Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

What is Blockchain Technology? A Complete Guide for 2024

WHERE WE’VE BEEN, WHERE WE ARE, AND WHERE WE’RE GOING

You may have heard of Bitcoin, Ethereum, or any of the other 100+ projects out there and might have wondered – “what is blockchain and cryptocurrencies all about anyway?”

It doesn’t matter whether you’ve found out about blockchain or cryptocurrencies through the news, media, friends, work, or business – if you’re looking to know what this whole blockchain thing is, you’ve come to the right place.

If you have a professional background, you may have heard of blockchain being referred to as “Distributed Ledger Technology” or DLT for short.

However, these two terms are not interchangeable. Blockchain sits under the umbrella term DLT; however blockchain does not encompass all of DLT, it is merely the first-mover in the space.

“A Blockchain is a decentralized, distributed, and public digital ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.”Blockhain in One Sentence

Blockhain in One Sentence

Okay… stop right there!

Unless you come from a technical or financial background, some of the terms above might seem like gibberish to you.

But don’t worry, we’re going to do a thorough piece by piece breakdown of that one-liner sentence above. By the end, you will understand what blockchain is through relatable and straightforward terms.

By the time we’re done, you should have no problem being able to explain what blockchain is and how it works.

But before we get into all that, let’s find out WHY we should even care about blockchains in the first place.

Why Blockchains Are Important

The first time the Internet came online was way back in 1969. However, it took 50 years before people could transfer digital property and value to other users over the internet in a safe, secure, and trustless manner.

The trustless aspect is the crucial component to all of this, and the solution for this transference of digital value was enabled by Bitcoin’s blockchain when it went live in January 2009.

The Fundamental Basis of “Trade” is Trust

Before we can pull out the digital machete and embark into the “crypto-jungle” we need to give a quick look at a few critical points:

“The act or process of buying, selling, or exchanging anything with value.”Definition of trade –

Definition of trade –

To trade anything, there are generally two or more parties involved. The underlying foundation for any successful trade to take place is each party trusting the other party to provide what they have agreed upon and promised to exchange.

If there’s no trust, then it makes it difficult for parties to commit and engage in trade. For instance, if people didn’t trust that PayPal would receive money from buyers and send it on to sellers, then no one would be using eBay. If you make any business transactions online, it might be best to hide your IP address and get some additional protection. This is best done by employing some of the best VPN services out there.

Similarly, if no one trusted banks to hold their money safely and securely, no one would deposit their money into bank accounts because you couldn’t be sure if you’d have access to that money the next day, week, or month from now.

But what makes this necessary?

To answer this, let’s take a look at how trading began in the first place.

You are a Neolithic man, and you own rice, which you worked hard to grow. That’s great, but what you’d like is some meat…

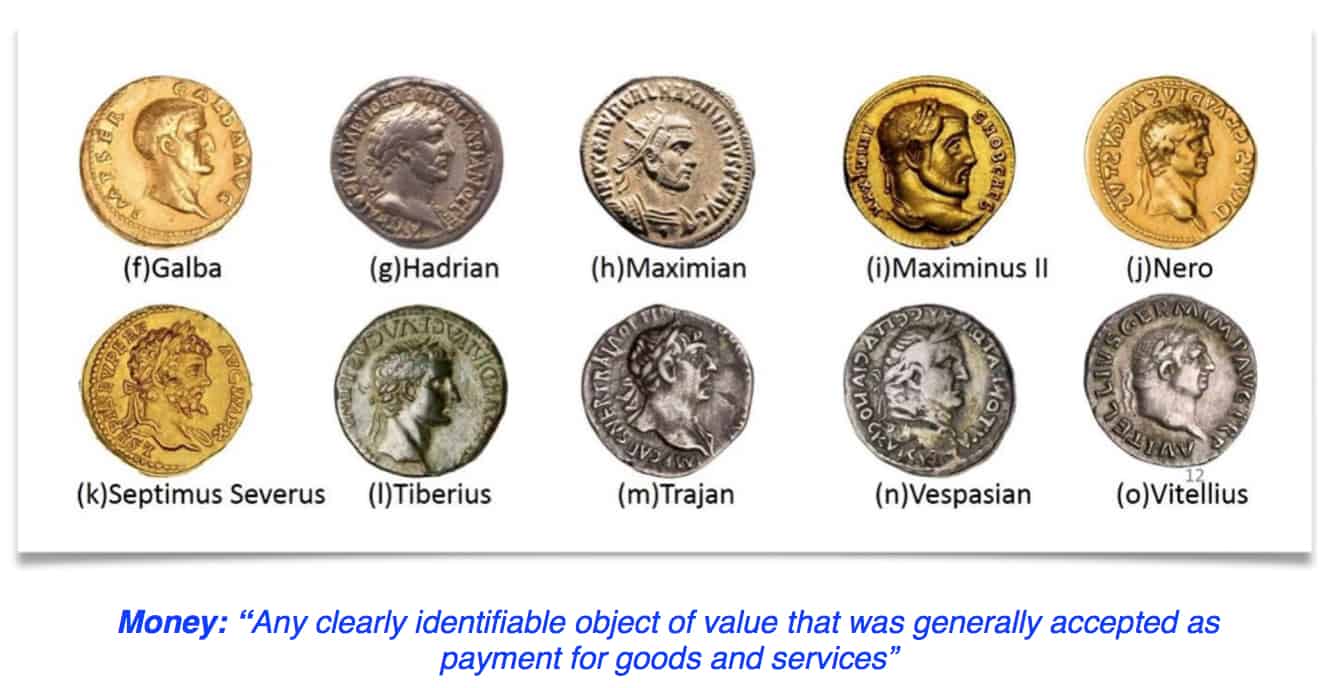

In the old times.. like, ancient times (Neolithic age 4k BC – 9k BC), trade was only executed by exchanging goods, so if you had rice but needed meat, you’d look for someone who had chicken but needed rice.

Now, as you can probably imagine, this became quite the popular practice. And as the number of people trading with one another increased, so to did the amount, volume and weight of each trade. Eventually, it got to the point where moving 50 sheep to trade them for 40 bags of rice wasn’t precisely the most efficient way of going about things.

So, naturally, innovation occurred, and the next generation of trade took place via the exchange of precious metals. Precious metals were more accessible to carry and had significant value tied to them due to their rarity. But, as trades became even more substantial, metal also became difficult to measure and heavy to carry. So, in the end, those pieces of metal were simplified even further into coins. This was the birth of money, and with it came third parties that allowed lending activities and provided security.

In other words, the first iteration of formalized banking.

From Bartering and Trading to Banking with Ledgers:

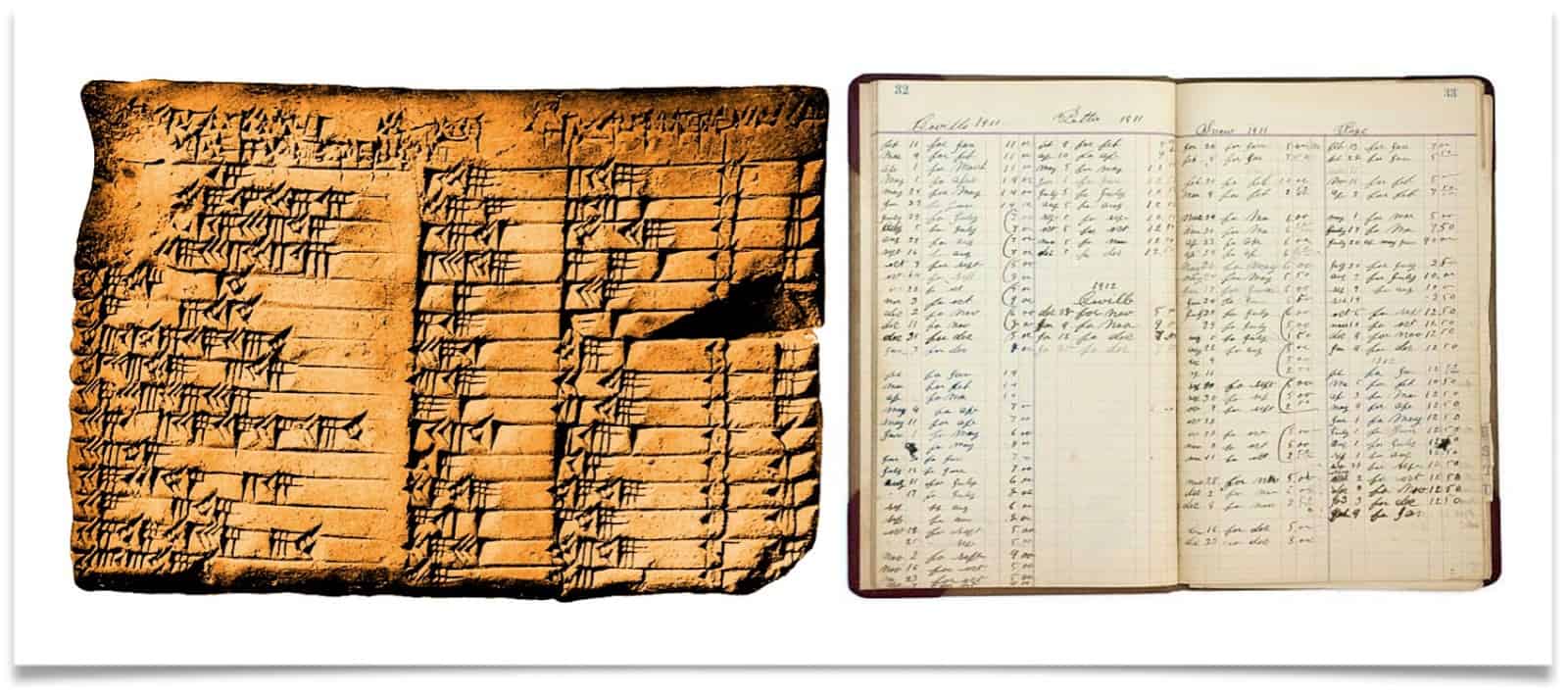

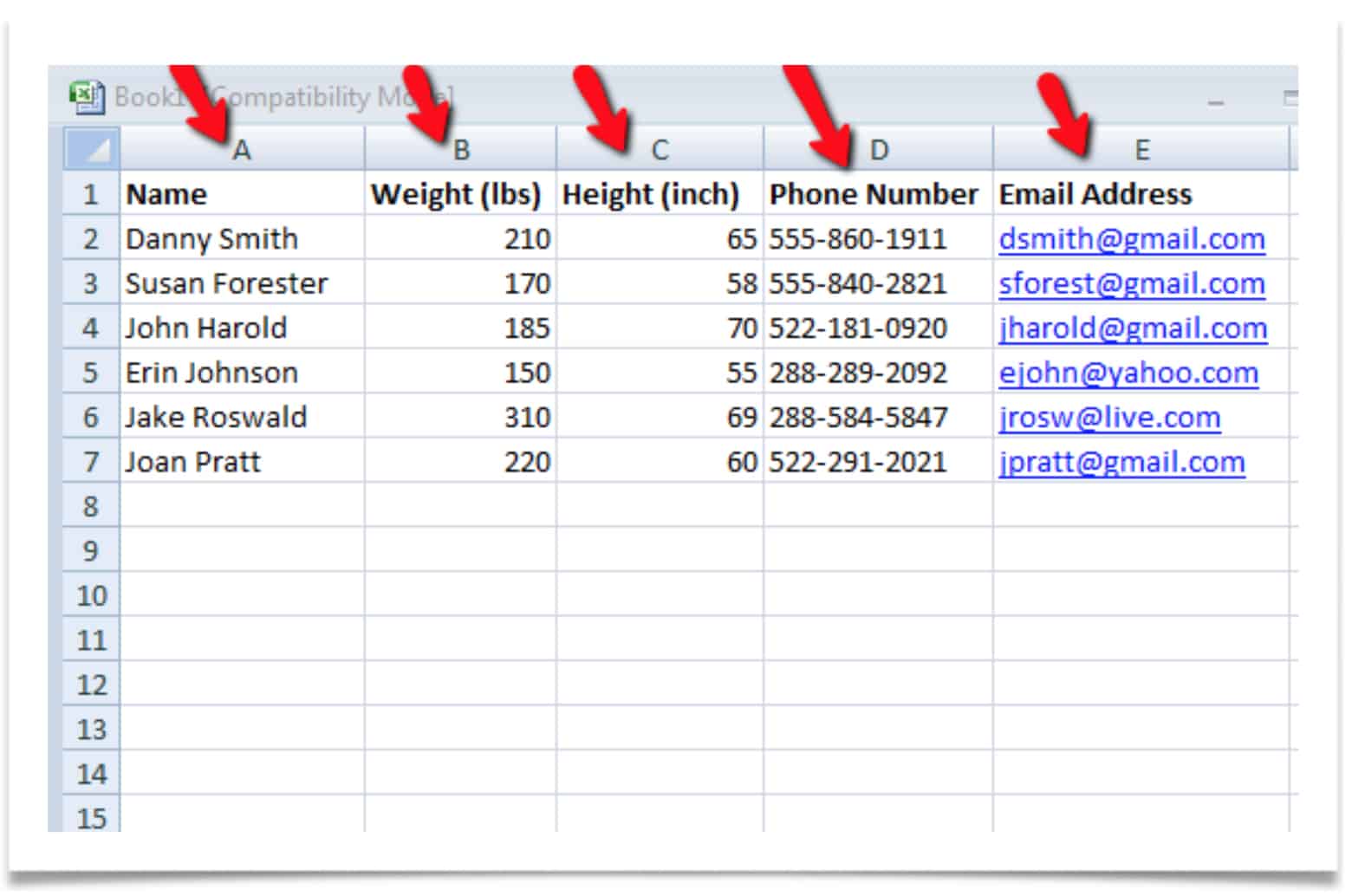

Your bank account can be thought of as a simple ledger, with a running list of debts (money going out of your account) and credits (money going into your account).

The earliest recordings of written communication found to date have been old ledgers, with these ledgers used to keep score of business, trade, and debt. Think of accounting as a book or other collection of financial accounts (which is the formal definition of a ledger, and also happens to be one of the simplest).

The Rise of “Centralized” Ledgers

When large corporate firms and bureaucracies took rise, they became the primary guardians for ledgers. And as the world shifted more and more towards a digital landscape, so to did ledgers.

These entities becoming the single governing authorities is what led to our centralized currency system.

The primary issue here is that whoever is in control of these centralized ledgers needs to be trusted. A digitized accounting is only as reliable as the organization maintaining it, all the way down to the individuals they employ.

When we deposit $100 cash into our bank accounts, the bank takes that deposit and then records in their ledger that your bank account has increased by $100.

If, however, the bank is corrupt, they can take your money and “forget” to credit your bank account for the $100 deposited and essentially steal from you. Or, the person handling the deposit could have made a simple mistake through human error resulting in you not being credited for the $100.

Ledgers in the Twenty-First Century

Although many people believe ledgers are primarily related to finances, cryptocurrencies, and money, ledgers in today’s day and age are used throughout many industries and fields.

Ledgers are also used to keep track of:

- Ownership – property, land titles, and certificates

- Status – citizenships, criminal records, electoral rolls, and employment history

- Identity – of individuals and businesses including birth, death, and marriage certificates

- Authority – who may access bank accounts, websites, or are granted certain privileges

The Next Evolution: Distributed Ledger Technology

The latest advancement in ledgers is the introduction of distributed ledger technology, with blockchain being the first distributed ledger that does not rely on a trusted central authority to maintain and validate it.

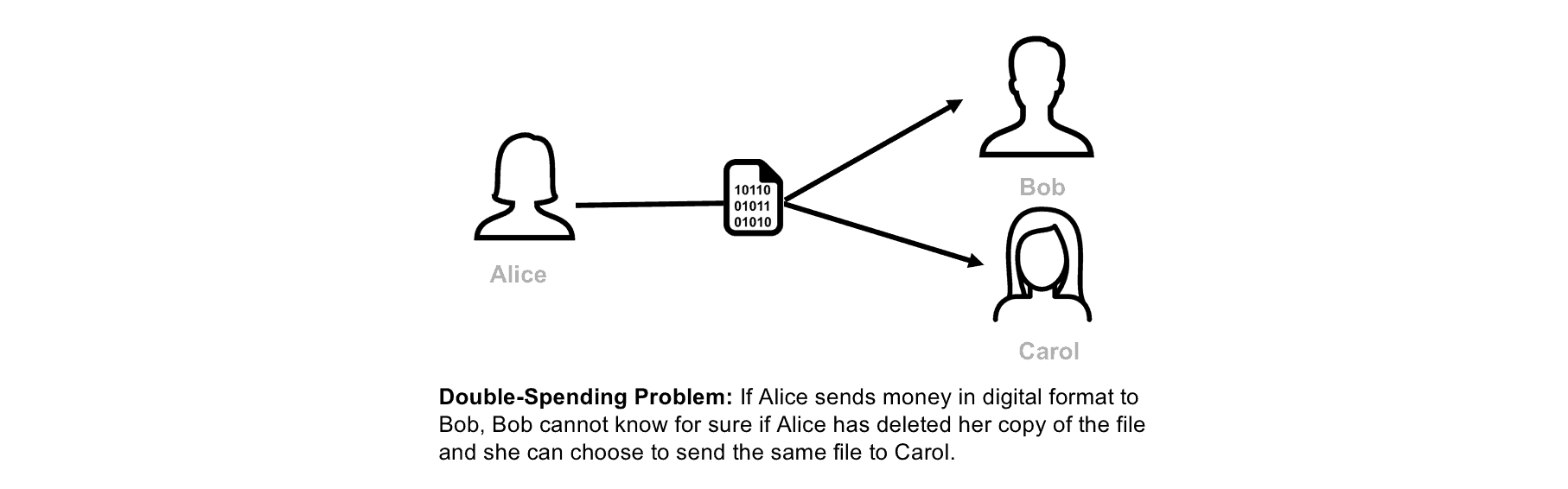

The Issue of Double Spending

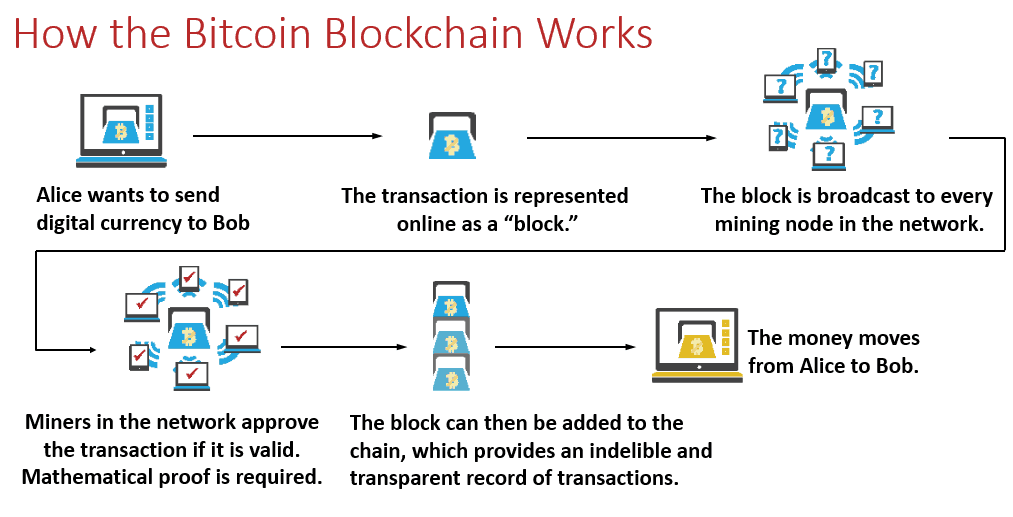

The innovation of blockchain allowed bitcoin to become the first digital currency to solve the double-spend problem.

The double-spend problem is a unique problem to digital currencies because digital information can easily be reproduced, replicated, and copied.

Before Bitcoin, it wasn’t possible to stop people from copying digital currencies, so any such money would have no inherent value because it could easily be used several times over. In other words, someone could use the same unit of digital currency two or more times.

This is called a “double-spend” attack.

This is precisely why banks exist today. Their job is to make sure no one can successfully “double spend” money they do not have or have not earned.

So, for the first time, blockchain has provided a means to eliminate the need for trusted middlemen (i.e., banks) for trade and safeguarding important information kept within ledgers. Thus, they are “trustless” because we are no longer required to trust external third-party entities to ensure the validity of ledgers.

“The practical consequence for the first time, a way for one Internet user to transfer a unique piece of digital property to another Internet user, such that the transfer is guaranteed to be safe and secure, everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer. The consequences of this breakthrough are hard to overstate.”– Marc Andreessen

– Marc Andreessen

Now that we have covered the “ledger” aspect of a blockchain and its inherent importance, we’ll dive into databases and the “distributed” nature of blockchains.

The Next Evolution: Distributed Ledger Technology

A database is merely a collection of organized data. This can exist in many forms. A paper example would be the old phone book directory, but in this article, the database we will be discussing is a computerized one.

Data is unprocessed information. This could be statistics, images, text, numbers, video, and audio.

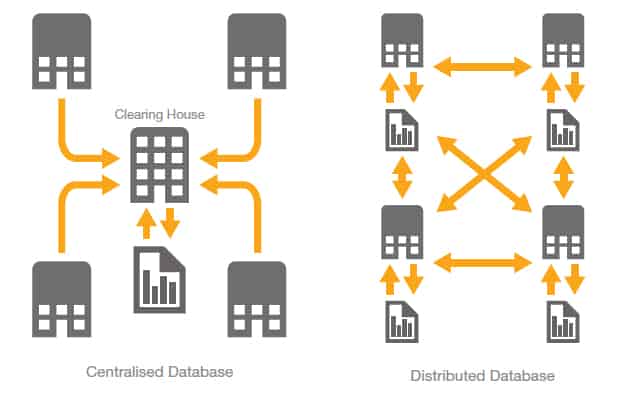

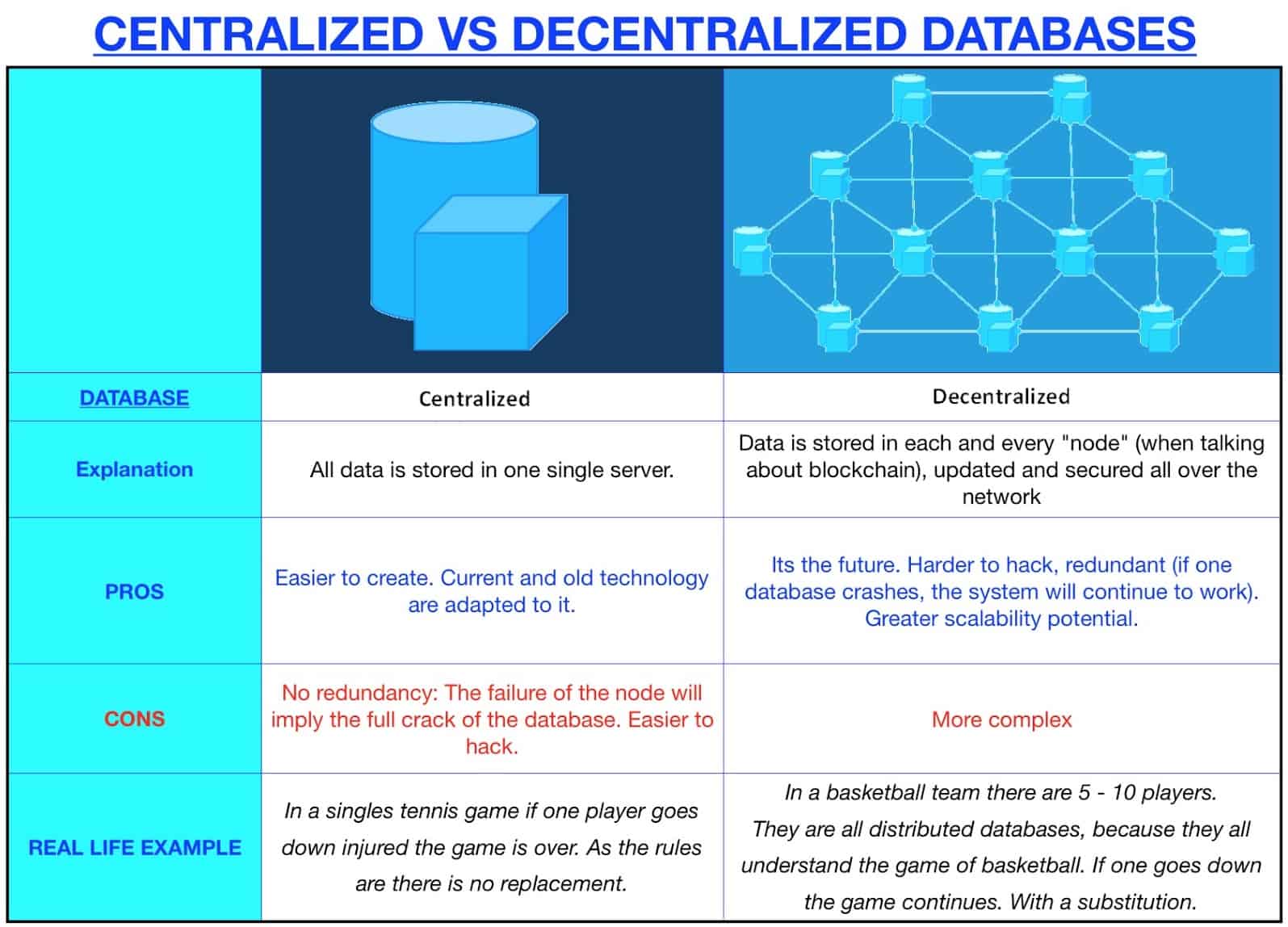

Centralized Databases vs. Distributed Databases

- A Centralized Database is a database with all information located in one place, such as the example above

- A Distributed Databases is a collection of databases that exist within two or more different locations.

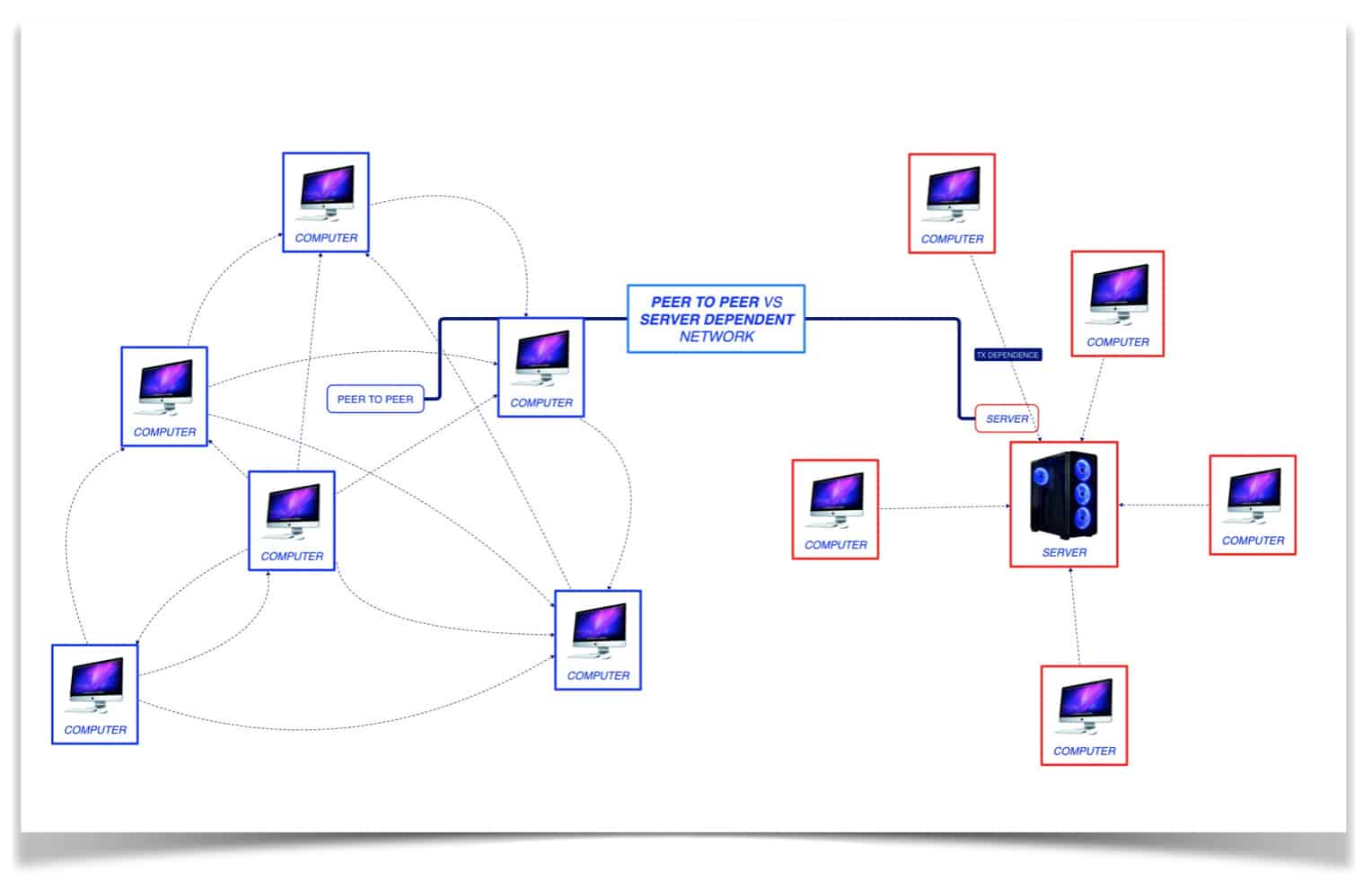

What is P2P?

P2P means “Peer to Peer.” Simply put, all this means is that two or more people can share files or other resources between their computers without the need for a third party or server that collects and sends the data.

The image below exemplifies this difference –

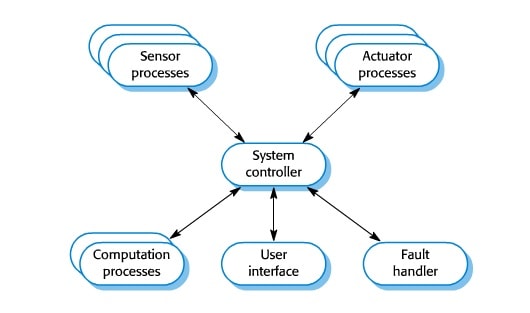

What are Blockchain Nodes

Blockchain networks rely on the essential role of its distributed parts, called nodes.

A node is a computer connected to the blockchain network that competes with the rest of the nodes in that network to solve computational puzzles and problems.

When the computational challenge gets solved by a specific node, it gets a reward. This is how people use their computational power to “mine” bitcoin.

Every individual node posses a copy of the entire blockchain network. And because these nodes are distributed around the world, it is next to impossible to change or falsify information across the web.

Background on the Development of Blockchain Nodes

Blockchain technology is very much like the Internet in that it has built-in robustness and many layers of fault-tolerance. That means if one node of the blockchain is down, the blockchain generally knows how to ignore that part of the chain and continue without interruption.

By storing blocks of information that is identical across its network, the blockchain generally cannot be controlled by any single entity (there is still the problem with someone owning 51% of the hashrate, but that’s a topic for another time) and as mentioned, has no single point of failure. This is not a topic that is easily explained

One of the very first implementations of the blockchain was the coin known as Bitcoin. Bitcoin was, in the scheme of technological progression, only recently invented.

An individual or group of people known as Satoshi Nakamoto released the Bitcoin whitepaper in 2008. Since that time, the Bitcoin blockchain has operated without significant disruption; so just like the Internet itself, Bitcoin and its blockchain have proven to be very durable.

If you’re interested in such niche areas, you could easily learn how to become a blockchain developer, and delve deeper into this promising industry.

So…What is the blockchain?

A blockchain is a “peer to peer” network composed of several distributed parties all using the nodes we discussed above.

The nodes are equal in capabilities and “influence” to the other nodes. There are no privileged nodes, and there is no central administrator device in the center of the network. This is the “decentralized” aspect of the blockchain.

In this system, you can add data without changing the previous data already present within it, because it has previously been immutably recorded by each node.

Therefore, every transaction that was ever made within the network is recorded, stored, and cannot be deleted.

This means these nodes don’t have to trust each other to come to a consensus, because every transaction was accounted.

All this explains why blockchain is a durable, robust, transparent, incorruptible, decentralized and public open ledger.

Now that you know what a blockchain is and how it works let’s go a bit deeper into how it validates, confirms, and adds new blocks of data.

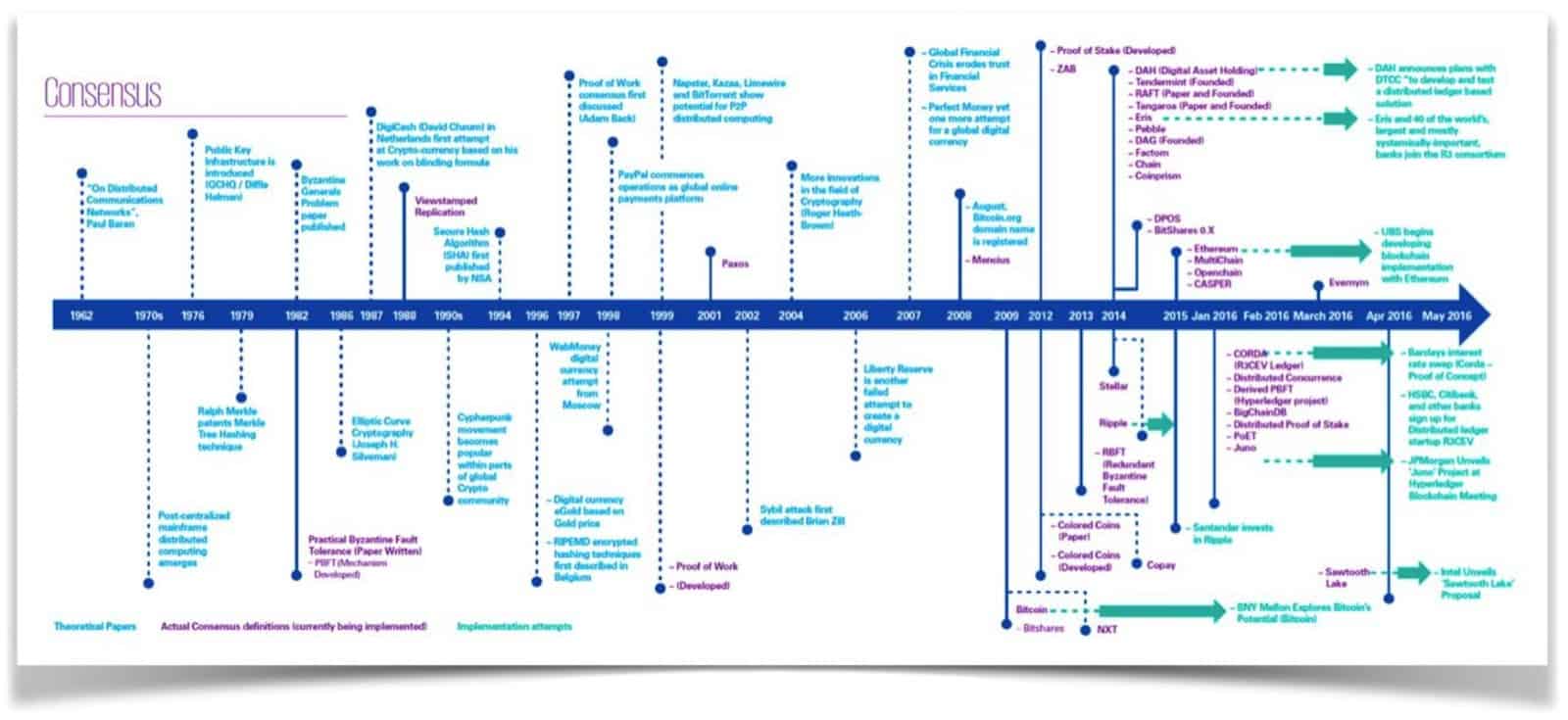

Brief History of Consensus Algorithms

The history of consensus algorithms pre-dates blockchain. Research in this area seems to have started in the early 1960s and continues through to today. See the timeline below for a broader understanding of the study and progression in this area of study.

What Are Consensus Algorithms?

In the world of commerce, we live in today; there is usually a central authority that we all trust to tell us the current state of affairs.

Examples of this are banks, credit card companies, and the organizations that provide our mortgages – we all trust that they know exactly how much money we have at any given time, which of our credit cards have a balance, and how much our mortgage payment is per month.

In the decentralized and trustless environment, this wouldn’t be the case. In general, consensus algorithms define how a decentralized network reaches an agreement, so that “trust” can still exist within it.

This building of consensus or agreement can take shape in a variety of ways, as researchers have devised several methods of mathematically ‘agreeing’ on an end state within the blockchain.

There are several types of consensus algorithms, and as research into this space continues, more will be developed.

Consensus between nodes is how the blockchain knows to add valid transactions to the chain, how to avoid a double-spend issue, and how to ignore those transactions that could be detrimental to the health of the whole system.

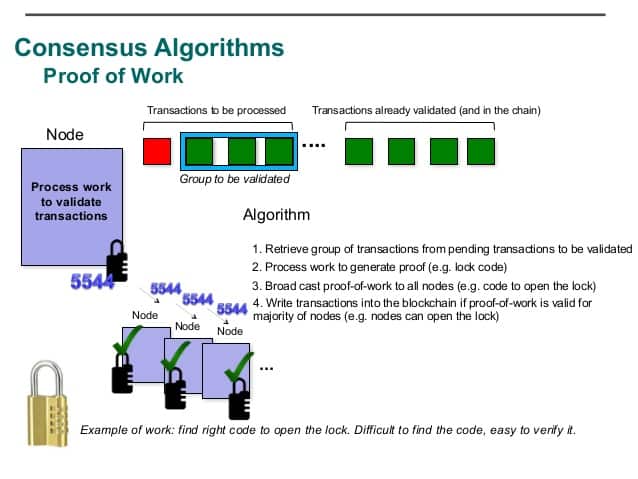

What is Proof of Work?

Proof of Work was the first blockchain consensus algorithm (more on this in a minute). It was devised by Satoshi Nakamoto for use in the Bitcoin blockchain.

It is the Proof of Work model that we have to thank for the massive mining operations taking place in China and other key locations (with access to cheap, and hopefully ‘green’ power) around the world.

Mostly, in proof of work consensus, the miners solve complicated mathematical problems that then used to create blocks. The rate at which they address the issues is referred to as a hashrate.

As the complexity of the math problem increases over time, higher and great hash rates (and therefore, more energy) is required to earn the block reward.

This hashrate is also the mechanism that is used to maintain the security of the bitcoin blockchain.

As long as there is not any conspiracy by multiple miners, and as long as its extremely expensive for one miner to hold 51% of the hashing power, the chain will remain secure because the miners are incentivized to maintain the security of the network. This does, however, present a problematic question for the future –

What happens when miners can no longer receive a block award for keeping the chain safe? Without incentive, Will they still maintain the network?

While this consensus mechanism works, it requires the amount of power to run a small city to maintain, and there is no sign of this need decreasing. So what are the other options to aid in achieving consensus?

What Are Consensus Algorithms?

As we read above, Proof of Work requires vast amounts of power to maintain the network. In an attempt to remedy this, another form of consensus that does not require the same level of force was created.

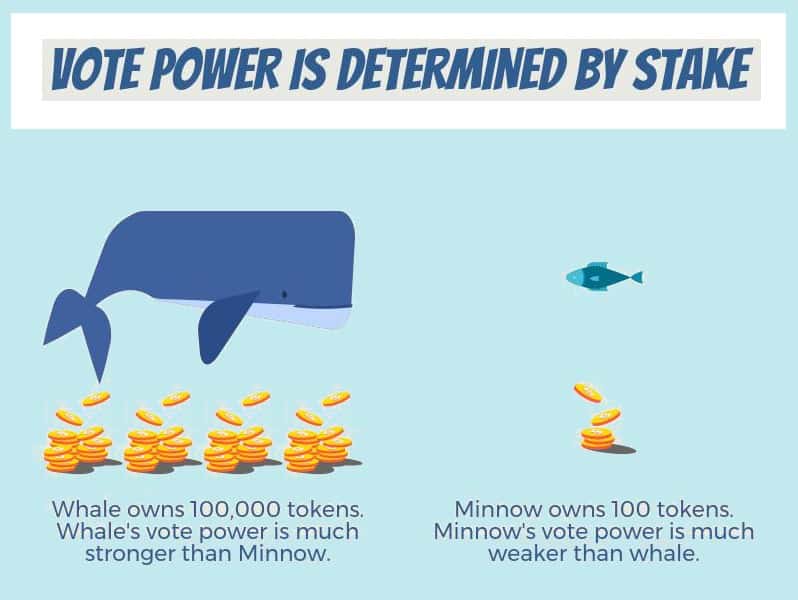

Proof of stake (PoS) is an alternative approach that has gained popularity in recent years. Some of the advantages over PoW is that no special hardware is required. This means that concepts like hashrate and mining are no longer relevant.

What happens in PoS is that each participant’s coin stake determines their likelihood of being chosen to win the block. That is, each network node is linked to an address, and the more coins that address holds, the more likely it is that they will mine (or ‘stake,’ in this instance) the next block. It is very much like a lottery whereby the winner is determined by chance.

The main difference, in this case, is that the more coins (lottery tickets) one holds, the higher the odds of receiving the block.

As a means of security, an attacker who wants to make a fraudulent transaction would need over 50% of the minted coins to process the required transactions reliably; buying these coins in large quantities would push the price up and make such an endeavor extremely expensive.

If you feel like this is something that you could make a lot of money from, you should definitely learn how to buy bitcoin. But, beware, as the market is pretty vicious towards beginners.

Delegated Proof of Stake (DPoS) Explained Simply

A similar approach to Proof of Stake is known as Delegated Proof of Stake.

This works more like an election in the sense that holders of the token will use their balances to elect a list of nodes that will have the opportunity to stake blocks of new transactions and add them to the blockchain.

This engages all coin holders, rather than just those that hold a lot of tokens.

Proof of Authority (POA)

Another variation on the evidence of stake consensus mechanism is Proof of Importance or POI. This consensus mechanism is not merely about coin balances, but it also adds the concept of productive network activity and reputation.

The odds of staking a block is a function of some factors, including balance, reputation (determined by another mechanism), and the number of transactions made to and from that address. This provides a more concise picture of a ‘useful’ network member.

Proof of Importance (PoI)

Proof of Authority (PoA) is the first consensus mechanism that relies on identity as the deterministic model.

They do this by having each owner of a validator register themselves with a Notary. By making their identities public, one is sure that their interest will be aligned with the overall health of the chain as it is their public reputation that is on the line.

Once a person is validated, their validator is trusted and allowed to participate as a decision point within the chain.

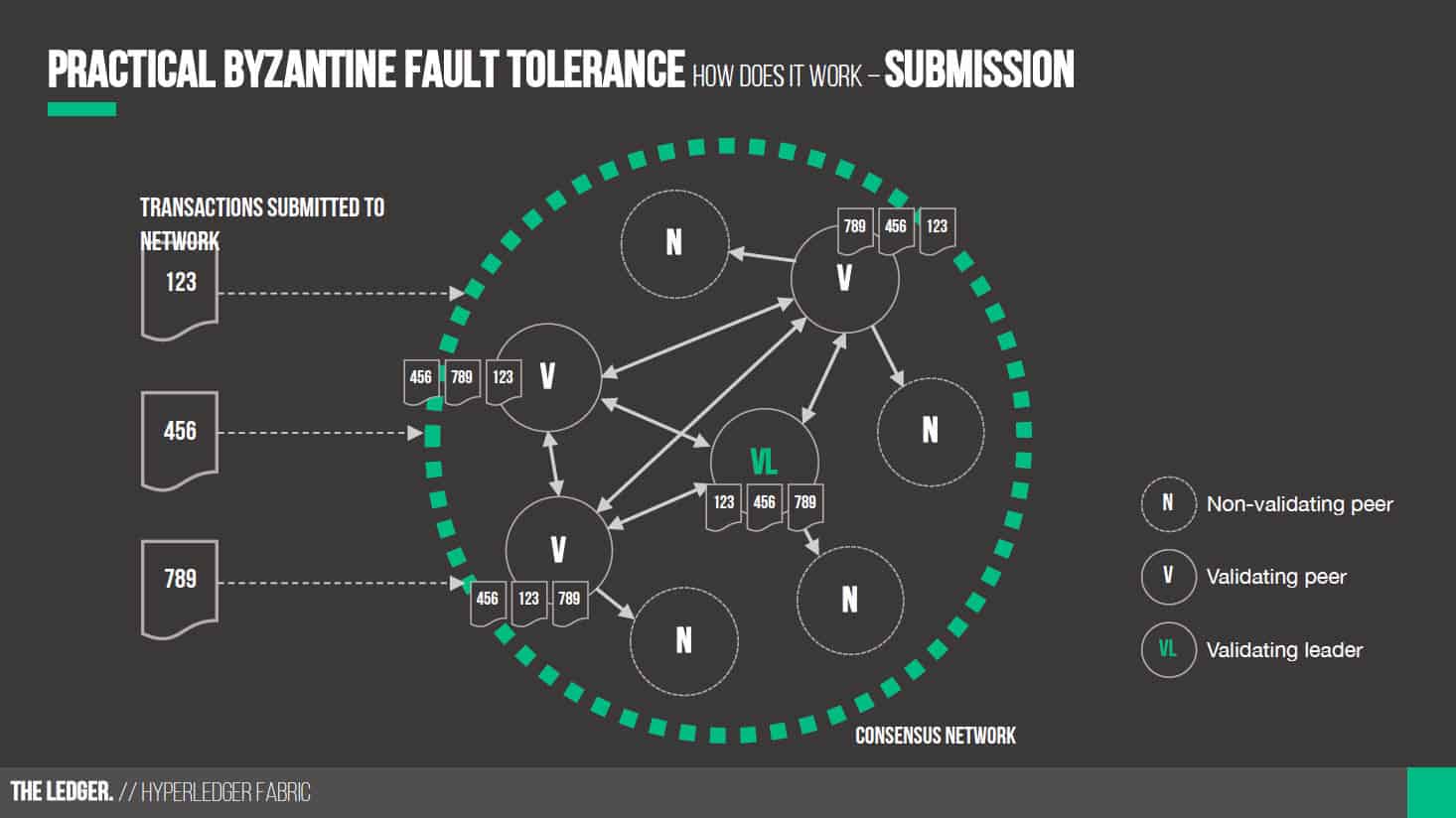

Practical Byzantine Fault Tolerance (PBFT)

This next form of consensus is (so far) only used by three different projects –Ripple, Stellar and Hyperledger.

The Byzantine refers to the Byzantine Generals Problem – which is, as the story goes – several armies have encircled a city, and the generals in charge of each of the troops need to agree on a plan of attack.

The complexity is that some “disloyal” generals might (when it is to their advantage) send a false message or send multiple messages to confuse the other generals and prevent them from reaching a consensus. The generals need to (with limited communication) conclude that the other generals will also come to with limited information.

The benefit of using this form of consensus is really that it requires less effort to reach an agreement than other types of consensus – which translates to faster transaction speed.

In closing out this section, it is important to remember that in all cases, the consensus solution selected aims to secure the network, make it as expensive as financially possible to attack the system, and to ensure that bad actors cannot gain control of the net.

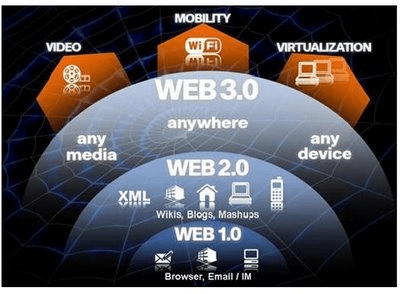

The Blockchain – Web 3.0?

Web 2.0

Google, Facebook, Apple, Amazon. When you hear these company names, what do you think of and what do they all have in common?

- Massive market share in their fields.

- Each company individually has a larger Market cap than the entire crypto market in its present state.

- Stores customer data without their consent.

- Centralized Data Storage and Analysis

- Disrupted by Data leaks which lead to identity theft and other problems

- Private network.

- Monopolized

Web 3.0

The Web 3.0 is aiming to fix all the issues mentioned in Web 2.0

- No central point of control. Ethereum provides a trust-less platform where the rules are unbreakable, and data is fully encrypted. This allows Peer to Peer transactions. It removes the middleman.

- No more Data leaks – When data is decentralized and distributed, files can be split and broken up in many pieces with encryption. Hackers need to hack all data at all sites then work out how the data fits together to decrypt it. In other words, if they get the files, the data would mean nothing. To this day, no blockchain was ever successfully hacked.

- On the blockchain ledger, all data can is traceable. This will allow users to see where their data is used. Currently, we don’t know what companies like Apple do with our data (we do, however, know what companies like Facebook do with our data).

- Interoperability – All devices will work with web 3.0. It won’t be held back by current limits, like what OS you are running. Developers programming open source is what will allow this.

- Permissionless blockchains – Anyone can interact with the network and start earning rewards. It doesn’t matter your experience, age, gender, etc. Everyone will have an opportunity to participate and earn rewards.

- Redundancy – Visa crashed in Europe this month leaving people using the VISA system unable to pay any bills.

With Web 3.0, this would not happen. If one node goes down, the blockchain will mark that node unusable, and no traffic will go there, which will result in more uptime.

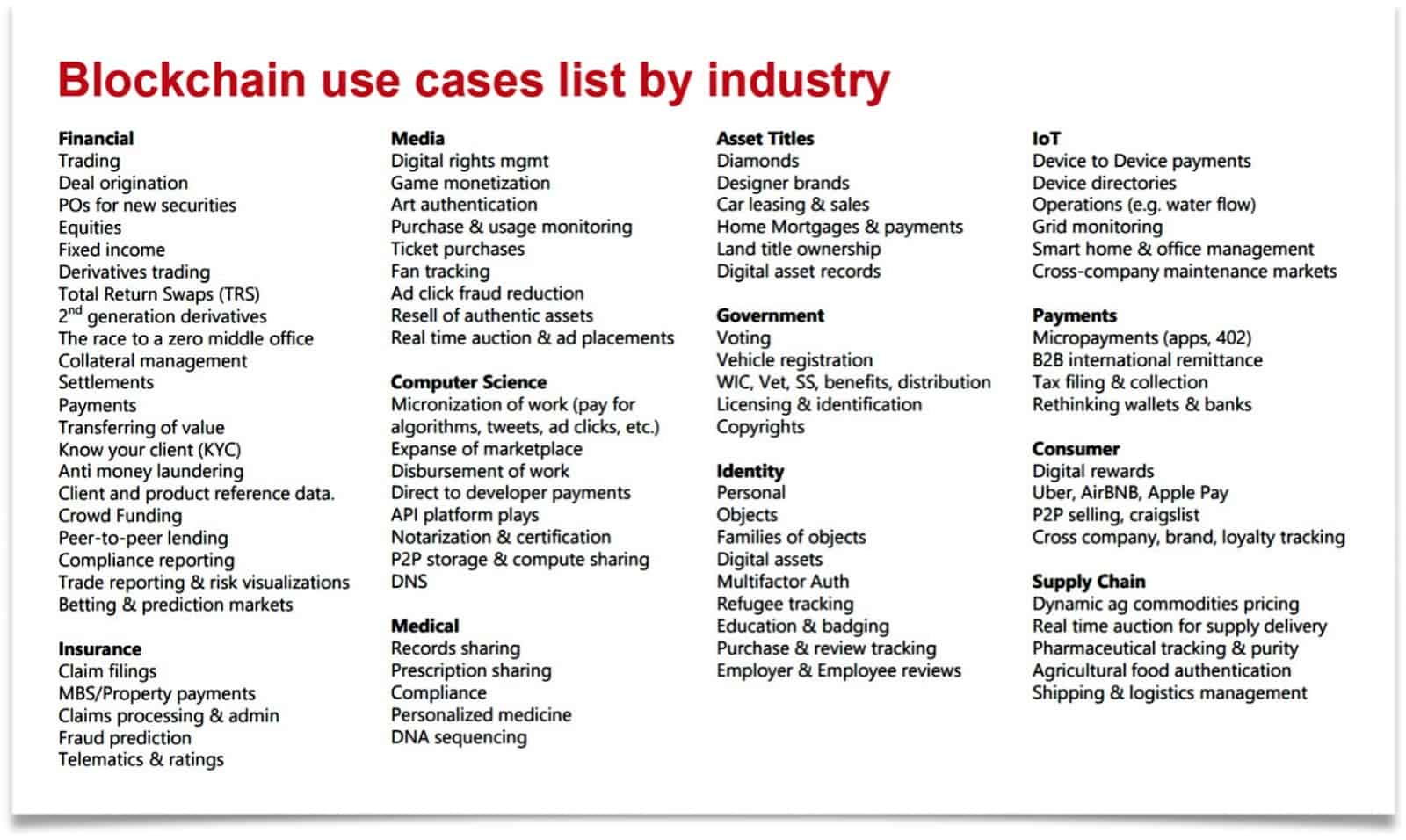

Blockchain Use Cases

What are some of the blockchain use cases? The blockchain can be used to improve most if not all of the functions in society – Governance, Finance, Healthcare, Real Estate and beyond.

The table below will hopefully shed some light on the potential of the blockchain :

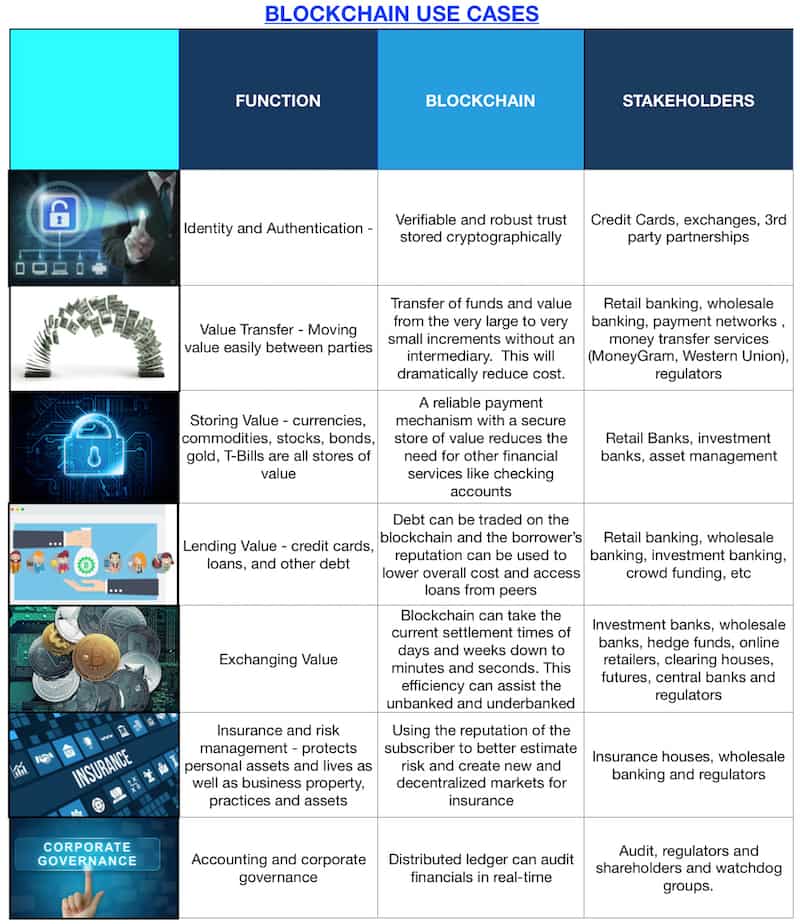

How does the Blockchain improve functions in Finance?

One of the areas listed above is Finance. As you can see from the use case list above, the finance industry is quite large and can most easily benefit from the concepts of the blockchain.

In the table below, we look at seven functions in the Finance area and provide information on what benefit the blockchain can give as well as some of the stakeholders that would benefit.

Now that you understand what a blockchain is and have an understanding of how it all works, you’re probably beginning to see that it is not a perfect system. Some of its current shortcomings include –

SCALABILITY – Most blockchains still have scalability problems, meaning the ability to maintain consistent performance, and therefore slow down as the total volume of transactions picks up. However, Bitcoin is for example using a side-chain solution, called Liquid; and a Layer 2 solution, called Lighting Network where transactions are being finalized within seconds without the need to use the main blockchain.

TRANSACTION COST – As the miners need to be paid to process transactions and keep the chain moving, especially during periods of high usage (like ICOs) the blockchain will slow down. This is where the concept of ‘Gas Wars’ will come into play because people will often voluntarily pay more transaction fees to ensure their transaction is processed before other transactions.

RESOURCES – As a blockchain grows over time, and stores more and more transactions, the total amount of storage increases. It also takes more time to download the full chain demanding an incremental improvement in bandwidth. This has the potential of making the overall blockchain quite expensive to maintain and operate.

One of the technologies that are looking to correct some of the blockchain shortcomings is known as a DAG or Directed Acyclic Graph. We will not attempt to cover the theory behind all of this but will instead focus on the key improvements and some of the blockchain applications. A DAG is also referred to as a Tangle.

So, what is the difference between a blockchain and the Tangle?

In general, instead of being an interconnected chain, the tangle takes the shape of a web-like structure with the nodes and edges. Nodes are similar to nodes in the blockchain; the difference is the edges.

An edge is a unidirectional connection between nodes. This makes it impossible to traverse the web in the opposite direction. This is what makes the Tangle ‘acyclic’ – it means that you cannot cycle through the same node by following the edges. In other words, the path will never be circular.

One of the main advantages in doing it this way is an increase in throughput by adding blocks in parallel instead of sequentially.

Blockchain and Games

So we covered the 1st, 2nd and 3rd generations of blockchains.

What are the features in the next generation, the 4th, that will set these projects apart?

The fourth generation of blockchain should not just focus on patching the deficiencies in the previous generation of blockchains – this NEXT generation blockchain needs to introduce new concepts that will bring the blockchain closer to full adoption by the everyday person. It needs to be :

- Economical

- Flexible

- Able to be used by both private individuals as well as corporations

- Strong public facing technology

- Support complex data types and be multi-dimensional

- Data sharding, chain splitting, and cross-chain functionality should be standard

- Needs to be scalable to support a high volume of transactions easily

- Needs to be more secure

- Requires a consensus algorithm that is not subject to a 51% attack

- Needs to remove the Proof of Work miners and introduce new actors to support the chain

- Needs to support transaction rollback and recovery

- Simplified

4th Generation Blockchains

Jared Psigoda, the CEO of BitGuild – one of the companies that spoke on DMarket’s gaming and blockchain panel at GDC:

Gamers and game enthusiast are no strangers to digital currencies. From the early days of World of Warcraft when “digital gold” was in high demand, (more than 100 million dollars) gamers had an affinity for digital currencies. However this “digital gold” was very hard to get, and gamers eventually resorted to Fiat for any in-game purchases.

By using Fiat currency (namely, USD to make in-game purchases) a lot of revenue was generated by these games. Last year (2017) alone it was reported by SuperData that the income that was taken in was more than 108 Billion dollars made by the gaming industry.

The biggest earner by far were mobile games, pulling in about 59.2 Billion dollars, but let’s take a look precisely at the “Free-to-play” category, which populates mobile phones everywhere.

These games thrive on in-game purchases, which is made easier with cryptocurrency and the blockchain. Gamers could now trade their in-game assets with each other or purchase them from the developers and not have to use USD or credit-cards to do so.

Additionally, cryptocurrency and the blockchain allow the purchaser of the in-game asset to own their digital assets of his or her choosing. Tokenized Assets also will enable the owner/gamer to potentially receive a portion of the game’s revenue for doing a certain outlined task.

Transparency is another big issue that Blockchain technology solves in the gaming industry. Specifically, in the Esports and Fantasy sports arena.

By using a token and an immutable ledger (a blockchain) E-sports and Fantasy sports teams, managers, players, and even sponsors can keep an accurate account of funds and payments. Thus, permanently erasing the need for a middleman/human intervention after contracts, prices, and fees have been agreed upon. This makes transactions instant, fast and safe.

These transactions are also called bitcoin confirmations, which might be the most popular name for them in some expert circles.

So to recap, blockchain can:

- can solve the issue of ownership for the gamers and their digital assets

- can resolve the issue of ease of purchasing/trading with the use of cryptocurrencies.

- solves the issue of transparency within the gaming industry.

Sources:

- https://www.accounting-degree.org/blockchain-technology-accounting/

- https://eacodex.com/blockchain/

- https://www.linkedin.com/feed/update/urn:li:activity:6262962581007265792/

- https://techcrunch.com/2017/08/03/from-barter-to-blockchain-a-history-of-money/

- https://blog.wavesplatform.com/review-of-blockchain-consensus-mechanisms-f575afae38f2

- https://medium.com/@chrshmmmr/consensus-in-blockchain-systems-in-short-691fc7d1fefe

- https://en.wikipedia.org/wiki/Byzantine_fault_tolerance

- https://getacryp.com/blockchain-vs-tangle-dag/

- https://hackernoon.com/this-is-what-a-4th-generation-blockchain-looks-like-multiversum-77165f1b8dea