Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Stock Market Basics for Beginners (2024 Guide)

Regardless of whether Omicron sped up a recession in Australia, moving too quickly with stocks is a recipe for disaster.

One moment, Netflix is a giant because more people are at home during the 2020 pandemic, next, in 2022, the streaming service is crashing in value. And the same boom occurred with Twitter, thanks to Elon’s takeover attempt – with nobody knowing what would come in the future.

In this guide, we slow you down. Here are the stock market basics for beginners.

Table of Contents:

- Are You Using Vanguard

- How to Invest in Stocks

- Stock Market Basics for Beginners

- Who Are You As An Investor

- Employer Investments

- Account Mins, Charges, Other Fees

- Mutual Fund Costs To Diversify or Not to Diversify

- How Forex is Different to Other Markets

Take a Breather… Are You Using Vanguard? (Review)

Did you know that Apple stock is worth more than Russia (GDP vs market cap)? This is one example of how much investment opportunity there is in the markets.

Things are changing quickly, so it’s not clear if commodities will become more and more important, while financial speculation is more and more dangerous.

But there will always be successful companies. Owning shares can give you a stake in their changing values. It’s hard to know who will win, which is why the smartest investors diversify how they allocate their investment capital.

Rather than having to worry about this for yourself, you can use Vanguard to handle the complicated and completely crazy financial space – so that you can avoid the inflation and possible recession impacting your cash during one-third of Australian businesses being hit by shadow lockdown rules. Vanguard seems to be one of the surest ways (if there is any sure way in the markets) to place substantial capital with minimal risk, to beat the markets.

To begin with, Vanguard is recommended by billionaire economist Ray Dalio as well as Warren Buffet and many others – and the fund is advised for people in poverty who need a way for their everyday cash to grow without massive risks.

Rather than spending countless hours learning about stocks, you can choose this fund.

Warren Buffett says that the Vanguard 500 Index Fund Admiral shares are great, which have seen an annualised compounded return of 7.1%. Buffett says that the key is not trying to select the perfect firm; but to buy up all of the big firms using the S&P 500 index and to constantly keep this low cost.

I often write that Buffett would even leave this as his single investment piece of advice to his wife if he was to die. This is obviously a strong recommendation, it would be for any economist but especially for one who is so aware of the fluctuations of economic markets, such as the massive inflation we are seeing from 2022.

For anyone who wants to know what is happening in the good old AU and Australian recession fears, as well as many other countries, there does seem to be a global recession that could increase to higher than we saw during the financial crisis of 2008. Have a watch of this animated video by Ray Dalio, called ‘Principles Are Dealing with the Changing World Order.’

All-in-all, Vanguard is a top-tier investment fund, which is awesome for getting annual returns year upon year whether market conditions are ideal or not. Vanguard is thus the best first move a new investor with good or small savings should think about if they are looking to secure their cash by investing in the financial markets. There is no needed technical knowledge, and you don’t need to spend time researching – this service is an expert at moving your funds into careful indexes and ETFs.

Don’t waste time researching or trading.

Vanguard handles the trading of shares for you. And if this route to financial investments seems good, it’s worthwhile also choosing the Vanguard stocks and shares ISA.

The ISA charges just 0.15% annually. And each trade made for you by Vanguard doesn’t incur any trading fees unlike many of the other providers. Concerning minimum funds, you can choose to pay £500 in one go, or more, or a monthly subscribe for £100.

If you want a competitive index fund or a S&S ISA – but don’t have the technical knowledge or experience of managing different stocks, then it’s strongly advised that you consider using Vanguard. (For those who are unaware, Vanguard is one of the UK’s best-used index fund providers.) So if you want to invest in stocks, bonds, or more – Vanguard gives you lots of various portfolios.

Overall, this service serves as a passive pathway into the markets, seeing as your single holdings are sorted out by Vanguard and their collection of experts. This cutting-edge funding provider only just came into the British investment fund space, so you can curate wealth with natural tax reliefs. Which really makes the small manager fees worth it.

As said, Vanguard needs only 0.15% in yearly fees, to manage portfolios. Which is much less, lower than most of the S&S funds on the British stage. So you only need to meet the minimum deposit demands for investments as set by Vanguard – which is £500 upfront or a monthly debit of £100 – after that, you’re in the clear. They’ll do the rest.

Pros

- Top index fund

- Great returns that are increasing yearly

- Founded by Ray Dalio

- More than 75 funds

- Annual fees are low, very low at just 0.15%

Cons

- You do need to have at least £100

How to Invest in Stocks

Seeing as you want to trade stocks, we advise that you know your Trading Data, and be patient with your strategy. Consider going with a fund manager, as these guys are excellent at protecting your capital.

Your capital is at greater risk with other platforms. This article will go through some of the other key stock market basics for beginners. And if you want to trade professionally, be sure to use a professional stock trading course. That said, let’s start with the bare stock market basics for beginners:

- Stocks are chosen first with risk in mind. Against the amount of profit, you want to make. Actual profits are created in these two main ways:

- If the value of shares rises when you own them, such as company stock, you can then sell them for more than you had to pay (day trading uses this too).

- Also, if stocks you are invested in provide dividends regularly to their shareholders (typically, each quarter), some of this goes to you.

Stock Market Basics for Beginners

Stock market basics for beginners start with knowing that shares provide tons of investment flexibility, in the sense that they can be used for short-term investments, as well as long-term pensions, and also for full-time day trading.

The second stock market basics for beginners to know is that firms who have “gone public” become therefore tradable on the open investor’s market. Firms enter the stock market in order to raise more funds for daily day operations, as well as to expand. These shares become tradable/outstanding.

A company’s total worth of stocks represents its total market value. Considering the Apple example given in the intro, this could be in the billions, or trillions of dollars.

The third stock market basics for beginners is that you’re buying a slice of that total value, which are called ‘shares, making you a shareholder. This means you’re getting investments in a firm’s future market value when you buy shares in it – with the aim it will do well and increase in value with time. And this occurs if someone is willing to buy the share from you for more than you had to pay for them initially, making you earn a profit.

Venturing into any investments into the stock market is a long game. For traders who slice the market by the minute, or profit from hour-to-hour market changes, even they only make big enough profits through doing this for a long time.

So the fourth stock market basics for beginners principle is that it’s a risk, but so is life. Just make sure you have the right experience to know that you’re not too locked into one company or class of stock, and this can be true, even if these are blue-chip firms – this type of firm has a massive market cap but it could be seriously overvalued, and this could be revealed in unexpected twists of the market.

The beginning of 2022 was a good demo: a snowball of global events such as more inflation, the Russian-Ukrainian war, spikes in British and Federal Reserve interest rates, in addition to the continued impact from COVID-19 lockdowns, saw more market sales.

The next stock market basics for beginners is that most advisers urge you to keep the best shares even during turmoil – eg. Ray Dalio boosted investments in many of China’s retailers which goes to show how non-intuitive trading can be.

The masters like Warren Buffett have put in 10,000+ hours of work into studying financial data, and have powerful talents for the work. However, a simple way for beginners to start learning how to invest in the markets is to have an online investment account, using a high-performing index fund.

A couple of brokers also give you demo accounts, this allows you to attempt real-time investments in the actual stock markets using simulators without actually investing real cash.

Who Are You As An Investor?

The next stock market basics for beginners is to consider the kind of investor you want to be. One type is a long position trader. Warren Buffett is a great example.

Such kinds look to master the key principles impacting how markets function.

The next stock market basics for beginners is to consider the big picture, as Ray Dalio calls it. Peer into big-scale moves impacting things behind-the-scenes between nations, firms, events like pandemics affecting businesses, and more.

By comparison, hour-to-hour day traders make many multiple decisions on-the-fly and are very active, but obsess with technical indicators, market rhythms, and other patterns key to the exchange. Which makes this trader a stress-lover and intense such as “Wolf of Wall Street.”

The next stock market basics for beginners to consider is if you’re the normal non-trader who wants a retirement strategy; using a company to invest some of your monthly earnings into an investment trust, or being helped by a financial adviser.

Employer Investments

If you have a tighter budget, you can invest 1% of your earnings into a pension plan via your work. Often, you won’t even notice this investment taking.

So the next stock market basics for beginners is to retire by using what Einstein referred to as the 8th wonder of the universe, the compound effect. This compounding cash is invested into people who then invest in mutual pools which may include your own firm’s shares.

Account Mins, Charges, Other Fees 💳

One of the most important stock market basics for beginners is to know that in the economy, there isn’t any such thing as a free lunch… Sure, certain services like eToro say their service is commission-free; but at some stage, there will be a commission.

And most financial companies have a min deposit, your account stays closed until a certain threshold of money has been deposited.

So the next stock market basics for beginners is to know it’s hard to make any real money without a decent starting pool. You should balance selecting a service with strong credibility for gains annually against minimum deposits and fees.

Most usually, the broker will ask for a commission per transaction. And if this isn’t the case, fees will be extracted in another way. Investment isn’t a charity game, it’s business.

The next stock market basics for beginners is that some fees fit some types of investors more than others. For example, day traders make multiple transactions per day. This means they will want a platform with great fees suiting high-frequency day trades. Indeed, depending on how these fees compound, this can seriously affect your gains. Usually, fees quickly add up if you frequently move in and out of moves, especially when investing small amounts of cash.

The next stock market basics for beginners is how trades are calculated, which is according to the number of different classes of assets, or the trade kind. For example, purchasing one share in five different companies will be seen as five separate trades with a charge for each.

For instance, let’s suppose you buy $2,000 in shares for firms. This can’t be done until you pay $40 in trading fees – let’s say each had a cost of $20 – this would mean 2% of your $2,000. This means a 2% loss immediately before your investment can make returns.

Furthermore, if you went on to sell these stocks, it would cost you the same costs, which means a total of 8% of your total investment being a starting-loss that needs to be made up, in order to make a net gain.

Mutual Fund Costs

Let’s cover stock market basics for beginners to do with fees for Mutual Funds.

Mutual funds are professionally handled pools of cash for many different investors that are assigned according to a set and time-tested investment approach, such as investing in a big exchange.

Members need to pay when entering a mutual fund. And a popular fee is the management expense ratio (MER), this happens when your mutual fund is under active management by a fund team and varies according to how many holdings are balanced annually. Usually, the MER is 0.05 and up to 0.7% yearly, depending on the fund. But the larger the ratio, the more it impacts returns.

Another stock market basics for beginners is to know the cost of sales fees which are also called loads. Loads are to do with what you pay on the front end, but some funds don’t have loads, and others have back-end loads. Keep in mind whether your fund charges a sales load before you choose that fund.

A key advantage of mutual fund fees, the win versus stock costs, is that mutual fund fees are set, no matter how big your investment is. This means that if you meet the minimum funds for your account, it’s possible to invest as little as $50, but you can also choose more. The way this loophole works is through the dollar-cost averaging (DCA), which is able to significantly help new traders.

To Diversify or Not to Diversify…

Diversification is the next stock market basics for beginners is to remember that there is no such thing as a “free lunch” in economics, but mutual funds are the closest exception.

To keep it simple, it works by assigning funds to a scope of stocks, to reduce the odds that one suboptimal outcome will significantly impact your overall cash.

That means, you’re not putting all your eggs in one basket.

For diversification, the largest difficulties arise when trying to invest in stocks.

The thing to know, the next stock market basics for beginners, is that stock fees quickly stack up according to however many stocks you have – which is because each stock is thought of as a different trade. In addition, there is a double cost: to open the trade and one to close.

This means a varied portfolio has lower odds of making a big return across ordinary short horizons when using mutual funds, if the starting cash is pretty small, such as $500.

The next stock market basics for beginners is to know why mutual funds and ETFs have become a key use of investing for retirees and long-term it’s because of the DCA loophole. It allows small amounts of cash to be invested into funds that already have lots of very large assets, across a big number of different classes.

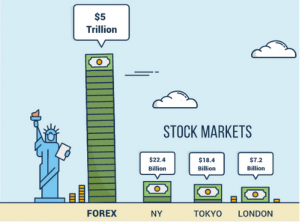

How Forex is Different to Other Markets

Our final stock market basics for beginners, just in case forex markets are for you. These work differently from other markets like the London stock exchange.

Fewer Restrictions

Our first stock market basics for beginners in this section is that regulations are less for forex markets compared to futures, stocks and bonds, and so on. For example, no central regulatory body does the management of the forex market, this is the same for clearinghouses. An interesting outcome of this is that shorting is commonly done on forex because shorting is not really possible. Indeed, whenever you sell one currency, you are buying another.

Forex Fees

Continuing with our stock market basics for beginners guide, there are fewer regulations on the forex market. And so this means fees differ widely across brokers. This means most forex brokers make their living by padding a premium onto currency pairs (spreads: which is the difference between buying a currency and the price of selling another). Some brokers charge a commission, which varies down to the volume of the trade.

Open Access

You’ve made it this far in our stock market basics for beginners guide. Make sure you consider the time of day and zones. Forex markets are always open, except for the weekend and a few holidays.

Leverage 🗽

The most dangerous aspect of the forex is that they let you leverage up to 30:1 (which is the FCA’s cap on leverage; unless you are a professional trader, who is able to do 500:1). This means traders can create an account for $2,000 and exchange up to $60,000 in currencies. This is a double-edged sword that can cut you or cut a door to profits.

You Might Also Like: