Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Stock & Share Portfolio Trackers

You can now keep track of your investments without having to manually tally every deal you’ve ever done in a great spreadsheet, thanks to the widespread availability of high-quality trading software.

And thanks to recent developments in the field of financial technology, it is now possible to buy and sell stocks just using a free mobile app, to consolidate all of your assets in one place, to track their performance, and to make trades on your own when the moment is right.

eToro is the worlds largest social investing platform giving you the option to invest in crypto assets, ETFs and stocks all in one place. eToro offers access to 3031 stocks and 264 ETFs.

Based on this premise, a number of firms have developed cutting-edge trackers that monitor your portfolio’s performance and provide additional value-added services like research, stock recommendations, and more.

In this guide, I’ve reviewed the top stock and share portfolio trackers available and explained who would benefit most from using them. Let’s go!

Table of Contents:

- Why Traders Use Portfolio Trackers

- Best Stock & Share Portfolio Trackers, reviewed!

- 1. Sharesight

- 2. Stock Rover

- 3. Kubera

- 4. M1 Finance

- 5. Yahoo Finance

- 6. Seeking Alpha

- 7. Empower

- 8. Tickeron

- 9. Portfolio123

- 10. The Motley Fool

- 11. Firstrade

- Buying Guide

- Conclusion

- FAQs

How We Choose our Platforms 📚

PA’s mission is to help its audience in whatever way it can. To achieve this goal, we provide in-depth coverage on a variety of topics, such as the following:

- Using state-of-the-art trading platforms

- The value of strong income streams

- Seeing through data and privacy propaganda

- Following the most recent developments in the world of finance

Keep in mind that wealth is a multifaceted concept that includes all of the aforementioned elements and more. Things to think about include becoming in shape, growing some of your own self-sustenance and self-reliance, or getting more traffic ⬆️ for your online business net-worth.

Why Traders Use Portfolio Trackers

Benefits of using a stock portfolio tracking service include:

- It offers information on the net gains or losses from trading that investors have incurred.

- Displays your investor assets and transaction history according to specific dates.

- Informs you of your portfolio’s sector allocation and percentage weightings.

Features to look for in a good portfolio tracking tool

The best portfolio trackers contain a wide selection of investment tickers and helpful analytical features. The following are the criteria by which we selected our top picks:

Budgeting: There is no need to worry, since there is a no-cost entry point for each portfolio tracking service on our list. Some even offer extras you may buy to boost your satisfaction. Therefore, a cost-free entry point is required.

Many assets that may be monitored at once: Everything of your assets, from stocks and bonds to exchange-traded funds, may be monitored with a decent tracker. Investing in cryptocurrency? There are crypto portfolio trackers.

Speed efficiency: Not only do you need a tracker that can be downloaded fast into your mobile device or computer, but the rate at which prices are updated is also crucial. Stock quotations on a tracker should be made available in real time or very close to it. In the event that you get a gift that is more than 15 minutes old, you will not be able to exchange it.

Intuitive interface: You can use a portfolio tracker with no training.

Top Stock & Share Portfolio Trackers in 2024 📉 – A.U. Reviews 📘

1. Sharesight Review – Most Popular Stock & Shares Portfolio Tracker

Sharesight is a game changer in the world of online portfolio monitoring.

They’ve won several accolades, including Benzinga’s Best Financial Adviser or Wealth Management Platform.

You’ve probably seen them around, for that reason. Sharesight allows you to keep tabs on the true value of all your equities listed on more than 30 worldwide exchanges including crypto 📀.

| Offering | Cost |

| Free Plan | 0 |

| Starter | $10/month |

| Investor | $16/month |

| Expert | $21/month |

With the custom group tool, you may keep tabs on a wide variety of assets, including currencies (including the leading cryptocurrencies), private equity, alternatives, bonds, real estate, and more.

Sharesight makes it simple to evaluate your investment portfolio against that of other users. In addition, it helps you keep track of dividends so that you can file your taxes without any hassle.

Replace Your Spreadsheets… 📊

With Sharesight, you can monitor stocks and ETFs listed on more than 40 exchanges across the globe, and the software has won awards for its performance reporting and tax functionality.

In addition, the powerful tracking tool can also keep tabs on 75 different currencies throughout the world and unlisted alternative assets like fixed-interest and investment real estate.

The best thing is… One convenient online portfolio manager has all you need.

The service brags that it can replace your spreadsheets, which is a desirable feature in portfolio management applications, by providing accurate performance data for all of your listed assets and allowing you to monitor numerous asset classes in a single interface.

You may actively compare the genuine performance of your assets to a wide variety of benchmarks, also letting you can assort and filter the results in a variety of ways.

Better still, you may track your portfolio’s performance against a benchmark 🔝 and see the results of dividends, capital gains, and currency changes (if investing overseas).

Track Your Dividend Returns…

Sharesight’s inclusion on this list is warranted not only for the aforementioned factors, but also for the fact that it allows for the efficient monitoring of dividends.

On the Taxable Income Report on the Internet, you may track your distributions, dividends, and interest payments throughout any time period and see how much you made in total, as well as how much of it came from domestic and/or international sources.

It is also important to be aware of dividend dates, payment schedules, and service delivery times, since they are not variables that can be easily misread by a spreadsheet’s formula. The software may also be used to forecast dividend income in light of dividend announcements.

Accurately valuing these assets is crucial because of the substantial passive income they may provide for investors.

Easily import your holdings by linking to your brokerage or stock trading app, uploading a spreadsheet, or keying in your trade history and opening balance.

Sharesight now works with over 170 brokers throughout the globe, and the company is happy to add any more that customers may need.

To try out the Sharesight service for yourself, just go over to their website and sign up for a free trial. During the trial period, you may monitor up to 10 securities in a single portfolio.

After that, you’ll want to think about upgrading to one of their subscription packages so you can keep tabs on your complete portfolio. To take advantage of their yearly plan discounts, click on this link.

Verdict – Do I Choose Sharesight?

Sharesight was a major breakthrough in the realm of online portfolio monitoring. It has been recognised as the Best Financial Adviser or Wealth Management Platform by Benzinga, among other awards.

If you have equities listed on more than 30 exchanges throughout the world, Sharesight can keep track of their actual performance for you. Using their own groups tool, you may keep tabs on a wide variety of assets, including currency (including major cryptos), alternatives, private equity, bonds, property, and more.

Using Sharesight, you can easily compare your investment results to those of your peers. On top of that, it automatically records your dividends, saving you time and effort during tax season.

Advanced investors may upgrade to premium plans for an additional $12 per month.

Pros

- Investment data for many accounts

- Dividend Income Report for Distribution Forecasts

- Tax filing tool

- Excellent customer feedback

Cons

- Few cryptosystems are widely supported

- Costs depending on your plan

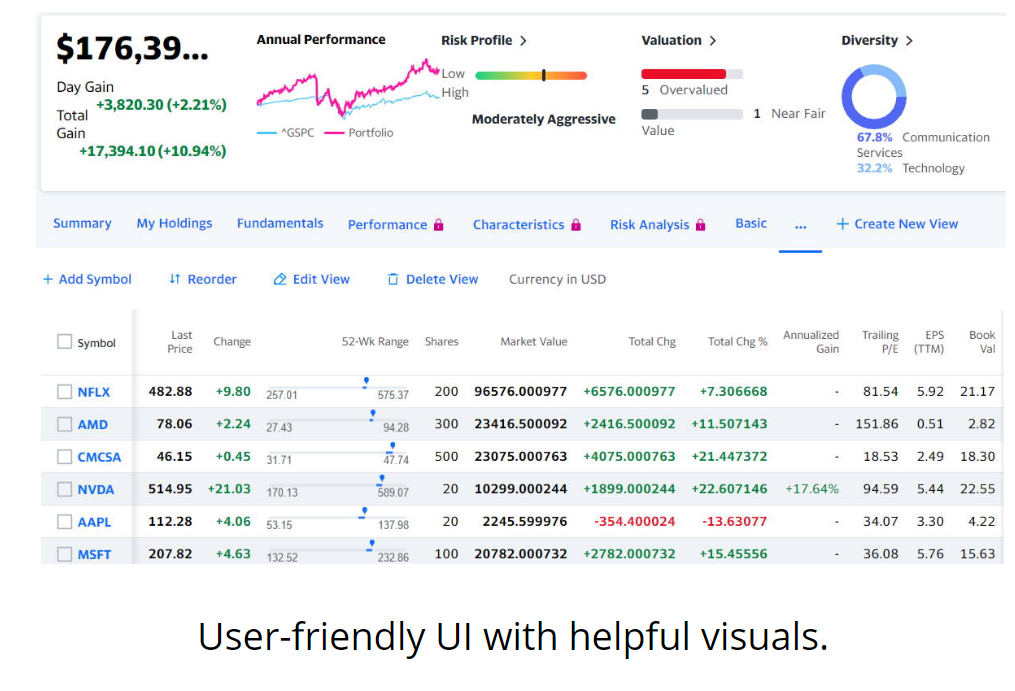

2. Stock Rover (StockMarketEye) Review – Next-Most Popular Stock & Shares Portfolio Tracker 💸

Are you engrossed in the market, using a thousand tools to monitor your investments’ progress?

StockMarketEye puts an end to that; it allows you to monitor your investments and the markets without having to switch between different applications or tabs in your browser.

This easy-to-use portfolio management programme puts a wealth of financial data at your fingertips, without requiring you to devote time to learning how to use it. Spend that time monitoring your transactions and portfolio’s performance instead.

| Offering | Cost |

| Essentials | $7.99/month |

| Premium | $17.99/month |

| Premium Plus | $27.99/month |

When it comes to stock screening, analysis, and monitoring portfolios, Stock Rover is unrivalled. Gains include a complete financial history going back ten years, a database of profits and dividends, and evaluations from the experts at Morningstar. To that, add superior tools for monitoring stocks and analysing portfolios, making this an excellent option.

Powerfully Track Your Investments Using Stock Rover 🏢

Know how well your social trading 🙅♂️ and crypto gambits are doing, all in one hub.

Stock Rover gives you the tools you need to keep tabs on the stocks you’re following with ease. A stock tracking watchlist might be one of three types:

1. Use the very effective stock screening & stock rating engine in conjunction with your Screening Watchlists to find promising opportunities.

2. With the aid of a watchlist, you may track and report on a wide variety of financial metrics, making it easier to identify promising investments. Flexible column settings give you the power to view precisely what you need.

3. The primary watchlists that allow for sophisticated analytics and portfolio reporting are Portfolio Watchlists. You have the option of manually or automatically syncing your portfolio watchlist with your broker.

StockMarketEye Amalgamates Everything 📊

Are you engrossed in the market, using many tools to monitor your investments’ progress?

StockMarketEye allows you to monitor your investments and the markets without having to switch between different applications or tabs in your browser.

This easy-to-use portfolio management programme puts a wealth of financial data at your fingertips, without requiring you to devote time to learning how to use it. Spend that time monitoring your transactions and portfolio’s ROI instead:

- ✔️ Keep tabs on your investments with ease.

- ✔️ Examine wins, losses, and efficiency in a hurry.

- ✔️ Check out prospective investments.

- ✔️ Keep tabs on international stock markets, mutual funds, currencies, ETFs, and more. Even buying bitcoin.

- ✔️ Investing accounts may be managed centrally.

Stock Watchlists Are No Longer Necessary ⛰️

StockMarketEye makes it easy to track hundreds of different securities from inside a single powerful interface.

Several stock exchanges now provide real-time stock quotations and data, making it easier to keep tabs on the market without having to manually compile the information.

Monitor your portfolio in real time with up-to-the-minute pricing and interactive charts, and set up custom alerts to be notified instantly if a predefined asset or set of securities in your watchlist undergoes a price change.

StockMarketEye improves your investment prowess by making your portfolio more organised and your progress more transparent.

As for research charts, get some perspective on your stocks with the help of StockMarketEye’s end-of-day and 1- and 5-day charts, among other features. Get deeper insight and make more informed investment choices with its suite of 14 technical indicators.

Overall, find enhanced charting capabilities, both in-built and for comparison. By keeping abreast of market activity, you may confidently seek out profitable trading opportunities.

Scoreboards to Quickly See Your Performance 🖥️

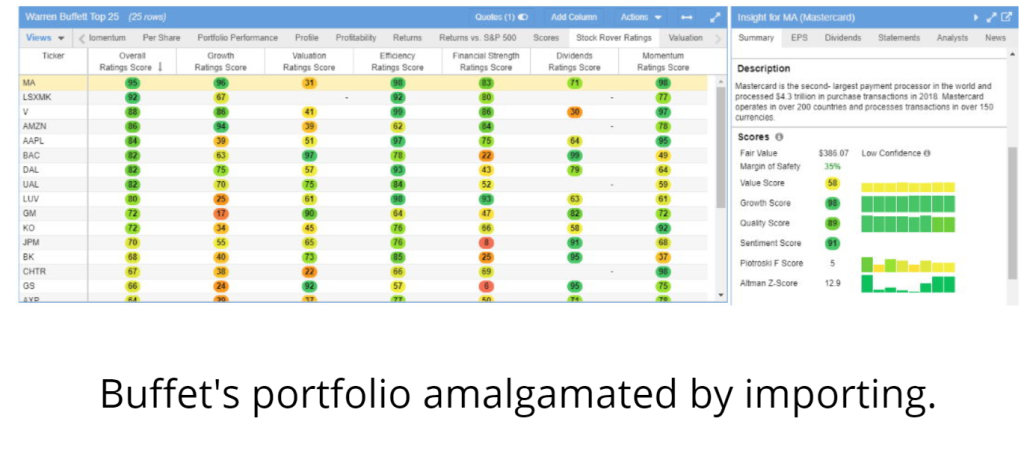

Stock Rover’s development team has added some fantastic features, my favourite being the aggregated scoreboard. See below for a snapshot of the imported Warren Buffett portfolio in its entirety, including his top 25 holdings.

Note the “Stock Rover Ratings” section as well. This page consolidates all of your holdings into one easy-to-understand rating system, which will save you a tonne of time and work while giving you access to a plethora of information.

You may develop a polished, user-friendly PDF report on any stock’s present and historical performance with the help of Stock Rover’s research reports. The study report innovates by producing a report that can be read by humans and which details a company’s market share, competitive landscape, dividend history, and expected future returns on investment.

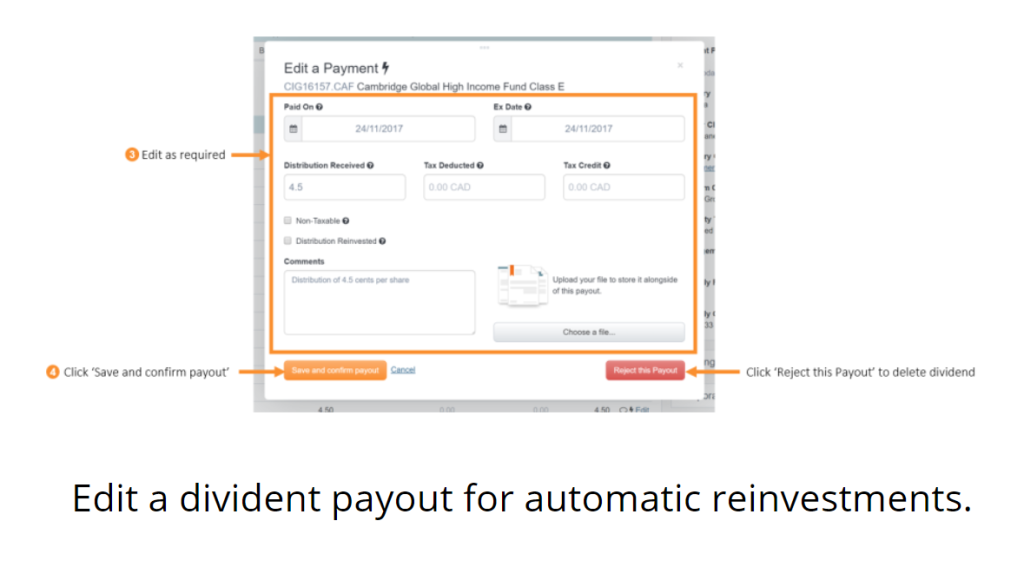

Buffett Stock Screener was used to find Comcast, a firm with outstanding potential, and the graphic below displays the dividend-adjusted comments on my investment.

Every 10,000+ equities traded on American and Canadian markets are summarised in detail in the Research Reports. The PDF format is convenient for viewing and sharing research reports on the go.

Verdict – Do I Choose Stock Rover Tracker? 🐂

It does it all. StockMarketEye’s onboarding process is straightforward. Use the Advanced Brokerage Import feature to import your trades from brokerages in the United States, United Kingdom, Canada, Australia, India, and other countries straight into the programme.

QIF, OFX/QFX, and CSV are only some of the common investment file formats utilised by market players. You may also enter your purchases manually if that’s more your speed.

Once imported, these brokerage services will allow you to see your current asset allocation and get insight into your portfolio’s performance.

StockMarketEye’s ease of use and accessibility sets it apart from the competition.

In other words, there is no cloud storage involved, and you only download and install the app on your platform or device. Instead, everything related to your brokerage accounts and investment assets is stored locally on your PC.

If you think StockMarketEye is a stock monitoring tool worth trying, you may download and check it out for 30 days without giving out any personal information.

See whether the practical features make investing easier for you to access by trying them out. StockMarketEye offers a 30-day free trial, after which a licence may be purchased online.

Pros

- Ease of use and accessibility

- Enhanced charting capabilities

- Onboarding process is straightforward

- Save a tonne of time and work

- Aggregated scoreboard

- Import watchlists into one hub

Cons

- No free plan

3. Kubera Review – Most Advanced Stock & Shares Portfolio Tracker 🏛️

Keeping tabs on your net worth is a great way to see whether you’re making progress in the correct direction financially.

Yet, anybody who has used a free app to monitor their wealth has undoubtedly been disappointed by how inaccurate they may be.

A normal tracker, Kubera is not. This wealth manager and portfolio tracker integrates with over 20,000 financial institutions and provides outstanding support for cryptocurrencies and DeFi. It’s great for bigger portfolios and one of the most comprehensive trackers available.

Kubera, on the other hand, isn’t free and it’s missing certain useful budgeting features. In this review, we’ll go over everything you need to know about Kubera before deciding whether or not it’s right for you.

| Offering | Cost |

| Starting | Starts at $150/month |

| Personal | $150/year |

| Family | $225/month |

Most Advanced Tracker

Kubera is the most cutting-edge and modern investment tracking software available today. Kubera is the most all-encompassing service available, with access to thousands of bank connections, more worldwide currencies than any other service, and in-depth details on your assets.

Kubera is the perfect solution for many people, including recent college graduates, homeowners, real estate agents, and crypto enthusiasts. Holdings may be tracked and analysed using data from marketplaces all around the globe.

With Kubera, you can see your wealth and account balances from any of the hundreds of banks and brokerages throughout the globe in a one location.

- Helps keep tabs on both fiat and crypto holdings

- Get data from over 20,000 financial institutions worldwide

- Files everything in one place so you can see your whole financial picture with the ease of a spreadsheet

Even separate your portfolio by regional investment, be it the Collective West or emerging nations, e.g. BRICS 🧱 investments.

Grow Your Net-Worth 💸 (includes Domains)

When you use Kubera, a premium portfolio and net worth monitoring tool, you can keep tabs on your assets, real estate, and other asset classes to obtain a bird’s eye view of your financial situation.

Claims that the platform is the “world’s most advanced net worth tracker” are backed up by the breadth of assets that can be monitored.

As of 2018, the firm has never existed before. Kubera was first used to monitor approximately $12.10 billion in personal finances and over $3.4 billion in institutional holdings.

So who is Kubera for?

Kubera is for you if you want the most comprehensive wealth manager available today. As mentioned in the intro, wealth management today is more than just stocks and shares; it’s also things like organic traffic growth 🌴, for those who own domains.

This is particularly true if you have a sizable holdings in cryptocurrencies and DeFi, which are not supported by the majority of wealth tracking services. If you prefer a spreadsheet-like interface for manually entering your assets and obligations, Kubera is a great option.

Kubera is not the right app for you if you’re looking for a wealth manager that also helps you manage your money and get insights into where your money is going. This is not a comprehensive financial platform, but rather a paid portfolio and net worth monitoring tool.

Monitor Stocks & Shares, Add More Assets Later…

Besides from the obvious precious metals, domain names, cryptocurrencies, foreign exchange, and other monetary assets, you may also keep tabs on real estate such as houses, fractional share trading, cars, and rental units.

Stocks, bonds, mutual funds, and other conventional investments are also included. In a nutshell, this platform consolidates the best features of popular portfolio management programmes into a single, convenient location.

You may check the current worth of your alternative assets, as well as an estimate of their selling price, at any moment without digging through reams of paperwork. With Kubera, it’s simpler than ever before.

Discover whether or not Kubera, the cutting-edge Portfolio Tracker available today, meets your needs. You may try it out for 14 days at no cost to be sure it’s what you’re looking for.

If you believe a monthly or yearly plan better suits your requirements, you may upgrade to one.

Verdict ⭐ – Elegant Stock Portfolio Tracking Solution

Kubera is an elegant, user-friendly, and professional portfolio and wealth management application. This tool is particularly useful for keeping tabs on investments and cryptocurrency, but you may manually enter any asset or obligation you choose.

Kubera isn’t without its drawbacks, though. It costs, because it serves people with good net-worths, and doesn’t have all the budgeting features that other options have.

Invest in emerging nations, tie in an unbelievable range of assets, including domain names, and more. When you join up for Kubera, you’ll need a Gmail address. There is a $1 fee for a 14-day trial of the service before you must decide whether or not to subscribe. Although a credit card is required to sign up, no charges will be made until the trial period concludes.

The many banks, brokers, and exchanges that Kubera works with make portfolio creation a breeze after you’ve logged in to use the platform.

Pros

- Connected to 20,000 banks and brokers

- Encrypted communication monitoring

- Ad-free

- Grow and track your net-worth

- Kubera does not mine data for advertising

Cons

- It’s a premium, advanced service

- Kubera lacks financial planning

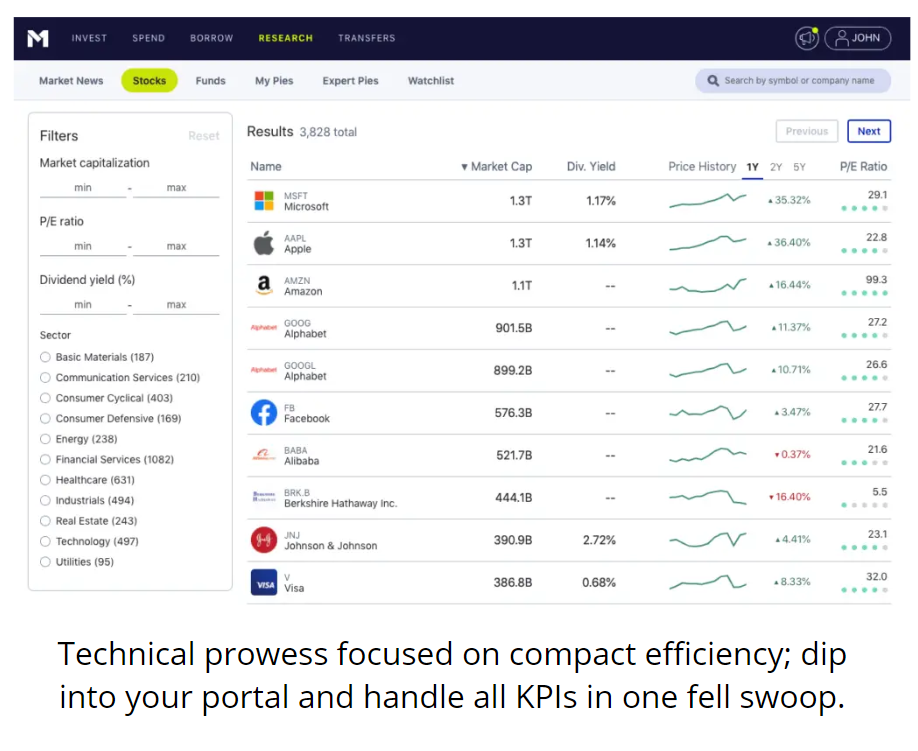

4. M1 Finance Review – Best Stock & Shares Portfolio Trackers with Robo-Advice

Due to M1’s status as a Robo-Advisor, all of your portfolio management needs, including hot shares 🔥, sales, and tax loss use, will be handled mechanically.

M1 is a Robo Adviser, or Automatic Advisor, that works with you to build and monitor a portfolio in accordance with your risk tolerance, time horizon, and investment objectives, which may prioritise growth, income, or moral principles.

| Offering | Cost |

| New members | Free for 3 months |

| M1 Finance App | $125/year |

While working with M1 Financial, you can be certain that all of these tasks, along with balancing and tax loss harvesting, will be handled mechanically. Even better, buying and selling stocks, shares, or government bonds doesn’t cost you a dime.

You just need $500 in order to start using M1 Finance’s automatic investment platform. We do not charge for any of our automated services or stock trading. Assets under management are not charged on an annual basis, further reducing expenses.

Your Sentinel that Stays Up at Night… 👁️

Our research found that M1 is the next-best Robo Adviser overall. They now handle over $4 billion in client funds. An automated adviser would benefit greatly from an M1 that is both regulated and secure.

The main benefits of automated investing services, often known as Robo Advisers, are that they provide the individual investor more control over their investments and more transparency and understanding of their portfolio.

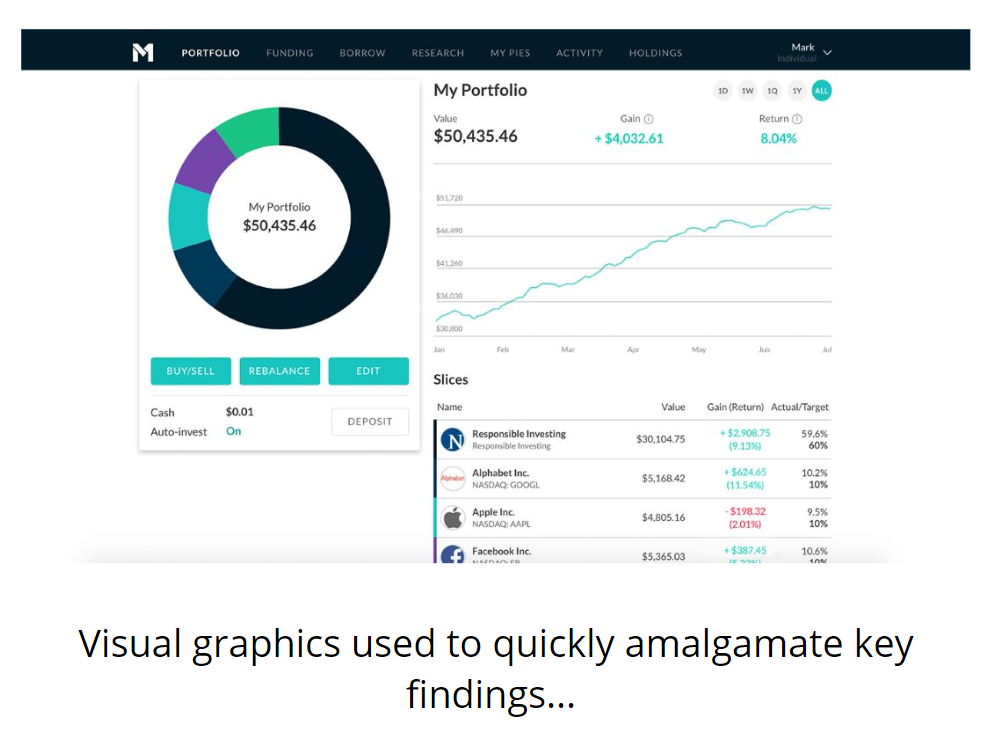

Your portfolio’s valuation, growth, and return are all clearly shown.

Whether you have one portfolio or several, M1 makes it easy to report on performance and profit/loss. You may learn about a firm and its financial standing by using the resources provided by the M1 investment platform. Not as in-depth as Stock Rover, but still useful for getting a feel for the company’s financial health and projections.

🤖 Robo for Rebalancing and Weighting Portfolios

In order to reach your sunny oasis, it is crucial to have the option to rebalance 🏝️ your investment portfolio. When a portfolio is rebalanced, its holdings are brought back in line with their intended percentages.

Initial goal allocations will drift as a user experiences the effects of time and fluctuating security prices. If your portfolio has drifted, it may no longer reflect your risk tolerance or preferred investment strategy.

By reallocating your capital, you may ensure that your portfolio continues to reflect your desired level of risk and progress towards your financial objectives.

Key Tools

- 📚 Asset Distribution in a Portfolio – The M1 adviser may invest in exchange-traded funds (ETFs), industry sectors, or bonds according to your instructions.

- 📚 Affiliation of Brokers – As M1 functions as a full-service broker, your transactions will be executed with their chosen liquidity providers, allowing for completely automated portfolio management. You won’t have to pay anything to have business on your behalf handled.

- 📚 Accounting for Future Earnings and Dividends – With M1, you have the option of reinvesting dividends or having them deposited into your checking account. The amount of dividends you may anticipate receiving this year can be easily seen in M1.

- 📚 Digital Investment Portfolio Management – M1 Finance’s strongest and most distinguishing feature is its ability to handle your whole investment portfolio automatically. When you need to develop your wealth or save for retirement but don’t have the time to maintain your portfolio, M1 is the way to go.

M1 Finance is Geared towards Goal Planning… 📅

M1 is designed for objective-setting, quickly. Shares of stock are represented as slices of cake or piec charts. You’ll need to divide up the pie, put money into it, and build a stock portfolio.

The Expert Pies feature on the M1 is another viable alternative. For individuals who would rather not actively manage their investments but yet want superior results, this option is available thanks to the firm’s in-house asset management staff.

Investors who are coming over from a Robo-advisor would like this function. More so, M1 Finance does not charge its customers any kind of brokerage fees.

Setting Objectives 🦿

Due to its exclusive emphasis on automating portfolio management for seasoned investors, M1 does not include tools like financial calculators or goal planners.

In the same vein, as the service is not meant to be advising in nature, human advisors are not available on the site.

Nonetheless, M1’s blog has a sizable article archive on a variety of broad, high-level themes related to financial literacy and investment.

Investors who want goal planning tools or who place a high value on human coaching may feel uneasy about the absence of hand holding. An improved investment experience based on expanding your wealth is made possible by the emphasis on portfolio management for seasoned investors.

Keep in mind that M1 isn’t aiming to be a robo-advisor that takes your basic objective and risk information and spits out a portfolio that complies with Modern Portfolio Theory and your time horizon.

Instead, M1 is on the lookout for financiers who want to lighten their portfolio’s management load without giving up customization, diversification, or automation.

Verdict – Fascinating Stock Portfolio Tracker for Experienced Investors 👑

M1 Finance is a fascinating platform since it combines automatic investment with extensive portfolio customisation, in addition to lending and spending options.

If you’re an experienced investor wanting to automate your strategy while still tailoring it to your own tastes, risk tolerance, and diversification objectives, then this platform is for you. Since M1 doesn’t take a cut of your earnings for either investment management or trading, it earns bonus points for being a cost-effective platform.

In summary:

- ✔️ If you are an experienced investor looking for a low-cost, flexible portfolio solution, M1 Finance is the way to go.

- ✔️ One of the most common ways to personalise an investment portfolio is by screening and picking from among sixty various options.

- ✔️ M1 Finance’s borrow and spend choices may appeal to investors who are on the lookout for a wider variety of products from a single platform.

- ✔️ Although M1 Finance’s goal monitoring is more flexible than that of other robo-advisors, it does not allow for the consolidation of accounts held with other providers.

Pros

- Portfolio customization options

- Low-interest margin loans are available for $5,000 investments

- Trading and account-administration are free

- Spending and borrowing improve portfolio management

Cons

- Loss deductibility is unusable

- No budgeting or professional guidance

- Financial goal-setting and planning are scarce

- Avoid pooling offshore savings accounts for investment capital

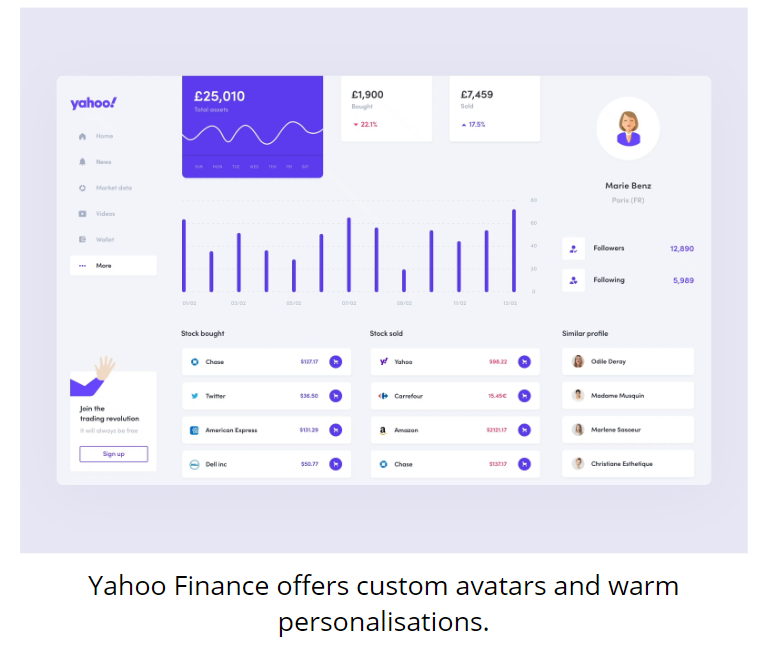

5. Yahoo Finance Review 📰 – Major-Outlet Stock & Shares Portfolio Tracker

Even if it integrates with your broker and offers decent free screening, Yahoo Finance’s portfolio tracker lacks robust features for managing your investments.

Be warned, using Yahoo Finance to handle a big portfolio is a time sink. For smaller holdings, to begin using the Yahoo watchlist monitoring features, you must first sign up for a Yahoo account.

After signing up, you’ll get free access to several useful features, including creating watchlists and keeping tabs on your portfolio, whether it be the NASDAQ or FTSE-100.

| Offering | Details |

| Platform | Free |

| Premium version | $49.99/month |

| Support | iOS, Android |

TL;DR: Stock Rover and M1 Finance are much superior than Yahoo’s subscription service, which includes supplementary reporting and analysis.

If you compare Yahoo Premium’s monthly fee of $49.99 to that of Stock Rover’s $27.99, you’ll see that Yahoo Premium is much more costly.

Tracking Investments 🏘️📰

Yahoo’s recently revamped interactive charts provide a streamlined, full-screen experience that’s both intuitive and impressive.

Yahoo Finance has you covered with 114 unique technical indicators. You may add trendlines, linear regressions, and even quadrant lines to the interactive charts.

The incorporation of BATS with Yahoo’s offering of real-time quotations and charts is a welcome development. Yahoo Finance has been hard at work improving its charting capabilities to compete well with those of other free providers.

They came up with a very original idea. The Yahoo Finance charts have been updated to allow stock trading. The “Trade.It” interface, with which Yahoo has collaborated, transmits trading requests to most major brokers.

You and your broker may conduct stock trades using Yahoo. While this is a welcome addition, it seems rather superfluous given that everyone with a brokerage account already has access to real-time data, charts, and quotations and can trade directly with the broker to track your Apple and Twitter shares (…wait, that last one’s no longer available).

Best-Selling Point ✅: Updated Research & News on Portfolios

There are perks to using tracking data from a major news outlet, as long as you ignore the various agendas behind the scenes and know how to discern.

The Yahoo Finance news team produces original content and operates a news aggregation engine. With Yahoo Finance Premium, you get access to several reports based on expert analysis and quirky account personalisations.

Whilst they may be of some benefit, the $49.99 monthly fee may be prohibitive given that many large brokerage houses provide research papers for free. Free stock transactions and research reports from Zacks and Morningstar are available to clients of Firstrade.

There is a vast selection of brokers that may be accessed via Yahoo Finance, including cryptocurrency. Yahoo Premium is required to download your stock position data and do portfolio analyses. Yahoo Finance Premium does not support automated portfolio management or portfolio weighting and rebalancing at this time.

To counter this, they publish your dividend income and your portfolio’s asset allocation by industry (for more, the Motley Fool covers this further).

Surprisingly Jampacked with Features 🐙

We were forced to place this pretty high up in this guide due to the strong popularity, brand-awareness, and list of features, however non-robust that they may be.

You can manually input your investments into this portfolio tracker or import them from a spreadsheet. Or automatically keep track of your assets and get information about them, including risk, fundamentals, news, and performance, using Yahoo Finance’s Portfolio Tracker:

- ✔️ Link your brokerage accounts together.

- ✔️ Consolidate your several portfolios into one convenient location.

- ✔️ Learn about stock market and economic factors that impact your ROI .

- ✔️ Get Yahoo Finance Portfolio Tracker on your iPhone, iPad, or iPad mini from the App Store, Google Play, or on your computer.

- ✔️ The app also has a free version.

- ✔️ Quick and simple connection to all of your financial accounts.

- ✔️ Financial progress may be monitored through a dashboard with built-in report generation features, including stock analysis using charts.

- ✔️ Keeping tabs on any dividends using the “dividend tracker”.

The majority of trackers include a free tier of service and paid tiers for more advanced tracking of investment holdings.

Look for applications that provide advisory services if you believe you would be interested in things like wealth management or portfolio evaluation. For those with assets under a specific threshold, several firms will provide a first consultation at no cost.

Verdict – Good Entry-Level Tracker

Tracking your stocks, commodities, bonds, and currencies couldn’t be easier than with the Yahoo Finance app’s intuitive interface. Personal portfolios may be created and monitored, and numerous portfolios can be kept in sync between devices.

Seeing your asset allocation and comparing it to benchmark indexes like the S&P 500 is a critical element of any good portfolio tracker software. It is also necessary to create a target allocation that takes into account your risk aversion and investment horizon.

While keeping an eye on your investments, it’s crucial to have a centralised dashboard like this, where you can manage all of your accounts and see real-time data.

Backtesting is another function that lets you see how your portfolio might have fared with a different asset allocation in the past. The ability to track your portfolio’s risk and see whether it’s over or under-weighted in any one investment or industry is also essential.

Pros

- Minimalist app with simple features

- Software works without Yahoo login

- Offers real-time quote watch lists

- Less capable than other brands

Cons

- Non-stock information is abundant

- Cryptocurrencies and commodities confuse the app

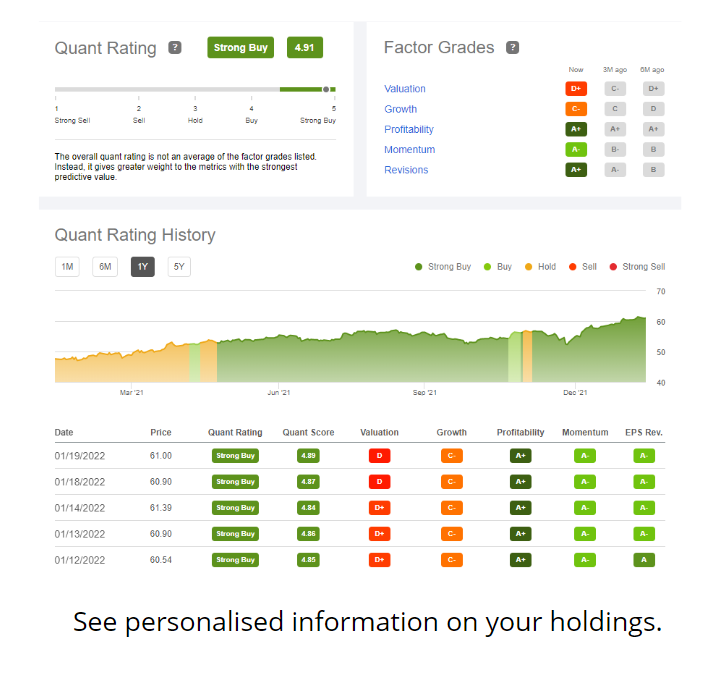

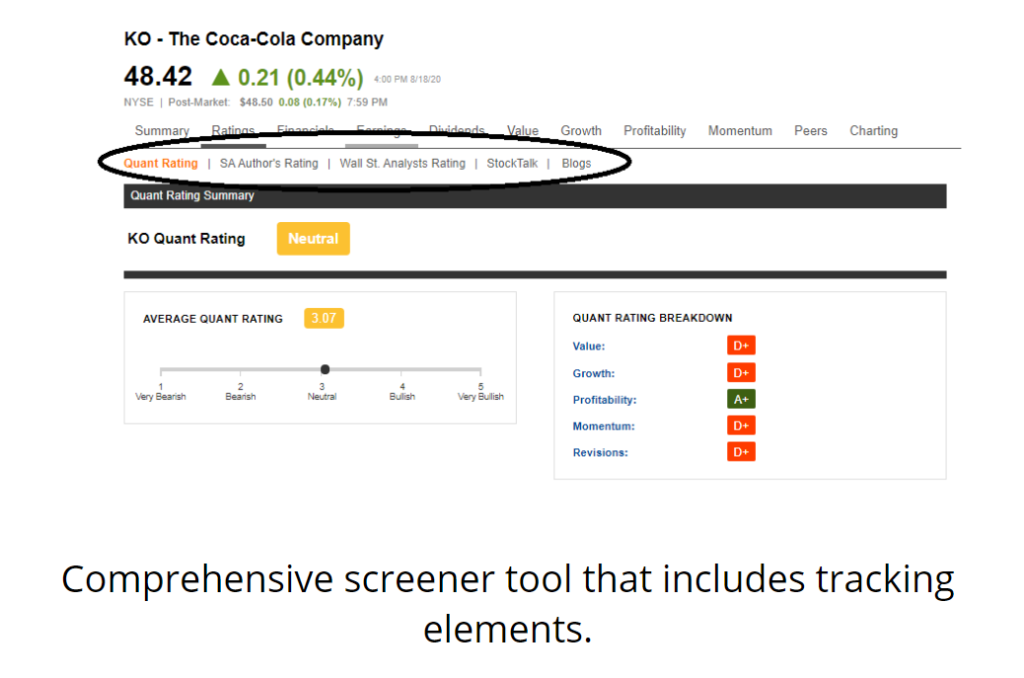

6. Seeking Alpha 💪 Review: Well-Established Stock & Shares Portfolio Tracker

For Aussies with an intermediate level of investment experience, Seeking Alpha Premium is a comprehensive, low-cost tracking solution.

In order to help you make more informed investment choices, Seeking Alpha Premium combines a stock tracker, a recommendation service, and research about the stock market and the economy as a whole.

Seeking Alpha’s features are adaptable to your investing style, whether you prefer mobile access or want to set aside time for in-depth examination.

- ✔️ Seeking Alpha is the only site that gives you unrestricted access to everything from.

- ✔️ Reports of quarterly earnings calls.

- ✔️ Rankings of Seeking Alpha Authors and Metrics for Their Contributions.

- ✔️ Financial statements spanning ten years.

- ✔️ Comparable stock price viewing.

- ✔️ Get profits and dividend projections, among other u.seful information.

| Offering | Cost. |

| Free | Free (the standard Seeking Alpha experience) |

| Premium | Spend $39.99/mo or $239.88/yr for the premium service |

| Pro | Pro – $299.99/mo / $2,399.88/yr |

What are the benefits of a Seeking Alpha subscription?

In a nutshell, Seeking Alpha condenses the essential financial data so that you don’t have to, facilitating the possibility of outperformance of the market by any person interested in self-directed investing. There is no better time than now to sign up for one of Seeking Alpha’s premium memberships.

The Premium services offered by SA are worth exploring, so sign up for a trial now to see if they meet your requirements.

Much More than a Tracker 🏛️

If you’re a trader, you can easily maintain tabs on the companies you’re following thanks to Seeking Alpha, a news and analysis portal devoted to the stock market. It was David Jackson who started the site, but now there are many more people involved.

The site claims to be the “world’s biggest investment community”, and it employs a crowdsourcing technique to compile news headlines and lengthier pieces from around the Internet, many of which include seasoned Wall Street investors and analysts.

Seeking Alpha’s material is more technical and in-depth than that of news services like The Motley Fool, and it typically includes investment ideas and investment advice for both professional and casual investors.

Seeking Alpha offers a wide variety of articles, resources for coming up with ideas, and resources for analysing stocks.

What are your thoughts on a Seeking Alpha premium subscription? To learn more, check out our in-depth analysis of Seeking Alpha below.

Flexible Plans

Access latest stories with the opportunity to construct portfolios, to personalise your news stream are just two of the many free services available on Seeking Alpha.

For example, free users can’t see the author’s rating of the stock in question or the author’s past performance. Not only that, but free users may only see the most recent 10 days of information.

There are two tiers of premium services available on Seeking Alpha. At the site’s Marketplace, both individual investors and businesses may advertise their high-quality investment services to potential customers.

Seeking Alpha does not produce any of these products or services; rather, it acts as a middleman in these exchanges. Even though we could devote a whole article to examining just one of these services, we’ll instead focus on the premium offerings from the firm today.

Premium memberships on Seeking Alpha provide access to additional content and tools for investors. There are three distinct membership options:

- Free (The typical Seeking Alpha experience)

- Spend $39.99/mo or $239.88/yr for the premium service.

- Premium – $299.99/mo / $2,399.88/yr

Should You Go Premium or Pro? ⭐

If you’re looking for a simple upgrade from the free plan, the Premium plan is it. Access to the premium material, which includes in-depth analysis, is available without any restrictions; from stocks to Aussie REITs.

Users get full access to all of Seeking Alpha’s research tools, including author stock ratings. Among them are pessimistic analyst ratings and thorough fundamentals and earnings monitoring on stock-specific websites. On the Premium plan:

- Many opportunities to consume news

- Fewer commercials

- More metrics in addition to the aforementioned stock ratings (quant ratings, grading, etc.)

After the Premium plan comes the much more pricey Pro plan. The primary benefit of this service is early access to the best long and short ideas from Seeking Alpha’s editors by one week. You can also use a stock filter that incorporates Seeking Alpha’s analyst ratings. The hefty yearly cost of this service, when compared to specialised stock advice sites, is difficult to defend. Key advantages of the Pro package include:

- Even more opportunities to consume research

- Obtaining materials before they are publicly available

- Get early access to brand new content

- Software for analysing stocks

- No advertisements

The company’s website has a comprehensive breakdown of the available options. There is a free trial period available for each membership package so that you may evaluate the service at no risk.

Verdict – Good Performance Metrics but Not a Specialist

This is less of a specialised tracker solutions but premium users of Seeking Alpha have access to metrics for monitoring performance, which may be used to evaluate the value of an author’s analysis or commentary.

Indicators display a stock’s performance since the article was published (which is particularly helpful when reading older articles).

If you’re a premium member, you can also see the author’s rating history to learn how well they’ve predicted the outcomes of past works.

The credibility of a source is crucial in the investment industry. You can tell whether the articles with investment ideas are trustworthy and whether or not the author’s ideas are sound by looking at their author ratings.

Pros

- Free stock analysis articles

- Author and Seeking Alpha-wide ratings accompany articles

- Infinite portfolio creation for filtering

- Basic data and earnings predictions

- Multicategory stock ideas and strategies

Cons

- Material may be overwhelming

- Stock ideas involve extensive study and self-analysis

- Essential subscription lacks stock screener or specialist tracker

7. Empower Review ⚡ – Powerful Stock & Shares Portfolio Tracker with Banking

With 3.3 million customers, Empower (formerly known as Personal Capital) offers free tools like the Personal Dashboard and a paid Wealth Management solution.

With inflation impacting Australian food prices, users can easily keep track of their various bank, credit card, and investment accounts by linking them to the free Personal Dashboard.

To help you evaluate your investment portfolio’s potential for loss, examine its historical performance, and determine how you should allocate your funds, Empower offers a free Investment Checkup tool. If you have too much money in utilities and not enough in healthcare, for example, you can use this tool to see where your portfolio is skewed and where it needs to be rebalanced.

| Offering | Cost |

| Tracking platform | Free |

| Financial planning | Varies, ask for a quote |

If you want to see how your portfolio stacks up against the S&P 500 and Empower’s “Smart Weighting” Suggestion, where the largest stocks don’t have as much of an impact and each sector is weighted differently, you can do that too.

Whether they are advisory fees, sales charges, expenditures, or anything else, the Empower Fee Analyzer may help you have a better understanding of what you’re paying for your accounts.

A Retirement Planner, an Investment Planner, a Financial Calculator, and more are all available.

Of course, you can get all of these and more with a full-service Wealth Management account with Empower.

Asset Management Services from Empower 🎰

Those who want more from their advisors can choose the Wealth Management plan. Combining AI and human oversight, this solution is convenient and reliable.

Empower recommends a portfolio based on your risk appetite, investment horizon, and other factors. Asset classes are spread throughout and rebalanced in the portfolios as needed. The six types of assets are:

- ✔️ Stocks in the United States, Australia, and overseas

- ✔️ Markets throughout the world

- ✔️ Treasuries

- ✔️ Funding from the international bond market

- ✔️ Diversified options for financial investing

- ✔️ Cash

Moreover, clients may choose to include SRI (socially responsible investing) strategies in their portfolios. What this implies, in a nutshell, is that you may restrict your portfolio to only include firms that are doing good for the world.

Financial advisers are available to assist investors with a wide range of financial matters, including but not limited to retirement planning, college savings, stock options, and more. The financial experts at Empower are accessible whenever you need them by phone, chat, email, or video call.

Please be aware that there is a $100,000 entry requirement for the Wealth Management plan. An advisory group is available to anyone with an investment portfolio of $100,000 to $200,000. With a net worth above$200,000, you may choose between two personal financial consultants. Those who spend above $1 million get additional perks, such as reduced costs.

Banking & Tracking…

Empower’s customised service considers the whole financial picture of each customer, not simply the assets under management.

Instead of trying to duplicate a market index like the S&P500, the firm utilises a portfolio selection technique it calls Smart Weighting, which allocates funds evenly across different industries.

Empower’s ESG screening of stocks is only one example of the socially responsible investing options available via the firm.

An investment audit, 401(k) fee analyzer, and a budget planner are just a few of the many helpful resources available to you at no cost via Empower. The Empower platform requires the creation of login credentials; however, participation in the Empower advice service is optional.

You can see your full financial picture in one location with the help of the free Empower dashboard. Value, cash flow, portfolio balances, and asset allocation are just some of the details that can be seen with a click of a mouse. With the holdings module, you can see how each individual investment is doing, how much it’s worth, and whether or not it’s been a “gainer” or “loser” for your portfolio as a whole.

Empower also provides a spending analysis, which breaks down your monthly costs into several buckets like food, healthcare, and entertainment. Linked accounts’ revenue and overdue debts are also monitored by the software.

Verdict – Hyper-Useful Banking & Tracking…

If you want a simple way to keep tabs on your financial situation, download Empower (previously Personal Capital).

You may connect it to your financial accounts, investments, credit cards, and more to get a comprehensive overview of your financial situation.

While the prices for Empower are more than average, the service is accessible to everybody because of its extensive suite of complimentary features. A group of financial advisers is available to all customers; those who invest $200,000 or more are assigned two advisors to work closely with them.

DIY investors, who can use Empower’s free and comprehensive tools to gain valuable insight into their portfolios, and high-net-worth investors, who can deposit enough with the service to gain access to dedicated financial advisors and the services you’d get when working with a traditional human advisor, should both find something of interest in Empower.

In the $100,000-$200,000 price bracket, investors have access to a team of financial advisers, but at rivals like Vanguard Personal Advisor Services, they can get the same level of care for less.

Pros

- Free financial tracking software

- Finance expert

- Tax-Efficient Retirement Account Withdrawals

- Purchase securities individually

- Free tools for investing big and little

- Financial advisors

- Innovative tax minimization

Cons

- High investment management expense (0.89% AUM)

- New accounts need $100,000

- High monthly management fee

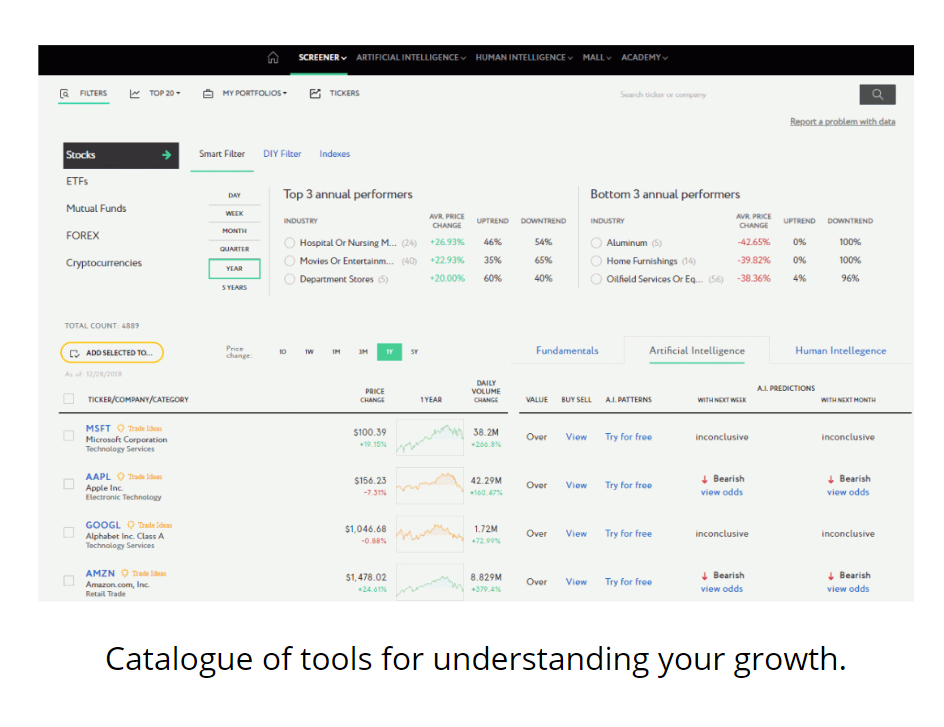

8. Tickeron Review – Top-Rated Stockmarket Portfolio Tracker for AI Algos

Based on our findings, Tickeron is one of the most effective artificial intelligence (AI)-powered stock portfolio management and monitoring software.

That’s owing to its vast library of algorithms and its speed and accuracy in constructing diversified, balanced portfolios with verified performance histories.

Tickeron has a well-designed portfolio management solution for its users. Tickeron streamlines the process of establishing a new investment portfolio to an absolute minimum of effort on the user’s part.

| Offering | Cost |

| Starter | Free to Join |

| Premium | Non-Transparent |

Tickeron will make you a personalised portfolio based on your answers to questions about your age, objectives, investment amount, risk tolerance, and preferred assets (stocks, ETFs). You may always make adjustments to your portfolio, and based on MPT, Tickeron will even give you a diversification score (MPT). The most exciting aspect of a Tickeron portfolio is the use of AI into stock trading decisions.

Full-Service Platform

Tickeron is an AI-driven, user-friendly marketplace designed to maximise your trading potential.

With the use of AI, the platform gathers stock market data and turns it into actionable market insight. Its artificial intelligence stock trading capabilities are much superior to the simple stock screeners most traders employ.

The Tickeron online app is more than just a collection of screens; it’s an all-inclusive trading platform with a wealth of resources for investigation and analysis.

The service provides artificial intelligence bots equipped with niche-specific trading algorithms.

Many trading styles like as swing trading, aggressive trading, long-term plays, gap trading, volume trading, and more may all be accommodated by these automated trading bots.

Trade confidently with Tickeron:

- ✔️ Stocks

- ✔️ ETFs

- ✔️ Crypto

- ✔️ Collective investment vehicles

- ✔️ Forex

While Tickeron is most useful for experienced traders, even novices may save a great deal of time using it. Even if you’ve never traded before, you’ll feel comfortable jumping into Tickeron thanks to the platform’s AI-powered reports and large variety of preset panels.

AI-Powered Analysis with Tickeron 🦾

In order to demonstrate the efficacy of its AI technology, Tickeron makes available an independently verified performance history for each stock Bot it manages.

You can see the full performance summary of a strategy, including its trade amounts, percentage of winning trades, Sharpe ratio, and transaction length, before committing to buying it.

It is also crucial that the AI software’s trading signals from the past can be independently audited. Transparency is essential, and tools like Trade Ideas and Tickeron make it possible to see the results of all past transactions, whether profitable or not.

For investors, Tickeron’s AI-powered stock recommendations are a great resource. In addition, the algorithm may be run on a custom index or watchlist to find trade opportunities in the stocks you choose.

Tickeron also provides cutting-edge portfolios that are constructed by artificial intelligence and have desirable qualities like as diversification and high return. The “GROWING BIG DATA & CREATING BLOCKCHAINS PASSIVE” asset allocation prioritises shares in firms that use artificial intelligence and blockchain technology.

When it comes to stock market AI software, I have to say that Tickeron is one of the best options available because of how professional, advanced, and user-friendly it is. Indeed, you should give Tickeron a go.

Tickeron – How to Make It Work

If you join up for a Tickeron account, you’ll get access to a suite of advanced analytical and portfolio-building tools. It also has a special marketplace where users may find new, specialised services provided by third-party providers.

Tickeron’s stock scanner is only one of many things that you may use without paying a dime. To use it to its best potential, though, you’ll need to sign up for an account.

The stock screener on Tickeron is among the platform’s most valuable features.

Most of all, it’s costless on the business’s website, however you’ll need to create a free account to use all of its features.

Very useful features can be found in the stock screener that is available at no cost. It’s superior to the typical web-based screener because of innovative capabilities like technical analysis scanning and pattern recognition.

Verdict – 🏆 Top Robo for Tracking

Tickeron’s AI Robots are among the top aspects of its service. They’re great for outsourcing your market research. These bots prioritise quality over quantity, reducing how many deals you make.

You’ll need to upgrade to the paid version. Swing trading 🏌️, volume trading, and gap trading are just a few of the many trading strategies that may be automated. See each bot’s trading history without joining, but seeing their current open positions requires membership.

Tickeron also has a powerful portfolio optimizer powered by AI. It’s totally programmable, so you can set it to zero in on stocks that align with your objectives and comfort level.

Once you program your portfolio into the platform, AI trading tools will automatically analyze your positions and show you how to tweak them for optimal performance. The Tickeron portfolio optimizer takes into account several parameters that may be modified by the user.

The best part of this feature is that it offloads the hard work of crunching the numbers and researching by making a machine do the legwork for you 🦿.

Pros

- AI-based stock market analysis

- Pattern recognition and trading rules backtesting

- Flexibility and free membership

- Online networking community

- Portfolio organiser and templates

- Free, intuitive trading alerts and notifications

- Screener covers mutual funds, FX, and crypto

Cons

- The website doesn’t transparently feature prices

- Newcomers may feel overwhelmed

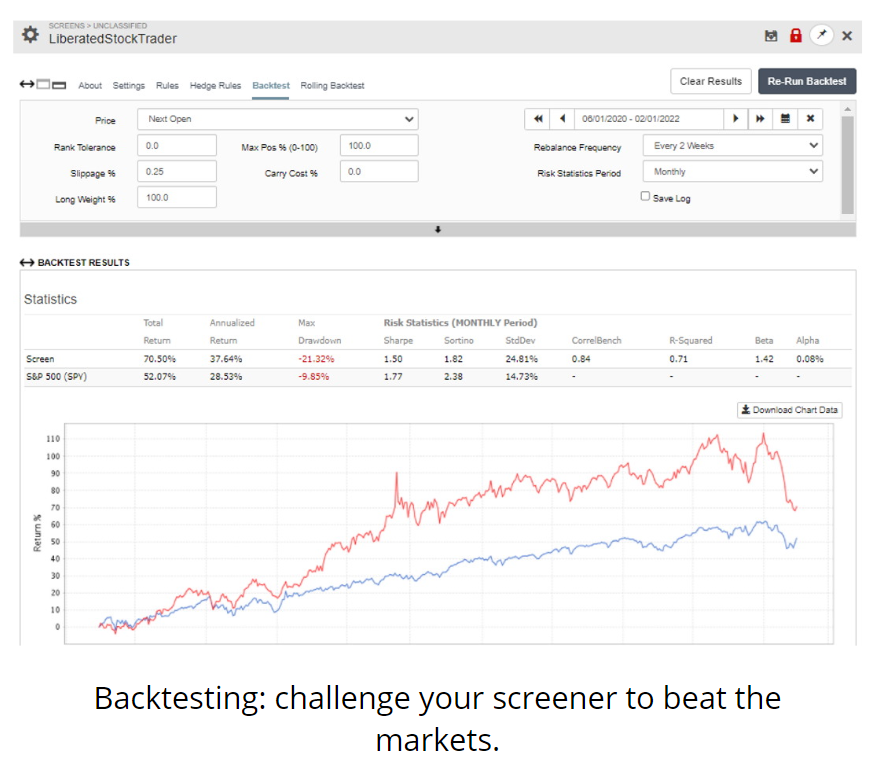

9. Portfolio123 Review – Specialist Stock & Shares Portfolio Tracker for Code Backtesting 💨

Portfolio123 provides an excellent mix of robust portfolio monitoring and a comprehensive 10-year financial record that backtests your investment plan.

Portfolio123’s interface with Tradier and Interactive Brokers is seamless. Portfolio123 will handle profit and loss reporting and automated trading based on rules but you cannot conduct trades directly from charts.

| Offering | Details |

| Starter | Free |

| Screener | Retail Investors $299/year; Non-Retail $999/year |

| Pro Plans | Pricing based on features, starts at $83/month. Discounts available for Retail Investors. |

| Enterprise | Unlimited logins, resources, contracts, solutions, and consultancy. Contact Sales. |

Strategy & Vision – Save Time 📚

Because it’s a specialist tool, Portfolio123’s screener lets you narrow your search to the stocks and ETFs that meet your specific criteria, potentially saving you hours.

By ranking the companies that best meet your criteria, you may narrow down a list of hundreds to just a few using the ranked screening feature in Portfolio123.

Construct your own bespoke worlds by deciding on the broad parameters that will be used to evaluate your ideas. Portfolio123 takes into account 460 factors, including as price changes, forecasts, and technical analysis.

Moreover, Portfolio123 allows you to screen companies based on their performance compared to the S&P500 or any other benchmark, allowing you to construct a strategy for selecting stocks based on their past performance vs the market.

Portfolio123’s Free plan is no-cost, while Screener is $25/month and Pro is $83/month. Portfolio123 is available for no cost, but its full potential is unlocked by upgrading to the paid Screener and Pro plans. The cost of their professional and automated screening services is reasonable in light of the features they provide.

Best Feature – Backtesting ⚙️

Portfolio123’s strong point is its backtesting engine. Portfolio123 provides the greatest backtesting solution for those who are serious about testing basic strategies due to its expert implementation, speed, and high degree of configurability.

You have a lot of control over Portfolio123’s backtesting capabilities, including entry rules, slippage, weighting, rebalance frequency, and custom periods.

Using the Portfolio123 screener, users may put forth their own hypotheses in addition to putting to the test pre-made notions. One’s own universe may be used, one’s own multi-factor rank applied, and either backtests or rolling backtests can be conducted.

The Portfolio123 screener is dependent on high-quality data, and the team behind it has been toiling away to eliminate financial data flaws like missing or unreliable figures in early assessments. Pre-built factors from us efficiently deal with N/As and use many algorithms to arrive at the optimal solution. To sum up, collecting high-quality data isn’t an overnight process; in fact, they’ve been at it since 2004.

In the picture below, you can see a LiberatedStockTrader screener created to beat the markets. For this purpose, a two-year backtest of the screener was run to evaluate its historical efficacy. This screener outperformed the market throughout this time period, returning 70.5% vs the S&P 500’s return of 52.5%.

Also Features a Powerful Stock & Shares Screener 🖥️

By ranking the companies that best meet your criteria, you’re able to narrow down a stock and shares list of hundreds to just a few using the ranked screening feature in Portfolio123. Your own bespoke universes, with your own macro criteria for which stocks to include, may be defined as well.

Having access to over 225 data points should allow you to test out most of your core hypotheses. There are 460 factors to consider in Portfolio123, such as recent estimates and revisions from analysts as well as technical data.

Moreover, Portfolio123 allows you to screen companies based on their performance compared to the S&P500 or any other benchmark, allowing you to construct a strategy for selecting stocks based on their past performance vs the market.

It’s astonishing how many potential indicators can be screened for. Screening options include using a company’s financial statements as the basis for your analysis, accessing technical factors, creating your own factors using period and announcement dates, excluding stocks with wide bid-ask spreads, narrowing your screen to stocks in a specific industry or sector, ranking factors against other factors and stocks in the same industry or sector, and adjusting your factor balance based on economic conditions.

This is a highly sophisticated screening approach I built in Portfolio123; it has virtually infinite rule combinations and is incredibly strong.

In principle, creating a Portfolio123 screener is as simple as going to the Research menu, clicking on Screens, and playing about with the results.

Although coding experience is not necessary to create a Portfolio123 screener, it is recommended. It takes a lot of effort to learn the coding logic and the names of the secret criteria if you want to make better screening rules.

Verdict – Skilled Coders and Charters Choice

While Portfolio123’s interface is straightforward, becoming proficient with it may take some time. It will take some time to get familiar with the layout and develop effective screening techniques.

The pre-made screeners may add convenience, but if you want something genuinely unique, you will need to put in effort. The restricted and non-intuitive charting serves to further bog you down.

Experiments with Portfolio123 find positive results. Swing traders and investors looking for moderate gain over the longer term will find Portfolio123 to be an effective screening and backtesting tool.

Portfolio123 is a fantastic option for advanced stock system creators with strong IT & software skill-sets because of its extensive set of fundamental criteria, 20-year financial database, and the most sophisticated financial backtesting engine.

Pros

- >470 First Sorting Measure

- dA 10-Year Simulation Tool

- Rare 10-Year Retrospect

- Screening Built Models

- 260 Essential Financial Indices

- Zero-Spread Trading

Cons

- No iOS or Android app

- Initially Confusing

- Poor Fair Value and Safety Margin Measurements

- Technical Analysis Graph Improvement

10. The Motley Fool Stock Advisor Review – Best Stock & Shares Portfolio Tracker for Long-Term

If you’re a self-directed investor with a long-term horizon who wants access to professional stock, shares, and mutual fund recommendations, The Motley Fool’s Stock Advisor is where you want to be.

Go elsewhere if you want the help of a financial professional or want to invest automatically.

| Offering | Cost |

| Starter | Free |

| Premium | $99/year, $39/month |

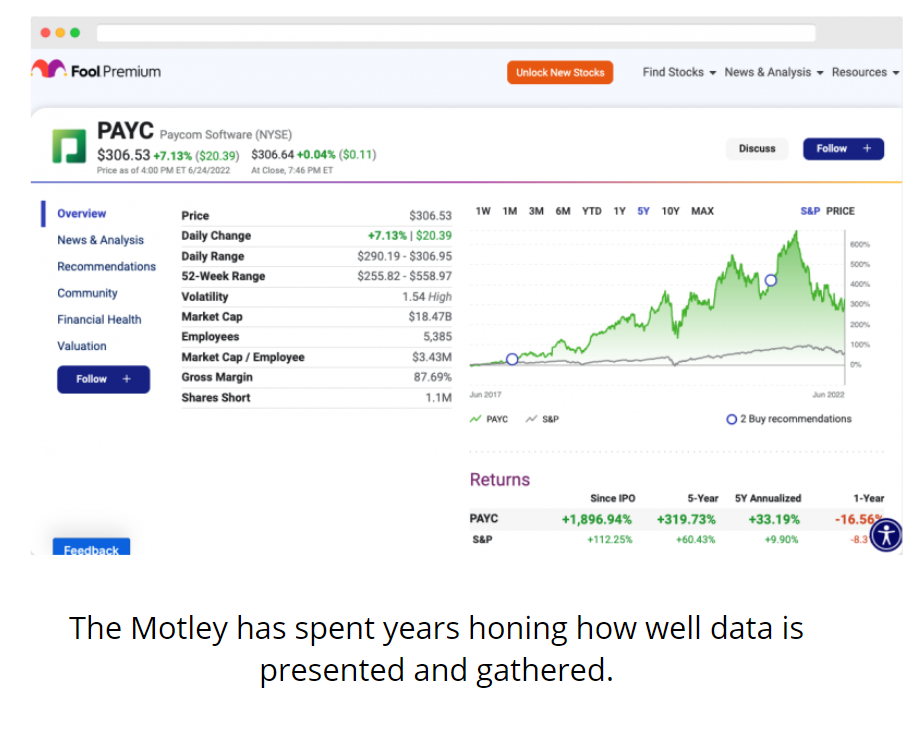

Should you use Motley Fool Stock Advisor? Stock Advisor, one of The Motley Fool’s many premium services, has been around since 2002 and gives subscribers stock recommendations, market analysis, and more. If you’re an individual investor looking for consistent access to equities hand-selected by professionals, this platform is a wonderful option.

Negatives include a lack of portfolio analysis, making it less than ideal for people seeking information on already-established portfolio holdings. Stock Advisor’s primary service is providing advice based on the analysis of its staff.

Advocates for Long-Term HODL…

Stock Adviser is Motley Fool’s flagship product, and its only purpose is to give you with the founders’ best stock selections to outperform the market. The trading tool advocates the buy-and-hold strategy, which is one of my go-to methods of investing.

Moreover, it offers you with a group of active investors that are motivated by high returns and tracks their suggestions over time.

As it not only tracks stock price changes but also gives interesting comments from the service and investors, it is a perfect addition to our list of stock monitoring platforms.

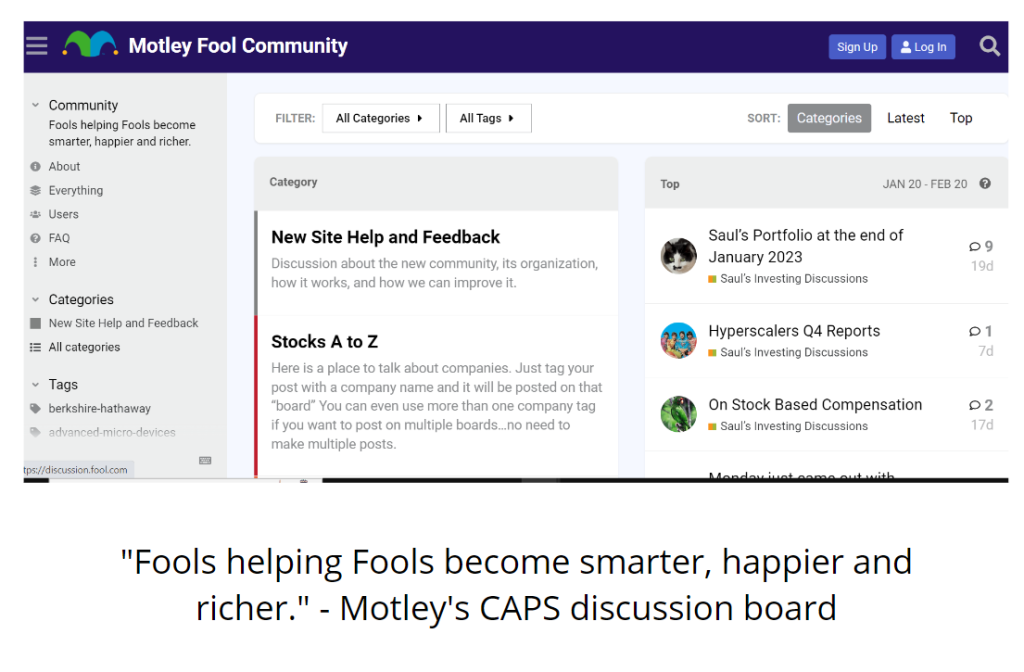

The latter is the opinion of a dedicated group of people who keep tabs on certain equities. Motley Fool CAPS is a forum that aims to aid investors in finding the greatest companies to purchase at the best periods, as well as the worst stocks to avoid.

Motley Fool Stock Advisor CAPS Community

Both tools provide real-time analytics, but the Stock Advisor and CAPS community at Motley Fool give that which is much more valuable: thorough research and expert opinion.

Not to downplay the useful data-driven tracking capabilities of the aforementioned, but this stock advisory service and tracking software offers both qualitative and quantitative tools for monitoring your holdings.

While this approach is unlikely to pique the attention of active day traders, when applied to the correct stocks it may provide superior returns over a variety of trading tactics. This is accomplished with little effort beyond initial research in terms of actively managing the portfolio.

Motley Fool Rule Breakers is the name of the company’s service that focuses on growth stocks. Stock Advisor is still my preferred option since it avoids riskier “moonshot” investments in favour of more reliable “steady outperformers”.

The “Steady Eddies” and “possible high-flying companies” recommended by the investing newsletter are stocks with solid financial fundamentals, as the service sees it.

Stock Adviser provides stock choices with investing rationales, analysis, and information to help you make informed investments in businesses that have a history of consistent long-term performance. If you are interested in investing, you may want to subscribe and become a part of the Motley Fools CAPS community.

Stock Rover vs. Motley Fool Stock Advisor

When looking for a tool to do research and analysis on stocks, investors have two excellent options: Stock Advisor and Stock Rover. Once again, Stock Advisor is the superior platform for novice, intermediate, and expert traders seeking stock recommendations and analysis.

For experienced investors, Stock Rover is the superior option since it allows you to link your brokerage account and do in-depth portfolio research. It also provides a wide variety of other investment resources, such as stock and ETF screeners, research papers, and technical analysis charts. Look at the price list here.

Key Strength – Advice/News for the Financial Markets 📰

From its inception, Motley Fool has provided an abundance of information about finance and investment. Stock Advisor, its stock research and recommendation tool, is revolutionary. Although you can’t conduct trades directly via the platform, it does provide you with the information you’ll need to make educated choices about your investments in your individual brokerage accounts.

The platform may be ideal for you if you are a self-directed investor seeking advice from industry professionals. The following are some of the benefits:

Recommendations 📙: I would say this is Stock Advisor’s most appealing selling point. Each month, users get recommendations for two new stocks to buy. To help members choose assets that are a good fit for their needs, Stock Adviser provides its top stock choices under the Best Buys Now tab.

Market Reports 📙: You may find its stock analysis useful if you put a premium on learning about companies. In addition to the subscription option, investors who just want a report on a single company may do so for $100. Have a look at this for further information.

Finance-related publications & online communities 📙: The platform’s instructional content and virtual investor community might be particularly useful to those new to do-it-yourself investing. In addition, it has a library of investment eBooks and videos.

Stock Adviser is suited for long-term traders who don’t mind letting their assets sit for a while, since the Motley Fool’s investing philosophy is based on the concept that members should invest in at least 25 exceptional companies and hold them for five years.

The prices are reasonable as well 📙: A new member may join for a one-time payment of $99** (the yearly membership charge is normally $199), which works out to around $1.90 per week (or a touch more than $7 per month). Nevertheless, if you want to test it out for a month, you’ll have to shell up $39, and there’s no money back guarantee if you change your mind.

Signing up is as easy as filling out a short form on their website. A credit card is required for subscription payment.

Verdict: B+ Rating

Stock Advisor, unlike The Motley Fool, does not have a profile with the BBB. The Better Business Bureau has given the organisation a B+ for its customer service.

There are a number of additional considerations in addition to the company’s performance and dependability that go into the bureau’s evaluations. Factors like these might help or hinder a company’s chances of success.

According to its BBB page, The Motley Fool has resolved 37 complaints in the previous 12 months. At this moment, there are no outstanding issues that have not been addressed.

Pros

- Initial discount

- Outperforms S&P 500

- High stock pick return average

- News and advice

Cons

- Expensive renewal

- Some stocks lose

11. Firstrade Review – Top Stock & Shares Portfolio Tracker for Full Services 🔢

Firstrade’s services for keeping tabs on stock holdings and preparing for wealth leaps and retirement are top-notch.

There is no cost to use Firstrade. In order to begin trading, you must fund your account after registering for free with this broker.

The table below shows that when it comes to commission-free trading, like Robinhood, Firstrade is your best bet. The fact that Firstrade offers the lowest commissions in the business is clear evidence of the company’s dedication to this area of excellence.

| Offering | Cost |

| Tracking | Free |

| Trading | Commission-free |

While TD Ameritrade, E-Trade, and Schwab have all been compelled to join the $0 Zero fees bandwagon, Firstrade continues to provide the greatest value when trading stocks, options, and mutual funds.

Firstrade offers one of the broadest varieties of commission-free exchange traded funds (ETFs) and zero-cost stock trading you’ll see anywhere. Purchase tech giants like Apple, Tesla, or Amazon. Or any other sector.

Lowest Fees in the Industry 🙅♂️

Throughout the course of its 35 years in existence, New York’s Firstrade Securities has been known as the first major broker to provide fully commission-free trading.

Among Firstrade’s many accolades is the “Clean Hands Kiplinger Award”, as well as honours for best value trading and customer service.

Free transactions with no commissions were a huge risk taken by Firstrade. Firstrade, which was already the winner of one 2018 study for having the lowest commissions in the industry, has now lowered those commissions and fees to zero.

Despite the fact that by 2019, prominent rivals like TD Ameritrade, E-Trade, and Schwab had all switched to offering commission-free stock trading, we remained committed to maintaining our longstanding policy of never charging a fee for any trade. As you’ll see in our commission’s comparison, Firstrade is still in the lead.

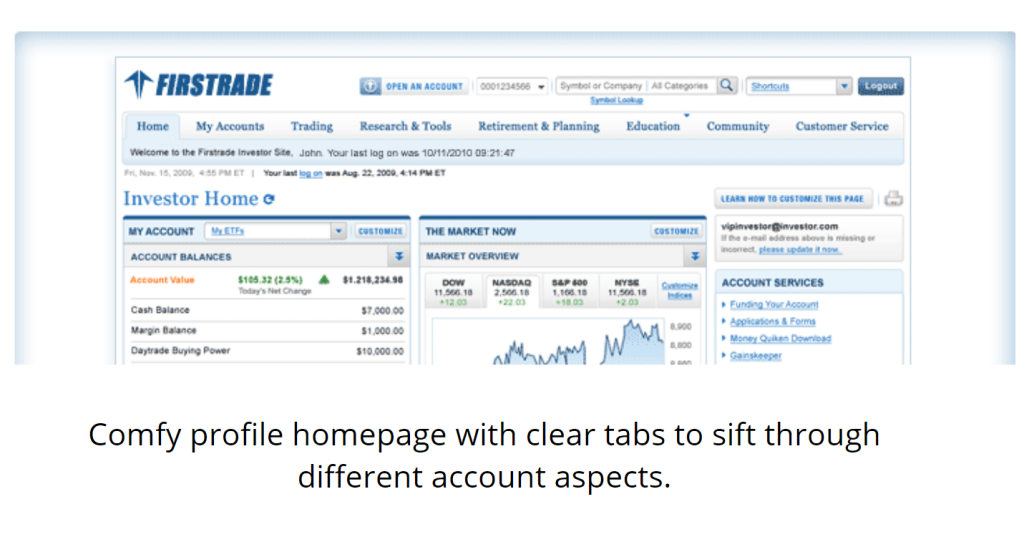

Reporting on the Status of Your Portfolio

Trading on and analysing your watchlist is free with Firstrade, as it would be with any broker. Firstrade Navigator, a well-designed and sturdy system, is used for all of this; it provides quick access to a wealth of information and enables for granular exploration.

It’s very modifiable, and there are many different widgets available for use in the interface. The studies and stock chart indicators are a standard part of the package.

Strong News Integrations

Free research from Zacks, Morningstar Research & Ratings, Breifing.com, and Benzinga News are all available to Firstrade customers (although not the real-time Benzinga PRO version). Since that Firstrade charges no commissions, the value added by these third-party services is clear.

When it comes to commission-free trading, Firstrade is unrivalled and widely recognised as the best broker available. Portfolio Weighting and Rebalancing, as well as Future Income and Dividend Reporting, are two areas where its management service may need to improve. Moreover, automated portfolio management and trading is not available on Firstrade since it is not a Robo Adviser service.

Traders may create an atmosphere that would wow even the most committed day traders.

Verdict – Powerful Commission-Free Trading with Tracking…

Firstrade is a great option for trackers, traders and DIY investors since it offers commission-free stock and options trading in addition to the greatest selection of commission-free exchange-traded funds (2,200) and monitoring tools.

That makes it Firstrade is a great option for brokerage services because of their 5-star customer satisfaction rating, its availability of a wide variety of pension accounts, and their users’ positive experiences with MorningStar.

With a flat charge of $0 each transaction, $0 per options trade, and $0 per contract, Firstrade continuesto dominate the commissions market. Yet, the fact that Firstrade provides access to more commission-free ETFs than nearly any other broker.

Bonds may be bought on a Net Yield Basis and Mutual Funds can be bought for nothing. Firstrade allows you to trade in anything except foreign currency pairs.

Pros

- Top broker for tracking, no commissions, strong infrastructure

- No fees or commissions

- 2,200+ bonuses

- Free ETFs

- Cost-Free MorningStar

- Broker for America, Europe, and Asia

Cons

- No CFDs or FX

- No cryptocurrencies

- Support delays

Best Stock & Shares Portfolio Tracker in 2024 (UK) – Trader’s & Investor’s Buying Guide

The best stock and shares portfolio trackers have just been released, so now seems like a good moment to discuss the sector as a whole.

Several of the companies you hold may well be market goliaths known as “blue chips” and are thus can be safer investments than others.

Today the biggest challenge is balancing speed versus safety. It’s unclear where the biggest advantage lies today; each person’s context differs. But there are further resources to help along your journey, although this isn’t financial advice. It’s always a risk. But with risk comes glory.

[to James Bond] Take the next one. There isn’t enough space for me and your ego. Vesper, Casino Royale

What is a Portfolio Tracker?

You can monitor the performance of your investments with the help of a portfolio tracker. The allocation you have now may be compared to your long-term objectives, and your portfolio’s performance can be measured against the market as a whole.

You may import existing portfolios or build new ones manually to try out different investing methods.

Keep in mind that examining your investments too often might lead to unnecessary trading, but if you want to make sure your asset allocation is on track, a portfolio tracker is a straightforward and useful tool. Every broker has a monitoring and research tool, but you can only use it with your own accounts.

You can receive terrific research if you have a 401(k) at TD Ameritrade and an IRA at Vanguard, but you won’t be able to integrate the two to obtain a whole picture. A portfolio tracker allows you to see your whole allocation in one place, allowing you to make more informed decisions.

Guide: 📚: Stocks Explained

Best Portfolio Monitoring Features

High-quality portfolio trackers provide extensive research tools and a wide selection of investment tickers. Our top picks were based on the following criteria:

Cost. Any of the following portfolio trackers may be used without spending a dime. Some include paid add-ons that improve the experience, but a basic, free approach is essential.

Integrations. Amalgamate a large quantity of your observable possessions. If you can’t monitor the investments you’ve made, there’s no use in using a portfolio tracker. Investing in stocks, bonds, or exchange-traded funds (ETFs)? No problem, a decent tracker will allow you monitor them all. You may even use crypto portfolio monitors.

Speed. It goes without saying that you need a tracker that works swiftly on your mobile device or computer, but update times are equally important. Don’t forget added privacy. The stock quotations on a tracker should be updated in real time or very near to it. If the prices you’re seeing are older than 15 minutes, you can’t make any trades.

Further 📙: Guide to how the Aussie ASX works.

[to Bond] Money isn’t as valuable to our organization as knowing who to trust. Mr White, Royale

Using Your Portfolio Tracker

Allocation of Assets

The first main way to use your portfolio tracker is seeing your asset allocation and comparing it to benchmark indexes like the S&P 500 is a crucial component of any good portfolio tracking tool.

Consider your risk aversion and investment horizon when developing a target allocation. A person who is 20 years away from retirement, for instance, is likely to have a higher risk tolerance than someone who is already retired. Hence, the asset allocation would change based on the timing of the cash needs.

Your preferred asset distribution may need to be revised in light of recent market volatility or personal developments. Hence, it is crucial to have access to a mobile app that facilitates portfolio rebalancing so that your investments better reflect your long-term objectives.

Constant Tracking and Updates

It is essential to have a user-friendly dashboard that allows you to connect all of your investment accounts and manage your portfolio in real-time.

Backtesting is another function that lets you see how your portfolio might have fared with a different asset allocation in the past. In addition, it is essential to monitor your portfolio’s risk and see whether it is over- or under-weighted in any one investment or industry.

Conclusion

In poker, you never play your hand. You play the man across from you. James Bond, Casino Royale

You may want to look into the aforementioned tools for managing and tracking your stock portfolio. With proper use, they may provide unprecedented understanding of your portfolio’s risk profile, asset allocation, and financial standing.

Investing in a diverse portfolio that includes stocks, bonds, alternatives, and more may help you achieve long-term success with your money.

You may learn how to amass riches if you have solid knowledge of personal finance, are committed to investing (either in a diversified stock portfolio or a mutual fund), and are patient.

You should try out the accessible portfolio and stock tracker services by beginning with the free versions

Best Stock & Shares Portfolio Tracker in 2024 📙 – FAQs

What is a portfolio tracker?

A portfolio tracker allows investors to keep track of their individual holdings

How frequently should you check your portfolio tracker?

It is recommended that you review your portfolio once a month for short- to medium-term investments and once every three months for long-term holdings.

What are the top portfolio trackers?

Sharesight, Stock Rover, Kubera, and M1 Finance are just a handful of the excellent portfolio trackers available today.

Why use a stock portfolio tracker?

It divulges information on the net gains or losses from buy/sell transactions made by investors. These reports inform the investor on the makeup of his portfolio and its sub-portfolios in terms of sector allocation and percentage, tracking your eToro holdings or whatever platform you use.

What is the best way to start trading stocks?

Several trading applications are used by Australians just starting out in the market. Getting to know oneself inside and out is the first order of business. Here you can find more information on the software we tested to determine the Best Stock Trading App for Beginners in Australia.

Have fun, and may this information be useful!

Please feel free to share your observations and experiences, and best of luck to you.

You Might Also Like: