Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

How to Trade CFDs on Forex Markets

With international currencies always in flux, such as when the Australian dollar and British pound nose-diving into a fiery wreck against the USD, it’s no wonder people are interested in shorting currencies heavily.

Trading these special contracts on forex markets is similar to trading ordinary shares, or stocks. It involves buying a Contract for Difference, also known as a CFD.

One difference is that it uses ‘leverage’ (loans) to let you exchange big money for big quick returns. In this guide, I cover some of this—the key risks and perks of this fast cash instrument. Learn how to trade CFDs on forex markets.

Table of Contents:

- 💼 What is a CFD

- 💼 What is the Forex

- 💼 CFDs on Forex: How to Trade Them

- 💼 Advantages of Trading Forex with CFDs

- 💼 Carrying Out a Trade

- 💼 The Truth??? Why Is CFD Trading Not Allowed in the US

- 📙 FAQs

What is a CFD?

- It’s an agreement between two parties detailing the conditions of an investment deal.

- 📝 Rather than buying stocks outright, to sell at a later date, traders enter into contracts where they speculate on movements of stock prices.

- They’re more explosive than direct stock investments owing to the use of leverage (you borrow lots of cash).

- 🔥🏝️ They’re used by hedge fund managers and financial advisors. Be warned, it’s like playing with fire for non-pros whenever leverage is applied—a high-risk investment that can lead to big profits or big losses with uncertain liquidity.

There is a fair bit of controversy over this topic. So head to ‘The Truth: Why Is CFD Trading Not Allowed in the US?’ section. There I discuss why CFDs are banned in certain countries. We don’t know the true answer but the conversation is fascinating!

Is CFD trading Legal in Australia?

Yes, in Australia CFD trading is absolutely legal, however, it is heavily controlled.

ASIC (the Australian Securities and Investment Commission) is responsible for ensuring the integrity of this market in Australia. ASIC uses seven disclosure benchmarks to evaluate the risks of trading over-the-counter (OTC) Contracts for Difference. (Remember, these benchmarks do not literally reduce the dangers – in CFD trading, there are always risks.)

Types of CFDs 📖

A CFD for short, is a legal financial agreement between two parties. The buyer agrees to buy (or “take”) a certain amount of an asset at an agreed-upon price at a future date. This asset could be any kind of financial asset: stocks, bonds, commodities, foreign exchange, or even cryptocurrencies.

Keep in mind, you’re not actually buying the asset; you’re speculating on its movement. The price of the contract is the agreed-upon price at which the asset is bought. There are two types of CFDs to note:

- Cash-settled

- Futures-based

The first one allows you to speculate on the movement of a given currency or commodity trade by buying or selling a contract that gives you the right to bid on a specific amount of the underlying asset. You can hold the CFD until you make a profit, or else reach your maximum acceptable loss.

The second type, futures-based, allows you to speculate on the movement of a given asset by buying or selling a contract that gives you the right to speculate on a specified amount of the asset at a specified price on a given date. Note that the underlying asset could be any financial instrument: stocks, commodities, currencies, or even cryptocurrencies.

Why People Use CFDs

CFD platforms allow investors to speculate on the price movements of different financial assets and currencies. The main benefit of this type of investment is that you can gain money if an asset goes up or if it goes down. You can also lose if you’re wrong about the direction of an asset.

CFDs may be used in high-frequency trading (HFT) techniques where trades can be executed in minutes or even seconds to minimise costs and speed up execution times. With HFT techniques, traders can exploit price movements in order to make profits by selling short positions or buying puts and calls at different prices than they would otherwise have been willing to pay.

However, if you open a trade at a lower price you cannot profit as much as if you were able to execute your position using leverage. This also increases the size of losses.

What is the Forex?

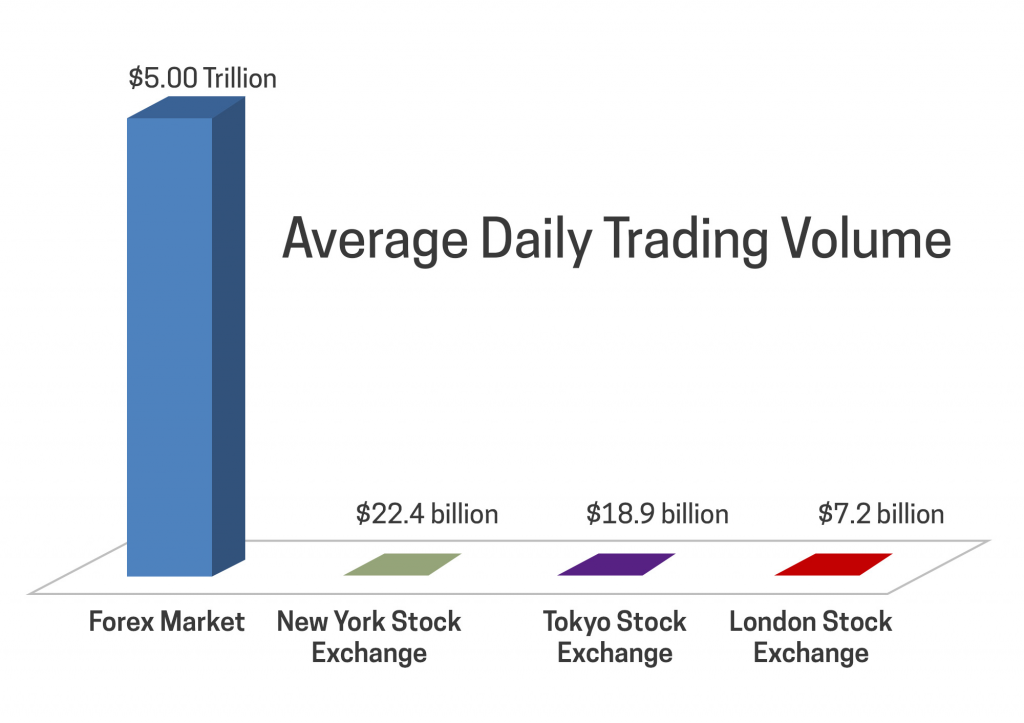

The Forex market is the largest and fastest market in the world. It is home to the biggest trading exchange in the world, way ahead of even the New York Stock Exchange; in fact, it’s bigger than all of the world’s exchanges put together. As they say, money makes the world go around.

The forex market can be a confusing place for new traders, but it doesn’t have to be. If you are new to trading or would like to learn more about how this market works, then you’re in the right place! Keep reading to learn everything you need to know about trading forex.

To start, forex or foreign exchange refers to the buying and selling of one country’s currency in return for another country’s currency. In other words, forex is the buying and selling of currencies, like swapping money. Investors want to hold the stronger currency so its value increases.

How Does the Forex Work 💰

Forex is a highly speculative market, which means that the prices move around a lot, but they don’t necessarily depend on any particular facts or information. Rather, it’s all the world’s happenings boiled down into a single figure; this makes forex a volatile game.

An important thing to know about forex is that the value of one country’s currency is influenced by the value of another country’s currency and world events. Here is an example: Say you live in the United States and want to buy a new laptop in Japan. You could use your American dollars to buy Japanese yen to pay for the laptop, using the current foreign exchange rate between the two currencies. The rate is in constant flux depending on economic conditions in the two countries, as well as world events.

CFDs on Forex (How to Trade a Contract)

If you want to trade CFDs on your own, you need a broker who can provide you with trading CFDs on forex markets. You also need to check if there are any restrictions on trading CFDs in your country. Here’s a rough guide to the legality of CFDs based on the country (Australia permits them).

Before you start trading, make sure you understand the risks involved and what you’re getting in return. Nowhere is it more true that you should make an informed decision about whether it’s worth it for you, as CFDs amplify every movement.

How to Buy a CFD on Forex 💹

Firstly, if you want to buy CFDs on forex markets, you’ll have to find a seller for that contract.

There are basically two ways to do this: you can directly contact the person who owns a contract, or you can choose a broker to handle the transaction for you. You’ll most likely choose the second path; you’ll have to find a broker who will provide you contracts for differences on forex, as not all brokers do.

If you want to sell the contract through a third party, you’ll have to find one who will buy your contract.

Example:

Suppose you want to “go long” Amazon stock at $750, meaning you want to buy the stock and profit from its rising value. Amazon shares can be bought or sold through a stock exchange, or CFDs can be bought instead to speculate on the changing value of the stock.

You invest $7500 of your hard-earned Australian cash into Amazon stock by getting a hundred shares at $750. Amazon rises to $800, you sell. You make $5000 by selling each share for fifty bucks more than you bought them for. Alternatively, you invest $7500 in Amazon CFDs at $750, then close your position for $800. You make $50 for each CFD, or $5000.

In this example, the final result was the same, but the path was different.

If Amazon shares had dropped to $700, you would have achieved the same result. You would sell your shares for $50 below whatever they cost you, but you would still eat the remaining price difference in Amazon’s value with CFD trading since the market did not move in your favour. Which means losing $5k.

How to Trade CFDs on Forex with MetaTrader Brokers

You can use US brokers that are compatible with MetaTrader in order to deal with forex and use leverage by following these steps:

- Get a broker. The first step to beginning MT4 brokerage trading is finding a reputable company that matches your trading approach and preferred fee structure. You must also ensure it is fully regulated and evaluate whether its charges are reasonable. You would benefit from broker with superior leverage options and technical indicators.

- Find a gap in the market. After you’ve created an account with a broker, finding the correct option in a chosen market is the next step. You will have to estimate changes in prices and margins for the next step.

- Make an order. Choose a position on the platform. If your losses reach a certain point, you can stop them by putting a stop-loss order, and you can lock in your profits after they reach a decent level by putting a stop-limit order.

- Exit. The most crucial phase is exiting the position when your chart and instruments indicate it. Do not allow your emotions to guide your trading, instead stick fast to your trading strategies and instruments.

Advantages of Trading Forex with CFDs

Why would a trader choose a CFD over a direct stock? CFDs provide extra features and versatility that you would have a hard time finding when investing. CFDs have three key advantages.

✅ 1. Shorting

Believing a stock price will fall, you borrow the stock and sell it, hoping to buy it back at a lower price and then return it to the lender.

When you enter a short position on a stock, you hope to profit if the price falls. A bearish position is sometimes referred to as a short.

You can profit from upward or downward movements (longing or shorting), such as with the highly in-demand oil commodity You can make money by selling oil CFDs if you believe the price is about to fall due to global economic weakness.

You can close your position if the price of crude oil drops by the same amount as the price of Rio Tinto sharesrises. If the price of oil goes up, you will suffer a loss.

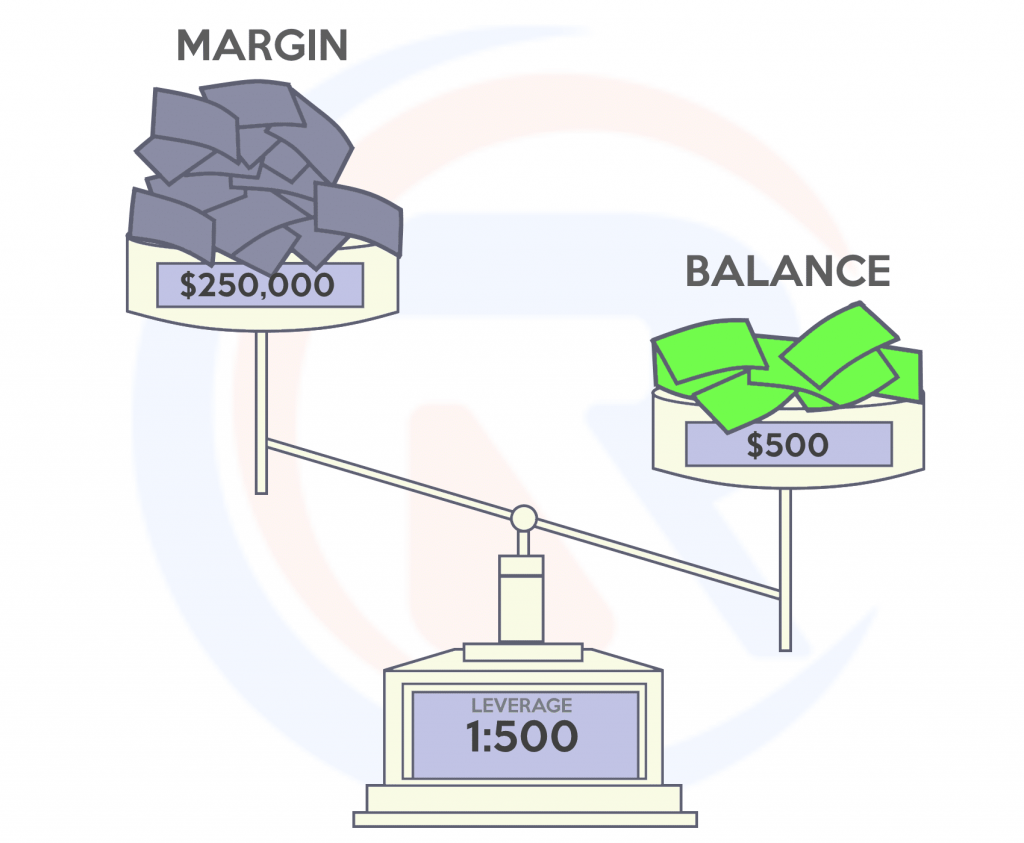

✅ 2. Margin

After opening a CFD position, you don’t pay the whole value upfront. Instead, you make a deposit that is 5% or more of the position’s cost. You’re not paying for the underlying asset; you’re simply betting on its future value changes.

To use this platform, a margin deposit is required. The flexibility to allocate your funds in a variety of ways allows you to leverage. You would not be able to bind all your funds into one position if you wanted to trade $20k of BHP Group CFDs.

Regardless of whether you used leverage to trade, your $20k investment would result in $20k worth of profit or loss. Therefore, it is critical to monitor your risk management even with leverage as a powerful tool.

✅ 3. Broad market access

You won’t be restricted in your trading asset types and classes if you don’t own the assets you are trading. You may be allowed to short or go long on a financial market with a CFD.

Having choices and a diversified portfolio are both advantages. By trading in different types of assets and locations, you can reduce your overall risk.

Carrying Out a Trade

When tracking the price movements of Coca-Cola shares, for example, a Coca-Cola CFD always tracks the same price movements. Coca-Cola CFDs are sold for $1 for every dollar they move up or down, and can be used to purchase a single share of Coca-Cola. When the price goes up, you’ll earn $1. When the price goes down, you’ll lose $1.

Each point the shares move will make or lose $100 in Coca-Cola CFDs. You profit or lose money on CFDs just like with other markets, for instance, bonds. You purchase or sell a fixed quantity of the asset you’re trading, and the total number of units you purchase or sell determines your profit or loss.

The key difference is that you’re dealing with contracts instead of currencies. Instead of trading currencies, you trade contracts that replicate actual real-time prices of those items.

Whenever the price of a Coca-Cola futures contract moves up or down, you will earn or lose $1 for every dollar of that change. Coca-Cola shares are the only thing that a Coca-Cola CFD can track.

Using Buy & Sell Values 📊

On a CFD market, you will see two prices listed—the sell price and the buy price. The price remaining between the sell and buy price is known as the spread.

In some cases, all of the CFD costs are included in the spread, so there aren’t any commissions. However, on some exchanges, spreads might be smaller buy you’ll pay a commission instead.

With long positions, you begin by buying CFDs and end up selling them, whereas, with short positions, you begin by selling contracts and end up buying them.

Tips

1. Always stick with what you know.

Keep to your area of expertise. There are a lot of CFD markets to choose from, but that does not mean you have to venture into fringe assets right away. It’s normally best to choose a few markets to begin with. Once you begin to feel comfortable, you may diversify a bit more.

2. Begin small.

A fraction of your starting cash should be risked on each trade, for example, a per cent or two. Evaluating the size of your trade can be enormously helpful. If you keep your total losses down by limiting the number of trades you make, you can profit even after making a number of mistakes. If you only risk 2% on each trade, you can afford to make 50 bad choices successively before losing it all.

3. Always use a stop.

A stop order closes a position if it reaches a particular level of loss. By removing some of the emotion from trading, stop orders help you maintain control over your risk on any given trade. No matter how experienced a trader is, they will never open a position without first setting a stop. In order to avoid slippage, you can employ a guaranteed stop.

The Truth – Why Isn’t CFD Trading Allowed in the US?

Today, there is so much data propaganda that it’s hard to tell what is the truth of anything. This is very true in the world of finance, where everything is a contest to capture and dominate the flow of capital. With that in mind, let’s backtrack our conversation about how to trade CFDs on Forex markets, all the way back to what these instruments are in the first place…

A CFD is a derivative trading contract that pays the difference in the settlement price between open and closing trades. You can trade on the rising or falling prices of assets using CFDs, but you do not own the underlying asset.

Alright.

It’s an agreement between the parties that defines how to finance the difference between the current value of a security and that specified at the time of contract. In addition to this, derivatives refer to financial agreements where you don’t have to mention the underlying asset. The growing interest in CFDs is due to the following reasons:

- Exposure: An investor may invest in CFDs in many different markets, including crypto, shares, futures and commodities.

- Leverage: In order to increase profits, trading can be financed by taking down only a small margin (a fancy word for ‘a loan’, while the remaining cash can be borrowed from a broker. However, this may also result in higher losses.

So far, so good.

What’s the Deal? 📖

Australians may wonder why America has banned CFDs. This section will explore possible reasons. Take this with an enormous pinch of salt! Whatever way that you spin it, contracts for differences are still very dangerous.

All US taxpayers are prohibited from conducting CFD transactions on domestic and foreign platforms. Furthermore, various regulators prohibit US citizens from opening CFD accounts following the crash of 2008. However, forex trades may be made using several US brokers (e.g. IG).

Several sites and forums claim that CFDs are banned because they are Over-The-Counter, non-exchange CFD trades that are not regulated. Leverage is also seen as a potential risk, which can result in substantial losses.

Despite the potential risks, seeking regulated CFD trading alternatives is common for US citizens. It must be emphasised that most regulated UK companies (eg. FCA regulated) do not let US customers use the internet to open one of these trading accounts.

The Hidden Story…

Despite the fact that leverage is low in EU countries, US regulators prohibit trading via EU brokers. This suggests leverage isn’t the real issue.

Why? What’s the issue?

Because of the US government’s ban on online casinos after 2008, US citizens can only play at US-approved casinos today. The reason politicians don’t want people to gamble online is that tons of capital flooded from US citizens into foreign countries and foreign casinos. After this prohibition, that money is expected to stay in US casinos (meaning America will keep money, with taxes absorbing into the state).

Similarly, US residents are no longer able to trade CFDs for profit overseas, which would cause money to flow overseas. As a result, residents, brokers, or tax collectors in the US will receive more money.

That doesn’t mean investors aren’t playing with fire.

Reportedly, as much as 80 per cent or higher of traders who invest a relatively modest amount of money (under $7k) in short-term assets lose cash. CFDs brokers earn a lot. American shares and markets are open to non-US residents, but only US citizens and residents may trade. Although, you don’t necessarily need to use leverage on your positions.

FAQs 📙: How to Trade CFDs on Forex Markets

What is CFD Trading?

CFD trading is a popular way for high-risk investors and some professionals to trade on ‘futures’ without actually owning the underlying asset. Through CFD trading, it’s possible to invest in a stock without actually purchasing shares. All levels of finance use this vehicle. You can also reduce your investment risk by investing in CFDs, although most retail investors will end up with a much higher exposure due to how they use these contracts. You’ll also need to have an account with a CFD broker.

How Are CFDs Used?

You can use a CFD to speculate on future price changes. It is also possible to use a CFD to hedge against a position. This can be a useful strategy in volatile markets.

They’re subject to market risk and may lose value. It’s also available to cryptocurrency investors. Bitcoin CFDs are a popular way for investors to gain exposure to bitcoin without having to actually own the cryptocurrency, which are also known as cryptocurrency CFDs. In most cases, you’ll need to be an experienced trader.

Can you trade CFD without leverage?

Leverage is not required to trade CFDs (Contracts for Difference) with some online brokers. Because CFDs are based on the future price of a product, selling CFDs on the dips is a useful option for traders looking to make a quick buck. Leverage can also come into play when trading CFDs, but it isn’t necessary. Before you begin trading CFDs, make sure to do your research and make sure you’re familiar with all of the terms.

Are CFD trades taxed in Australia?

If you’re trading CFDs, they’ll always be on revenue accounts. This means you include any profits in your taxable income and can deduct any losses.

Do Hedge Funds Trade CFDs? ⛵

Professionals trade CFDs. Hedge funds and other asset managers often use CFDs to substitute for physical assets or short sales of UK-listed stocks rather than physical holdings (or physical short selling). Investment banks or trading companies employ professional traders who can use CFDs for speculation or hedging. The market is still growing and professional traders employed by investment firms or trading companies can use them for speculation or hedging purposes.

Why are CFDs banned in the United States?

All trading money will go to US citizens, US-based brokers, or US tax collectors in order to prevent the outflow of money to worldwide brokers. Of course, traders who invest less than $5000 in short-term trading assets are likely to lose money in around 80% of cases worldwide and in the United States too ( see the figure).

Is CFD trading in the USA going to be legalised in the coming years?

It’s unlikely that CFD trading will become a part of the US trading market, as the USA would only suffer from it.

Conclusion 🌞

Trading CFDs on forex markets is a tempting way to increase your wealth fast. It’s a speculative investment that can benefit massively from positive moves in the market. Trading CFDs on forex markets provides the potential for quick profits.

However, it’s important to note that trading these contracts involves a lot of risks. There’s the potential for big, instantaneous losses in forex markets. Trading CFDs on forex therefore inherently comes with a lot of risk, particularly for non-professionals. Overall, CFD trading can be a quick and profitable way to trade futures. However, CFD trading can also be a risky strategy.

You can get started with forex trading by checking out a broker.

You Might Also Like: