Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

How to Buy IPO Stocks

Businesses often begin as private enterprises that are reliant on their own cash flow or backed by private investors.

Eventually, they might ‘go public’ through a process known as an initial public offering (IPO). Going public lets the wider market fluidly buy and sell shares of that company.

- Related guide: 📉 Stock market basics for beginners

IPOs are always a busy period. Media and market analysts can create a lot of buzz around the latest talk of the town, piquing investors’ interest. And this enthusiasm can bring about volatility and rapid price changes.

This raises a few questions… Can IPO stocks help your portfolio—and if so—how do you go about buying IPOs? Let’s examine this topic closely to find out.

Table of Contents:

- 📖 What is an IPO

- 🚶♀️ Step-by-Step Guide

- ❎ IPO Risks

- 🎛️ IPO Alternatives

- 📚 FAQs

- 🌞 Conclusion

How to Buy IPOs: What is an IPO? 📘

Although it might be exciting to see a firm go public, the initial public offering, or IPO, is just the culmination of a protracted process. The public shares of the firm are often offered to investment firms and affluent people during an IPO.

Investors in an IPO can be getting in “on the ground floor” of a new trending business, with the chance for sizable gains as the business expands.

This benefit is far from assured, though. IPOs frequently have significant risk factors, and their stock values can fluctuate a lot. Since some businesses fail after going public, speculating in an IPO stock requires extensive study and risk tolerance.

Fun Fact 💡: 951 businesses started trading publicly on stock exchanges in 2021. This represents an all-time peak as well as more than twice as many as in 2020.

How IPOs Work

IPOs are frequently used by business owners to 💰 raise money in order to pay off debt, finance expansion—or generate investor interest in their companies.

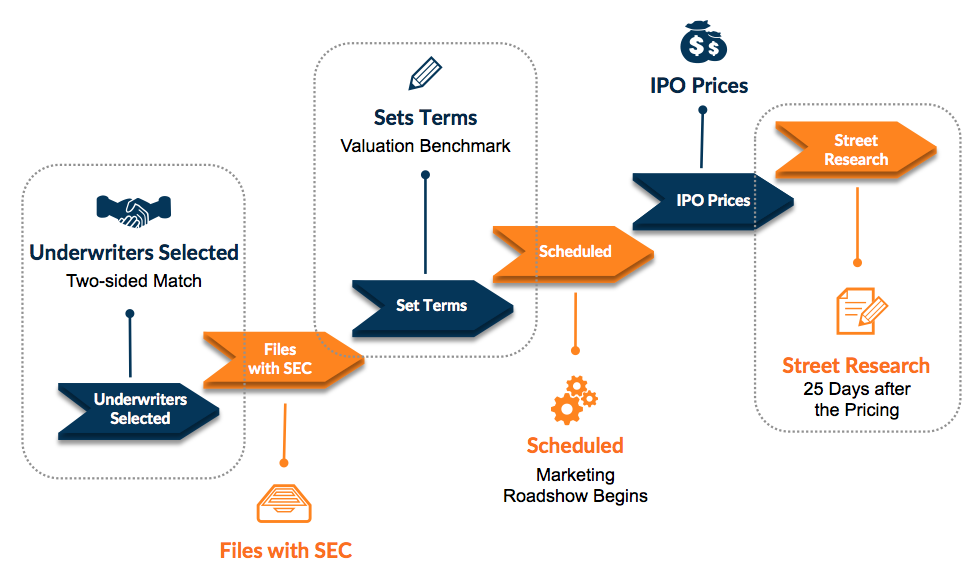

Three key steps occur in the IPO process:

- Underwriting 🗊: When a business starts the IPO process, it selects a leading underwriter, often a brokerage house or investment group, to assist it in submitting to the Australian Stock Exchange (★ ASX).

- Valuation 🏢: In order to ascertain the firm’s worth, it must be appraised. The public stocks are then given a price by the underwriter.

- Stock Sales 📈: Prior to the IPO becoming effective, the firm may transfer its shares to various investment institutions and merchants. The shares are subsequently made available by these groups to stock brokers, financial firms, and angel investors. After the IPO is complete, the company’s shares are made accessible to the general market.

Who Can Buy IPOs?

IPOs are frequently used by business owners to raise money in order to pay off debt, finance expansion, or generate interest in their companies among investors.

Many traders may find it challenging to obtain entry to IPOs. Regardless of when the firm goes mainstream, each of its IPO shares can already be allocated for buyers if the business is well-known or generates a lot of excitement around it.

Investors such as following could be granted early access:

- Syndicates 🏛️: Syndicates frequently buy and offer for sale huge volumes of IPO equities to brokerage firms and financial firms. The high-net-worth customers of these brokerage firms and organisations who desire early exposure to specific firms may then be offered those shares.

- Staff and colleagues 🧑🏻🤝🧑🏻: The IPO firm’s inner circle may be eligible to purchase shares prior to the offering’s formal opening as a token of appreciation for their early support, along with the company’s management and colleagues, relatives, and first venture funders.

- Wealthy people 💰: Since there is sometimes a limited amount of IPO shares, brokerage firms may place restrictions on who can join in an IPO sale. Consumers may be required to achieve certain trading frequency standards, have a sizeable number of assets with the broker, or even have a long-standing connection with the IPO business.

After the regulator approves the IPO, any shares that remain would be sold on the open market.

Due to this, accessing IPO equities can be difficult for novice investors. If there are any remaining shares available, you might be able to insert a drafting with your brokerage, but there is no assurance you would get them.

How to Buy IPOs: Step-by-Step Guide 🚶♀️

It is essential to talk to your brokerage regarding how you could get exposure to an initial public offering if you are a wealthy person and a business you are intrigued by is going public.

If any open shares are offered, even if you don’t have a lot of money, you could still be able to buy them by making an order.

- Order using an 🖱️ Online Trading App

Tip 💡: Look through our ranking of the top brokerage firms to identify the one that most closely matches your requirements while you investigate and purchase the IPO stock you desire.

Do Your Research 🌐

Begin by looking up future initial public offerings on a stock market like the ASX (guide: ⭐ how to invest in the ASX 200).

The IPO process can take many months, so keep checking frequently for the most recent data. Examine the records the underwriter has submitted to the regulator if you’re considering investing in a future IPO. A prospectus lodged with Australian Securities and Investments Commission (ASIC) may include the following:

- 🗸 Information about the company’s history and its management group

- 🗸 Financial stability, business strategy, and forecasts for the company

- 🗸 Accessible financial records

- 🗸 Risk elements

- 🗸 The share offer pricing and dividend schedule

- 🗸 Any necessary disclosures and details

ASIC reviews this application and other papers. Once authorised, the business would go public and start trading stocks. There may be many versions of each document since certain information may change before ASIC accepts the file.

Since the absence of publicly available data is one of the factors that IPOs may carry a significant level of risk, doing your research on the IPO firm you intend to invest in is crucial. Because private corporations are exempt from the same disclosure requirements as publicly traded companies, there is less information available about the firm’s past and outlook for the future.

Be careful not to fall victim to an organisation’s IPO hype. The mere fact that a business is going public does not imply that it is sound financially. With great enthusiasm, several firms have gone public, yet a few months later, share values plummet sharply. Some even closed their doors after only a few years.

Get a Broker that Deals in IPOs

Find a broker who sells the firm’s IPO stock after researching the business you’re intrigued by. A broker who is part of the first syndicate offer is what you need.

You also want a broker with sufficient stocks for their customers. Make sure you can purchase the IPO shares if you locate a broker selling it depending on your connection with the brokerage.

Since IPO equities sometimes have a limited supply, financial firms and brokers frequently impose restrictions on who may purchase them. To engage in an IPO, you may frequently need to fulfil qualifying conditions.

You’ll find many brokers only allow professional traders with large risk tolerances and significantly wealthy investors access to IPOs. To see if you meet the brokerage’s qualifying conditions, review them.

Requesting IPO Shares 📖

Your next step is to use your trading account to seek out shares in the IPO, if your stockbroker is offering the IPO stock and if you fulfil its criteria. Usually, you would input your request’s specifics, select the account you wanted to use to accomplish the transaction, and then send your order. This procedure is referred to as an Indication of Interest (IOI).

Keep in mind that you haven’t yet placed an order for the IPO shares. You’re only telling your broker that you satisfy its qualifications and are considering one of its initial public offerings (IPO) stocks. You won’t be able to purchase the shares just because you submit an IOI.

Placing Your Order ✔️

You might be allowed to submit a conditional offer after indicating your desire to buy the IPO stock. The offer, which often comes before the IPO goes public, does not assure you that you will be able to purchase shares of the offering.

Depending on when ASIC approves the firm’s IPO filing, you might be allowed to amend or cancel your purchase after you’ve already placed it. At this time, your offer would become effective, and the IPO stocks would start to show up in your trading account.

How to Buy IPOs 📕: The Risks

Online stock traders may view IPOs as a fantastic chance to swiftly accumulate wealth or earn big profits from their investments. Nevertheless, all assets have liabilities, and initial public offerings (IPOs) may have higher risks than the typical managed fund or exchange-traded fund (ETF).

Some dangers you could experience before, during, or after buying IPO stock:

- ❎ As an investor, there is no assurance that you will have access to the IPO shares.

- ❎ If you do not even match the qualifying standards, you might not be allowed to participate since there is a high entry barrier.

- ❎ IPOs could not go as planned. There aren’t any assurances that the IPO value will remain above its introductory level or that the business will be successful in the long run.

- ❎ Due to the fact that both public and private corporations have different ASIC disclosure obligations, you might not have unlimited access to the data and records that would enable you to make an educated decision.

Keep in mind that every company’s IPO is different and should be assessed according to its own advantages and disadvantages. Individual investors can lack the time or expertise to evaluate each new IPO possibility that is offered, or they might perceive crucial data incorrectly.

- Related guide: 🗿 10 biggest AU companies by Market Cap

IPO Stock Alternatives

Other investing alternatives may give you a route into making investments that are less dangerous, in a more approachable manner—if you have your mind set on IPO investing but fear that it could be too challenging.

Opportunities Post-IPO 💨

If you like a company that is making it public, but are unable to purchase IPO shares, you might want to think about buying after the IPO period is through with a safe broker. This way, you could avoid the roller coaster impact of changing pricing and be in a more advantageous position to make a judgement by waiting until after a company’s initial release before making any final decisions.

By waiting until the share is once again accessible, you could also gain access to further data that will give you more insights into whether or not you would truly like to invest.

IPO Funds

A few ETFs and mutual funds could provide access to IPOs. Nevertheless, investing in them still carries a higher risk than doing so with a regular managed fund or ETF. You might need to look for a portfolio containing IPOs because mutual funds are often cautious financial products that seek low-risk products to add to their portfolio.

ETFs and Stocks

If none of the IPO choices seem wise, or you don’t feel comfortable taking on the increased risk, think about investing in ordinary shares, managed funds, index funds, or ETFs. You could have fewer losses even though your return might be lower.

A yield on your investment in ordinary or IPO stocks is not guaranteed, therefore keep in mind that all investing alternatives involve risk. To help you balance the risk versus the possible profit, be sure to conduct your research, and confer with your financial consultant.

How to Buy IPOs 📙 – FAQs

What happens after an IPO?

In the weeks and months immediately after the completion of the IPO, its shares may be highly hazardous and unpredictable. It could be difficult to assess the company’s prospects given the lack of available data.

As investors assess the underlying worth of the firm, IPO stock values also frequently see large fluctuations when they initially become accessible.

How do IPO lock-ups work?

An IPO lock-up is a clause that may be present in an IPO sales agreement that forbids those who purchased IPO stock from transferring them for a predetermined period of time. Although it differs from case to case, the average wait is normally 3 months. An investor’s ability to sell a certain amount of shares at once could also be restricted by a lock-up contract.

When participating in an IPO firm, lock-up periods are essential since stock values could decrease sharply as investors prepare to sell their shares as soon as they can.

Are IPO stocks available on Robinhood?

Investors might be capable of placing orders with Robinhood for a limited number of IPO equities. You wouldn’t be taking part in the IPO directly, and it doesn’t ensure that your purchase would be processed.

The day the IPO becomes accessible, Robinhood only allows you to add your purchase to the queue; however, it won’t process your request until the company starts selling publicly.

- Related guide: 📚 Robinhood review

Conclusion 🌞

A new company’s IPO might be an amazing experience, but it can also be a rollercoaster ride for investors. Don’t let excessive media attention entice you into making rash judgments even if there is a tremendous buzz around an IPO.

IPOs have a number of dangers, so keep in mind that if you don’t fulfil your brokerage firm’s eligibility standards, you might not be able to participate in them. You may look into investment options through the top Robo-Advisors and gain some investing tips from Bill Gates if you’re looking to invest but just don’t feel ready to take on the task of IPOs.

You Might Also Like: