Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Shares to Buy Now in Australia

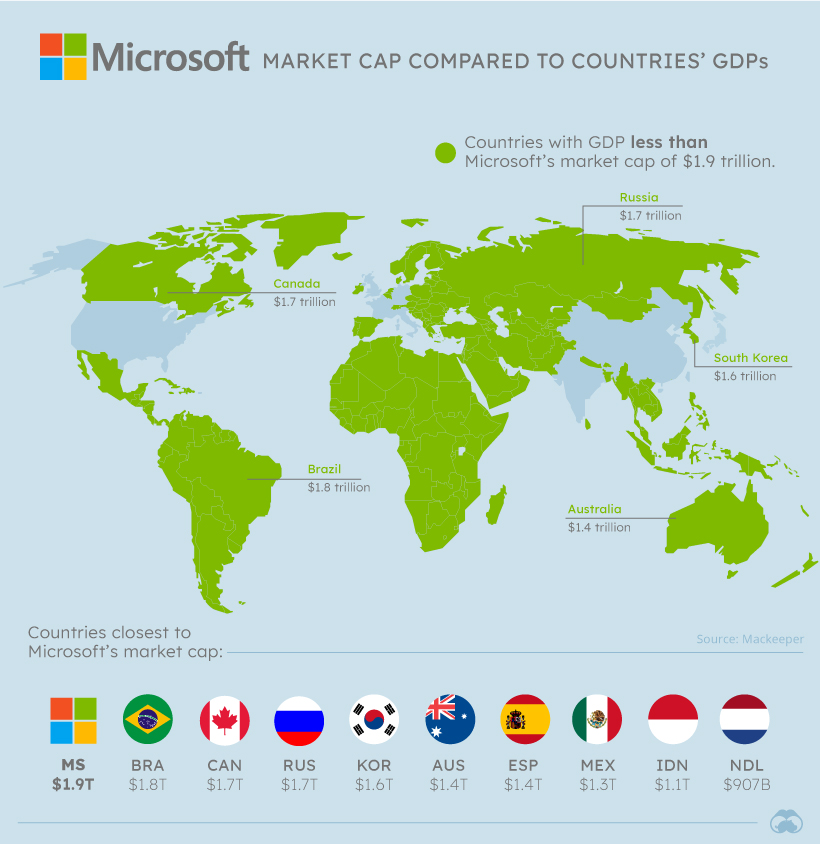

Microsoft is worth more than the whole stock market of Brazil.

Shares are all about perceived value. They’re units of ownership in a corporation; pieces of that firm’s value, which could rise or fall in the future.

When you buy a share, you’re normally hoping it’ll grow, so you can reap profits, as a stakeholder.

Shares do work in many different ways, so I’ve also covered key scenarios to be aware of, below. But as always, we’ll head right into our picks… So without further ado, first, in this guide we’re going to cover the best shares to buy now.

Table of Contents:

How We Choose Our Platforms 📚

Did you know, the U.S. stock market represents 46% of the entire world’s stock market in size? So we’ll recommend the most conservative offerings for long-term investment, by going through the biggest companies on the planet by share value. But we’ve also covered the best “meme stocks”.

We obviously can’t guarantee returns. In a previous guide, I’ve covered technical analysis and software. But large-cap companies like these hold the most natural potential for holding value rather than suddenly plummeting and losing your investment. Let’s begin!

The Best Penny Stocks Australia – Our Reviews

1. Apple Inc. – Luckier than the Number 7

Key Features:

- Stock name: (AAPL)

- NASDAQ exchange

- Revenue: $365 billion

- Net income: $94 billion

- Total Market Cap: $2.9 trillion

Pros

- Biggest company on the stock exchange

- Resistant to the “winner’s curse” stock problem

- Doesn’t look to be overvalued

Cons

- Revenue warnings on the horizon

📓 Reputation

The “007” of the Shares world: Apple (Apple never dies) has a large enough market capitalisation to equal a G7 country’s annual GDP.

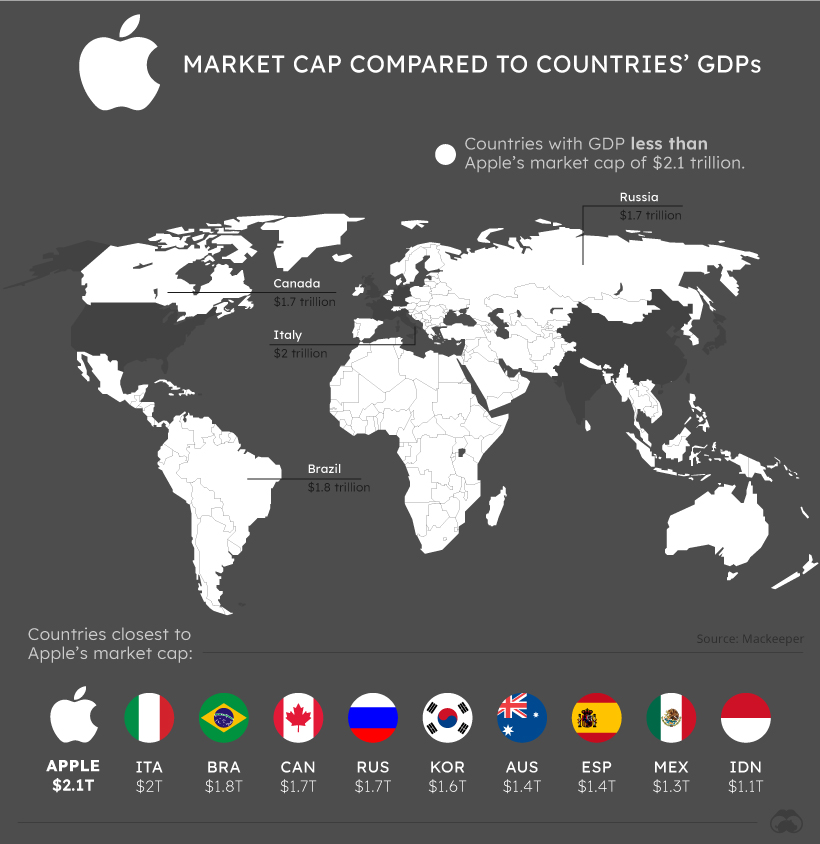

With a market cap of over $2.1 trillion, it’s greater than almost 97% of countries around the world, in terms of their individual GDPs, a list which includes Australia (sorry to say), Brazil, Canada, Italy, and Russia. In fact, its value is so high that this leaves – from the global list – only seven countries that exist on the planet with a higher GDP than Apple’s market cap.

Apple manufactures, designs, and markets a wide range of consumer technology services and products, including personal computers, smartphones, tablets, wearable, and home entertainment devices, and much more.

The iPhone is its trademark product, as well as my computers. But Apple has also massively grown its service-based sales. For instance, operating media content stores, offering payment & cloud services, and recently offering Apple+ – a streaming service providing on-demand entertainment media.

This gives it large room for steady future growth. However, a few flags to be aware of that could signal negative changes in the future include: revenue warnings on the horizon; falling sales in China; and Apple Store issues (i.e. “Apple tax” dissatisfaction where more and more affiliated companies such as Spotify and Netflix are attempting to avoid paying fees for customers who need to buy software using the iOS App Store, where Apple takes a cut or commission).

2. Microsoft Corp. – Impressive long-earnings

Key Features:

- Stock name: (MSFT)

- NASDAQ exchange

- Revenue: $176 billion

- Net income: $67 billion

- Total Market Cap: $2.6 trillion

Pros

- Growing cloud services, catching up to Amazon’s

- Strong earnings history landlocked by a series of positive growths

- 2nd-biggest stock in the stock market

Cons

- Question-marks over how well Microsoft fares in recessions

📓 Reputation

Microsoft would be the 10th-richest country in the world if you compared worldwide GDPs to Microsoft’s market cap. This among other technological giants with market capitalisation is well over $1.5 trillion: Apple, Google, and Amazon.

Microsoft does global development for devices, software, solutions, and services. Its flag mark product is its Windows and office software suite. But since the late 2010s, they’ve been watching out of relying on their software arm. Getting more revenue read profit from cloud computing offerings, which now is one of the market leaders for.

Microsoft’s primary cloud platform is called Azure. They also own LinkedIn, which is the primary social networking site for jobseekers. As well as Skype technologies.

However, one flag to look out for is that Microsoft tends to struggle during economic slumps. For instance, between 2008 and 2009, Microsoft dropped in value by nearly 60%. It’s not as diversified as Apple; its software-wing still makes up a large chunk of the company’s revenue, and so it’s overall less resilient.

3. Alphabet Inc. – Which you know as Google (and everything else: diversification)

Key Features:

- Stock name: (GOOGL)

- NASDAQ exchange

- Revenue: $239 billion

- Net income: $70.6 billion

- Total Market Cap: $2.0 trillion

Pros

- Ridiculously high valuation compared to earnings

- Immense buyer-backing

- Very diverse portfolio of side bets with strong upside potential, from YouTube to delivery drones

- 3rd-largest stock in the stock market

Cons

- Heavily invested in cloud services, which is falling in profit margins

- Scattered investment portfolio

📓 Reputation

Alphabet is Google’s parent company. The corporation has the lion’s share of the global search market. But an immense range of sum assets is offered, spanning mostly across digital and technological services, and includes:

- ☑️ The Android operating system for smartphones

- ☑️ Email services (Gmail)

- ☑️ The Chrome browser

- ☑️ Google Maps

- ☑️ Google Cloud and Google Drive cloud storage solutions

- ☑️ Google play app Store

- ☑️ Google photos

- ☑️ Youtube

- (*And that’s still only a slice of their offerings…)

*Google Cloud, for instance, lets developers make and launch applications and a range of productivity collaboration tools. The hardware wing of Alphabet is also growing in revenue: such as with the Fitbit, Pixel phones, and a range of Google Nest home products. This diversity is part of its strength and weakness. There’s a certain “uncertainty” with its capital allocation strategy. An immense number of side bets have been made that only loosely tie into its core advertising & search business.

Side-bets Google has taken on include: healthcare, delivery drones, green energy, self-driving vehicles (Waymo), and robots. Some of these – such as Waymo – have exceptional promise. But it’s yet to be seen whether this strategy of “moonshot” capital ventures will secure much real shareholder reward.

Buying Guide

Shares are flexible, meaning they can be used as a micro-investment strategy, a long-term retirement plan, or as a full-time career in trading and finance.

Shares for beginners 🥧

What are shares, firstly? A share is a unit of claim to a company – in other words, the money you’ve invested into a corporation. Which it then uses to operate, in return for providing you with a stake or “share” in the company’s future revenue. What is this stake exactly?

It’s a mixed bag of financial and legal rights. Aspects of ownership. For instance, shareholders – technically speaking – legally have influence in annual board meetings. But it tends to be majority stakeholders who sway corporate decisions the most.

Some firms also use shares as a financial asset that give extra claims to declared residual profits, shared equally among shareholders, and distributed in the form of dividends. But regardless of whether dividends are on offer, shareholders participate in the distribution of the growth of company stock prices.

Let’s give an example. Say you’ve invested $20 into Apple. If you’re a shareholder without dividends written into the agreement, profits aren’t directly distributed to you as a stakeholder. Instead – as Apple’s profits rise – you’ll participate in the simultaneous rising price of its stocks, and the amount that you gained is proportional to the number of shares (units) you have invested into Apple stocks.

In other words, dividends are a tangible stake in company profits. Whereas non-dividend shares are speculative pieces of a company’s performance. As a quick roundup of different ways of thinking about shares as an investment:

- ☑️ Selling shares (capital gains minus dividends) – Profits are made by capital gains alone (i.e. dividends not included). “Capital gains” is an economic concept where profits derive from selling an asset that has gone up in value due to holding it over a period of time. In this instance, that tangible property is shares (units of ownership) in a company’s stock – but, in principle, it could be other things such as a business, car, or property.

- ☑️ Cash dividends – Sometimes get mixed up with “capital gains”, but this works differently. Cash dividends are fully distributed to shareholders as part of the company’s profits after tax. Cash dividends offer a regular stream of cash for investors. Long-term investors can stay invested in a firm and still receive steady cash flow – encouraging “long” position holders to continue holding remaining shares, or to invest in more. Cash dividends can be a huge incentive for investors reliant on investments for living costs, especially retirees who may not have a second source of income.

- ☑️ Share buyback dividends – Where a firm purchases its own shares from shareholders, lowering its number of outstanding shares. Shares are purchased at a premium, relative to the current market, incentivising more investors to take part. This is a useful strategy when a company believes that its share price is undervalued and wants to push the price along. Also, surplus cash lying on the balance sheet can be distributed to shareholders. It’s also a more tax-efficient way to return capital to stakeholders.

Micro-investing guide

Micro-investment is an investment strategy where a tiny amount of your money, relative to your budget or revenue, is invested regularly into assets. It’s the equivalent of a piggyback.

For instance, instead of investing $400 each month into stock purchases, micro-investing is based on adding a few bucks here and a couple of cents there.

Your portfolio grows fractionally, but each day. Many micro-investment strategies require an app or platform directly linked to your debit card. One example of this is PayPal, which lets you add in small amounts of your funds for cryptocurrency investments, according to your configuration preferences. Another well-known example is Acorns app.

As a demo of a micro-investing app. Let’s say you spent $3.58 on your morning coffee during your commute, the app can automatically wound up you purchased to the nearest dollar and transfer $0.42 to your portfolio. And also according to whenever you have extra leftover in your budget.

Micro-investing advantages ✔️

- Very simple to get started – One of the primary reasons it has grown in popularity. Traditional brokerage accounts required forms to be filled, and there are funding minimums on accounts. Mutual fund accounts, for instance, can be set at a minimum of $1000 or more. To start micro-investing, you only need to download the app and register an account, which can be done on your phone in minutes. Once a bank or debit card is linked, you can start making your first investment in a matter of days.

- Automatable – It’s also easy to automate micro-investments. This saves needing to manually manage positions; such as the example given above, where money is added to an investment portfolio by rounding up every purchase to the nearest dollar. You can also make automatic contributions weekly.

- Starting small – Add cents to your portfolio at a time, building up the habit of investing small amounts (distinct from savings: see below), rather than waiting until you have more investment money put aside. While micro-investment depends on tiny psalms, if this is consistent, it can snowball. Consistency generally wins out.

Micro-investing disadvantages ✖️

- Not a substitute for saving – investing generally this first step should be taken towards growing wealth. Pretty much everyone should have an emergency fund that could be used for handling unexpected bills without having to sell investments, or take out a loan.

- Limited capital gains – A strong investment portfolio that earns 15% annually, will only provide $15 from a $100 investment. As micro-investment hinges on tiny sums of money, your returns can also be slim for a long time. It’s a good way to build the habit of investing but – depending on how regular and consistent investments are – later down the line, larger investments may be needed to boost capital gains.

- Extra fees, fewer investment options – Trading fees come into play whenever you use the financial markets; there are extra costs associated with using certain collections of securities, such as mutual funds. Micro investments mostly use collections: mutual funds, ETFs, and baskets of stocks and bonds – which is the second weakness. Micro-investing apps do not let you select individual bonds or stocks for investing in. You have to use a predesignated list containing options that are preferential to you. So if you have a particular strategy to carry out, it’s harder to do this with micro-investing services.

Market cap

Market capitalisation, commonly shortened to “market cap”, is a company’s current market value – and this is speculative, i.e. based on market opinion.

This calculation is based on the stock exchange. A corporation’s market cap will be the total price of all shares of a company’s stock being held by its shareholders. For example, a corporation with 20 million shares, going at $50 per share, would have a market cap of $1 billion.

Market capitalisation is an important concept as it lets investors compare one corporation to another, in relative size. It’s a basic measure of how companies are valued on the market: current supply-and-demand trends or prospects – and it’s a hard figure: what investors are willing to pay for a company’s stock right now.

- ☑️ Large-cap firms – typically have a market value of at least $10 billion. Large Firms typically are blue chip; having a strong reputation for goods and services, consistent growth, and a track-record of steady dividend payouts. They’re commonly industry leaders, with familiar brand names to the national consumer audiences. For this reason, large-cap stock investments are often more conservative than investing in a mid-cap or small-cap stock, possibly offering a lower risk exposure in return for less rapid growth upside.

- ☑️ Mid-cap firms – typically are valued on the market at between $2 billion and $10 million. There is usually more growth potential than is possible for large caps, with less risk than small caps. Companies at this level are established in their industries, but these industries may also be experiencing or going through aggressive growth. So medium-size companies may be fighting for more market share and competitiveness.

- ☑️ Small-cap firms – normally have a market value of $300 dollars to $2 billion dollars. These are mostly younger companies servicing niche markets or emerging sectors. Small caps frequently have the most aggressive growth and highest risk of the three categories. Because there are fewer resources to draw on, smaller companies are more threatened by economic or business slumps. There were also more market uncertainties, because competition is more intense and emerging industries have more untried aspects. But small cap stocks give the most substantial growth potential for long-term investors that can tolerate risks of sudden price swings in the near-term.

FAQs

Are meme stocks a good trade?

Meme stocks bring a lot of risks. So they suit traders who prefer volatile markets – where there is potential for enormous upside – and therefore who have a sound understanding of trading risk management before setting up a position.

What are the 7 best meme stocks?

According to Yahoo Finance, these entries are current future (or have done so in the past and may again) “to the moon” candidates:

- ☑️ Bakkt Holdings (BKKT)

- ☑️ Cleveland-Cliffs (CLF)

- ☑️ Nokia (NOK)

- ☑️ Cassava Sciences (SAVA)

- ☑️ Virgin Galactic (SPCE)

- ☑️ Tilray (TLRY)

- ☑️ PubMatic (PUBM)

*All are available on the NYSE, other than the last two, who are on the NASDAQ.

You Might Also Like: