Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Oil Trading – How Do You Trade Oil?

First up, physically trading oil isn’t possible for most traders. Despite this, you can find lots of liquid markets tracking the price of oil across ETFs, options, futures, or oil-centric stocks.

The market itself is bewildering on many levels to professional and individual traders, and prices can fluctuate immensely on daily basis. It pays to learn more. Let’s review some of the top ways to trade oil.

Table of Contents:

- 🛢️ Overview

- 🛢️ Supply and Demand Forces

- 🛢️ Grade and Region

- 🛢️ Oil Trading Via Stocks, ETFs and ETNs

- 🛢️ Oil Trading Through Futures and Options

- 🛢️ Leading Producers of Oil – US, Russia and Saudi Arabia

- 🛢️ FAQs

Overview: What is Oil Trading? 🪔🛢️

Commodities are raw materials used in manufacturing and other industries. Their trade is linked to their inherent value in manufacturing, energy and other utilities.

They include things like gold, silver, copper, corn, wheat, soybeans and, of course, oil. Commodities have been around for thousands of years and have been used as currency by many different civilizations throughout history, because they are often easy to transport and store.

Today, commodities are traded all over the world through commodity exchanges such as the Chicago Board of Trade (CBOT) and the New York Mercantile Exchange (NYMEX). The price of commodities fluctuates based on supply and demand factors just like stocks; however commodities tend to be more volatile than stocks because they aren’t tied to any particular company or industry.

For example, if a company like Apple or Microsoft releases a new product, the stock price will likely rise because investors are excited about the new product boosting the company’s profits. If the product release goes badly, the stock price will probably fall. But for oil, this is only true to a certain degree…

While commodities don’t have as strong a relationship with any particular company or industry, there are some exceptions such as mining or agricultural stocks that could benefit from positive changes in the value of oil. Oil is also highly affected by supply and demand factors such as geopolitics, weather, natural disasters and even war, as we’ve seen in recent times.

Commodities can be traded in several ways including futures contracts, options, investing in stocks that benefit from positive changes in oil or mining, and direct physical ownership of the commodity itself. In this article, I’ll look at all three types of commodities trading and how you can use them to make money.

- 📈 Because it’s a commodity, the value of oil in the market fluctuates according to supply and demand, with this somewhat under the control of the OPEC (Organisation of the Petroleum Exporting Countries) cartel.

- 📈 The quality grade of oil differs by site. Is it heavy or light? Sweet or sour?

- 📈 Many view oil as a good diversification to hedge against inflation.

- 📈 Physically trading oil is not an option for most investors, but there are plenty of liquid markets where the price of oil is tracked to some degree or the other.

Traditional Science Behind Fossil Fuels

Fossil fuels are the most common source of energy. They’re also one of the most abundant resources on the planet, with more than half of Earth’s oil, coal and natural gas lying inside federal or state parks and other protected areas.

Petroleum comes from the remains of ancient plants and animals being trapped in rocks. These rocks are then heated and compressed, causing the organic materials trapped within them to break down.

When this process occurs, hydrogen atoms are released and combined with carbon atoms to produce petroleum. Petroleum is used as a source of energy, and as a raw material for many other products.

The production of fossil fuels doesn’t follow a strict timeline. Oil and natural gas can be formed from plants and animals that lived millions of years ago, but they also form as a result of current geological processes. The formation of these materials occurs in certain environments. This means that it is possible to identify the geological conditions that led to the formation of fossil fuels in specific locations.

History of Oil’s Productive Value

Oil is valuable because it is used in the production of so many different products. Petrol is the most common form of oil formed by hydrocarbons and crude oil.

To begin with, it’s used to make plastic, paint, pharmaceuticals, and other chemicals. It is also used in the production of petrol, diesel, and other fuels for vehicles, generators and heating systems.

Overall, why oil is valuable:

- ✔️ It’s an important fuel.

- ✔️ It’s a limited resource.

- ✔️ It’s used in many diverse industries.

- ✔️ It’s traded on the futures market.

Sour vs Sweet Crude Oil

As mentioned in the intro, there are different qualities and grades of oil. Crude oil is the liquefied hydrocarbon made from organic matter. Some of these are liquid — with further refining, they can become very useful products, like diesel and gasoline fuel. But the rest is too viscous to be refined.

Sour crude oil contains a greater percentage of problematic sulphur compounds. This oil is more plentiful in tropical areas.

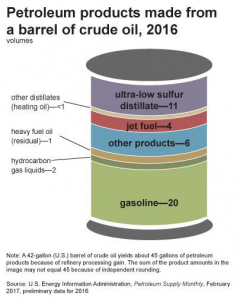

To be able to use oil for energy, and to obtain the valuable parts of the hydrocarbons, it must be refined. This process is known as “cracking”, which converts basic crude oil into sweet high-quality oil. Lighter hydrocarbons are separated from heavier portions. Ultimately, diesel and gasoline products are made through this cracking process — producing products that are much more valuable.

Oil Trading: Supply and Demand Forces

Worldwide, oil is a highly valued commodity. According to some estimates (the EIA), the worldwide demand for oil was around 100 million barrels daily for 2023, which is an all-time record. There are many reasons for this, including an increase in demand from emerging markets, meaning that the price is anticipated to continue to rise.

Although many of these emerging economies provide subsidies for their consumers, the economy may suffer if oil producers start selling at a loss.

Oil is very sensitive to supply and demand forces. If a large new reserve is discovered, for instance. Or, if production falls. Or, If there are tensions between nations which mean that some countries can pump out more oil than others, and supply might be threatened. Special events, like the Arab uprising of 2020, saw the collapse in oil prices as the economy slowed down. And in 2022, the Russian-Ukrainian conflict saw massive disruption to the oil markets, amid rising inflation, sanctions, plus more — pushing the price of oil to more than US$100 per barrel.

Oil Trading: Grade and Region

If you have been to a highly populated city still in the process of developing standards of environmental regulation, you will know the difference between high-quality and low-quality fuel. The latter doesn’t burn as clean, leading to a cityscape with a lot of smoke, pollution, and associated health costs from breathing in contaminants.

Other regions of the world, like the United States and United Kingdom, have more stringent regulations in place regulating the quality of oil. The best quality oil is called “sweet crude”. This is one of the reasons why countries like the US with large oil reserves still import oil, as not all their reserves are high-0grade oil and refining low-grade costs money.

Regardless of whether oil is being sourced from the fields of the North Sea, western Texas, or the UAE, characteristics that make it perfect for refining into gasoline are lightness and sweetness.

Effect of Speculation on Oil Volatility

It’s not just the oil supply and demand from a country’s citizens and industry that influences the price of oil. It is also affected by investors speculating on futures contracts. Large-scale institutions take a keen interest in oil markets, using them for all kinds of reasons including pension funds. Oil is certainly a long-term allocation asset.

Meanwhile, scalpers hold crude oil for very short time in order to make quick profits. Some people believe the reason why the price of oil is so immensely volatile is largely down to these short-time-horizon traders. Although, others believe they have minimal effect on the price in actuality.

Oil Trading Via Stocks, ETFs and ETNs

Whatever the reasons for fluctuations in oil, investors seeking to get into energy markets and make returns have several options. Most of all trading happens in derivative markets, utilising either options or futures contracts. Although many of these are not accessible for individual retail investors, there are other routes you can use to get oil into your portfolio.

A straightforward way of doing this is to invest directly in the companies that drill for oil. These are accessible through stocks. Another approach is to invest by buying up energy-sector ETFs.

There are a range of energy stocks available through mutual funds such as the Global Energy Sector Index Fund (IXC) from iShares. There is reportedly a lower degree of risk in these funds because they exclusively invest in oil and oil service companies.

But for direct exposure to the changing value of oil, there are options for using either an exchange-traded note (ETN) or a fund (ETF). In either case, they are typically arranged using oils future contracts, instead of energy stocks. Keep in mind that the price of oil generally does not follow the stock market cap or how your currency moves — so these tend to track the value of oil closer compared to stocks for energy, potentially serving as hedges in a diversified portfolio.

What is an exchange-traded fund (ETF)?

ETFs are investment funds traded on stock exchanges, much like stocks with the price fluctuating depending on supply and demand. They are similar to mutual funds in that they hold many different investments and can be bought and sold throughout the day. However, different to funds, ETF shares can be bought or sold whenever during the trading day.

What is an exchange-traded note (ETN)?

ETNs are senior, unsecured debt securities issued by financial institutions that track a benchmark index or a basket of assets. They are designed to have similar returns to those of their underlying benchmark or asset, but you do not actually own the underlying assets. ETNs are riskier than traditional ETFs because they are unsecured debt securities that are subject to the credit risk (default) of the issuer.

Oil Trading Through Futures and Options

Oil can be traded on the futures market, which means you can buy and sell oil contracts for future delivery. You are not actually buying or selling oil, but rather a contract to buy or sell oil at a later date.

A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price at a specified time in the future. Futures contracts are standardised agreements that are traded on exchanges such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

The price of a futures contract is determined by supply and demand for that particular commodity at any given time. For example, if there’s more demand for crude oil than there is supply, then the price will go up because people will be willing to pay more for it than what it’s currently worth. If there’s more supply than demand for crude oil, then the price will go down because people won’t be willing to pay as much for it as what it’s currently worth.

Trading oil is very similar to trading other commodities like gold or silver. You can buy or sell futures contracts for a specific amount of oil at a specific price on a specific date in the future.

If you buy a contract, you’re betting that the price of oil will go up by the time your contract expires. If you sell a contract, you’re betting that it will go down instead. You can also trade options on futures contracts if you want to limit your risk or if you want to make smaller bets than are allowed with futures contracts alone.

Development of Oil Futures

The first oil futures contract was created in the early 1970s. The first contracts were based on crude oil, but they were later expanded to include refined products like gasoline and heating oil.

In the 1980s, the NYMEX began trading crude oil futures. This exchange is now owned by CME Group, which also owns the Chicago Mercantile Exchange (CME). In 2000, NYMEX and CME merged to form a single company that trades both energy and metals. The new company is called CME Group.

How Do You Trade Oil via Options Contracts?

You can also trade options on oil, which gives you the right to buy or sell oil at a specific price at a specific time in the future.

You can trade oil through an online broker. You can also trade it through your local stock broker if you have one, but this will be more expensive because they will charge commission fees for each transaction.

The price of oil changes every day based on supply and demand factors, so it’s important to keep up with these factors if you want to make money trading oil futures contracts. If there are more buyers than sellers of an asset (in this case, more people want to buy than sell), then the price goes up; if there are more sellers than buyers (more people want to sell than buy), then the price goes down.

Where? Leading Producers of Oil – US, Russia and Saudi Arabia

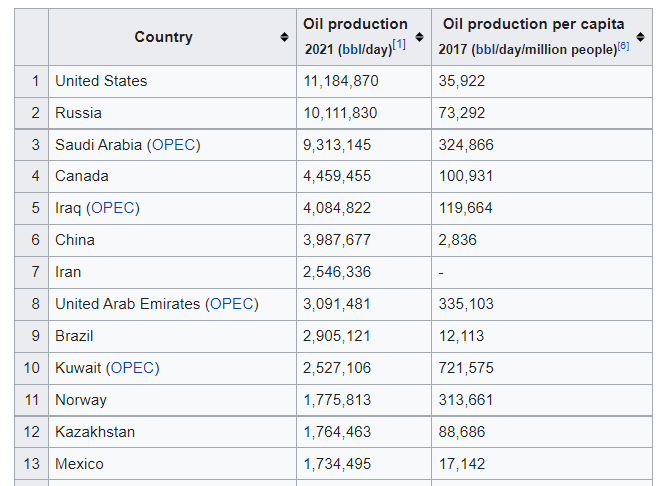

In 2021, according to some measurements, the average production of oil was 77 million barrels daily. And more than 70% of this production was issued by the top 10 nations and 37% (with some overlap) sourced from the current 13 OPEC states.

Recent history has seen the top three producers as the United States, Russia, and Saudi Arabia. Each country saw large-scale production decreases at different points in the past, such as the oil crisis of 1973. However, since 2014 each has churned out oil at near peak levels of 9-11 million barrels per day bbl/day).

Nevertheless, Saudi Arabia and Russia are the greatest oil exporters. Monthly, the USA produced nearly 12 million barrels per day as per figures from November 2019, which was actually the largest level for the US in its history. Indeed, in Q1 of that year, the US became a net gas and oil exporter — something that hadn’t happened since 1953.

Meanwhile, between 2021 and 2022, Russia was the second-largest oil producer after the US. Its daily output of oil came only after the United States, and was ahead of Saudi Arabia for that year, according to figures from statistics company, Rosstat.

Furthermore, according to this data, Russia was producing an average of 10 million barrels a day between January and May 2021, which was less than a million barrels less than the US — once again, meaning that the US was the largest oil producer for that period of time. Saudi Arabia was significantly less, in third place at a little over 8 million barrels per day.

In fact, oil production was more than 40% of Russia’s gross exports for the months of 2021 (January to May). That said, although exports did reduce to 16.9% relative to the period before that, the figure was 50.8 million tonnes. And Russia produced a total of more than 200 million tonnes of oil in 2021, which was around a 6.2% reduction in annual averages.

Before the occurrences of 2022 – with the conflict in Ukraine and lines of conflict between the collective West and the Russian state — Russia had agreed to boost its production as per an agreement with the Organisation of the Petroleum Exporting Countries (OPEC). However, this has since been quashed and many things have happened including the destruction of key pipelines.

Brazil: noteworthy underdog nearing top-5 status

Brazil ranks in eighth place, among the top 10 producers of oil in the world. Recent figures are at nearly 3 million barrels of oil daily, coming in behind the UAE. This explosion is relatively recent — signalling that this Latin American nation could even be on its way to becoming a worldwide top five oil producer.

As with tracking a company’s health via its history of dividends and market capitalisation, we can look at Brazil in a similar way. In a little under 10 years, the biggest economy in Latin America — Brazil — has achieved its status as an industry-leading oil producer. For instance, at the close of 2020, Brazil did not only have the status of producing the most oil in Latin America, achieving an average of 3 million barrels per day. It also ended that year as the planet’s seventh-biggest producer — even coming behind OPEC nations United Arab Emirates and Iraq.

And, according to the Energy and Mines Minister, Brazil intends to become the planet’s fifth-biggest petroleum exporter before the close of the decade. So far, its government is predicting that the country will pump 5.3 million barrels of oil daily by 2030, allowing it to significantly increase exports.

Let’s compare this to its current average of 3 million barrels daily of crude oil and condensate, documented in July 2021, to the pre-existing average of 2.94 million in the first seven months of 2021. This slow progress suggests there are substantial efforts needed before Brazil can hit such a competitive target.

Regardless, the energy-demanding country, China, will remain its central consumer — Brazilian crude oil is in demand. China ranks as the second biggest economy in the world but is expected to achieve status as the biggest refiner of oil internationally. As the pandemic becomes a memory, as much of Europe freezes, the demand for oil will reach even greater demand than we’ve ever seen before.

Countries are demanding crude oil that has high quality and is low in metals and sulphur. However, it is no longer because of the need for environmental regulations to be met — there is an air of desperation we have never seen before in the collective West for energy. In terms of distribution, Asia is a major international shipping port. Singapore ranks highest among them for volume, but Hong Kong is in fourth place.

With that in mind, it can be expected that Brazil will keep expanding its old production, while China continues its economic growth trajectory and refining activities. However, the low costs for oil per barrel that the world hoped for are unlikely to be seen again for a very long time. Too many international crises have made this natural resource of vital importance. Not just for energy, but for geopolitical survival. There will surely be a lot of support for Brazil’s current plan of a US$17 billion investment in a new oilfield, in order to bolster its production capabilities.

FAQs

How Can Ordinary Investors Start Trading Oil?

Once again, it’s very difficult to physically trade oil. At this point in time, it’s essentially a military and state security asset. However, there are many opportunities for investors to trade on derivatives. For instance, ETFs and ETNs track the oil commodity in various ways. To invest in gasoline, natural gas and oil as a sector, you need to choose stocks or funds that are adequately weighted by changes in the industry.

How Much Crude Oil Is There Left in the Ground?

Middle of 2022 figures suggested there were around about 1.4 trillion barrels of oil remaining in the earth. Figures estimate that in 45 years or so, these oilfields will be drained according to the current consumption rates. Allegedly, however; there is an enormous confluence of geopolitical influence and globalist agendas affecting the veracity of these supposed facts.

Which Country Produces the Most Oil?

As of 2022, the United States became the world’s largest producer of oil, in part due to extraction from shale oil deposits. After the US is Arabia, Russia, Canada, and then China.

What is fractional distillation?

Fractional distillation is the process of separating a mixture of substances into its component parts. The lighter, more volatile components are separated from the heavier, less volatile ones. Fractional distillation is used to separate crude oil into its various components. It’s also used to separate natural gas into its component parts: methane, ethane, propane, butane, and so on. It’s even used to separate the types of alcohol produced from fermentation processes in the production of beer and wine.

Why is sweet crude oil preferred?

In the past, oil companies looked for fields of oil that would yield a high percentage of sweet crude. Sweet crude is higher in octane and easier to refine into gasoline. It also has a lower sulphur content, which makes it easier to refine into diesel fuel.

Conclusion 🌞

How do you trade oil? Who wouldn’t love to be able to simply go to their back garden and scoop up enough oil to shove into their petrol tank? Unfortunately, oil is a scarce enough (and guarded-enough) resource that even physically be able to trade is unlikely for most investors.

Most of us, therefore, invest through other means, including funds, stocks, and futures contracts — all of these focus on and track the energy sector in different ways. Finding a trustworthy source of information is one way to get started. Then, educate yourself on the different nuances of what is happening. One thing is for sure… It is next to impossible to extract the political aspect from the trading aspect where oil is concerned. So a good trader has a clear understanding of the various market forces at various levels.

You Might Also Like: