Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

How to Sell Shares in Australia

If you’re an investor who’s moved between countries, or carry shares in a company that was taken over by a foreign firm – you may end up with small shareholdings in stocks in other countries you’d prefer to get rid of.

Selling should be an easy solution, but in the above situation can be surprisingly finicky.

How you actually sell your shares will depend on what country your shares are listed in, and the seller’s residence.

eToro is the worlds largest social investing platform giving you the option to invest in crypto assets, ETFs and stocks all in one place. eToro offers access to 3031 stocks and 264 ETFs.

You’ll need to know exactly how your shares are being held… Meaning it’s not possible to recommend a specific broker or to give a concrete process, as this will differ depending on your own circumstance.

But the basic rules apply, so this breakdown will explain how to sell overseas shares – and selling shares normally.

Table of Contents:

- How Investing in Shares Works

- Selling Shares Explained

- Easy: How to Sell Shares in Australia

- How to Sell Shares Overseas

- When To Sell Shares

- Best Stock Trading Platforms for Australians

How Investing in Shares Works

Theoretically, successful day-trading depends on two key decisions: buying when time is right and selling when the time is right.

To make any reliable profit, both decisions need to be executed correctly. And the keystone principle to sensible trading is to always have an overarching strategy.

In either case, day trading is a full-time job, and taking a casual approach is likely to lead to big unexpected hits. Buying a stock is relatively simple, brokerage fees need to be kept in mind, selling to soon leave gains on the table, and there is an innate tendency people have towards greed.

We’ve already mentioned preferring to skip headaches from owning shares in a country you no longer live in – which can cause complicated tax issues – or after a company is taken over by a foreign firm. A few extra reasons:

Selling Shares Explained

Buying shares (equities, securities or stocks) gives you partnership of a company, dividends and other benefits.

You can buy shares for yourself, or pool together funds with others – also known as the collective investment or managed (mutual) fund.

Buying stocks comes in two main forms: buy orders and sell orders (ie. order executions). You must first have an open order before you can sell that order. The three typical order steps:

- Market – A ‘market order’ is your request to buy or sell a stock at the currently listed market price. This is typically executed immediately.

- Stop-loss – ‘Limiting’ orders that is conditional on your stocking a specific value set by you. Once it hits, your position is closed.

- ‘Closing’ market – Closes the order (whether buy or sell).

(This means that – if you initially made a “sell” market order – to sell your shares, and enter out of the market, will ironically mean to buy.)

Easy: How to Sell Shares in Australia

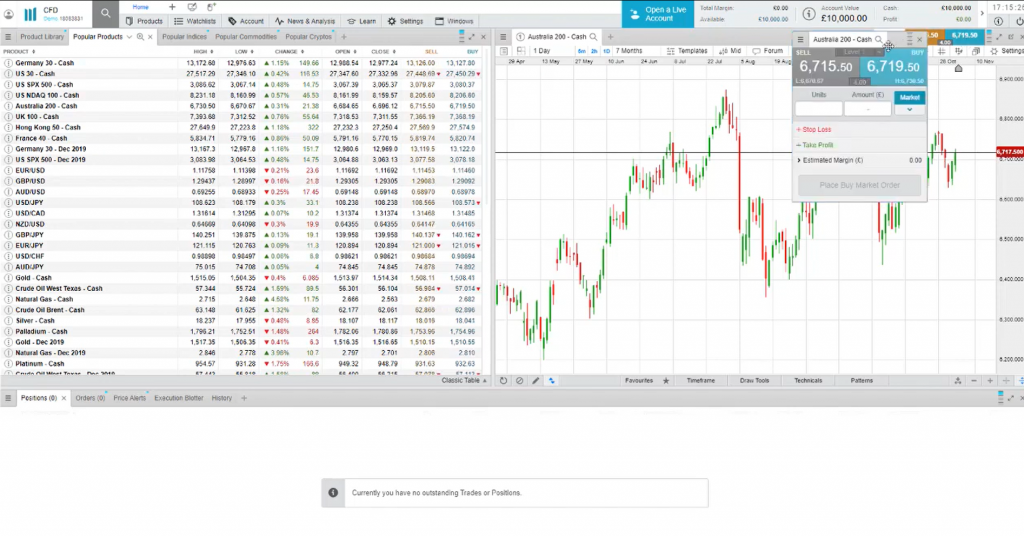

MetaTrader 4 is the most used Forex trading platform for analysing and trading the financial markets. Your specific trading platform may be its own proprietary version (eToro for instance has its own user interface).

I do not typically recommend MT4 for trading stocks, though it works great for Forex.

So I’ll rundown how to open, basically manage, and close an order from start to finish using the ‘CMC Markets’ platform as an example – our second-most recommended stock app.

Stock apps have the same framework, so you can replicate the following steps in your choice app – we’ve included an extra subsection for eToro, to cover how to buy and sell via copy trading:

Step 1. Pinpoint Orders

Your product will give you a range of on-screen options, which should include a watchlist, account balance, price alerts, orders and positions.

Head to ‘positions’ to see any that are open. Click on one to bring up its order ticket, revealing more details: units, amount, stop loss – plus how much you entered in for, relative to the current market price. You’ll have an option to place an opening or closing order.

Once you have an open position, you will see the amount staked, current market value, conversion rate, total profits or losses – and the total ‘take profit’, which means the amount you’ll receive once you close your order at that very moment in time.

Note that latency delays may mean a discrepancy between the total take profit you see on-screen and the final amount – after you click confirm and the order enters a queue for processing (which is nearly but not quite instantaneous).

Step 2. Modify Position Order

Modify in order to adjust the stop-loss point or take-home level – which can be done on the order ticket or directly from the technical chart.

Once your stock touches that level, you will be automatically entered out of that position.

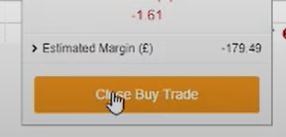

Step 3. Close Order Immediately

Alternatively, to close out your trade instantly, we open the order ticket and choose to close the Buy or Sell trade.

This resolves your ticket immediately, and you’ll get a confirmation. The order has been successfully closed. You can stop sweating now 😅.

How to Sell Shares Overseas 📚

I have shares in Commonwealth Bank in Australia. What is the simplest way for me to sell these shares?

Queries like this come frequently from international investors or ‘digital nomad’ types. It’s particularly common in today’s volatile climate, where stolid business moguls are encouraging business people to leave the more bureaucratically bloated places, for safer asset havens.

This is usually more complicated and will vary by circumstance. But whatever your reason for selling your overseas shares, here are some general guidelines.

Get out your pen and paper 🖊️📄️

Step 1. Pinpoint How Your Shares are Held

You need clarity on how exactly your shares are held. You may know that you had some shares in Commonwealth Bank – but without proof of ownership, and a way to transfer share ownership to a buyer, your stockbroker cannot execute a sale for you.

We’ll need to establish what form your shares are in, plus any key contacts needed to transfer ownership. The most common (stockbroker nominee accounts being the most common today – with paper certificates and dematerialised shares, for older or slightly older shares) possibilities are the following:

- Certificated form: Which means you have a physical paper to hand, certifying your shares. This is the more archaic proof of ownership form for shares – since about the last decade or so, electronic settlement has been the standard, but for older holdings this may apply.

- Electronic (dematerialised) form: Note, it should be in your name – ‘dematerialisation’ means no paper certificate exists, but you are still registered as the owner in an electronic registry, inside the company’s own registrar or transfer agent. Dematerialisation normally requires the owner to specifically register directly (for instance, the Direct Registration System in the U.S.). But in some cases, you are registered in more arcane ways – such as during a merger and acquisition or company takeover, wherein data from certificated shares are migrated to the new electronic register instead of the issuing of new paper certificates.

- Corporate sponsored nominee: In lieu of your name appearing on the register, your shares are listed on your behalf by a company nominee – who is sponsored but the firm you hold shares in. The company’s registrar will usually manage the nominee company, particularly if your shares were acquired from a stock grant plan or employee stock option.

- Stockbroker nominee account ⭐: Which means your stockbroker (who you used to buy the shares) is the recorded owner of your shares on the shareholder’s register. Your specific shares can be further discovered through the stockbroker’s personal register – which tracks each of its clients rights for the shares held under its imprint. Indeed – stockbroker nominee accounts are by far the most common form shares are registered today in most markets – though not for holding leftover holdings.

- Bank custodial account: Similar to the above – in this case, a bank is the registered owner of shares, therefore tracking what holding each of its clients is entitled to. This is frequently seen with holdings in a few continental European areas, where holding stocks through banks is typical.

- Central security depository (CSD): which will be listed in your own name. People holding through CSD’s ordinator will have an C’s personal CSD account – but this is atypical for private investors in most places. In a handful of regions however – for instance, Singapore – it’s more common for sole traders to have their own account open with the CSD.

Regardless of whether your shares are dematerialised – or in a corporate sponsor nominee’s name – your contact will still normally be in the company’s registrar.

Step 2. Pinpoint Who to Contact

Based on what form your shares are in, you can narrow down who to contact to find out your exact holdings and initiate transfer:

- For paper certificates: If your initial shares were certificated, they were likely bought some time ago. Since then, the company may have merged with another firm or been taken over. Some countries no longer use paper certificates and are fully on the electronic register. To pinpoint the position, you may need to contact the transfer agent or company’s registrar.

- For existing online accounts: If you see in an online account when you view your shareholding details through your transfer agent or registrar – such as one the following (for Australia): Advanced Share Registry Services, Link Market Services, Boardroom P/L, Computershare or Security Transfer Registrars. In this case, the shares are probably in your name – or by a corporate sponsor, on yours and the company’s behalf – as managed by the registrar, who will be your key contact (or the transfer agent).

- For those who receive bank/stockbroker statements showing holdings details: The same goes for those with an account that lets you view details. The shares are likely with a nominee or custodial account. Your bank or broker is your key contact in this case.

- For those with personal accounts with the national securities depository (CSD): you may have an account and SUV holdings, or you receive electronic or paper statements from the CSD. CHESS is the largest CSD in Australia – others include the UK’s CREST, Hong Kong’s CCASS and Singapore’s Central Depository (CDP). Typically, investors need to keep up accounts with a broker (often called a sponsor) to maintain a personal depository account – so your broker is in fact your key contact in this case. Singapore is one exception; residents can hold a personal CDP account directly in their own name.

Step 3. If Further Investigation is Needed

How to sell shares in Australia is the easy part, for residents. If your extraterritorial detective work is coming up with a fat nothing, here are a few things you can try:

Company Website

Sometimes you can find the registrar by checking out the company’s website and letting them do the legwork. Simply ask if you are named as one of the registered shareholders – or if your shares are in the possession of a corporate sponsored nominee.

Takeovers & Mergers

If you find your shares are in the firm that has had a change of ownership – your best point of contact is the registrar itself or the new company’s investor relations team.

Account Sponsored Nominee

If there is no record of you as a shareholder in any of the registers or in a corporate sponsor nominee, this indicates your holding could be in a custodial or nominal account elsewhere. Search your records to see what bank or broker you purchased the shares through. They are your key contact – use them to determine if you still have an open account and if any shares are in their custody on that account.

Next Steps

After you determine your shares location, reach out to whoever’s holding your account details – eg. the custodian bank, stockbroker, central securities depository or registrar – they’ll tell you what you are entitled to.

Even if you have a 25-year-old certificate proving your ownership of 5,000 shares in the company doesn’t necessarily convey your current entitlement: terms and conditions may have shifted as a result of stock consolidations, mergers, takeovers, and stock splits.

At the least, you’d have updated your records, clarified your key point of contact, and any reference number you will need to migrate your shares to a broker in order to sell them on the exchange.

Your next move is to evaluate options for selling international shares (easiest when they’re with a broker, bank or in a nominee account).

When to Sell Shares

Natural Reasons to Sell:

- Your order was misinformed: Seasoned traders come across this at some point. You monitored the stock – perhaps even a meme coin – as it made incredible strides daily, and finally decided to take a moonshot with a sizable order. And, soon as you do, realise this was probably wrong. The best resolution is to close a position, even if it means eating up a small loss on the trade.

- When a stock hits a technical inflection point: Multiyear lows (that is, trading at or below a downside breaking point) oftentimes signals further losses ahead. In this event, it’s usually prudent to sell the stock once it reaches the downside of this inflection point. The opposite direction also applies: if the stock bulls through a critical resistance level, it may indicate more gains to be had at a higher trading bracket for that stock – which means it is sensible to sell off some of the position rather than all of it.

- A stock hits your target: You’ve held onto a static underperforming stock for months or years. Skein wings and is now trading at your original entry price or higher… You went against all prudence, by holding onto losing stock for longer than you should have – and the stock is now performing at the level it was when you first bought-in (you just want to get it off your hands). Or your long-term strategy is paying off – it’s hitting a target threshold that you predetermined… Once again, the inflection point is often statistically a good demarcating point to base this decision on.

- Disintegrating company value proposition: A company may fundamentally deteriorate: revenue or earnings slow, competition increases, margins reduce alongside higher costs, or the valuation is less attractive. Its quarterly earnings report gives an early signal of diminishing promise, sometimes the ‘ forward guidance’ signals even sooner before the earnings report. Further warnings can be gained from market reactions to negative press, such as fraud or cybersecurity issues, underwhelming earnings, reduced forward guidance – and tends to be rapid, with the stock likely to dip substantially. In this case, the investor needs to decide whether the deterioration is permanent or temporary. To miss the plunge, it may be wiser to close a position first, then determine if it should be rebought later.

- Sector woes, bearish market: A host of other cryptocurrencies – including Bitcoin – saw a consistent downturn in value during the financial crisis of 2018. Which should illustrate the challenge with predicting the permanence of downturns. Timing against archival market patterns can also be too ham-fisted of an approach. But there are times when the market looks overextended – rather than being a promising tortoise in the race – eg. one of the big crypto exchanges you’ve probably heard about – it’s the old hare being upturned – eg. centralised banking. In this case, you may want to shore up the weak names in your portfolio – particularly those with large debt burdens or poor financial positioning, which will collapse first. This can even be signalled early by a rival company issuing bad news of trouble in your sector.

- Personal demands: Financial reasons include: a stock has grown out of proportion to the rest of your portfolio (such as with my earlier solar stock example); in order to trigger a loss for tax purposes; or you may sell shares to gain liquidity for an investment opportunity, such as real estate. Older investors may sell in order to reduce risk exposure, as they consolidate their equity portion of their portfolios. Younger investors, to buy a car or to make a deposit on a mortgage.

Best Stock Trading Platforms for Australians

I added eToro for those who are low on time – eToro lets you socially trade, with more than five million users it’s the largest social trading platform in the world. It’s also regulated by the Australian Securities and Investment Commission (ASIC).

Let a proven expert auto-make your stock and shares decisions.

Available: Stock, 47 forex currency pairs, indices, commodities, and 36 cryptocurrencies

eToro AUS Capital Ltd ACN 612 791 803 AFSL 491139. OTC Derivatives are speculative and leveraged. Capital is at risk. See PDS

Fees: Either 0.1% or $8.00

Acceptable Currencies: 50+, including AUD and USD

You Might Also Like: