Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Unveiling the Ultimate Showdown: eToro vs Plus500 Australia – A Comprehensive Breakdown

The world of online trading is complex, competitive, and ever-changing. Choosing the best platform for your digital trading needs is an important decision that can impact your financial future.

Plus500 and eToro are two platforms that have made their way to the forefront for Australian traders who are ready to roll up their sleeves and tackle the world of financial markets.

These two giants of online trading each offer distinct features, including pros and cons to consider.

In this guide, we tear each of these platforms apart, to understand the features, what elements make each one stand out, and where there might be room for improvement. In the end, the goal is to provide people like you in Australia, with all the details needed to make an informed decision about which platform is best aligned with their trading goals.

TL;DR

- eToro and Plus500 Australia are two leading trading platforms, each offering something different to online traders.

- eToro Australia is a multi-asset platform. They offer a full and diverse range of options, including crypto, ETFs, stocks, and CFDs.

- There is a strong focus on social trading and copy trading features with eToro, making it a good fit for those new to trading.

- Want higher risk and higher returns? Plus500 specialises in CFD trading across multiple assets

- Plus500 offers a streamlined, uncluttered interface that advanced traders appreciate.

- Regardless of which you choose, both are regulated by top-tier authorities, including ASIC in Australia

- eToro offers an academy with full courses, along with a demo account, to help new traders learn without risk.

- Plus500 is a clear winner from a pricing standpoint, offering commission-free trading.

- Privacy Australia can be used as a complement to eToro and Plus500 to double down on security and safety with online trading.

Comparing Options: eToro vs Plus500

When it comes to trading platforms for Australians, eToro and Plus500 emerge as titans in the game. While they share some similar features and capabilities, there are also stand-out differences between the two.

In this comparison, we’ve looked at key criteria including regulation, product offering, trading platforms, fees, pricing, educational resources, and customer service, along with social and copy trading, deposit/withdrawal methods, and reputation.

In other words, we’ve stayed objective and left no stone unturned. At the end of the day, these are both great platforms for trading in Australia, but their differences make them better aligned with different audiences.

Before we dig into the review, let’s first take a look at each criterion and why it’s important.

Criteria Breakdown

Regulation and Security: Robust security and regulation are critical for a safe and reliable online trading experience. Regulatory oversight is important because it guarantees that the platform you use is operating fairly and with a high level of transparency.

This is in addition to the importance of strong security features to ensure your data and money are safe.

Product Offerings: Each person who uses an Australian trading platform comes to it with different trading needs and financial goals. Choosing a trading platform that is aligned with your individual needs is important. Depending on your needs, the platform with the most product offerings isn’t always the best.

Trading Platforms: Here we looked at features like usability, for instance. Traders of all levels are coming to these platforms, making it important for tools like eToro and Plus500 to meet a spectrum of needs.

Fees and Pricing: Value is important for traders in Australia. This isn’t to say that the cheapest is best. Instead, we know that consumers like you are looking for the best features and capabilities balanced against fees and pricing to find the best value. We look at how eToro vs Plus500 measures up in this department.

Educational Resources: Does the trading platform offer educational resources for its users? Do these educational resources offer information and training for advanced as well as new traders? We look at what these two popular trading platforms offer.

Customer Support: This is a point that can make or break a person’s experience with a platform. It’s important to make a decision with knowledge of a company’s approach to customer support, problem resolution, and response times.

Social and Copy Trading: Social and copy trading can offer a more engaging experience, especially for new traders. For more advanced traders, this feature may not be as important.

Deposit and Withdrawal Methods: We looked at the range of deposit and withdrawal methods offered by each platform. This is an often overlooked area when choosing a trading platform in Australia. Community Reviews and Reputation: What are others in the community saying? What about expert reviews? It’s important to take a look at a trading platform’s reputation when making a decision. Here, we’ve done some of the heavy lifting for you.

eToro

What eToro is Best Known For

eToro Australia was developed to revolutionise how people invest their money. Where eToro shines is in their innovative approaches to social and copy trading.

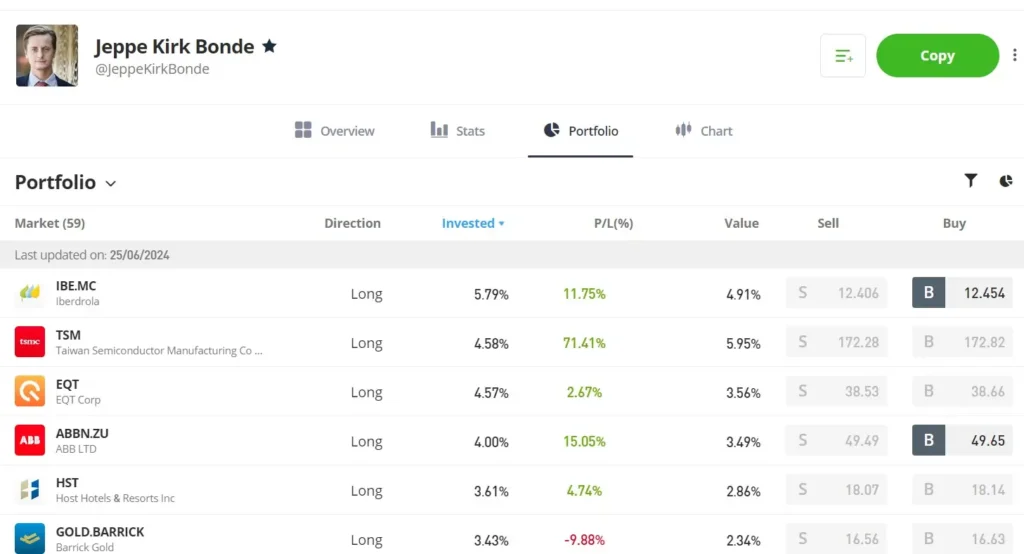

For those who aren’t familiar with social and copy trading, this allows eToro traders the opportunity to observe, learn from, and replicate strategies used by successful investors. In the most basic sense, eToro offers hands-on learning with limited risks.

With this focus, eToro has emerged as a top trading platform for traders with a spectrum of experience – from novices just entering the market to advanced, skilled investors who are willing to share their expertise.

eToro Description

eToro was founded in 2007, as a multi-asset investment platform. Their mission was, and still is, to make trading accessible for everyone in Australia – regardless of experience or knowledge of trading. As the public’s knowledge and confidence in online trading grows, society as a whole becomes less dependent on traditional financial institutions.

eToro was behind the world’s first social investing platform, which was established in 2010. Today, eToro Australia is still considered a leader in social investing and also offers a diverse range of financial investments for all traders. Today, this includes cryptocurrencies, stocks, CFDs, forex, and ETFs.

There are currently more than 30 million registered users around the world. It’s considered one of the best trading platforms for trading beginners, but also offers innovative features that appeal to seasoned professionals.

eToro Features

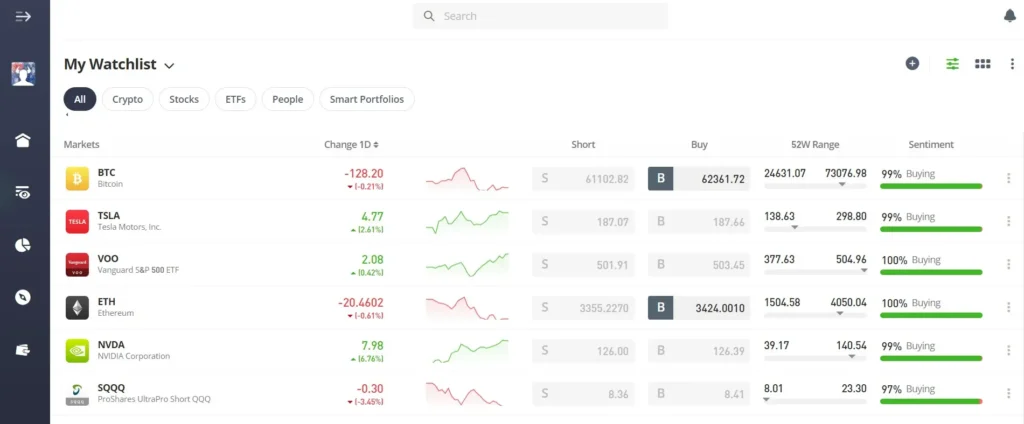

eToro offers a range of features, but where it really stands out among competitors like Plus500 is with its social trading platform. The benefits of eToro’s social trading platform are that it offers a robust, engaging community of traders of all levels, providing insights and a platform for knowledge sharing.

For new traders, social trading becomes an invaluable resource for learning and getting their feet wet in the trading world where new investors don’t always feel comfortable.

Seasoned professionals in trading turn to eToro for its robust features, but also the opportunity to learn from other pros, while sharing their own knowledge base with those who have less experience or a less successful track record.

A few other stand-out features of eToro include:

SmartPortfolios: eToro SmartPortfolios are portfolios that contain themed, yet diversified, assets. SmartPortfolios introduces thematic investing that includes both active and passive investment opportunities. Currently, eToro offers more than 70 SmartPortfolios that are continually adapted to market conditions.

ProCharts: This is eToro’s advanced comparative and analysis tool that has been designed for manual traders. eToro designed ProCharts based on user feedback and is customizable so that you can view multiple charts for the most in-depth analysis, choosing the ones that matter most to your trading strategy.

News and Analysis: Stay up to date on current trading news, along with weekly features, market analysis, and insights from trading pros.

Virtual Portfolio Demo Account: eToro Australia recognizes that trading can be intimidating for beginners. This is why they offer each new user a free $100,000 demo account to practise building their own portfolio, and take risks or make mistakes without financial risk.

eToro Pros

Social and Copy Trading

This is by far one of the best and strongest features of eToro Australia, especially for those who are relatively new to trading.

User-Friendly Interface

eToro stands apart as one of the best trading platforms for all experience levels in trading. The user-friendly interface is one of the features that attracts new users and keeps them on the platform.

The extended benefit of the user-friendly interface is a community of successful traders who are loyal to eToro partially due to the platform’s accessibility.

Diverse Investment Options

A look at eToro’s investment options shows impressive diversity. Currently, there are 4.955+ stocks, 670 ETFs, 35 commodities, 99 crypto, and 21 indices. This makes eToro a great platform for diversified trading and meeting different investment goals.

Educational Resources

Some other online trading platforms in Australia offer bits of advice or a helpful blog here and there. With eToro, you get an entire academy. The eToro academy offers loads of educational materials, including everything from webinars to detailed video tutorials. Current featured courses include Intro to ETFs, Investing 101, Options Trading, and Crypto for Beginners.

eToro Cons

Higher Fees for Certain Transactions

It’s important to do some research on fees before committing. While eToro offers commission-free stock and ETF trading, the fees for others, like CFD, are notably higher than some of its competitors. eToro does offer transparency with its fee structure, with all current fees listed on its website.

Limited Advanced Trading Tools

While eToro has the market cornered for new investors, those with more experience in trading may find that the platform doesn’t offer the same level of advanced trading tools as some of its competitors. There are also limited customization options with eToro.

Neither of these is a big deal for those new to trading, but it’s a noticeable lack for those with advanced experience.

Narrow Account Variety

If all you need (or want) is a brokerage account, then eToro has you covered. However, there aren’t options for specific account types, such as retirement accounts.

eToro Criteria Evaluation

Regulation and Security 4/5

We don’t have any complaints about eToro when it comes to safety and regulation. eToro Australia is regulated by the Australian Securities and Investment Commission (ASIC). In other locations, they are also regulated by top authorities, including the FCA in the UK, CySec in Europe, MFSA in Malta and FinCen in the United States.

Product Offerings 4/5

eToro’s diverse offerings include stocks, Forex, ETFs, CFDs, and cryptocurrencies, offering opportunities for a wide range of investment goals under a single platform.

Trading Platform 4/5

With the ability to view, copy, and learn from experienced traders, eToro is a great platform for all levels of investors. We also give eToro props for its user-friendly and accessible interface.

Fees and Pricing 3/5

This unfortunately is a shining point for eToro. While we appreciate that they offer some commission-free options, they make up for it with higher fees for other types of transactions. When compared across the board to their competitors, eToro will likely cost diversified investors more in the long run.

Educational Resources 5/5

We’re impressed with eToro’s educational resources. The eToro academy offers a number of guides and courses to help new traders feel confident. In addition, they also offer the opportunity for a hands-on experience with a free demo account to get started.

Customer Support 3/5

With customer support, eToro checks off all boxes of support channels, including email, live chat, and phone. Customer support in general gets mixed reviews. Some users love the attentiveness of the customer support team, while others have found their conflict resolution to be lacking.

Social and Copy Trading 5/5

As mentioned with the product offerings, social and copy trading options with eToro are a huge plus. This allows traders to learn from investors who have a track record of success and avoid costly mistakes that new traders often make.

Deposit and Withdrawal Methods 4/5

There’s nothing exceptional or lacking about eToro’s deposit and withdrawal methods. Credit or debit cards are accepted, as are e-wallets and bank transfers. Withdrawal times will vary depending on the type of method used.

Community Reviews and Expert Recommendations

The majority of reviews, from both beginners and seasoned experts in the trading community, are overwhelmingly positive for eToro.

Experts cite the ease of use for beginners as one of eToro’s strong points, claiming that it’s among the best forex brokers for those who are new to trading. Social trading and copy trading capabilities are shining stars. Plus, experts really like the virtual account that allows new users to live, learn, and invest with fake funds.

Coming from the experts, the biggest downside of eToro is that it isn’t necessarily the best platform for seasoned investors, and the fees exceed those offered by other platforms.

Community reviews share similar sentiments. Here’s an example of a recent eToro review posted on Trustpilot.

“I was choosing between two investing platforms a few years ago and I’m happy that I went with eToro. Platform is very easy to use and account managers are doing a great job engaging me / updating me with any important news. I also like the 5% interest rate on cash position and currently see no reason to move my funds away from the platform in upcoming years. Recently met my account manager, Monika Hrivnakova, we had very good discussion and I enjoyed the chat.” – Trustpilot reviewer

The user-friendly interface and welcoming feeling toward those new to trading represent a common theme in community reviews. Social trading and copy trading capabilities earned accolades as well.

What were the not-so-positive community reviews of eToro Australia? Primarily, the platform lost points with slow withdrawal times and sometimes less than optimal customer service – although this is a common theme with many of these types of reviews.

eToro Price

It’s completely free to create an account with eToro. From there, eToro’s pricing structure really depends on your region and type of trade. eToro does offer a number of commission-free trades, including stock and ETF trades, for example.

Other transactions, including forex and CFDs, come with higher fees. These fees, which may vary based on the market, are often higher than what you’ll find with other trading platforms.

There are also a number of additional fees that eToro charges. There’s a withdrawal fee of $5, and also an inactivity fee. Any account that has remained inactive for longer than 12 months will be subject to an inactivity fee of $10 per month.

Is eToro the priciest trading platform out there? No, not really. However, they’re not the most economically friendly, either. It’s important to consider the fee structure across the board to determine if eToro is a good value for you.

Where to Find eToro

eToro is considered a global platform and this includes availability in Australia. If you’re trading outside of Australia, particularly in the United States, know that eToro isn’t available in all US territories.

Those interested in learning more about eToro Australia can do so through its website at eToro.

Plus500

What Plus500 is Best Known For

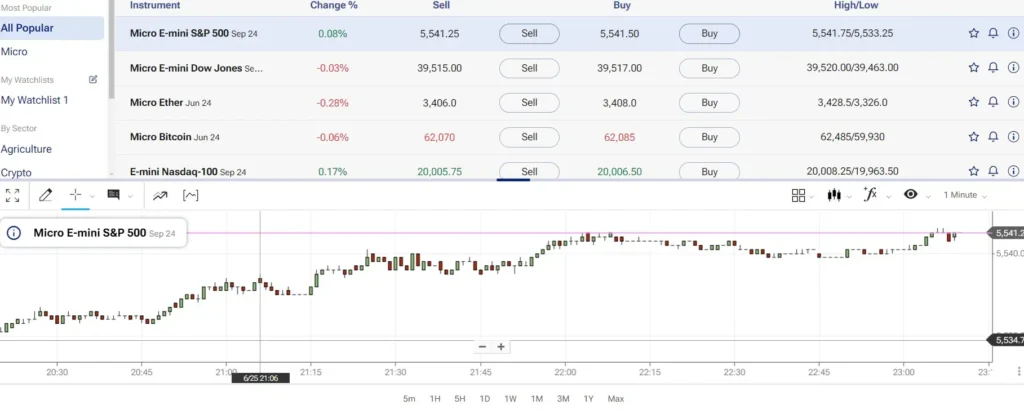

Plus500 Australia is a global leader in CFD trading. Compared to other types of trades, CFDs are highly risky, and an area of trading that most appeals to advanced investors. Plus500 offers CFDs in multiple asset classes. These include stocks, cryptocurrencies, forex, and commodities. Plus500 also offers ETFs.

For many, the appeal of Plus500 is its uber-streamlined trading experience. The streamlined interface and competitive pricing shine through as two of Plus500’s strongest points.

Plus500 Description

Plus500 is a multi-asset fintech platform with a prominent global presence. The UK-based company is located in the City of London and was established in 2008. Plus500 is publicly listed on the London Stock Exchange, as well as being part of the FTSE 250 index.

Plus500 offers a diverse range of CFDs, primarily targeted toward experienced traders who have moved beyond needing the learning features offered by eToro.

Plus500 Features

At its core, Plus500 offers a user-friendly interface for traders who are interested in CFDs. While Plus500 Australia makes sure there’s a seat at the table for new traders, the user base appears to be more experienced with advanced knowledge of trading and GFDs.

Regardless of the level of experience users bring to Plus500, they’re sure to be impressed with the simple, straightforward trading process and advanced analytical tools:

User-Friendly Interface: Straightforward, uncluttered and a seamless user experience are notable features of Plus500 Australia.

Advanced Analytical Tools: Plus500 offers a range of advanced analytical tools to help you analyse current market trends and also forecast potential future movements across multiple markets. Plus500’s analytical tools can be customised to meet your needs.

Range of CFDs: Plus500 Australia offers one of the most diverse ranges of CFDs. These include crypto, trade shares, commodities, and forex. Whether you’re experienced in CFDs or just getting your feet wet, Plus500 can help you feel comfortable with the process.

Risk Management Tools: Plus500 Australia takes measures to help protect your financial investments with risk management tools. These include Guaranteed Stop Loss orders and negative balance protection with a Margin Call feature.

Plus500 Pros

Specialised CFD Trading Platform

Plus500 offers their WebTrader platform which was built with CFD trading in mind. CFD trading is complex, meaning an uncluttered interface is essential. It’s the small details that matter, and Plus500’s clean interface wins major bonus points.

Competitive Pricing

Plus500 Australia offers one of the more competitive pricing structures among trading platforms. For the most part, they offer commission-free trading, being compensated primarily through the market spread. Traders who are looking for a cost-effective option will appreciate the commission-free offerings.

Diverse CFD Offerings

Currently, Plus500 offers its users more than 2,800 CFD instruments. This spans across multiple asset classes, with no shortage of trading opportunities.

Regulated by Top-Tier Authorities

In Australia, Plus500 is regulated by ASIC. They operate through various subsidiaries throughout the world, based on locations. For example, FCA in the UK. This ensures safety and regulatory compliance on a global scale.

Plus500 Cons

Limited to CFD Trading

Those who aren’t interested in CFD trading may find that the Plus500 doesn’t offer the diversified trading opportunities they’re looking for. Traders seeking direct ownership of underlying assets will likely prefer a different platform, such as eToro.

Lack of Extensive Educational Resources

Plus500 does offer a Trading Academy, but it pales in comparison to the academies offered by similar platforms. Rather than full courses, Plus500 offers a few guidance articles on a small number of topics.

No Social Trading or Copy Trading

This could be considered a pro or a con, depending on your investment goals and needs. For less experienced traders, social and copy trading can offer a huge advantage, making Plus500 less suitable for that market.

No Phone Support

Plus500 doesn’t offer dedicated customer service phone support. Instead, They can be contacted via email or WhatsApp, which can be inconvenient for customers who prefer voice communication for customer support issues.

Plus500 Criteria Evaluation

Regulation and Security 5/5

The regulation and security of Plus500 go through top-tier authorities around the world. The Australian market is regulated by ASIC.

Product Offerings 4/5

We give Plus500 a 4 out of 5 in this category, but realise this might be different for others based on individual needs. Most offerings are for CFD trading, but they’re offered across a full spectrum of assets, with a nicely diverse range.

Trading Platform 4/5

Plus500’s trading platform is clean, intuitive, and user-friendly. Users like that it’s not cluttered and gets straight to the point. The trading platform also includes advanced analytical tools and important risk management features.

Fees and Pricing 5/5

Plus500 offers exceptional value, with commission-free trading and tight spreads. This is one of the most cost-effective options for CFD traders.

Educational Resources 2/5

Educational resources with Plus500 aren’t non-existent, but they are extremely limited. They offer a few short articles, but nothing in terms of comprehensive multi-lesson courses on trading. This could be a turnoff for new traders who are looking for a trading platform they can grow with.

Customer Support 4/5

Customer support is available through email, chat, and WhatsApp. Plus500 is known for its fast response times. However, they lost a point due to a lack of phone support.

Social and Copy Trading 2/5

Those looking for a more interactive trading experience will likely find Plus500’s lack of social and copy trading to be a disadvantage compared to other platforms like eToro.

Deposit and Withdrawal Methods 4/5

There are no complaints here. Plus500 accepts the full range of deposit methods, including credit and debit cards, e-wallets, and bank transfers.

Community Reviews and Expert Recommendations

Community reviews and expert recommendations for Plus500 largely centre on one important detail – it’s one of the most reputable and leading CFD trading platforms in Australia. Traders who are interested in CFDs can’t do much better than Plus500.

Overall, the majority of commentary on review sites is positive. For example,

“Great website with good services and products, they give good leverage for investment and they have good rewarding program for investors to continue grow your investment with them.” – Trustpilot reviewer

While Plus500 is primarily CFD trading, which typically falls into a more advanced trading category, the reviews are speckled with new traders who found the interface easy to use and found the limited educational materials to be more than adequate.

Our take is that it really depends on the level of trading knowledge you bring to Plus500. Those with at least a baseline of knowledge will likely find easy success due to the intuitive interface. However, those with little to no prior trading experience or knowledge may struggle.

Likewise, industry experts praise Plus500 as one of the best global trading platforms for CFDs. Its competitive pricing is another strong point that gets mentioned repeatedly, with experts noting the exceptional value Plus500 provides.

Plus500 Price

Much like its interface, the Plus500’s pricing structure is about as straightforward as it comes. They offer commission-free trading. Traders on the platform are only obligated to cover the spread, which is typically tight.

Plus500 doesn’t charge any fees for deposits, plus there are a limited number of free withdrawals per month. The downside of Plus500 pricing is they have a short inactivity period before they begin charging a fee. Currently, accounts that are inactive for three consecutive months will be charged $10 per each additional month of inactivity.

Where to Find Plus500

Plus500 has a global presence and is currently available in more than 50 markets. Traders in Australia can access the Plus500 website.

FAQs

What is the main difference between eToro and Plus500?

eToro and Plus500 are both leaders in online trading in Australia. While they both have excellent reputations, their focus is quite different. Plus500 is primarily focused on CFD trading across a range of assets. With eToro, there is more diversity in types of investments, with social trading and copy trading capabilities.

Is eToro or Plus500 better for beginners?

For beginners, eToro is often seen as the best option. The streamlined interface of Plus500 is beginner-friendly, but CFD trading, which the platform specialises in, can be risky for new traders. With eToro, beginners have access to social trading and copy trading to help them build confidence.

Are eToro and Plus500 regulated and safe to use?

Yes, both eToro and Plus500 are regulated in Australia by ASIC. Globally, both platforms are connected with regional regulatory bodies, such as FCA and CySec. Regardless of which trading platform you choose, regulation is critical for protecting traders and requiring transparency in operations. Additionally, both Plus500 and eToro offer robust security measures with high-level encryption to keep data and funds safe.

Can I trade cryptocurrencies on eToro and Plus500?

Yes, cryptocurrency trading is available on both platforms, although there are slight differences. eToro offers crypto trading through direct ownership of the underlying asset or through CFDs. With Plus500, crypto is traded only through CFDs. With CFDs, traders don’t have direct ownership of the assets.

Do eToro and Plus500 offer mobile trading apps?

eToro and Plus500 both offer mobile trading apps, which provide users with the ability to access their trading accounts from anywhere. Sometimes, there’s a usability gap when comparing mobile and desktop applications, but this isn’t the case with eToro and Plus500 mobile apps. Each offers the same easy, intuitive, and seamless trading experience on the apps that they offer from their website.

Final Thoughts

In this comparison of eToro vs Plus500 Australia, we’ve learned that both are exceptional trading platforms. They both offer robust tools and trading options, but the decision really comes down to your individual trading goals, your level of experience in trading (specifically with CFDs), and most importantly – personal preferences.

New traders and those interested in a more diverse range of investment options should consider eToro. With social trading and copy trading, plus the eToro academy, this platform emerges as a great choice for beginners and pros.

However, for those who are more experienced and are focused on CFDs, Plus500 is an exceptional platform. The streamlined interface and competitive pricing make it an appealing option for those who aren’t intimidated by the complexities of CFDs and just want to get down to the business of trading.

Regardless of which you choose, combining your online trading with a robust privacy-focused tool can make the world of a difference.

At Privacy Australia, we’re here to help with resources and research on the best tools and VPNs to help you protect yourself and your privacy, so you can stay as secure as possible whilst trading.

Is eToro or Plus500 the best trading platform in Australia? The verdict isn’t one for us to decide, but one for you to consider based on your preferences and trading goals. We encourage you to explore eToro and Plus500 further and evaluate each platform to determine which is most aligned with your needs. Happy trading!

You Might Also Like: