Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

IG Review

The basics:

- Caters to new traders and experienced traders alike

- One of the oldest names in “spread trading”

- Primarily works in foreign currency and CFDs

- Convenience features include fast account approval, demo account, and a mobile app

- Huge number of currency pairs that they offer leverage on

Table of Contents:

What is IG? 🔎️

IG is a broker that has been around since the 1970s. In those days they were trading small shares on Wall Street, but with the explosion of trading and “trickle-down economics” seeing brokers frequently being bailed out and deregulated in the 1980s, they were quickly able to grow their assets.

These days, they are one of the biggest foreign currency brokers in the United States, with offices all over the world. They have access to markets in Europe, Southeast Asia, the Middle East, and Oceania regions.

The big thing that IG offers is trading foreign currency on what is called “leverage”. The meaning of “leverage” in this case is extremely unique to the foreign currency context. Learning what this means is important to learning how IG functions, so be prepared for a quick lesson.

Though you should note that if you do not know what leverage is, IG also provides great introduction lessons and learning tools for traders who are either new to trading or simply have not traded in leverage before. So, this review is not your sole source for information on leverage.

Furthermore, understanding what trading on leverage means is integral to understanding what IG does for you. This is because it is the primary thing that sets IG apart from other foreign currency brokers.

What is Leverage? ⚖️

You may have heard of “trading on margin”. Well, trading foreign currency on leverage is a lot like trading for stocks on margin. One of the big similarities is how risky it can be.

Imagine there is a currency that you want to buy. You look at it and say, “The way things are going right now, I think this currency will double in value within the next month.” So, what do you do?

If you do not have a lot of money, then you are not going to be able to buy a lot of this currency. Imagine you only buy $10 of it. In a month your money doubles to $20. That is cool and all, but you rarely get to double your money, so only making $10 off of the phenomenon is a letdown.

Of course, if you had $100,000 you could double your money to $200,000. That is a much more significant payday. But it is unlikely that you just have $100,000 lying around.

That is where Leverage comes in. Here is how leverage works:

- You identify a currency that is going to increase in value. You do your research and construct a pitch for how certain you are it is going to increase, what makes you think that, and what the risks associated with the gamble are.

- You find a broker (in this case IG). You pitch this investment to them. This pitch boils down to you saying, “Give me $100,000 to work with and I can double it.”

- You and IG sign a contract where they loan you $100,000. In this contract they set out terms for how this money is to be used and how it should be reimbursed should you succeed or fail.

- You invest the money that IG loaned you in accordance with the investment pitch you laid out to them in step 2. Ideally, this yields a return that allows you to profit.

The contract IG offers you will proffer two possibilities: The first one is that your investment strategy succeeds. Keeping with the example we gave, that means you double the $100,000 loan to $200,000.

If Your Strategy Succeeds

In this situation the contract you agreed to beforehand will direct you to give a portion (usually a pretty large portion) of the money you made back to IG. While most loans are paid back by paying pack a principle amount plus interest, in this case the amount of money you pay them will be all at once.

This is an important distinction, as it applies to the alternative situation as well.

If Your Strategy Fails

In this situation the exact same thing happens: The contract you agreed to directs you to give a portion of your money to IG. This happens whether you have enough money to pay them back or not.

When you pay them after your strategy succeeds, you are expected to pay them back all at once. But if you fail you will be subject to paying IG back in the more traditional manner: Monthly payments with interest, on top of a massive hit to your credit score. Basically, you work for IG for the rest of your life.

The Dangers of Leverage ❌️

Obviously, this is a risky endeavor. You can bet big and make a huge profit. In fact, you can bet big and make a small profit. But most concerning of all, you can bet big and ruin your finances for years to come.

The issue is that if you borrow a big sum of money in order to make a big sum of money, then you better be able to deliver that sum. And since you needed to borrow money in order to invest in the first place, it is unlikely that you have that money to pay back (though it is possible that you do).

When people start to think of this risk, they usually come to the conclusion that the most pragmatic approach to leverage is never taking a loan you cannot pay back no matter how things shake out.

If you take a $10 loan and double your money and end up giving $15 of that to IG, then you made $5 with basically no risk to yourself. If your strategy did not work, you would have to pay back no more than $15 dollars to IG.

But that situation will rarely happen for two reasons: For one, it is not even worth the time it takes to fill out the paperwork on IG’s end. They have bots that can help you with leverage that is so low yield that it is not worth their time, but even this is pushing the limits of what the bots will accept.

The second reason you will rarely see leverage used so carefully is because it is just not how human nature works. People are not in the stock market to make careful investments that grow their money.

People are in the stock market to get rich without having to work very hard at all. And until human nature changes, the risks of leverage will seem totally reasonable to many people.

How is IG Outside of That? ➡️

Beyond their dealings with leverage, IG can be considered average on the front end and above average on the back end. It can even be considered great on the backend. What does that mean? Well, it means that it does not offer anything that unique on the surface, but the nuances to its systems are better.

The Front End

IG makes a sub-par first impression by only allowing you one kind of account. This means there is no premium version for people who want to pay a subscription to avoid commission fees.

When it comes to IG, you pay the commission fees they offer you. This is not actually as bad as it is probably going to feel—paying commission fees is a natural part of the risk management of foreign currency trading. It is actually a bit suspicious when a broker does not charge commission fees.

And given that IG works with leverage, it is not surprising that they are looking to mitigate risk.

Still, people have come to expect different account options, so it is not a great first impression. It does make up for it in two ways: Its app is incredibly easy to use, and its knowledgebase is very helpful.

A good knowledgebase is what sets good brokers apart from bad ones, and great ones apart from good ones. In this case, IG stops just short of greatness. It is an approachable and well-written knowledgebase. The only issue is that most of its focus is dedicated to talking about leverage.

As a result, IG’s knowledgebase can feel like it is either setting you up for success or setting you up to give IG lots and lots of money.

The Back End

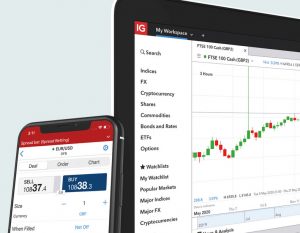

Behind the curtain, however, is where IG shows its quality. To start with, their mobile app is a dream to use. It connects with the licenses they give you for MetaTrader, runs perfectly even as it processes tons of datapoints, and connects to all of IG’s analytics and research databases.

Those analytics and research databases are substantial too. They are going to be hard to read for a new trader, and rarely does the knowledgebase bring you to understanding them, but if you can grasp them then they provide frequently updated, often high-detail assistance in understanding the market.

The last thing in their “back end” is what they call “volume-based rebates”. These are rebates of the interest you provide to IG after successful trades. The way they work is that as long as you trade a certain volume of money each month and clear a profit for the month, you get the rebates.

Volume based rebates exist to support people who make good trades. You can think of it as a way to be employed by IG without actually being employed by them. You make them the money they get from the trades, and then they “pay” you with these rebates (which can be substantial).

Who is IG For? 🤔️

IG should be for advanced traders only. In fact, IG’s website has a constant warning on the top of it that specifically tells you that the kind of trading they offer is for advanced traders only.

But of course, they also have tools to try and get people who have never traded before to trade for them. It makes sense: Either those people succeed, and IG pockets most of their earnings, or they do not and IG gets to charge them debt payments until the end of time.

If this sounds like a cynical take on their business model, then perhaps you should consider the rest of the market: Very rarely do brokers offer anything like leverage. And brokers never offer something that they do not profit off of. Leverage is an incredibly risky way of doing business.

So, if a large broker is trying to get as many people trading on leverage as they can, you better be asking yourself why that is not normal. Because there is an answer to that question: Trading on leverage is not normal because trading on leverage creates an antagonistic relationship between broker and client.

IG is for the trader that thinks they can somehow outsmart the broker in question and make a profit.

Conclusion 💡️

IG is a foreign currency and CFD broker that trades on leverage and margin. That means they loan you money, and you pay it back through trading, whether that is over time or all at once.

This is an incredibly risky way of doing business. If you succeed, they will pay you for succeeding for a year straight. If you fail, you will be indebted to them for the rest of your life.

Make no mistake, the interest rates as they develop should you fail will make sure that loan never goes away. This is not a trading platform for beginners. Their app is nice and their analytics and extremely useful for trading in the securities that they trade in. If you know what you are doing, then IG will do everything it can to help you succeed. But do not expect them to be loyal should you ever fail to double their money.

You Might Also Like: