Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

What Is Micro Investing?

Among the most essential steps that you can do to achieve your financial objectives is investing. Investments can have a far greater long-term return than savings accounts, which may only generate a little amount of interest.

Starting up is one of the largest issues that the majority of folk have with investing. It might be challenging to know how to invest and what to invest in.

Finding the cash to invest might be even more difficult for many people. Many equity funds or brokerage firms demand minimum contributions of $1,000 or over.

But making several, small contributions over a lengthy period of time is known as micro-investing. It’s simple to get involved and put your cash on the market thanks to mv apps.

Table of Contents:

- 🇦🇺 At a Glance

- 🇦🇺 Detailed Overview

- 🇦🇺 Micro-Investing Advantages

- 🇦🇺 Micro-Investing Drawbacks

- 🇦🇺 Expected Returns

- 🌞 eToro Micro-Investing Review

- 🇦🇺 How Micro-Investing Platforms Operate

- 🇦🇺 FAQs

What Is Micro-Investing? ⭐ At a Glance

A quick reminder: the PA team offers you mission-critical data efficiently and concisely. But make sure to do your own homework and seek professional assistance where needed. That said, let’s look briefly at how micro-investing works:

- Micro-investing entails utilising little sums of cash to buy assets.

- Investing tiny sums automatically in shares, exchange-traded funds (ETFs), or other assets is simple with the help of micro-investing applications.

- Some people may find it simpler to construct a diverse portfolio while forming a regular saving habit by using a micro-investing app.

- 🏡 To grow properly, it’s critical to comprehend any possible fees associated with using a micro-investing programme.

Pros

- More investment accessibility

- Lower minimum initial investment

- Investing routinely can add up

Cons

- Ongoing costs

- May not reach your financial objectives

- Few asset options

📘 Detailed Overview

What is micro-investing?

Micro-investing is a financial approach in which you make extremely tiny financial commitments as your income permits.

In this way, micro-investing focuses on making small additions to your portfolios, such as a few bucks here and a few cents there, as compared to setting up recurring stock investments, such as $400 per month. You can add micro-investments to your account as frequently as multiple times each day.

Micro-investing could be a method for you to start expanding your portfolio if you’re uncertain about trading or don’t have much money put aside to invest. It’s a strategy to build wealth since little investments may develop into significant quantities of money over time. Various platforms are available based on your preferred investing approach.

Note: Micro-savings applications, which enable you to deposit tiny sums in an FDIC-insured savings account, are different from micro-investing applications. Any site’s terms and conditions should be read carefully because some “savings” apps may provide both investing and savings alternatives.

The use of an application or other tool that links to your debit card is essential to many micro-investing schemes. Rounding up expenditures is a common method of financing investments. One of the most popular apps that provide this capability is Acorns.

Rounding up

The software, for instance, rounds up purchases to the nearest dollar and adds $0.43 to your account if you purchase a $2.40 coffee every morning. Of course, if you have more money in your allowance, the applications also enable you to contribute more.

The majority of micro-investing services do not allow you to select specific equities for investment. Instead, they build a diverse portfolio of equities and bonds using mutual funds and ETFs. You may choose the funds you wish to invest in or you may allow the app to choose the funds based on your responses to questions about your tolerance for risk, based on the platform you use.

Micro-Investing Advantages 📐

Many investors choose micro-investing because it offers a variety of advantages. In principle, micro-investing enables you to make investments using your funds, even if you have a small amount of them.

Get started by rounding up your expenditures to the next AU dollar. Even debit cards that regularly round up your transactions and invest the difference in ETFs or fractional shares of stock are available through wealth management apps like Acorns and Stash.

1. Simple

The simplicity of getting started with micro-investing is one of the main factors contributing to its rising popularity. Choose a business to deal with, complete the necessary paperwork, and credit your account with the required threshold the broker asks if you wish to start a standard trading account. The minimal investment in mutual funds is sometimes $1,000 or more.

You only need to install an app and create a profile to begin micro-investing. On your smartphone, you may start using it right away. Within a few days of linking your debit or checking account, place your initial investment. Additionally, you won’t need to bother creating a balance before beginning.

2. Automatable

The fact that micro-investing is simple to automate is yet another factor that makes it valuable for so many consumers.

For almost all micro-investing platforms, you may increase your holdings without directly placing orders. Rounding up your debit card transactions is one method several micro-investing applications automate your earnings.

3. You can make incremental savings.

Having enough money to start trading is among the most difficult aspects of it. You still must have sufficient cash on hand to purchase a greater share of an exchange-traded fund (ETF) if you choose to bypass mutual funds and associated hefty minimum deposits by doing so.

But if you just have a cent in loose change to add to your account, micro-investing enables you to make as small an investment as you’d like. Once you have more cash to put away, it becomes simpler to develop the habit of preserving more if you can establish the routine of saving little sums.

You won’t need to be concerned much about those costs because the majority of micro-investing providers create your portfolio using inexpensive mutual funds, index funds, and ETFs. The majority of micro-investing platforms, however, impose extra fees since they must find a means to generate income.

These charges might be as little as $1 per month or as much as a per cent of your account annually. The long-term success of your portfolio is directly impacted by trading expenses. Keeping costs low is crucial to success since even a 0.25% yearly fee may add to thousands of dollars over time.

⭐ Summary of advantages

- Access: Micro-investing applications can assist individuals who would otherwise feel excluded from or intimidated by the stock market in forming the habit of saving and investing.

- Lower required minimums: You don’t need thousands of dollars to invest; you may build a diverse portfolio with just a little spare cash.

- Investing routinely adds up: Even when you make tiny investments, with time your total increases because of combined forces of interest compounding and dollar cost averaging.

Micro-Investing Drawbacks

Micro-investing has its own issues, including high expenses and few available investment alternatives, despite the ease and marketplace access it provides. No matter how little the investment, you should take all considerations into account.

Even if micro-investing has a number of noticeable advantages, it’s necessary to be aware of its following disadvantages.

1. You won’t earn vast sums

Long-term wealth building through investing is excellent, but it doesn’t come for free. The amount of money you put into the stock market has a significant impact on the returns you get. If you invest wisely and make 15% in a year, you will only receive $15 compared to $100 in the marketplace. You would have made much more money if you’d have made a bigger commitment.

Your profits may be modest since micro-investing depends on making tiny initial investments. It’s not a bad method to begin, but you’ll need to begin creating bigger contributions in order to see a major return on your investment (investment ideas).

2. Some extra charges

Investing is expensive, just like anything else. An expense ratio is a proportion of your investment in the portfolio that you pay as a fee each year for the majority of mutual funds and exchange-traded funds. For instance, if you invest $100 in a managed fund with a 0.5% cost ratio, the annual charge to hold that fund is $0.50.

⭐ Summary of drawbacks

- Monthly costs: It’s critical to understand what you’ll spend before installing a micro-investing app since fees might reduce your returns.

- Reaching savings objectives: Your retirement savings objectives could not be met if you only invest your spare coins.

- Options: You may only be able to invest in equities, exchange-traded products, or premade baskets with micro-investing applications.

Expected Returns 🖩

A sizeable amount of cash may be amassed by micro-investing over a number of years, but the profits must be balanced against the associated expenditures.

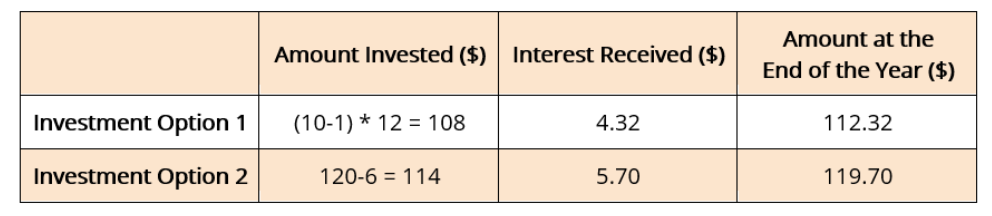

When making investments, a person has two possibilities. The first choice is to invest $10 each month on a micro-investing website that costs $1 per month, in order to subscribe. The funds gathered at the finish of the calendar year are then put into a portfolio that provides an annual return of 4%.

The main alternative is to invest $120 for one year in a fixed deposit plan with a $6 one-time fee and a 5% annual return. After a year, he calculated the value of his investments:

In reality, micro-investing is likely not the greatest choice for people who want to establish a sizable investment. Long-term savings are substantial, but after taking inflation and other expenditures into account, the return on savings is significantly reduced.

In this situation, it might be wiser for the individual to set aside a sizable chunk of money and place it in a conventional fixed deposit account. It may not be the case, but it is generally preferable to compute the net profits when comparing two investment possibilities.

In recent years, shares of well-known corporations like Alphabet, the parent company of Google, and Amazon (how to buy AMZ stock) have traded for more than $2,000 each, making it impossible for some investors to buy just one share. When the price reaches these levels, many corporations divide their stocks to help make them cheaper.

However, until then, fractional shares let you invest regardless of how much a single share would cost.

Savings regularly over time and investing in the stock market has been successful in the long run. Dollar-cost averaging is a method of investing that eliminates the need to choose whether to enter or exit the market. You will buy more shares when prices are low and fewer shares when costs are high due to frequent purchasing. You’ll be purchasing over time and average your purchase prices if you use dollar-cost averaging.

eToro Micro-Investing Review

Without question, eToro is among the most recognisable brands in online investment. They have a terrific micro-investing app with many nice features that are all suitable for beginners and advanced investors alike.

Low starting cost

There aren’t that many accounts that let you begin investing with lesser sums. You may invest small sums with eToro (review), starting with just $25 for cryptocurrencies and $50 for other marketplaces. Then use it to set up your micro-investment portfolio, or sign in at any moment to add money.

CopyTrades

You might use copy trading and follow the experts’ lead if you’re unsure of where to put your money. Users may examine what their preferred professional investor is doing and replicate them using eToro’s copy trading tool in an effort to achieve some of the same performance.

Education resources

With eToro, every investor wishing to get started in the market will discover what they need. They provide a wide range of instructional resources aimed at streamlining the procedure and giving investors of all experience levels the chance to obtain some practical experience before committing their own money.

A large portion of the instructional resources is available to users as papers and videos that they can read and view. All users also will have exposure to an investment community, which may be helpful when people are seeking suggestions on how to make things actually work in their favour.

How Micro-Investing Platforms Operate

There are several applications that offer micro-investing services, but they all operate in a unique way. However, there are primarily two ways that they work. Some of the applications provide fractional investment, which is the purchase of a portion of equity.

Fractional investment is prohibited on the stock exchange, but the applications buy a complete share and split it up for its customers. People who cannot afford a complete share might purchase fractional shares using the cash they have saved.

Other applications demand that the users connect their bank card or bank account. The programme then rounds up each purchase to the next integer higher and transfers the leftover money to the user’s investing fund. For instance, suppose Person A connected their debit card to a micro-investing app.

They purchase $2.50 worth of coffee at a café each morning. $3 is debited from their bank account each time their card is used to pay in the card machine. In their investment fund, the leftover 50 cents are immediately placed. Although the money is quite tiny, consistent donations over time will build up to a sizeable amount.

What is Micro-Investing? 📘 FAQs to help you start

To determine whether micro-investing is a suitable fit for you, you should ask yourself a few questions.

Have you established an emergency fund yet?

Although investing is a crucial stage in the process of accumulating wealth, you shouldn’t start there. Everybody should have access to emergency savings so they can pay for unforeseen expenses without borrowing cash or liquidating assets. Before you begin investing your money, make absolutely sure you have at least 6 months or a year’s worth of expenditures set aside.

Does Your Investment Philosophy Complement a Micro-Investing Provider?

You may not yet possess an overarching plan because micro-investing is frequently the first experience many have had with investing. Micro-investing should work for you if you appreciate the concept of index funds and using equity funds. But it may be too simple for you if you strive for more complex techniques that depend on selecting equities or employing alternatives like options.

Are You Able to Invest Enough to Make the Fees Valuable?

The costs for using a micro-investing platform might range from a fixed monthly charge to a percentage of the assets you have deposited, dependent on the provider. Make absolutely sure you deposit enough funds into the account if you’re paying a set monthly charge so that you have an opportunity to earn more money than you spend.

Have You Created a Strategy to Exit Micro-Investing?

Long-term, you should have a strategy for switching to an investing provider with additional features and, ideally, a lower price structure. This could include everything from a SoFi Invest account for individuals who prefer to be hands-off to an investment with a robo-advisor like Vanguard for individuals who prefer to invest in equity mutual funds.

Conclusion 🌞

Investing is a crucial component of preparing for objectives like retirement, but getting started may be challenging. Only one aspect of the process includes learning how to invest, what to put the money into, and how to arrange your portfolio optimally. The hardest thing for many individuals is saving enough money to contribute meaningfully.

You may set away tiny quantities of money and gradually expand your portfolio with the aid of micro-investing services. “A journey of many miles starts with a single step,” as the proverb says. Micro-investing may be the crucial first step in accumulating money.

Once you find a safe broker, micro-investing is a fantastic method for getting started, but it’s typically only the beginning.

You Might Also Like: