Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Mastering Financial Spreads: A Comprehensive Guide for Traders and Investors

Trading can be a complex business, and there are many terms and strategies to learn to get the most out of it. One term we hear a lot is ‘spreads.’ But just what is a financial spread and how can it help with trading?

When I first started trading, I found it difficult to absorb all the strategies and information I needed. I found that going slowly and taking my time was the best step. It doesn’t matter how complex a strategy or concept is, if we break it down enough, we can master it. Let’s take financial spreads as an example. Understanding them improves data extraction speeds, which boosts trading efforts.

But it goes further than that. Financial spreads tell us a lot about market dynamics before entering a trade, including volatility, risk, and potential profits.

Confused? Don’t worry. In this article, I’m going to break it all down. By the end, you’ll know exactly what financial spreads are and why they’re so important.

TL;DR

- Financial spreads are differences between two related financial metrics.

- Understanding spreads is crucial for assessing market liquidity and risk.

- Various types of spreads exist, including bid-ask, credit, and option spreads.

- Financial spreading involves analysing and standardising financial statements.

- Spread betting allows traders to speculate on price movements.

- Spreads significantly impact trading and investment strategies.

- Market volatility and liquidity are key factors influencing spread behaviour.

- Technical and fundamental analysis techniques are used to interpret spreads.

- Emerging technologies like AI and blockchain are reshaping spread analysis.

- Effective risk management often involves spread-based strategies.

Understanding Financial Spreads

First, let’s break down what is a financial spread. Put simply, spreads serve as an indicator of market efficiency and liquidity. They help us make decisions when we’re trading. So, the most basic explanation is that a financial spread in finance tells us the difference between two related financial metrics. That difference tells us a lot about market conditions, risk levels, and where potentially profitable opportunities might lie.

Spreads can be expressed in dollars or another currency, or they can be given more relatively, such as percentages. The components of a spread are often referred to as the “legs,” and they can be positive, negative, or zero. These tell us what the market conditions are, e.g. good or bad.

Check out this beginner’s guide to derivatives, which gives even more context on how financial instruments relate to spreads.

Bid-Ask Spreads & Fixed Spreads

One of the most common types of financial spreads we see is the bid-ask spread. So, what is this? It’s the difference between the highest price a buyer will pay (their bid), and the lowest price the seller will accept (ask). Bid ask spreads can often be seen on trading platforms, especially with stocks and shares.

The other type is a fixed spread, and this is a lot easier to work with. A fixed spread is when the difference between the bid and ask price doesn’t change. This type of spread means we can predict our trading costs and stay in control.

Yield Spread

A yield spread is the difference in yields (generated earnings) between two bonds or bond indices. This type of spread is often used to compare the relative value of different types of fixed-income securities. We often see common yield spread comparisons between corporate and government bonds.

A change in yield spread shows market sentiment or economic conditions and helps with trading decisions.

The Role of Spreads in Finance

I’ve talked about the definition of a spread, but let’s talk about their role a little more. Spreads play a crucial role in helping trade decisions. They provide valuable information about what is going on in the market and any potential opportunities. As such, they’re key indicators for traders, investors, and financial analysts.

Liquidity Indicators

When determining what is a financial spread, I’ve mentioned that spreads are an important indicator of market liquidity, and generally, tighter spreads show higher liquidity. On the other hand, wider spreads show lower liquidity.

Liquid markets tend to have lower transaction costs because their spreads are tighter. However, spread width can vary based on trading volume and market conditions. We can assess liquidity risk by monitoring any changes in spread behaviour and making decisions based on that.

Risk Assessment Tools

Minimising risks is an important part of an investment strategy and spreads come into play here too. I’ve talked about how spreads are used as tools for assessing financial risks and they give insights into market risk and even systemic risk.

For instance, a credit spread can help us understand the creditworthiness of a bond issuer before making a decision. Option spreads help to assess how volatile a market is and may be over a short amount of time. Interbank lending spreads help us identify stress in the financial system. All this allows us to make better trading decisions and keep our level of risk lower.

Caption: Financial spreads help with financial decision-making.

Types of Financial Spreads

I’ve just mentioned a few different types of financial spreads but let’s delve deeper and understand more. After all, financial markets feature several types of spreads and each serves a specific purpose and gives unique insights. By understanding these, we can make stronger decisions.

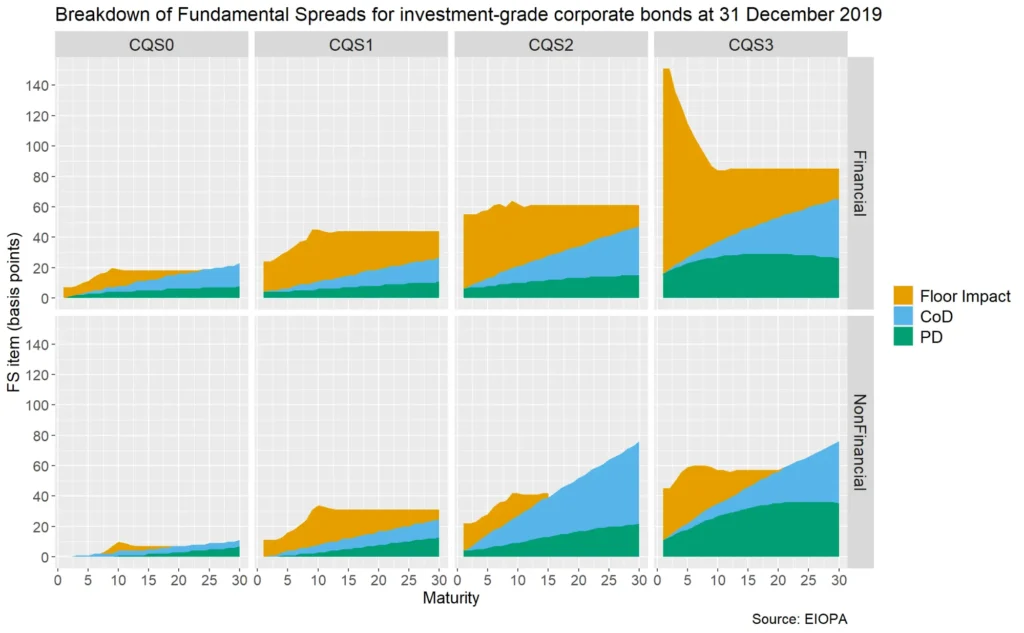

Credit Spreads

A credit spread tells us the difference between bonds of different credit qualities. In essence, they tell us about the credit risk associated with corporate or government bonds. For example, a wide credit spread indicates a higher credit risk.

Credit spread analysis is vital for fisd income investors in particular along with credit analysts.

Option Spreads

Next, we have option spreads. These can be used to limit risk or speculate on price movements. They involve a combination of option positions and they’re designed to create risk-reward profiles. As the name suggests, option spreads are often used in options trading strategies. They allow us to customise our exposure to various market factors.

Vertical Spreads

A vertical spread involves options of the same type, either calls or puts, and the expiration date. They are used to speculate or hedge against price movements within a specific range. Bull call spreads and bear put spreads are commonly vertical spread strategies, which can cap both potential profits and losses.

Horizontal Spreads

A horizontal spread is sometimes called a calendar spread. These involve options of the same type and strike price, but different expiration dates. These spreads are commonly used to profit from changes in potential volatility and over time. However, when using horizontal spreads, careful timing is vital.

Forex Spreads

The forex market is extremely popular and it’s no surprise that spreads play a big part. Here, spreads show the difference between the bid and ask prices for different currency pairs. When making forex trading decisions, the forex spread is a key element to consider.

Here, spreads can be either fixed or variable, and this depends on the broker and the market conditions. Major currency pairs usually have tighter spreads than less common ones. Of course, spread costs can significantly affect how profitable a forex trade is, so careful analysis is important.

Forex spreads are so vital that new features like integrated wallets and fractional sharing have emerged. For instance, the broker Admirals offers more than 8000 instruments for CFD trading, according to Techopedia. This tells us a lot about the growing sophistication of spread betting platforms.

Horizontal and vertical spreads can be used to help in trading decisions.

Financial Spreading and Statement Analysis

Now, let’s move onto financial spreading. This is the process of reorganising and standardising financial statement data to help with analysis and comparison. Doing this is vital for credit analysis, financial modelling, and investment research.

Spreading financial statements allows for careful and consistent analysis across different periods of time and companies. Thanks to recent developments in technology, automated spreading tools are now often used to improve accuracy and efficiency.

The Process of Financial Spreading

There are several steps involved in financial spreading, including extraction, standardisation, and quality checks.

Put simply, this process takes raw financial data and converts it into a format that allows for easier analysis and comparison.

Data Extraction and Standardisation

The first step in financial spreading is data extraction. This means collecting information from financial statements. When extracting information, OCR technology is useful. This is particularly useful when using PDF financial statements. In fact, according to Evalueserve, automated technology helps with accuracy of extracted information by up to 99.6%.

Next comes standardisation. This categorises and organises the information into a specific format that’s easier to understand. However, standardisation rules may vary by industry and the purpose for analysis.

A key point to mention is that non-recurring items must be treated the same across this process. Otherwise, the spread may not be accurate.

Ratio Analysis in Financial Spreading

Another term we often hear is ratio analysis, which is calculated using spread data. This is a vital part of financial spreading and it gives important insights into the financial health and performance of a company.

Common ratio categories include profitability, liquidity, and solvency. Analysing these ratios over a period shows key financial patterns. However, if necessary, specific industry-ratios can also be used for more targeted analysis.

Automation in Financial Spreading

Technology is changing how we do most things in our lives, and financial spreading is no different. Automation allows for increased speed, consistency, and accuracy. There are several different types of technologies that can be used to streamlining and boost the financial spreading process.

AI and machine learning algorithms are a key feature. These learn and improve spreading accuracy over time. Of course, automated systems are more efficient because they can handle large amounts of data faster than manual routes.

OCR and Machine Learning Applications

I briefly mentioned OCR technology earlier, so let’s delve a little deeper. This stands for Optical Character Recognition and it’s a type of machine learning technology. This allows fast and accurate extraction of financial data from different document formats, including PDFs.

Natural Language Processing, or NLP, can also be used to extract information from footnotes and disclosures. This ensures no important data is missed.

Benefits and Challenges of Automated Spreading

While all technology has benefits, there are also challenges. The same goes for automated spreading. It’s important to know the pros and cons to ensure effective implementation of this type of technology.

Of course, the benefits are obvious. These include increased speed, better consistency, and reduced human error, therefore resulting in accuracy. But what about the challenges? These mostly remove around the initial set up costs, which can be large, and the need for ongoing system maintenance.

It’s also easy to assume that there is no human involvement in this process, but it’s still important to have oversight. This is particularly important in complex or unusual financial situations.

However, we also need to keep in mind that manually spreading financial statements can be time-consuming. In fact, according to Numerated, manual process can take well over an hour with countless keystrokes. So, it’s easy to see how automated options save time and money.

Caption: Financial spreading can be done manually or using automated technology.

Spread Betting and Financial Markets

Spread betting is a type of derivatives trading. It allows us to speculate on the price movements of different financial instruments without owning the assets themselves. Using this information, we can profit from both rising and falling markets. This type of spreading is particularly popular in the UK.

However, it’s important to note that spread betting is a risky option as it uses leverage as part of the calculation.

Fundamentals of Spread Betting

Let’s break it down. Spread betting involves placing a bet on whether the price of a particular financial instrument will go up or down. How much profit or loss depends on how right or wrong the bet is.

These types of bets are typically quotes with an offer price (buy) and a bid price (sell). In spread betting the spread shows the broker’s fee, and traders can use stop-loss or limit orders to help manage risk.

Regulatory Landscape for Spread Betting

Spread betting is a popular option but it is regulated in various ways across different areas. For instance, some countries see it as a form of gambling and it is prohibited or limited. However, in others, it’s a regulated financial product the same as any other. For instance, in the UK, the FCA regulates spread betting.

However, even in the UK, spread betting is carefully monitored. According to GOV.UK, the CMA raised concerns about Spreadex’s recent acquisition of part of Sporting Index. This ongoing scrutiny is something to be aware of for any possible future changes in regulation.

Impact of Spreads on Trading and Investment Strategies

From everything we’ve learned so far, it’s easy to see that spreads have a significant impact on different trading and investment strategies. Of course, spread behaviour often changes, due to market sentiment and liquidity conditions. Being able to understand and use the spread information available helps with decision-making. In the end, it could enhance profits.

Spread Analysis in Trading

To help make careful trading decisions and identify opportunities, different spread-based indicators and techniques can be used. For instance, spread compression or expansion can show potential trend reversals. Relative spread analysis can help identify mispriced assets and any arbitrage opportunities.

We can use credit spread analysis for fixed income portfolio management. Equity investments often use yield spreads to assess stock valuations. Additionally, spread trades give much information for sector rotation and decisions related to asset allocation.

Building a diversified portfolio is important in trading. This allows us to keep risk to a minimum, without putting “all our eggs in one basket.”

Learning how to start a shares portfolio is a good starting point and spread-based strategies can be used within this.

Yield Curve Strategies

A yield curve strategy is used to make decisions based on the movements and shape of the yield curve. A regular curve slopes upward and this shows the expectation of economic growth. If we see an inverted yield curve, this usually shows concerns around recession.

This type of strategy is very useful for fixed income investors. It gives deep insights into the economy and how it might change. However, these strategies can also use positioning along different parts of the curve based on spread expectations.

Pairs Trading

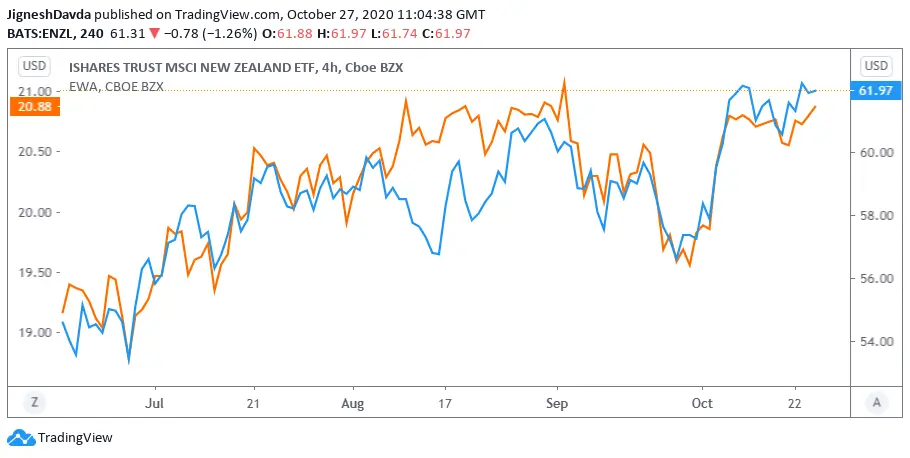

Another useful strategy is pairs trading. This involves taking opposite positions in two securities with the aim to profit from the relative performance of the two. By looking at securities that have been historically correlated, we can go long on the underperformer and short on the outperformer.

A successful outcome requires careful analysis of the statistics shown and, of course, risk management.

Caption: Financial spreads help with careful decision-making and aim to increase gains.

Factors Influencing Financial Spreads

Financial spreads can be affected and influenced by many different factors. Understanding this is important to accurately analyse spread information and make careful decisions.

For instance, macroeconomic conditions have large impacts across market spreads. While microeconomic factors specific to individual sectors or securities can also play a strong role. We also need to look at regulatory changes and market structure as these can also affect spread behaviour.

Market Volatility

It’s probably unsurprising that market volatility is a key factor in spread behaviour. Overall, high volatility leads to wider spreads. Different asset classes may also show varying sensitivities to market volatility.

We can measure volatility using indicators like the VIX index for equity markets, and by staying up to date with economic news. Volatility index futures can also be used to hedge against any spread widening.

Liquidity and Volume

Two crucial factors that often affect spread behaviour are market liquidity and trading volume. Higher levels of liquidity and volume usually cause tighter spreads. However, low liquidity usually results in wider spreads.

It’s worth noting that liquidity can vary significantly across different time zones and markets. Therefore, liquidity risk is something to consider when using spread-based strategies.

Additionally, in high-volume markets, increased competition usually leads to spread compression. We often see this in high liquidity markets, such as large-cap stocks and major forex pairs.

Spread Analysis Techniques

I’ve talked a lot about spreads and how they work, but how can we interpret them based on careful analysis? Spread analysis techniques cover many different methods and these use both technical and fundamental analysis routes. We can use spread analysis in many different markets and financial instruments. Combining several techniques usually leads to better results.

This type of analysis is done through indicators, charts, and statistics tools. The idea is to identify patterns and trends in spread behaviour.

Spread Charts and Indicators

Spread charts and indicators are specialist tools that allow us to clearly see and analyse spread behaviour. This information allows us to identify potential trading opportunities and manage associated risk.

For instance, spread chart ratios can highlight the relative value between two different securities. Additionally, Bollinger Bands applied to spreads can show overbought or oversold conditions. Custom indicators can be developed for specific spread types and strategies, giving a flexible approach to analysis.

Fundamental Analysis and Spreads

In this context, fundamental analysis involves looking at the economic, financial, and market factors that affect spread behaviour. This is a good approach for long-term investors and analysts especially.

Within this we have credit spread analysis, which assesses both company financials and industry trends. Macroeconomic indicators can give important information on potential yield spread movements, while fundamental factors can explain spread anomalies that keep happening.

Caption: Fundamental analysis is an important tool for investors.

Emerging Trends in Financial Spread Technology

As technology shifts and changes, it’s no surprise that there are several emerging trends on the horizon related to financial spreads. Technology moves at a fast-page and we’re seeing new ways to analyse spreads, trade, and manage risk.

As a starting point, big data analytics help us to use more sophisticated spread analysis techniques. We also have high-frequency trading algorithms which impact spread behaviour across several markets. Additionally, RegTech (Regulatory Technology) is starting to play a big role in spread monitoring and compliance.

AI and Machine Learning in Spread Prediction

AI (Artificial Intelligence) and ML (Machine Learning) are both playing a major role in spread prediction and analysis. Both of these technologies can process large amounts of data quickly. Through that, they can identify patterns and use that information to make predictions.

Neural networks are a particularly useful tool to recognise complex spread patterns, while machine learning models can adapt to changing market conditions.

Blockchain and Decentralised Finance (DeFi) Impacts on Spreads

Two other aspects that are starting to introduce new concepts in spread behaviour and trading are blockchain technology and Decentralised Finance (DeFi). Both these innovations create both opportunity and challenges.

DeFi uses automated market markers that creates new spread dynamics. Additionally, blockchain-based prediction is emerging as a new technique for spread betting, alongside cross-chain spreads.

Risk Management and Spreads

Every trader, whether experienced or not, needs to manage risk. This is a vital part of dealing with financial spreads and many strategies and tools can help in this regard.

A simple option is diversification across different spread types. This helps reduce portfolio risk in times of trouble. We can also use risk metrics like Value at Risk (VaR), and stress testing. The latter is used to understand spread behaviour under extreme market conditions.

Hedging Strategies Using Spreads

We can use spreads as effective hedging tools to protect against risk. There are several different strategies to use here, and the chosen one depends on the specific risk.

For instance, interest rate swaps use spread mechanics and these can be used to hedge against interest rate risk. Credit default swaps are also useful to protect against credit risk through spread mechanisms. Finally, options spreads can be used to hedge against volatility or price risk.

Regulatory Considerations for Spread-Based Risk Management

The trading world is regulated carefully and there are regular changes to guidelines. Of course, this also affects how spreads are used in risk management. Staying up to date with new changes and complying with regulations is vital at all times.

A few examples include Basel III regulations, which impact how banks use and then reports on spread-based risk measures. Dodd-Frank and EMIR regulations also affect OTC derivative spreads and their reporting. Then we have regulatory capital requirements, which can influence the attractiveness of different spread strategies.

Learnings Recap

We’ve covered a lot of ground in this guide, but all of it is vital to help understand the complex world of financial spreads. We’ve talked about the basic definitions and the advanced strategies, and also covered emerging trends.

Understanding financial spreads is important to fully grasp market dynamics and pricing. We now know that there are different types of spreads and each has its own purpose in different markets.

By using spread analysis techniques, we combine both technical and fundamental approaches, however emerging technologies are also reshaping the whole process.

As with any type of trading endeavour, effective risk management is key. It’s also vital to pay attention to regulatory considerations when using financial spread strategies. Covering all this will give a much better chance of a safe and successful trading experience.

In the end, mastering spread analysis can enhance our trading and investment decisions. Yet, this is an area that requires continuous learning and adaptation, even for advanced traders.

Final Thoughts

Now that you’ve got a better understanding of just what is a financial spread, we invite you to explore Privacy Australia.

We have a range of resources to help you in your trading journey. These include information such as commodities trading in Australia. We aim to help all traders understand more about the markets and strategies to improve the chance of success. After all, this is a complex business which requires staying up-to-date with new changes and strategies.

Aside from learning about trading strategies, it’s just as important to stay safe while trading online. After all, trading involves a large amount of sensitive information and data being placed in the public domain. To help reduce the risk, we offer a range of resources to give advice, such as using a VPN and password protector.

Our goal is to help Australians navigate the online world in the safest and most successful way, while protecting their digital sovereignty.

You Might Also Like: