Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Long Term Investments (2024: Australia – An Honest Guide)

Are you angry, afraid, or feeling you don’t want to miss out?

This is what happens when you get trapped in short-term thinking. Which is the absolute opposite to what we could call ‘long-term awareness’. But how can you switch channels?

Head to the buying guide, to find out how, before checking out our top long-term investments.

Table of Contents:

- Must Read

- The Truth

- 1. Gold

- 2. Silver

- 3. Farmland & Agriculture

- 4. Developing Skills

- Best Long Term Investments

- FAQs

Must Read 📙

Overall, data is highly untrustworthy these days. In today’s environment, it’s key that you develop proper awareness of data propaganda.

In the words of Tom Luongo, a Research Chemist in his past life, goat farmer, and an Austrian Economist whose publications are on sites that include Zerohedge, Lewrockwell.com, Bitcoin Magazine and Newsmax Media:

“Shore up your life: get rid of your counterparties [where you’re dependent on somebody else staying solvent during a crisis], get rid of your debt, get rid of your obligations, be cash-flow positive, and build up your network of communications of people you trust.”

“The best you can do right now is try to survive it, don’t try to thrive, unless you’re very good at picking stocks.”

What’s Really the Best Long Term Investment in Australia? 📈 – The Truth

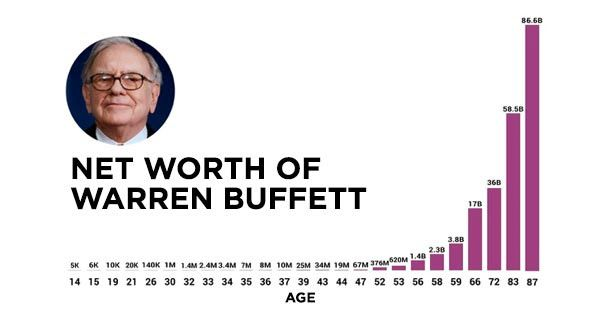

Have a look at this graph of Warren Buffett’s net worth over time. The first thing you might be thinking is that it will take you until you are eighty years old to earn enough to retire.

In fact, this graph would look the same if you compared his net worth from ages 21 to 31. The point is, that this is a pattern that happens when you have long-term awareness versus short-term thinking. (He was worth $1 million at 30 years old.) Not easy, but it’s effective.

Guide – using long-term awareness

Top Long Term Investments – Reviews 2024 🇦🇺

None of this is investment advice ⚠️

1. Gold – Best Long-Term Investments Store of Cash

Last time I checked, gold (how to buy gold) was at a considerable low, making it a decent time to hold some long-term. But obviously the value of gold changes.

This is one of the few investments I can actually recommend, for if you have extra cash you want to store in case inflation worsens. Gold has a long history that goes all the way back to antiquity. It may have been used more than 2000 years ago as a form of currency.

Gold was discovered by people in its natural form in rivers all across the globe, and most historians believe that it was one of the first metals that people used – and over time it became a central feature for many different cultures, due to its malleability, brilliance and natural beauty.

The Egyptians also used gold, with it being the capstone of the Pyramid of Giza. It became a sign of social status. In Ancient Greece, gold became a symbol of wealth and a form of currency. (Although, they didn’t actually award gold medals to athletes).

The Aztecs and Incas also used gold. So gold was common for ancient civilisations.

The Gold Standard

So how about today? The long and short of it is that gold – also considering its long track record across time – seems to hold up as a long-term holder of value.

Make no mistake, gold is probably not an investment to make if you want to amplify the value of your investment. But in a period of high inflation, gold can be used to hold cash savings. Compared to holding cash, which might reduce value due to inflation, gold tends to hold up across time.

In the modern era, we saw the gold standard become passed by the U.S. Congress, meaning that it became even more stabilised by becoming fixed against the dollar.

And despite the gold standard being no more, there is still a tracked, ‘set’ price on the various financial exchanges.

Pros

- Could be a strong way to ‘lock in’ the value of extra cash

- Gold has a long and rich history

- Great alternative to extra cash savings

Cons

- Not great for actually making money

- Gold will probably shoot up in price but only after the dollar stabilises

2. Silver – Second Top Long-Term Investments Alternative to Cash

Silver ranks as the next-most valuable precious metal to gold that is traded in high-volume. Indeed, at one point, there was also a silver standard that ended earlier than the gold standard.

Silver also has a long history, where it has supposedly been used as a form of value and tender for over 4000 years.

Because silver is no longer legal tender, the main use of silver comes down to its properties, which make it useful for manufacturing a range of products including clothing, medical uses, photovoltaics, as well as HS compliance solder.

These applications are also increasing, including for food hygiene, water purification, preserving wood, and RFID tags. Overall, a 2010 study showed that more silver was being used for industrial purposes (487 million ounces), jewellery (over 160 million ounces) and by investors (a bit over 100 million ounces).

Less Stability Than Gold

The value of silver supposedly highly depends on supply and demand as well as speculation, as with the majority of commodities.

Overall, precious metals historically hold value over time, and this has been the case for thousands of years. But the value of silver is infamously more volatile in comparison to gold because the market is smaller.

Also, the market is less liquid and demand oscillates more greatly across investment and industrial demand. Today, there is great supply-chain instability. And also keep in mind that purportedly the price of silver has exponentially increased since 2005.

Pros

- Could be a strong way to ‘lock in’ the value of extra cash

- Great alternative to extra cash savings

Cons

- Less stability than gold

3. Farmland & Agriculture – Powerful Long Term Investment

Almost half of Australia’s farmland was bought in 2021. So if investing in farmland sounds surprising, it shouldn’t.

As the world’s leading powers shift and influence and supply chains are severely impacted by this tension, the ability to produce things you can live off directly from the land sounds much more appealing to people than it once did.

Not only can you support a family, if you create a homestead, you can also become the cornerstone of a local community – providing people with valuable produce and supporting other families.

Ways of investing in farmland

The most direct way to invest in farmland is to either convert the land you already have into a small garden that grows food (and let it grow into a bigger production of the time), or to buy new land elsewhere that is either farmland or that can be converted.

For the average person, especially if they are renting accommodation or live in the inner city, it will be challenging to create growing land (some people have managed to grow produce indoors in tubs and barrels), but there is a hard limit such as having chickens if you live in the city.

So the third option is to invest in farming productions, by investing in the agricultural sector. There are numerous ways to indirectly invest in agriculture, ranging from agricultural exchange-traded funds (ETFs) to form REITs and the commodities markets.

Farm REITS

These are reportedly the nearest an investor can come without actually owning a farm themselves. Farm focused real-estate investment trusts (REITs) include names like Gladstone Land Corporation (LAND) and Farmland Partners Inc. (FPI).

These entities typically buy farmland and then rent it to farmers. So when you invest in an REIT, you are often investing in more than one farm, and perhaps in a wide geographic region.

Agricultural shares

When you invest in agricultural stocks, you are accessing one of the many publicly traded firms that carry out activities in the farming sector. These companies include those growing and producing crops directly as well as those who have industrial relationships that support farmers, including:

- Seeds and fertilisers – companies that assist with the production and selling of fertilisers and seeds.

- Machinery – farmers require a lot of different equipment to carry out their activities – two names include AGCO Corp. (AGCO) and Deere & Co. (DE).

- Processing and distribution – those who create the supply chain infrastructure for getting crops and produce from the farm to market and even local grocery stores. Two names to note are Bunge Limited (BG) and Daniels Midland Co. (ADM).

ETFs and mutual funds

Exchange-traded funds can give investors diversified access to the agricultural sector. For instance, the VanEck Agribusiness ETF (MOO). Mutual funds do the same and only technically have some differences in how they work.

Commodities

There’s been quite a lot of volatility with the commodities industry, due to the tension between the diminishing Western powers and BRICS nations, which includes Russia and China. This makes it tricky to tell what domino effect you’re investing in. However, it’s possible to directly invest in commodities, including grains (GRU), corn (CRN), livestock (COW), coffee (JO), and more.

Pros

- Farmland is high-value

- Farmland value will grow even more with time

- Indirectly invest in farmland

- Become the cornerstone of a local community

Cons

- Difficult to directly buy farmland

4. Developing Skills – Top Long Term Investment for Hard Value

The next best thing to directly growing food, that you will live and support on, is to have skills that your local and the wider community need…

There is extraordinary diversity with what your valuable skill could be. For instance, you may be a skilled programmer, helping to keep databases and system networks afloat.

Or a plumber keeping homes working smoothly. You might be a performer who is skilled at an instrument, helping to support inns, public events, and a loyal audience.

Either way, a powerful long-term investment is investing in skills needed in order to provide value to others. This will involve learning your craft, practising, and investing energy into furthering things.

Udemy

Udemy is one of the most popular marketplaces for students acquiring new and sharpening pre-existing skills – with a wide selection of topics and mentors.

The most powerful way of understanding this process is that, generally speaking, the hard work and dedication you put into acquiring and furthering skills that you have now will probably not show results in the short term – but long-term, you will get the exponential benefits.

Start now – when you really begin to get the advantages of both skills, you might even struggle to remember all the hard work that you put in that got you them!

Pros

- Develop valuable skills that support you for a lifetime

- Support and offer value to others

- Grow in your skill

Cons

- You can’t be lazy

5. Special mention – Bitcoin

Bitcoin deserves mention in this guide and can be seen as a potentially attractive long-term investment for several reasons.

Firstly, Bitcoin operates on a decentralised network known as blockchain, which ensures transparency, security, and immutability of transactions. The underlying technology has demonstrated its resilience and ability to function independently of centralised authorities, which appeals to those seeking a decentralised and trust-less financial system.

Secondly, Bitcoin has a finite supply, with a maximum limit of 21 million coins. This scarcity factor, coupled with increasing global adoption, has the potential to drive up the value of Bitcoin over time, as demand surpasses supply.

Additionally, Bitcoin has exhibited significant price appreciation since its inception, albeit with volatility. This has attracted investors who believe in its potential as a store of value or digital gold. As more institutions and individuals embrace Bitcoin, its market acceptance and liquidity continue to grow, further solidifying its investment appeal.

Moreover, Bitcoin serves as a hedge against traditional financial systems and macroeconomic uncertainties. In times of economic instability or inflationary pressures, some investors turn to Bitcoin as a means of diversification and protection against potential risks.

However, it is important to note that Bitcoin’s value is subject to market fluctuations and regulatory developments. As with any investment, thorough research, risk assessment, and understanding of the market dynamics are crucial before considering Bitcoin as a long-term investment option.

Best Long Term Investments – Buying Guide 📊

This section is unlike any other investment blog you’ve ever seen. While they sell you a dream, this section will be dedicated to bringing you down-to-earth.

What are Long Term Investments?

Long-term investments are sometimes impossible to see unless you already have the right kind of awareness. For instance, many traditional investors believe that gold is a great investment because it tends to hold its value even in economic downturns.

Precious metals are overall similar, because they are useful for manufacturing. For instance, copper is useful for coinage and plumbing, while gold is highly malleable and very resistant to corrosion, and other metals are vital for certain industries.

But knowing that much alone doesn’t make those things good long-term investments. A good long-term investment ultimately comes down to the person who is investing.

So this section goes far deeper than just the surface level, giving you a look into the kind of character that is required to invest well over the long term – so that you are resistant to the troubles of the times.

The question is, are you in a state of emotionalism and lots of obsessive thinking? If so, you probably are not in a state of awareness.

Using Long-Term Awareness

The things that are good for you often suck in the short term, whereas things that are bad for you can often feel amazing in the moment. There are about a million instances of this…some of which I’m sure you will be familiar with first-hand:

- Not committing to learning a challenging skill like data science, or to building a strong marriage, might be the easy way in the short term. Yet in the long term you suffer, such as lots of empty memories without actually growing your abilities or starting a family – and it can make it harder for you to do the right thing later on.

- Eating a bowl of ice cream tastes amazing, but leaves you with a terrible stomach and a foggy mind, just to mention two bad health consequences.

- Being frugal with your money and lifestyle can seem to outsiders like you are unsuccessful, but will lead to you being able to afford your own house, retire early, support your family, and so on.

Long-term thinking is about training yourself to act in the opposite way to all of the above. It’s not a single action, neither is it a single investment opportunity. It’s about the things you focus on.

As with the often told stories about lottery winners who later become broke, if you were already on the path to good long-term thinking, money will amplify this – however if you have the habit of being short-term with the things you do, money will only send you into a rockstar spiral to the bottom.

You will know that you are in a spiral of short-term thinking when the following happen:

- You constantly doubt yourself.

- One moment you have strong self-confidence and the next moment you feel like you are worthless.

- Just when you are close to completing the project and achieving success, you sabotage yourself and quit.

- You are always in debt and never manage to save up anything more than a few hundred or maybe a few thousand dollars – whenever you save a bit, you end up spending it!

This kind of cycle makes it completely impossible to have long-term investments. Even when you invest in something that could potentially be a long-term investment, all of your motivations will end up making that action fail.

Admittedly, there is definitely some luck involved. Perhaps you will be lucky despite having all of the above internally going on. But there are plenty of examples that show the costs that come with living in a state of short-term emotionalism. They say that people make their own luck through being prepared to seize opportunities when they arise.

Case Study 1 🍢: The Marshmallow Experiment

This experiment was created by Walter Mischel, in order to test young children’s ability to delay their gratification.

Young children were grouped together and each given two options. They could either have one marshmallow now and eat it straight away, or get two marshmallows if they waited for the interviewer to leave the room and return.

This simple experiment revealed that most kids did not have the impulse control to not eat the marshmallow straight away. But a very small group of kids did delay longer.

Years later, researchers who ran the test numerous times on different children over the years discovered a surprising thing that they were not even testing for. Children who had been able to delay gratification during the test had significantly higher cognitive capabilities as well as the ability to deal with frustration and stress – also scoring higher SAT scores.

And according to some reports, it also correlated with a large spectrum of positive results later in life, ranging from physical health to academic success.

Case Study 2 💊: Valeant Pharmaceuticals: How Not to Run a Company

Valeant Pharmaceuticals was a successful business leading the way in developing new pharmaceuticals for a range of conditions, including diabetes.

The company was eventually brought up by a highflying CEO, Michael Pearson, who developed a name for himself and stardom for completely transforming the company and flying private jets and attending basketball games where he sat in the front rows.

Investors flooded to get a piece of the hot company that had a meteoric rise on Wall Street. But behind-the-scenes there was an accounting scandal and all sorts of aggressive tricks – like a 500% spike in the price of one diabetes drug – being used to mask its floundering state. This led to the company plummeting from Wall Street and being sued and forced to pay $45 million in settlements.

Why did the company that was so successful fail so abysmally?

Michael Pearson was very good at managing perceptions and encouraging investors to believe that the company was transforming the pharmaceutical landscape. He managed to get the company to have unprecedented profits.

But how exactly did he accomplish this? By closing down all of the research and development departments. These departments had been very successful over the years in creating lucrative drugs to treat medical conditions.

In the short term, the company experienced unprecedented increases in market value, making it a hot commodity on Wall Street. But because it closed research and development, eventually the competition gained more and more advantage over it – until the only way for it to compete was to fiddle with accounting and to spike prices of its old drugs.

Short-term thinking with zero long-term awareness.

The Trick 🎱: Principles of Long Term Investments

The short-term thinking cycle can be so spellbinding: a person burns out all of their best years of productivity, so that they end up broke for the whole of their life as well as with other consequences such as bad relationships, poor health, and overall self-destructive habits.

The trick to breaking out of this spiral is simple but requires commitment. Simply put, you need to develop awareness that this cycle is happening. The moment that you have this awareness, you have the opportunity to break the spell.

However, it’s not enough to simply know that you know that short-term thinking is destructive, you also have to develop and practice this awareness:

- ☑️ Doing nothing for at least a few minutes or longer when you first wake up and before you go to bed. Rather than meditating, just be aware without any agenda.

- ☑️ Find quiet spaces during the day. Rather than immediately turning your radio on when in the car, driving in silence for a while.

- ☑️ Practice being aware of when you have extreme doubt, fear, happiness, excitement – or any emotion or thoughts.

These practices help you to begin to see the connection between things you own and do and the trajectory of your life. For instance, having a massive television in your living room isn’t costly because it is expensive, but because it demands that you watch it each day!

Anti-Fragility

Anti-fragility is something growing stronger when put under pressure or even an attack. A very simple example of this would be pumping weights at the gym.

In the short term, your muscles will tear slightly causing soreness. But long term, you can potentially grow more muscles and be even stronger than before you started going to the gym.

Long-term awareness works in a similar way. The more that you become aware of the narrow path of awareness of your emotions and various impulses, rather than reacting in the moment to your various desires, your ability to do this grows stronger.

When you have the choice to use the gentle slope or to take the hill, you would take the hill if you see that this is the better path, even if it sucks more in the short term. At some point, you’ll reach the point where you love the hill.

FAQs

What’s the Biggest Mistake Entrepreneurs and Investors Make?

Most people take the short term path. Just think of Instagram: you post and then get a bunch of lies. This is training you to get instant gratification. Do the action, get an instant reward – to get a chemical reaction in your brain. This is how slot machines work and it’s extremely addictive. You find this everywhere life now:

- You want fast food that tastes great.

- You want instant business results that make overnight riches.

Because of this need for short-term gratification, you make poor long-term decisions and end up destroying your health and business in the future. So the opposite approaches:

- ☑️ Go to the gym and work out – it sucks now but afterwards you feel great.

- ☑️ If you are eating healthy now, it’s not so tasty – but afterwards you feel great.

- ☑️ If you read difficult books now, it’s not so awesome – but in the future you will be smarter.

How Can I Be Successful at Long-Term Financial Investing?

Forget the gimmicks, forget the financial markets, the special deals and latest trending opportunities. The hearthstone of long-term investment is to train yourself to use common sense rather than seek instant gratification. This leads to you making decisions that are long-term good for you even if they are sort of boring in the short term.

Oftentimes, the big gnarly thing that you don’t want to take on will give you a second order consequence of being far ahead than you would have if you always went for the downhill slope. So don’t allow negative emotions or arrogance to stop you from doing the common sense thing:

- ☑️ Downgrading your lifestyle, such as living in a smaller accommodation.

- ☑️ Ignoring fashion trends like that hot new car.

- ☑️ Focusing on building up credit (savings) rather than borrowing and getting into debt.

What Is Long-Term Awareness?

That’s a question for the gurus and prophets – but we deliberately named this awareness rather than thinking because there does seem to be a difference between the two. Thoughts tend to drag you into your emotions and worries, whereas awareness is contemplative without obsessive ideas. Having a sense of peace is probably the right direction.

Final Thoughts

Second-order consequences come about from a person’s level of awareness. Those who have poor awareness of themselves and their patterns of behaviours will inevitably end up severely limiting their talents.

For instance, someone may be a higher-earning doctor, but then they end up with an expensive luxurious lifestyle that they then have to keep up: the cars, the holidays, and a massive family home. This bleeds them dry so that they constantly have to work just to keep up the lifestyle.

An enormous number of high-earning professionals end up depressed and drained because of the cycle. So any long-term investment begins with the right attitude; long-term awareness. Practice this before you run into the first long-term investment opportunity – as it probably won’t last without it.

You Might Also Like: