Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Australian Income Tax Brackets & Rates (2023–2024)

If you’re learning about taxable income or are considering moving to Australia, you’ll need to know about income tax and the different tax brackets to know how much tax you’ll pay each year.

Your circumstances will determine the income tax you pay and which tax bracket you fall under. So, even if you’ve been paying income tax for a little while already in Australia, you might be on the verge of a pay rise, and any new changes to your income could alter your tax bracket.

Anyone working in Australia and earning above the tax-free threshold must pay income tax. Even if you don’t work but have some income source, you may still be required to pay income tax. In this article, you’ll learn all about taxable income, Australian income tax and the tax brackets.

Table of Contents:

- What Is Australian Income Tax

- What Is Assessable Income

- What Is Deductible From Income Tax

- How Is Income Tax Calculated

- What Are Last Year’s Tax Brackets

- 2023–2024 Tax Brackets and Rates

- Will the Tax Brackets Change 2024–2025

- Conclusion

- FAQs

What Is Australian Income Tax? ➡️

The Australian Tax Office (ATO) collects income tax from working Australians each financial year. In Australia, the financial year runs from 1 July to 30 June the following year. We’re currently in the 2023–24 financial year. Usually, tax is calculated and automatically deducted from your salary. However, if you work for yourself, you’ll have to complete your tax return each year; you have until October 31.

The federal government imposes income tax on the taxable income of individuals and corporations. Any residents in Australia are subject to income tax. So, you must pay income tax when you earn a certain amount. Australia has a progressive tax system, which means the higher tax bracket you fall into, the more tax you pay.

You must pay tax when you earn money from employment, pensions, government payments, assets, investments and foreign income. When looking at income tax, you will come across taxable and assessable income. Taxable income is the total income considered for tax calculation. Assessable income is taxable after reapplying deductions, exemptions and other allowances. Taxes are calculated based on assessment income.

What Is Assessable Income?

Assessable income must be declared in your annual tax return. You may be unsure of what counts as assessable income, so we’ve compiled a list of the different types of income that fall under assessable income:

- Employment income: Any income you receive from full-time, part-time or casual work. Employment income includes any allowances from your employer like car and travel. Any other employment income like tips or lump sum payments when you leave a job.

- Super pensions and annuities: If you’re receiving a pension from your super fund, you may have to pay tax on this income, too. You may need to declare both taxed and untaxed elements as income in the financial year you receive the payments to determine your overall tax obligation.

- Government payments: If you receive any payments from the Government, such as Age Pension or carer payments, you must declare them on your tax return.

- Investment income: If you’ve made an income from interest accounts, dividends or returns from managed funds, rent from an investment property or any capital gains on the sale of an asset.

- Foreign income: If you have clients overseas or make money from somewhere other than Australia, you must declare that income even if it has already been taxed overseas.

Income tax is the most significant stream of revenue in the tax system. Anything that falls under personal earnings, business earnings, and capital gains will be subject to income tax deductions. So, now that you know what assessable income is, it’s time to explore what expenses can be deducted from your income tax.

What Is Deductible From Income Tax? 📝️

Depending on how much money you earn, you can pay a 19% tax rate up to 45%. You only pay tax on everything above the tax-free threshold. Did you know that you can claim back some of your tax? You can claim some of it back for certain work-related things and get a tax refund.

The following are allowable deductions from your assessable income:

- Work-related expenses: If you have to use your own money for work expenses such as claim vehicle and travel expenses, if you incur them as part of your work duties and if your employer does not reimburse them. Other expenses include care of uniforms, the upkeep of your home office if you use your own mobile phone and internet for work, overtime meals, tools and equipment.

- Management of tax affairs: You can claim the cost of managing your affairs if you’ve paid for help with your taxes, including advice and lodging.

- Personal super contributions: If you make a tax-deductible contribution to your super fund up to the annual limit of $27,000, you can claim a tax education and send it to our super funds.

- Interest, dividend, and other investment income deductions: Expenses associated with earning assessable interest or assets such as bank fees, interest on money borrowed to buy shares and additional costs related to assets.

- Donations: If you donate to charities, you can claim under deductible gift recipients. However, you can’t claim a donation if you’ve received a personal benefit in exchange for the donation.

How Is Income Tax Calculated?

Income tax rates depend on your circumstances. There are different tax brackets for different types of residents in Australia. If you’re part of one of the following groups, you may have a different tax bracket than everyone else:

- Australian residents: If you’re an Australian resident, for tax purposes, you must declare income all you’ve earned in Australia and overseas. You’ll be considered an Australian resident for tax purposes if you have always lived in Australia or have come to live here permanently, have been in Australia continuously for six months or more, or are an overseas student who has come to Australia to study and enrolled on a course that’s more than six months long.

- Foreign residents: If you’re visiting Australia for less than six months for a holiday visit or working in various locations around the country, you’ll count as a foreign resident for tax purposes.

- Children: Special rates apply if you’re under 18 and receive unearned income like investment income. For example, if you work a part-time job or receive other income from family trust distribution.

- Working holiday makers: If you have a visa subclass 417 (working holiday) or 462 (work and holiday), you are a working holiday maker.

The tax bracket you fall into will depend on your earnings and how much you’ve made within the financial year. The following section will dive into previous tax brackets and the brackets for this year.

What Are Last Year’s Tax Brackets? ➡️

We have different taxable income brackets for each type of resident in Australia to help you work out how much tax you can expect to pay. You will fall into one of five tax brackets depending on whether you’re an Australian or foreign resident.

Tax brackets typically range from 0 up to $180,001 and over. Last year, there was a low-income tax offset and a middle-income tax offset that helped relieve some of the taxable income tax paid. However, this scheme ended on 30 June 2022.

In the following sections, we share the last year’s tax brackets for all residents. All the following brackets are from the Australian Government and Australian Taxation Office and are for the 2022–23 financial year.

Resident Tax Brackets

The 2022–23 tax brackets are as follows:

- 0 to $18,200: There will be no tax on this income.

- $18,2012 to $45,000: 19c for each $1 over $18,200.

- $45,001 to $120,000: $5,092 plus 32.5c for each $1 over $45,000.

- $120,001 to $180,000: $29,467 plus 37c for each $1 over $120,000.

- $180,001+: $51,667 plus 45c for each $1 over $180,000.

Foreign Residents Tax Brackets

There are 2022–23 tax brackets for foreign residents:

- 0 to $120,00: 32.5c for each $1.

- $120,001 to $180,000: $39,000 plus 37c for each $1 over $120,000.

- $180,001+: $61,200 plus 45c for each $1 over $180,000.

Tax Rates If You’re Under 18 Years Old

You will pay tax on your earnings if you’re under 18 and not an expected person with expected income. You will be taxed if you fall under the following:

- An expected person: Your expected net income is taxed at the same individual income tax rates as an adult.

- Have expected income: If you have a part-time job, your expected net income is taxed at the same individual income tax rates as an adult.

- Expected income and other income: Your expected net income is taxed at the same individual income tax rates as an adult, and any other income, such as family trust distribution, will be taxed at higher rates.

- Have only other income: If you have other income from family trust distribution, it will be taxed at higher rates after taking away dedicated claims for that income.

These are the following tax brackets for under 18s:

- $0–$416: You will pay no tax on this income.

- $417 to $1,307: Nil plus 66% of the excess over $416.

- Over $1,307: 45% of the total that’s not expected income.

Working Holiday Makers Tax Brackets

The 2022–23 tax brackets for working holiday makers:

- 0 to $45,000: 15c for each $1.

- $45,001 to $120,000: $6,750 plus 32.5c for each $1 over $45,000.

- $120,001 to $180,000: $31,125 plus 37c for each $1 over $120,000.

- $180,001 and above: $53,325 plus 45c for each $1 over $180,000.

2023–2024 Tax Brackets and Rates 🔎️

Taxable income and income tax haven’t risen over the past year, which is a good sign for taxpayers. The Australian Government has been consistent with their brackets for all types of residents from last to this financial year. All these brackets are from the Australian Government and Australian Taxation Office and cover residents across all Australian states.

The following sections share this financial year’s tax brackets for all residents. All the following brackets are from the Australian Government and Australian Taxation Office. None of these graphs includes the medicare levy, medical levy surcharge, or other tax offsets.

Resident Tax Rates

If you’re an Australian resident, this section will be most beneficial. But before we look at the brackets, let’s dive into what paying personal tax income means.

You can earn up to $18,200 without paying taxes. However, for everything you earn above $18,201, you must pay tax on this income. The more you earn typically means that you will pay more tax. However, a huge misconception is that you’ll pay tax on all of your income, and that’s not true.

For example, if you get a pay rise and you move from the low back into the next, although the personal income tax rate is higher, you only pay the extra percentage on the amount over the tax-free threshold. So, if you now earn $20,000, everything above $18,201 is tax payable, not the whole amount, just the additional $1,799.

The tax brackets are as follows:

- 0 to $18,200: There will be no tax on this income.

- $18,2012 to $45,000: 19c for each $1 over $18,200.

- $45,001 to $120,000: $5,092 plus 32.5c for each $1 over $45,000.

- $120,001 to $180,000: $29,467 plus 37c for each $1 over $120,000.

- $180,001+: $51,667 plus 45c for each $1 over $180,000.

Foreign Residents Tax Brackets

If you’re visiting Australia for less than six months for a holiday visit or working in various locations around the country, you’ll count as a foreign resident for tax purposes. There is no tax-free threshold for foreign residents.

There are three tax brackets for foreign residents:

- 0 to $120,00: 32.5c for each $1.

- $120,001 to $180,000: $39,000 plus 37c for each $1 over $120,000.

- $180,001+: $61,200 plus 45c for each $1 over $180,000.

Often, you aren’t required to pay the Medicare levy tax, but that’s subject to holding a Medicare entitlement statement.

Working Holiday Makers Tax Brackets

You are a working holiday maker if you have a visa subclass 417 (working holiday) or 462 (work and holiday). If you’re on a working holiday in Australia, you’ll be expected to pay tax on any earnings. There is no tax-free threshold for holiday makers in Australia.

The tax brackets for working holiday makers:

- 0 to $45,000: 15c for each $1.

- $45,001 to $120,000: $6,750 plus 32.5c for each $1 over $45,000.

- $120,001 to $180,000: $31,125 plus 37c for each $1 over $120,000.

- $180,001 and above: $53,325 plus 45c for each $1 over $180,000.

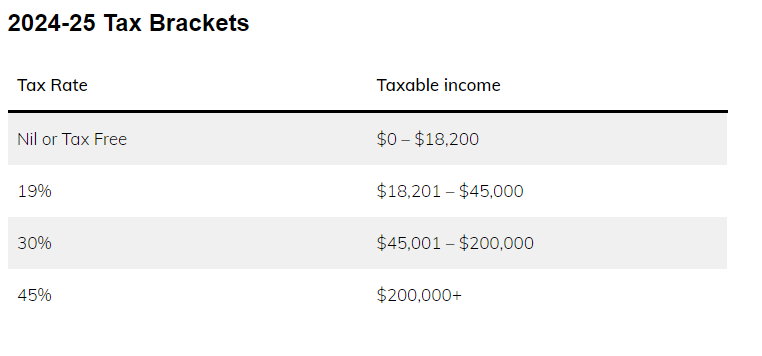

Will the Tax Brackets Change 2024–2025?

There will be a change in tax brackets next year. The Australian government is abolishing the 37 per cent tax bracket entirely. Australian residents earning over $41,000 will only pay 32.5c for each dollar up to the top marginal tax rate threshold. So, in 2024, the marginal tax rate bracket will be readjusted to $200,000.

The above graph shows your expected changes in the tax brackets next financial year. There may be changes between now and then, so keep an eye on the government website for future tax changes.

Final Thoughts 💡️

If you still need to figure out how much income tax you’ll pay, you can use an income tax estimator or a Tax withheld calculator to give you a more exact amount of tax you can expect to pay based on your earnings. If you’re wondering if tax changes depending on where in Australia you are, it doesn’t. All tax brackets are the same for all Australian states.

Refer to the Australian Taxation Office for potential tax liability or bracket changes. Any changes to income tax and other taxes will be updated for residents to see.

Frequently Asked Questions 🗯️

What Is the Tax-Free Threshold?

As an Australian resident, you can earn up to $18,200 without paying taxes. However, for everything you earn above $18,201, you must pay tax on this income. The more you earn typically means that you will pay more tax. However, a huge misconception is that you’ll pay tax on all of your income, and that’s not true.

If you’re a foreign resident or working holiday maker, there is no tax-free threshold, so you’ll be expected to pay tax on your earnings. How much tax you’re expected to pay will vary between brackets and earnings.

How Much Is Tax in Australia for Foreign Residents?

There are different tax brackets for foreign residents. How much tax you pay will depend on your taxable income. There are three tax brackets:

- 0 to $120,00: 32.5c for each $1.

- $120,001 to $180,000: $39,000 plus 37c for each $1 over $120,000.

- $180,001+: $61,200 plus 45c for each $1 over $180,000.

The higher your taxable income, the more income tax you pay. There is no tax-free threshold for foreign residents, but the good news is that the tax rates haven’t increased in the last year.

What Are the Australian Income Tax Brackets?

You will fall into one of the taxable income brackets if you’re an Australian resident. The brackets are as follows:

- 0 to $18,200: There will be no tax on this income.

- $18,2012 to $45,000: 19c for each $1 over $18,200.

- $45,001 to $120,000: $5,092 plus 32.5c for each $1 over $45,000.

- $120,001 to $180,000: $29,467 plus 37c for each $1 over $120,000.

- $180,001+: $51,667 plus 45c for each $1 over $180,000.

How Much Is Medicare Levy?

The Medicare levy helps fund some of the cost of Australia’s public health system. The Medicare levy is 2% of your taxable income, and you must pay it in addition to other taxes. You may have to pay a Medicare levy surcharge if you earn over $90,000.

What Is Income Tax?

The federal government imposes income tax on the taxable income of individuals and corporations. Any residents in Australia are subject to income tax. So, you must pay income tax when you earn a certain amount. You must pay tax when you earn money from employment, pensions, government payments, investment and foreign income. When looking at income tax, you will come across taxable income and assessable income.

How Do I Get a Tax Refund?

You can lodge a tax return online when you submit your annual tax report. You need to visit the AOT website and process your return. You can lodge your tax return online with myTax, a registered tax agent who can lodge a paper tax return.

You Might Also Like: