and overall fees.

You don’t want to break the bank on trading and non-trading fees when taking your first steps in a new market. Additionally, you don’t want to spend hours trying to execute an order at 2 AM when your Aussie friends are asleep because you didn’t exactly pick a user-friendly platform.

Think of all the factors that can help you choose a reliable broker for your investment.

Australian Brokers with US Market Access

So, what are my options? You have two, and I’ll start by listing the first and more accessible one.

Many Australian brokers provide easy access to the US market. CommSec, nabtrade, and Stake are popular names and chances are you’ve already used them to trade in the ASX.

So, what are their benefits?

First, you already know them, so you know exactly where you stand. They provide services perfectly tailored to suit Australian investors and their platforms are easy to navigate.

Second, they follow the regulations in Australia, so you know you’ve got your back covered if someone goes wrong. Brokers like eToro and AvaTrade can be good options because both are registered to operate in Australia and provide access to multiple markets, including the US market.

According to “Mozo.com.au“, Moomoo, a new addition to CHESS-sponsored brokers, earned two awards in 2024 in the Casual ASX Investor and Casual ETF Investor categories, potentially making it an attractive option for Australians looking to invest in US stocks.

International Brokers Available to Australians

But Australian brokers aren’t the only option. If you’re a seasoned trader, working with an international broker might make more sense. These brokers offer more features that cater to the needs of experienced traders and investors who aren’t afraid to take the risk.

They sometimes charge lower fees but their platforms can be challenging to understand and navigate. So, if you’re a beginner, they might not work for you. Names like Interactive Brokers and TD Ameritrade can be good choices.

Account Setup and Verification

It’s time to set up your trading account. Don’t worry, the verification process might seem lengthy but it guarantees the safety of your hard-earned money.

You don’t want to throw your money unknowingly into a market without securing your financial and personal information, do you?

Required Documentation

Before you start, I encourage you to have a proof of ID and a proof of address ready. Then, you’ll have to fill in a W-8BEN form. This form will determine how much of your income, if any, will be held by the IRS and prevent double taxation. See? It’s not that bad.

Funding Your Account

Congratulations! Your account is almost ready.

It’s time for the big step—funding your account. It’s usually a straightforward process, and if you’ve picked the right broker, you’ll have numerous deposit options.

But be careful with those forex fees that can quickly eat up your funds, faster than a koala munch on eucalyptus leaves. There are other costs to consider, which will be highlighted in the following section.

Currency Conversion Considerations

Converting currency can be a bit tricky, especially for beginner traders. Exchange rates can go up and down, and it takes some training and patience to find the best rate.

At the same time, you should keep an eye on the conversion fees when withdrawing and depositing your money. For large transfers, hiring forex specialists and experts would be the best solution.

Executing Trades in US Stocks

So, how do you trade US stocks from Australia?

Yes, we’ve gone through the prepping stage and it’s time to trade your stocks and make some money. Trading US stocks is pretty much like the Aussie ones, with a few differences we will discuss below.

Types of Orders

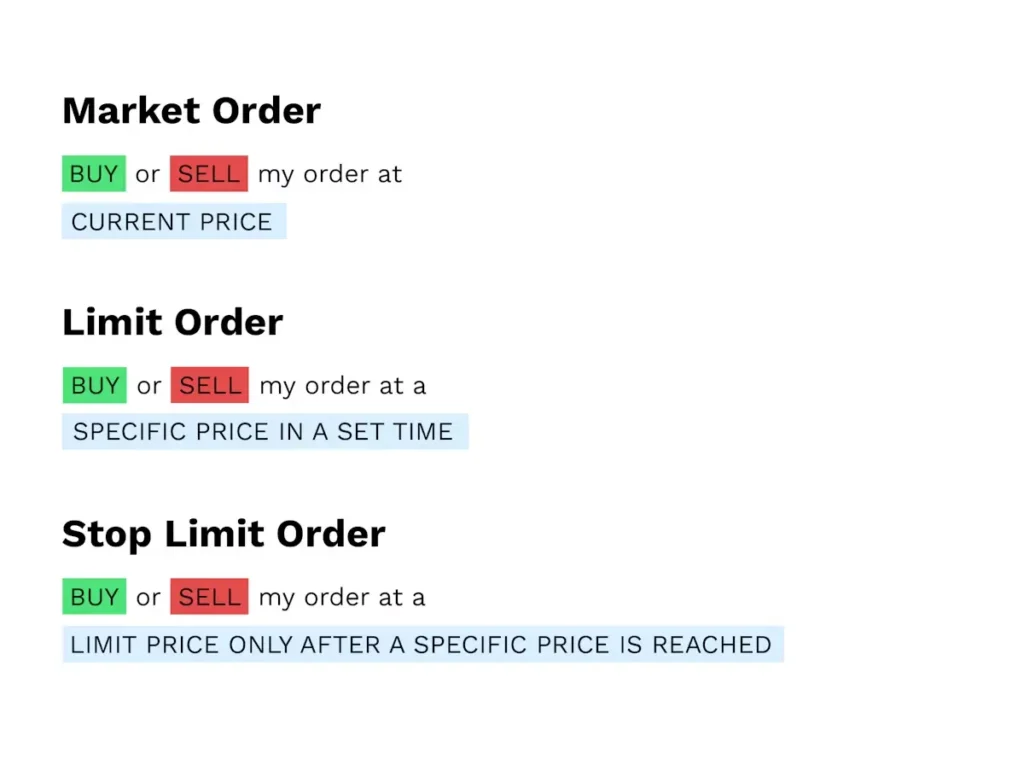

Before you place your first order, you should understand the different types out there. These are the most popular ones.

- Market orders give instructions on how to buy or sell stock immediately at the current market price. They’re very simple and work for highly liquid stocks but the price can change drastically, especially in a highly volatile market.

- Limit orders determine a specific price at which you as a trader are willing to buy or sell stocks. These orders involve a lower risk and provide investors with more price control but there’s no guarantee of execution.

- Stop orders become market orders when a certain price is reached. This order type will limit losses and work for traders and investors who don’t want to spend all the time monitoring the market. However, sometimes the execution price can be worse than the stop price.

Other less common types are stop-limit orders, trailing stop orders, day orders, fill or kill orders, all or none orders, and GTC orders. These are more complicated to understand and work for more experienced traders and investors.

Understanding the different types of orders is paramount if you want to become a successful investor.

Best Practices for Order Placement

Learning about order types is a must, but what are the best practices for order placement?

Successful order placement is a mix of different strategies and practices that focus on understanding the market’s dynamics and responding to them.

First, you should set clear goals. Ask yourself, what exactly are you willing to achieve by entering the US market? Then, decide how much you can risk to achieve these goals.

Next, you should do thorough research with technical analysis to stay informed. Of course, using a reliable broker that provides high-quality and regularly updated educational services will be a big plus.

Checking everything is essential because you don’t want to make any mistakes. I recommend sticking to limit orders in the beginning as they provide more control and protect you from unexpected price swings.

Navigating Trading Platforms

So, what is the best playing field?

Navigating trading platforms can be a little tricky, as each one comes with different features, pros, and cons. Trust me, there isn’t one perfect platform that works for everyone. So, it’s crucial to study different platforms and familiarise yourself with their differences and similarities.

Some features like having a user-friendly interface are a must. You don’t want to choose a mysterious trading platform that makes you ask too many questions.

Paper trading is another cool feature. It’s an educational tool that allows traders to place and execute orders in a virtual account without using their real money. Other cool features include copy trading and offering demo accounts.

Mobile Trading Apps

Today, many traders prefer mobile trading apps that enable them to trade on the go. Whenever and wherever you like, you can place and execute orders, buying and selling stocks at the most convenient prices.

Choose a trading platform that offers a user-friendly mobile app with all the features offered on the website. Remember that you shouldn’t get carried away, and proper research before taking any step is essential.

Real-time Market Data and Research Tools

Knowledge is power in the stock market, and staying informed is one of the best practices to become a successful trader.

Most reliable brokers offer real-time data and research tools to keep you informed. Learning how to use and interpret research tools is like having your own financial advisor and it comes with a lot of benefits.

Most reliable brokers offer real-time data and research tools to keep you in the know and the US stock market promises excellent opportunities for Aussie investors.

Tax Implications for Australian Investors

Every Aussie investor is probably wondering about the taxes they’ll pay once they start trading US stocks. Don’t worry, thanks to our thorough editorial process, you’ll have all the information needed.

Estimating your taxes might seem complicated at first, but once you know the rules, you’ll be good to go.

US Withholding Tax on Dividends

As an Aussie trading US stocks, you’ll be eligible for a 15% withholding tax on dividends. This is the American Government’s cut on money you made, and no it’s not as bad as it sounds.

Claiming Foreign Tax Credits

Sad about the money you paid to Uncle Sam? Australia has got your back mate.

Yes, you can usually claim a credit for withholding tax on your tax return, so you aren’t taxed twice. The ATO allows foreign tax credits for those taxed in the US, so you won’t watch all your investments go to waste.

Capital Gains Tax Considerations

But, hey… it’s not the same when you sell your stocks for a profit. The ATO wants its share in this case, and you will pay capital gains tax.

However, if you’ve been holding the stocks for more than 12 months, you might be eligible for a CGT discount.

Record Keeping for Tax Purposes

If you’re going to trade stocks, record-keeping isn’t an option. Yes, you might rely on your memory for short-term periods, but when it’s time for the tax season, every piece of information will make sense.

This is why I encourage you to record all the purchase prices, sales prices, dividends, and any fees you pay. Your accountant will thank you and preparing your tax papers will be a breeze.

Currency Fluctuation Impacts on Taxation

Currency fluctuations can impact your taxation big time. Remember that you’ll pay Aussie dollars to the ATO, but you’re trading in US dollars. Differences in exchange rates can quickly turn a profit into a loss and vice versa.

Diversification Strategies with US Stocks

Diversification is one of the main reasons many Australian and other global investors want to trade US stocks. You know how they say you shouldn’t put all your eggs in one basket? Luckily, the US market offers many baskets to help traders reduce their risk.

Sector Exposure in the US Market

Our good old ASX is pretty heavy on banks, financial services, and miners. This lack of diversification is every investor’s nightmare. One wrong move and your whole portfolio will be gone. Not a pretty mental image, right?

However, the US market is another story. You can build a diversified portfolio with multiple sectors with stocks related to banks, financial services, tech, healthcare, and consumer goods.

Whether you’re interested in the latest Silicon Valley technology or want to summon The Wolf of Wall Street’s spirit, you’ll find what you’re looking for.

Technology and Growth Stock Opportunities

Another benefit of trading US stocks is access to industry leaders. The US market is the land of stock opportunities with almost everything you need if you want to invest in tech or experience huge growth potential.

Think Apple, Meta, or Amazon. All the tech giants are available for purchase.

But remember that with great opportunities, comes great volatility. The US market involves some risks you should consider before your first dive.

ETFs and Mutual Funds for US Market Exposure

Worried about choosing the right individual stocks to add to your portfolio? Why not try ETFs and mutual funds?

ETFs are investment funds that are traded on stock exchanges, and designed to track a specific index, commodity, or asset class. They offer instant diversification because they hold a collection of different assets within a single fund, and learning how to buy ETFs has never been easier.

Professional portfolio managers who decide which stocks and assets to buy and sell manage mutual funds, so they involve a lower risk than making those decisions on your own.

Both options offer great benefits for first-time traders who are dipping their toes into the US stock market and worry about drowning.

Comparing Direct Stock Investment vs. Fund Investment

So, what should you go for?

Choosing between investing in direct stocks versus investment funds is like choosing between cooking a delicious meal from scratch and ordering a takeaway. Each of these decisions has pros and cons.

Direct Stock Investment

Here are some of its pros:

- You have full control over the direct stocks you buy and sell.

- If you pick the right stocks, there’s a big opportunity for substantial gains.

- Dividends provide a steady income stream, even when you aren’t trading.

- There’s no management fee.

- It provides more control over the timing of your capital gains to manage tax liabilities.

Yet, there are some drawbacks you need to think about:

- High risk and volatility can be an obstacle to many investors.

- Managing your own portfolio takes a lot of time and effort, and making mistakes isn’t unheard of.

- Building a diversified portfolio takes significant capital that might not be accessible to many.

Fund Investment

Investing in ETFs and mutual funds provides different advantages:

- Since funds include various assets, risk is better distributed. This reduces the impact of a single stock’s poor performance on your overall portfolio.

- Fund investment involves professional portfolio management. These professionals make informed decisions based on expert analysis and research for better outcomes.

- Even as a first-timer, you can still invest in a diversified portfolio without having significant capital.

- They are more cost-efficient than stocks.

Nevertheless, there are some disadvantages to consider:

- As a trader, you have no control over your portfolio. The portfolio manager makes all the decisions, which might not always align with your personal goals.

- You’ll have to pay management fees.

- Some funds might be overly diversified, leading to average market performance regardless of how the individual stocks are performing.

- Investors might find themselves eligible for tax liability even if they haven’t sold any shares because investment funds are subject to the fund’s capital gains distributions.

Currency Hedging Considerations

According to “Webull.com.au”, some brokers offer 2% interest on uninvested USD balances, providing an additional benefit for Australian investors in US stocks.

So, how can you protect this money from exchange rates’ uncertainty?

Currency hedging can be a successful risk management strategy to implement if you’re trading US stocks. Using tools like hedged options, forward contracts, futures, and swaps, you can protect your money from potential losses due to fluctuations in the exchange rate.

As an investor, you can lock in an exchange rate for future transactions.

Pros

- Currency hedging has several benefits.

- It provides traders with predictability regarding cash flow for better financial planning.

- It reduces the risk of investment.

- Different hedging instruments offer different degrees of flexibility.

Cons

However, there are some disadvantages to pay attention to.

- By locking in an exchange rate, investors lose the opportunity to gain if the exchange rate changes favourably.

- Currency hedging strategies involve premiums for options, margin requirements for futures, and spreads for future contracts, making them less cost-effective.

- Hedging strategies can be complex to implement.

Risk Management for US Stock Investments

Investing in US stocks promises a universe of opportunities, but it’s not always rainbows and butterflies, mate. Yes, some risk is inevitable but there are also several risk management strategies to keep everything in check when you buy US stocks.

Currency Risk

Let’s start with every Aussie trader’s biggest fear—currency risk. Even if you sell your stocks for a profit, currency risk can eat up all your funds without you even knowing it.

Your good old Aussie dollar goes up against the US dollar, and suddenly your investments don’t look like they’re worth your effort. The opposite can happen, and you’ll be happy counting your cash. So, how can you overcome this annoying risk?

Hedging Strategies

Do you know how wearing sunscreen can reduce the risk of sunburn when you’re on the beach? It doesn’t totally eliminate it, and you can still get burned if you aren’t careful. The same applies to hedging.

Using currency-hedged ETFs and forex forwards can mitigate some of the currency exchange risks You can also rely on the perfect timing for potential gains.

However, some uncertainty and risk will always exist. So, it’s safe to say perfect coverage is almost impossible.

Market-Specific Risks

Some types of risks are associated with the US market due to its nature. Political drama, economic scandals, meme stocks that fluctuate in value due to online popularity, and tech bubbles can significantly impact your experience as an investor.

Sector Concentration Risk

Perhaps tech stocks are among the most alluring on the US market. I mean, the tech sector is growing, and profitable, and nothing can go wrong with these industry leaders, right?

Wrong. Sector concentration is a common mistake committed by less experienced investors and I’m here to help you avoid it.

Even if you’re a big fan, putting all your money into the tech sector is a big mistake. You’ll need some stable sectors to diversify your portfolio. They might not be that shiny but they’re reliable. Remember that diversification is your best friend.

Information Asymmetry

Now, let’s face it. As an Aussie, there will always be some degree of delay when you’re trading US stocks. A lot of things can go on when you’re sleeping and you might miss some relevant information that directly impacts your investment.

My advice: is to stay on top of the latest news by checking reliable sources before making any move. Activate your news alerts to avoid information asymmetry. Some brokers provide in-depth and regular updates to make your job easier.

Utilising Research Tools and Resources

Brokers provide many research tools and resources to analyse the stock market. As a trader, using these tools can provide the necessary information and data to help you make informed decisions. Subscribe to several financial news services and consider splurging on a fancy stock screener.

Keep an eye on research tools to better understand the US stock market.

Advanced US Stock Investment Strategies

Are you ready to level up your stock game? Some advanced strategies will help you navigate the world of US stocks like a pro. It might not always be an easy ride, but with great risk comes high potential gains.

Options Trading in US Markets

Options trading is like ordering a custom-made meal—it’s convenient but it might get complicated. These are contracts that give the trader the right to buy or sell a stock at a predetermined price.

Calls, puts, strikes, expiries, and premiums are all new terminologies that you should learn if you’re into options trading. But once you get the hang of it, you’ll be able to diversify your portfolio and improve its performance.

Regulatory Differences for Options Trading

The ASX allows options trading, but in the US market, there are new rules. Several authorities overseeing options trading like the SEC, FINRA, and OCC govern trading.

Understanding the regulatory differences is paramount as it can help you navigate this world easily.

Short Selling US Stocks

Short selling is a high-risk high-reward investment strategy. It’s mainly betting that a stock price will go down, where it represents the potential for profit in a declining market.

Nevertheless, careful risk management is essential because things can go bad pretty fast. Knowing that unlimited losses are possible highlights the importance of studying the market.

Privacy Australia can help you find the best brokers for short selling to protect your investment.

Risks and Margin Requirements

Due to the higher risk of short selling, investors are subject to different requirements. They should maintain a margin account with minimum equity to guard against market uncertainty risks.

If the price of the stock rises and the account’s margin is below the required level, investors should add more funds or close their position at a loss.

Algorithmic and High-Frequency Trading

Algorithmic trading and high-frequency trading are two advanced strategies that leverage technology to execute orders.

Algorithmic trading relies on computer algorithms to automate investment decisions based on predetermined criteria. This trading strategy offers many benefits by reducing human error, decreasing costs, and offering the ability to process large amounts of data.

Despite its speed and convenience, the technical complexity can be a big obstacle. Moreover, during periods of market stress, liquidity can quickly dry up.

High-frequency trading is a subcategory of algorithmic trading that involves executing large numbers of orders at a very high speed by holding positions for short durations. The main difference between these two trading strategies is speed. HFT strategies are usually more complex.

HFT firms are market makers that help align prices and maintain market efficiency. With the speed of this strategy, investors can capture opportunities that are missed by most players. Nevertheless, market manipulation is a big concern and traders are more affected by market volatility.

Technology and Infrastructure Needs

Both strategies are suitable for experienced traders and investors. The complexity and high-risk nature of these investment practices can be an obstacle to many entry-level investors.

Technology hardware and software obstacles usually represent a big turnoff. Low-latency connections and computer hiccups can quickly crush your investment dreams.

US Stock Market Analysis Techniques

US stock market analysis is a must if you want to become a successful trader. To solve its mystery, use technical analysis and fundamental analysis.

Remember that Privacy Australia allows you to compare different brokers and the analysis tools they provide.

Fundamental Analysis of US Stocks

How do you think Warren Buffet made his fortune? Back in the day, the only way to go was by doing a fundamental analysis.

Fundamental analysis is the first and most important step to take, as it allows you to evaluate the company’s financials, management, and competitive position. It’s a basic analysis tool that gives you an idea of what you’re getting yourself into.

Key Financial Metrics and Ratios

Key financial metrics and ratios allow you to evaluate a company’s financial health, performance, and value in the US market. These metrics can be categorised into several groups, like profitability, liquidity, and leverage. P/E ratio, EPS, ROA, and ROE are all important terms you must understand.

Technical Analysis in US Markets

Technical analysis is another story. You use price patterns, trading volumes, and indicators to predict the future performance of stocks. Does it involve some degree of speculation? Yes, but it relies on science and mathematical predictions.

Both fundamental analysis and technical analysis are critical for successful trading. Only you can decide the best mix that aligns with your investment goals.

Popular Technical Tools for US Stocks

Several technical tools can help analyse performance in the US market. Moving averages like the SMA and EMA, RSI, MACD, ATR, Bollinger Bands, Fibonacci Retracement, and Stochastic Oscillator can help you make informed decisions.

Macroeconomic Analysis for US Investments

Looking at the big picture helps you have a better understanding of individual investments and financial markets. Macroeconomic analysis involves looking at several economic indicators, policies, and global factors that influence the performance of US stocks.

The GDP growth, corporate earnings, geopolitical risks, inflation rates, unemployment rates, interest rates, exchange rates, trade balance, and the government’s monetary and fiscal policy regarding the Federal Reserve all impact US stocks significantly.

Key Economic Data Releases

Significant data releases like non-farm payrolls, CPI, and GDP reports provide important information to help you make better decisions. But, remember that trading around news releases isn’t for the faint of heart as the market volatility can be too much for most.

Australian investors can achieve amazing gains by investing in the US stock market.

Building a US Stock Portfolio

Now, it’s time to build your US stock portfolio. What are your investment goals?

This process is pretty much like creating a mixtape—sorry GenZ. You can add your favourite hits and hidden gems to achieve the right level of diversification and create a personalised mix that addresses your needs.

Asset Allocation Strategies

How much risk can you tolerate?

Answering these questions will help you with asset allocation. Think of the stocks, bonds, and cash you can mix to create a portfolio that aligns with your goals as an investor.

Are you looking for stable yet not-so-flashy investments? Or are you interested in high-risk investments that promise massive gains? Your answers will determine the best asset allocation mix for you.

Integrating US Stocks with ASX Investments

Investing in US stocks does not mean your days with ASX investments are over. While US stocks add spice to your investment and help diversify your portfolio, your good old Aussie stocks represent the comfort food you usually crave.

Ensure you create a smart mix that doesn’t get too messy.

Sector Rotation Strategies

So, let’s say that you tried investing in a certain sector and it proved successful. This doesn’t mean that this sector will be a reliable investment all the time.

Sector rotation is an important strategy to implement as market performance changes like the seasons. Knowing which sector is on the rise by doing research and analysing the economic cycle will help you create a successful portfolio.

Identifying Sector Leaders

Identifying industry and sector leaders is a crucial part of doing your homework as an investor in the US market. These companies play a crucial role in directing the market and can significantly impact your investments.

Companies with strong financial positions, competitive advantages, and successful management usually perform well in the US stock market. Adding them to your portfolio is probably a good decision.

Dividend Investing in US Stocks

Some investors choose to invest in stocks that pay regular dividends. Cash and stock dividends provide a consistent income even if you aren’t buying or selling anything.

Most investors and traders who crave stability choose to invest in dividends. Think of retirees, beginner investors, and those who enter the stock market for stable gains. Choosing dividend payers like Dividend Aristocrats can be a good choice.

However, dividend investing isn’t always the correct answer. Companies can reduce dividends and past performances don’t always reflect future ones. Moreover, investors should consider taxes and missed opportunities from investing in other companies.

Dividend Aristocrats and Growth

The S&P 500 Dividend Aristocrats is a successful stock market index that increased its dividends steadily over the past 25 years. This is why it has been successfully attracting beginner investors and those who want to achieve some stability in their portfolios.

But, ignoring dividend growth stocks isn’t right. Yes, they might start small but the growth potential is outstanding. It just takes some faith and patience.

Regulatory and Compliance Considerations

As an Aussie investor, trading US stocks will probably feel like driving on the wrong side of the road. You know what will make it possible? Understand all regulatory and compliance considerations.

Yes, they might not be everyone’s favourite topic, but they’re essential for your safety.

ASIC Regulations for International Investing

Let’s start with how the ASIC protects your money.

Although you’re investing your money in international markets, you still have to play according to the ASIC’s rules. Your broker should, too. Otherwise, you’ll get into trouble, and you don’t want that, do you?

Reporting Requirements

You’re required by law to report your US investments to the ATO. You should keep track of your trades, dividends, and capital gains according to the ATO’s reporting requirements.

This will make your job easier and you’ll be a law-abiding citizen according to the ATO. Not bad at all.

SEC Regulations Affecting Foreign Investors

It’s not just the ASIC, but the SEC also has its own set of rules that you have to follow if you want to play the game on Wall Street.

You aren’t at a disadvantage because you’re an Aussie. These rules apply to everyone, including foreign investors, and they’re meant to keep the market safe.

Insider Trading and Market Manipulation Rules

Insider trading refers to trading stocks, bonds, or options by someone who has access to non-public information about the company. Since such information will affect the company’s financial situation, inside trading gives the investor an unfair advantage.

The SEC bans this practice and there are serious legal consequences due to market manipulation. My advice: don’t try to go after insider information.

FATCA and CRS Compliance

FATCA and CRS want to ensure that everyone is reporting their foreign accounts accurately. The good news is that this ensures your investments are safe, but you might have to file some extra reports.

Implications for US Stock Investments

The FATCA and CRS rules apply to you as an Aussie investor. But don’t worry because if you’re dealing with a reliable broker, they’ll probably do all the work on your behalf.

However, if you have some substantial US investments, you might be required to provide more paperwork. This shouldn’t be a problem but if you’re confused, consult a tax pro—it’s way cheaper than financial penalties and fines.

Future Trends in US Stock Investing for Australians

Predicting the future of US stock investing for Aussie investors isn’t like looking at a crystal ball. Yes, there’s some degree of speculation but some current events can give you a somehow accurate idea about future trends and what they hold.

Fintech Innovations in Cross-Border Investing

Fintech or financial technology refers to technological advances in providing financial services and solutions. Today, the new trends in fintech promise a rewarding world for all local and foreign investors, including Aussies.

Think about fractional shares, zero-commission trading, and robo-advisors. They provide appealing opportunities for traders, even first-timers. Thanks to fintech, the US market continues to be more accessible.

Blockchain and Cryptocurrency Integration

We can’t talk about fintech without mentioning blockchain and cryptocurrency integration. Both represent a significant development in the US stock market.

Tokenized stocks, crypto-based ETFs, using cryptocurrencies for transactions, and blockchain-powered trading platforms all promise new investment opportunities. But beware of these trends’ high volatility.

Since we care about protecting your investments, we’ve prepared a list of the best crypto trading platforms you can use. We encourage you to check it out to choose one that aligns with your investment goals.

ESG and Sustainable Investing in US Markets

New approaches like ESG and sustainable investing focus on the impact of investments on the society and environment.

Environmental, Social, and Governance investing relies on integrating environmental, social, and governance factors into investment decisions. They include resource management practices, the company’s carbon footprint, community relations, labour practices, ethical business practices, and diversity.

Sustainable investing refers to investing in companies that contribute to sustainable development. Both investment strategies represent a growing trend in the US market.

Comparing ESG Standards: US vs Australia

The US government might have different views on green investments compared to the Australian one. For the US stock market, these practices might be more of a voluntary decision.

However, Australian companies are obliged to follow green policies as part of their mandatory reporting. Both countries have successfully integrated ESG standards into their financial markets, but they do so within different contexts.

Potential Regulatory Changes

Regulations are not etched in stone. International investing guidelines can change due to various economic and political reasons. So tightening the rules on SPACs or crypto might happen. Stay tuned for any upcoming changes.

Impact of Global Financial Reforms

As someone investing in the US stock market, you aren’t immune to global financial reforms. Global minimum tax rates and changes in reporting standards cause changes that will change your experience trading US stocks.

How Privacy Australia Can Help

Now, a question might be weighing on your mind since the beginning of this article—what does all of this have to do with Privacy Australia?

Investing in the US stock market means sharing sensitive personal and financial data online. This is where we come in.

Privacy Australia can help you protect your information from foul play without affecting your international investment experience.

Data protection is our speciality, and thanks to our in-depth reviews and guides, you can browse the internet safely.

Are password protectors safe? What is the safest VPN? Head to Privacy Australia today and you’ll find the answers.

Learnings Recap

This marks the end of our journey. Our detailed guide that reveals the secrets of investing in US stocks from Australia has reached its conclusion.

The US stock market represents an excellent opportunity for Aussie and other foreign investors. Here are some points to consider.

- Remember it all starts with choosing a reliable broker and understanding the needed paperwork.

- You don’t have to stick to US stocks, as mixing them with ASX blue chip stocks results in beneficial diversification. Nevertheless, understanding tax implications is paramount because you don’t want to get into trouble.

- Short selling and option trading are advanced strategies that work for seasoned Aussie investors.

- Several analysis techniques can help you navigate the world of US stocks safely.

- Build a diversified portfolio with different assets for maximum safety.

- Regulations and rules will protect you, so don’t ignore them.

- Keep an eye on future trends as they can significantly impact your investment.

- While navigating the US stock market, data privacy is a must. This is where Privacy Australia comes in.

Final Thoughts

Investing in the US stock market from Australia might seem a bit intimidating. Sure, it’s a scary adventure but it’s exciting and promises a lot of potential gains.

Remember that the road to successful investing starts with a single trade. Do your research and start small as you dip your toes into the market. While trading different assets, Privacy Australia has done the research for you so you can protect your personal and financial data online. Whether you’re looking for information on different platforms like eToro or the best cyber security practices, we’ve got your back.

You Might Also Like: