Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

CFD Trading in Australia for Beginners

Another addition to your long list of confusing acronyms: FB, ONSs… now CFDs.

This less cheeky one stands for ‘Contract for Difference.’ CFDs basically let you place a deposit instead of buying the full trade.

In fact, you’re not buying the contract directly. You’re entering into a contract with a CFD broker. They’ll stake the trade enough for you to open a position for a fraction of its full value.

This does stretch your investment capital further, which is a key benefit to using CFDs ie. you can start trading without having the coin to hand. But the risks? Well, bigger losses if a trade goes bad.

Disclaimer

CFD trading is dangerous for those with no experience in the stock market. Honestly, I would not recommend it to anyone except intermediate traders and experts.

Another concern is security:

To not get affected by compromised accounts—just as with best practices when paying with your credit card online—always be sure you’re protected with all the security you need, whenever trading online. That said, let’s have a look at CFD trades for beginners.

Table of Contents:

- How CFDs Work

- New CFD Regulations (2021+)

- What are the costs of CFD Trading

- What Instruments Can I Trade

- Advantages of CFDs

- Disadvantages of CFDs

- CFD FAQs

How CFDs Work

Let’s explain; CFDs have grown enormously in popularity in the last decade because less upfront capital is needed to participate.

How do CFDs work? You’re creating a legal agreement rather than buying a trade directly. This obligation focuses exclusively on the price change between your open and close positions.

This covers the broker from any losses. The contract stipulates that you, the buyer, must pay the seller for the difference between whatever the asset’s value was, at the contract’s creation, and its current value.

The underlying value of the assets is not factored into this agreement. Nor is any stock, commodity, forex, or futures exchange utilised. Securities and derivatives are viable financial products for CFD trades.

Fair warning: CFD trading is an advanced, very short-term trading strategy only for experienced traders.

Keep in mind also, when doing a CFD trade, there will be no delivery of physical goods or securities. And CFD investors never actually own any underlying asset but rather gain revenue based on that asset’s price change. For instance, instead of selling or buying physical silver, a trader can simply speculate on whether the price of silver will go up or down.

⭐ In essence, traders who use CFDs are making bets about whether or not the price of an asset or security will increase or decrease. Traders can therefore choose an upward or downward direction.

Quick Example

What is CFD trading? A handy demo:

You’ve purchased a CFD on the SPDR S&P 500 (SPY), with 5% down for the trade. A month later, the asset reaches $60 more per share from opening.

You bounce from your kitchen counter, steaming fresh-made coffee to hand, flip out your phone app and offer your holding for sale. In this instance, the net difference between the original purchase price of your CFD, and the price you sell it for, will be netted together.

This net difference, say $3,000, represents your gain (the trade is settled through the investor’s brokerage account—and duly completes the contract you and the CFD buyer agreed to).

In the other direction, you’ve entered into a CFD trade believing an asset’s value will fall—so you placed an opening sell position with the same 5% down. To close that position at a profit, you would need to purchase an offsetting trade once the value drops. The net difference of that “loss” is cash-settled through the brokerage’s account—that’s essentially how CFDs work.

New CFD Regulations (2021+)

But how do CFDs work today? To dive deeper, the CFD industry is not yet highly regulated and so isn’t allowed in certain countries, such as the U.S. To protect yourself, it’s therefore important that you look at your brokerage’s credibility and reputation before selecting.

So what is CFD trading? Well, it differs by territory.

Countries You Can Trade CFDs…🌏

- CFD Regulations AU– From 29 March 2021, the Australian Securities and Investments Commission (ASIC) introduced a new set of rules for around over-the-counter (OTC) CFD trades. To improve both the industry standard and retail trade outcomes by reducing the available CFD leverage: margin rates on certain CFDs were reduced, funds in your CFD account must be at least 50% of the margin required for all of your open CFD positions—among other changes.

- CFD Regulations UK– Back in October 2020, the Financial Conduct Authority (FCA), UK regulator, announced it would ban the sale of derivatives referencing certain types of critical assets to retail consumers. This has been in effect since January 6, 2021. While crypto CFD trading has been a large and rather lucrative business for retail FX brokers, the FCA supported its decision by saying poor consumer understanding of cryptoassets, extreme volatility in price movements, and the risk of cybercrime—made it too much risk.

- Other countries that allow CFDs– The list includes Belgium, Canada, Denmark, France, Germany, Hong Kong, Italy, Switzerland, Singapore, Spain, South Africa, the Netherlands, New Zealand, Norway, Sweden, and Thailand. Note that in some cases such as in the U.S., even if you cannot trade as that citizen, certain non-residents can still trade CFDs while in the restricted country.

What are the costs of CFD Trading?

Market data fees:

The CFD trading platform you use may require you to activate a market data subscription in order to view price data for CFD shares. This may cost you an extra fee.

Holding costs:

At the end of each trading day, a position still count may be charged a ‘CFD holding costs.’ The holding fee can be positive or negative depending on your position’s direction and the subject holding rate.

Spread:

Also when trading CFDs, you need to pay for spread, which is the buy and sell price difference. Let’s say you open trade using a specific buy quote, and close with a different sell price. The narrower this spread is, the less of a positive difference that the asset’s value needs to move in order for you to start making a profit.

Commission (only for shares):

If you decide to trade share CFDs, you may need to pay a separate commission charge. There is normally a commission if you trade commodities and forex pairs. But, brokerages usually charge a fee for stocks.

For instance, broker CMC Markets charges from .2%, or $0.02 per share for US/Canada shares (perhaps with a minimal commission charge). Each open and close trade is also registered as a separate trade—so you will pay two commissions for one full completed position.

A financing charge may also be applicable if you hold your position long-term; overnight positions are treated as investment products—wherein the seller has borrowed money in order to buy an asset. (You will usually be charged an interest rate for each day that you hold the position.)

📺 To illustrate what CFD trading is—with a known example—let’s say you want to buy CFDs for the share value of Netflix.

The current price of Netflix is $23.50. You place a $10,000 trade. You open with the expectation that this share value will rise to $24.80 per share. This makes the bid offer spread $24.80 minus $23.50, which is $1.30.

You are charged a 0.1% commission for opening a position, with another pending sale 0.1% for when the position closes. And if this becomes a long position, you need to pay an overnight financing charge (which is usually 2.5% plus LIBOR’s interest rate).

You purchase 426 contracts for $23.50 per share, putting a trading position at $10,011. Let’s say that Netflix increases to $24.80 in 16 days. Your initial trade value is $10,011 but the final value reaches $10,564.80.

Calculate your profits (minus all fees) after deducting $10,011 from $10,564.80:

=$553.80

Due to the 0.1% commission, to open your position you will pay $10. And let’s say the interest rate is 7.5%, which you need to pay for each of the days the position is held. You have to multiply all 426 shares by $23.50 by 0.075 and divide it by 365 which amounts to $2.06. Multiply this by the full 16 days:

=$32.89.

Before closing your position, you’ll need to pay another 0.1% commission fee of $10. Your final net profit will amount to all profits ($553.80) minus all charges (2 x $10 commission and $32.89 interest = $52.89):

=$500.91.

What Instruments Can I Trade?

Instruments:

There are 1000s of instruments that you can take a position on for CFD trading. This ranges from forex pairs, eg. AUD/USD and EUR/USD; to Germany 30, UK 100, or Gold; and traditional share trades, wherein you don’t need to take up a physical share. I’ve paraphrased a few well-known lesson examples below:

Warning ⚠️: The below examples are not actual tips or strategies on CFD trading, I’m using them for demonstrative purposes—to answer the question “what is CFD trading” more clearly!

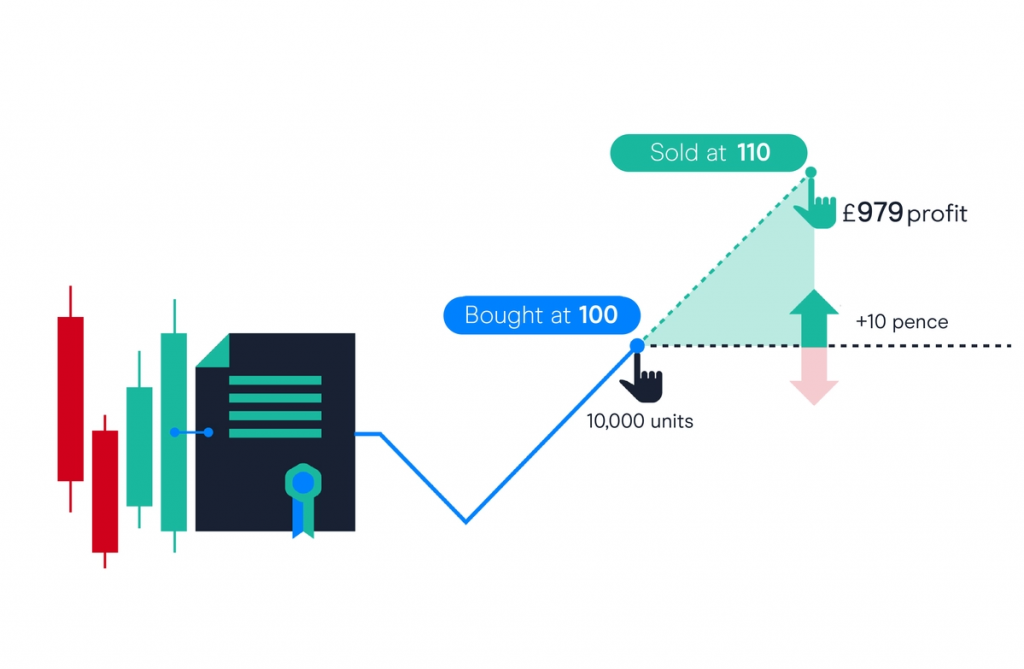

Long position process:

Example: Purchasing a company share in a rising market and holding a long position. You see a company that is trading at a $1 buy price, with a spread of 2 cents. You decide to buy at $0.98, believing that the company’s price will rise over the long term.

You purchase 10,000 shares at $1 , paying commission of $10, and the 0.10% commission.

The margin rate is 3%, meaning that you only have to deposit 3% of the trade total as position margin. That’s $300 (ie. 10,000 units x $1, which is $10,000 x 3%). Keep in mind that if the price props up further, you could lose more than the $300 margin, as losses are calculated based on your position’s full value.

Result #1: You make a profitable trade—your prediction was correct and the price rises over the next 7 days to $1.10/$1.12. You exit your buy trade by selling the current closing value of $1.10. And you pay the commission, ending up with a net profit of around $1000. Here’s a useful illustration:

Result #2: Your trade is a losing one—your prediction was incorrect and the company falls in value to 93/95 cents. Because you think it may continue to fall, you limit your losses by closing your position at its current sell price of 93 cents. Once again, you pay the commission of .10% multiplied by 10,000 units.

Because prices dropped by 7 cents in the wrong direction, multiply this by the number of units you bought (10,000) to reach your loss total of $700, plus the total commission fee ($10 at opening plus $9.30 at exit, which adds to a total of $719.30.

Here is another diagram to illustrate how CFDs work:

Short position process:

In this case, you pinpoint an instrument that you believe will drop in value in the short-term. In order to profit from this predicted price fall, you can purchase your instrument at its current potentially low price, in order to make a profit (ie. selling at a higher price) later. As with holding long positions, if the value goes in the opposite direction, you make a loss—this loss can exceed your deposits. (This same dynamic is true for purchasing an instrument at a lower value in order to sell it at a higher value.)

One benefit with this strategy is bypassing holding fees. But the risk is increased, due to more volatility… By now, you should be starting to get a clearer picture as to what is CFD trading.

Advantages of CFDs ☑️

Larger Leverage:

You get a higher leverage with CFDs than with traditional trading. As mentioned in the regulations section, much of this leverage has been limited today, since about 2020. ASIC and the FCA both mentioned protecting consumers as one of their key intervention reasons.

At one point, the leverage was as small as 2% leverage (50:1). But it’s now closer to 3% in most cases (3:1). This could continue to 2:1.

No Stock Borrowing / Shorting Rules:

In some markets you must follow rules that disallow shorting, meaning that the trader has to own the instrument before doing short plays, or utilise different margin rules for short or long positions.

CFD trades however can be shorted whenever, without needing to borrow, because it’s the broker—rather than the trader—who owns the underlying asset.

No Day Trading Limitations:

You’ll also be able to bypass day trading requirements. In some markets, you need to have a minimum of capital in order to day trade. Or there will be rules on the number of days you can trade on an account.

The CFD market, due to not being as regulated, does not obey those restrictions. Any account holder can day trade. An account can be opened with as little as $1000, although you will see 2-5 times this as more common minimum deposits.

Access Global Markets From One Platform:

You’ll find thousands of products existing in each of the world’s big markets, giving you constant access. Trade diverse instruments in worldwide markets.

Brokers today give you a diverse range of CFD trading choices. Choose the trade index, stock, treasury, sector, commodity, and currency CFDs. This enables speculators from a wide background of financial products to participate in CFDs — as a supplement to exchanges.

No Fees for Professional Brokers:

Access the same order opportunities as with traditional brokers — this includes limits, stops, and contingent orders. Certain brokers granting guaranteed stops will charge you for this or shore up costs some other way.

Brokers make earnings when traders pay the spread. From time-to-time, this may include fees or commissions. To open, you have to pay to ask price, and to exit or short, you must pay the bid price. The spread size depends on how volatile the underlying asset is — although you can often get fixed spreads.

Disadvantages of CFDs ❎

You Must Pay Two Spreads:

CFDs give you an alternative opportunity to traditional exchanges, but there are trade-offs. The central pitfall is needing to pay the spread on both opens and closes, destroying the possibility of profiting from small moves.

And even though you won’t have the same fees that you pay in traditional markets (or the regulations, commissions, or greater capital requirements), your profits will still be trimmed by a small margin by the double spreads.

Underdeveloped Industry Regulations:

A double-edged sword, the CFD industry is still in its genesis with regulations. (2020-2021 saw landmark additions to requirements in most countries.)

For this reason, traders need to take time to closely examine their CFD broker’s credibility, financial history, reputation and longevity rather than relying on its governmental ties, or even its liquidity. There are many standout CFD brokers available, but it’s important to investigate this before creating an account.

Volatility:

Like day trading, CFD is quick-moving and needs close attention.

The main risks traders are exposed to are liquidity risks and the need to maintain margins; if you cannot meet the costs of losing price differences, your broker may sell your position—and you’ll have to recoup the cost regardless of what happens to the underlying asset after this.

CFD FAQs 📘

What Are CFDs?

What is CFD trading: CFDs, contracts for differences, are contracts between financial institutions and investors wherein investors hold a position based on the future value of an asset.

This difference is cash-settled, without physical delivery of securities or goods; the broker and client exchange the difference in the initial price of the trade — compared to the value when it is closed.

Why Are CFDs Illegal in the US?

Because they are considered over-the-counter (OTC) products, which means they don’t participate in regulated exchanges. Regulators are also concerned about high leverages, potentially causing amplified losses to retail consumers.

As a result, the CFTC and SEC disallows US citizens (and residents but not non-residents) from opening CFD accounts on any platform.

Is CFD Trading Legal in Australia

Absolutely, and there are many great CFD-ready platforms. Trading has become better regulated since CFD trades became subjected to one of the strictest Australian regulators—the Australian Securities and Investment Commission (ASIC). This has increased the protections of client investments. Before choosing a platform therefore, you should ensure that it’s regulated by ASIC in Australia.

Are CFDs Safe?

CFDs can be a problem when the advantages outweigh the risks, which includes liquidity, money, and market hazards. There are other risks too, such as low industry regulation and the pressure of keeping high enough margin due to the potentially more vast losses from higher leverages.

This isn’t a trading route recommended for inexperienced traders or non-day traders — your positions must be monitored closely. Once again, make sure any platform you choose is regulated by ASIC.

What Assets Can I Trade as CFDs – and is CFD trading taxable in Australia?

Depending on your country’s regulations, the range available is stocks, indices, options, commodities, currencies, cryptocurrencies. And yes, CFD profits are taxable in Australia, with losses being includable as a deduction.

Summary: How Do CFDs Work? 💡

With Contracts for Differences, you’ll pay the difference between a buy and sell position, rather than buying an asset.

The main advantages of CFD trading are reduced margin requirements and fees, the absence of day trading or shorting rules, and easy access to global markets on one platform. Also higher leverages.

But it also poses a risk of magnified losses. And despite no exchange fees, you have to pay a spread for opening and closing positions — which can rack up if larger price movements don’t pan out. Australian regulators today have taken steps to reduce these risks. Lastly — is CFD trading taxable in Australia? You better believe it, baby.

You Might Also Like: