Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

ClearScore Review: Demystifying Your Credit Score for Free

Whether we’re trying to get credit to buy a house or make a large purchase, knowing our credit score is key. Lenders use this number to work out whether we’re likely to pay the money back or not, based on our previous credit history.

Of course, a credit score can go up or down depending on several factors. A late payment on a credit card can affect a credit score. Equally, paying off a loan in full can affect it too. Whether positive or negative, credit scores are vital and knowing what it is, allows us to work on building it up.

Generally, a high credit score means lenders see that person as low risk. Conversely, a low score means they’re less likely to issue credit. One way to find out is to use a credit score company. There are many on the market, but FCA-regulated ClearScore is the one we’re going to talk about today. By reviewing this company carefully, we can understand whether they’re a good fit or not.

TL;DR

- ClearScore offers free credit scores and reports from Equifax.

- User-friendly interface with personalised insights and coaching plans.

- Includes identity protection features and financial product comparisons.

- Limited to Equifax data only.

- Highly rated for its free service and regular updates.

Criteria Breakdown

Before we jump in and start our ClearScore review, we need a set of criteria to measure it against. We’ve pinpointed accuracy, ease of use, community reviews, pricing, features, and data security. These are the key areas we need to focus on to decide whether ClearScore is a positive choice or not.

What is ClearScore?

What It’s Best Known For

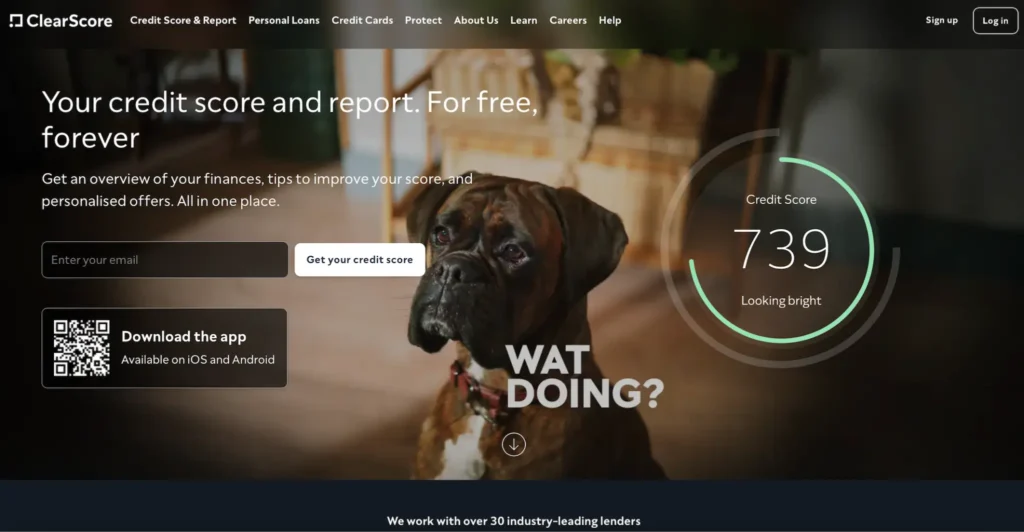

ClearScore is a recognisable name in the credit world. It allows us to check our credit scores, identify areas of improvement, and also identifies personalised borrowing options. In addition to this, ClearScore has strong privacy measures, ensuring that our personal data is kept safe.

The biggest plus point about this company is that they offer their services for free. However, they get their Equifax information. While this isn’t an issue, it’s important to remember that credit scores change frequently. That means our data may not be 100% accurate on any given day. It’s a small chance, but it’s still there.

ClearScore is a popular option, with more than 12 million customers in the UK, South Africa, Canada, New Zealand, and Australia. The company launched in 2014, so it has a decade of industry experience. Besides giving us access to Equifax’s information, it also teams up with financial institutions. From there, they advertise lending goods, choosing the ones that suit each individual best. As a result, we can see the lenders that are more likely to accept applications. In essence, it removes the lenders that our credit scores don’t match at that time.

However, it’s important to dig deeper and understand more about this company. Let’s continue our ClearScore review and talk features.

ClearScore provides users with their credit scores and personalised lending options.

Features

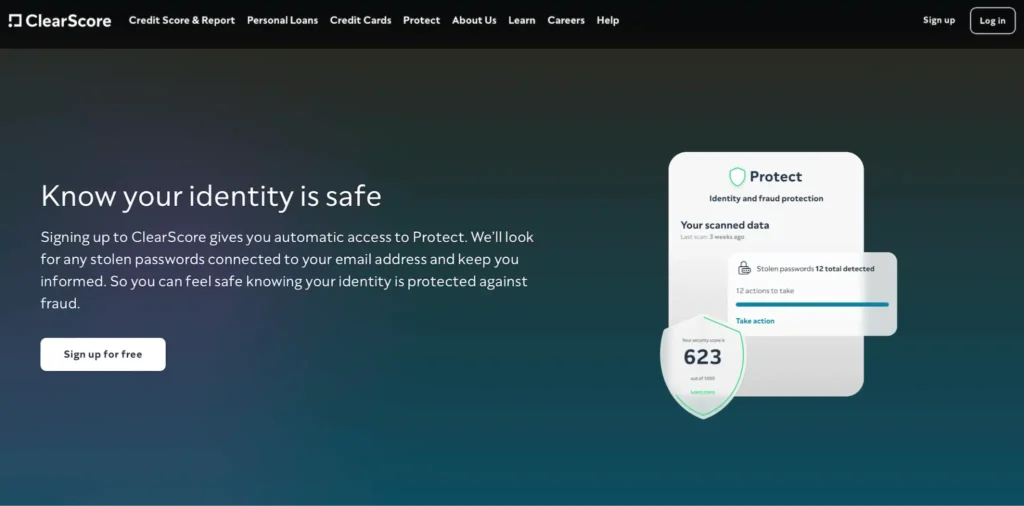

It’s easy to assume that ClearScore simply gives us our magic number (our credit score) and that’s it. Thankfully, there’s more to it than that. With credit score monitoring to identify protection, this platform helps us keep a close eye on our financial health. It also allows us to ensure that nobody has stolen our identity. In that case, we can quickly identify if loans or cards have been applied for without our knowledge.

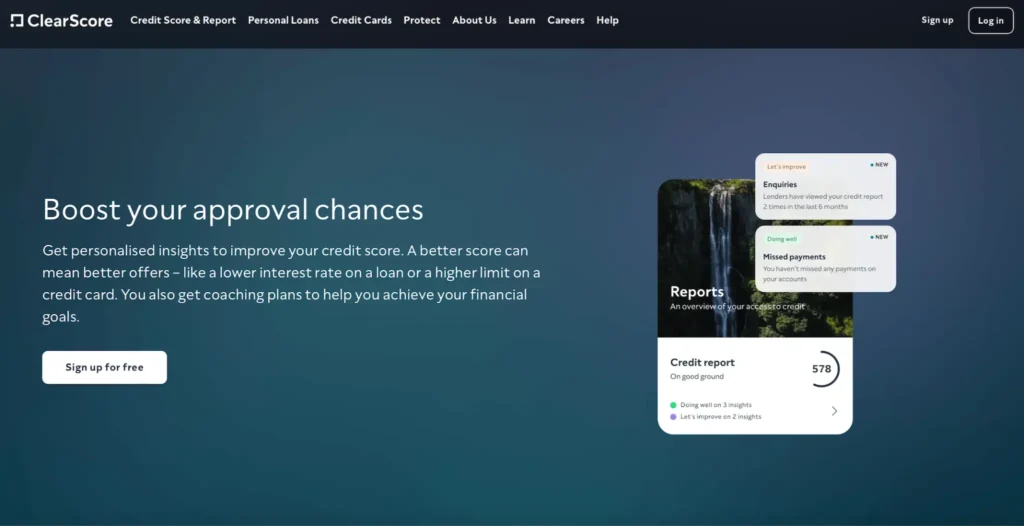

ClearScore gives access to free, unrestricted monthly updates to our Equifax credit score and report. Additionally, the ClearScore marketplace gives personalised credit products tailored to our credit score. These have a higher probability of being accepted.

This service is important because applying for lending with a low chance of acceptance can also affect our credit score. Lenders do a credit search to decide whether to accept an application, which is reflected on our credit report in some cases. Therefore, the less unsuccessful searches the better when it comes to building a high credit score.

Additionally, ClearScore Protect is a feature that allows us to potentially identify identity theft and fraud. Alongside this, the ‘Learn’ section of the site has many materials to assist in financial planning and monitoring.

Pros

ClearScore is a popular company and has many advantages. Let’s talk about some of the most notable ones.

Free Service

Let’s start with one of the most important aspects – pricing. The good news is that ClearScore is a free service. It allows us to access our credit information from Equifax without charge, therefore helping us monitor our financial health.

Of course, this is particularly useful for those struggling with money who are trying to build their score. Not having to pay for extra services is a big advantage.

User-Friendly Interface

Another important aspect is how easy the platform is to use. ClearScore certainly has a user-friendly interface. The platform is easy to navigate, intuitive, and doesn’t have any complicated features.

In some cases, financial companies’ websites can be technical and difficult to use. That’s not the case here. Language is simple and easy to grasp. All features are clear and available to all.

ClearScore gives personalised recommendations for credit applications.

Regular Updates

It’s important to remember that there is always a very small chance that our credit report may not be 100% up to date. ClearScore uses information from Equifax and depending on our recent financial activities, it might need to catch up.

It’s also a good idea to check that expired loans or cards have been removed from the report. Allowing these to sit there when they’re paid can affect our credit score. If an expired item over six years appears on the report, simply contact ClearScore.

Despite that slight warning, ClearScore does update its information from Equifax weekly, giving accuracy peace of mind. Additionally, new accounts and credit card activity appear on the online account almost instantly.

Comparison Tool

ClearScore provides a comparison of lenders that are likely to accept applications. This varies from person to person, depending on their specific score. In this feature, we can see the terms attached to that potential offer, alongside our likelihood of acceptance. It filters out the lenders who are likely to reject an application.

By allowing us to compare potential lenders, we can make strong, informed decisions about our financial health. After all, there are many lenders on the market, and some are better than others. The more information in this regard, the better.

Tips for Credit Score Improvement

Alongside giving our credit score in writing, ClearScore also gives personalised tips on how to improve it. Again, these tips will vary from person to person. However, these personalised tips are like having a financial advisor on hand.

By following this advice, we can build our credit scores over time. And remember, a higher credit score doesn’t only make acceptance more likely but it also means better payment terms and interest rates.

Identity Protection

The final advantage to choosing ClearScore is its ability to spot fraud and identity theft quickly. By monitoring our report weekly, we’ll be able to quickly see any odd entries. From there, we can get in touch with the necessary authorities without delay, minimising damage.

Let’s say we check our report and see a credit card was applied for and accepted last week. If we didn’t do that, we can reach out to the credit card company and the authorities. The card will be cancelled and no further damage will occur. However, if we don’t keep an eye on our credit score, more cards and loans could be applied for. Over time, this could add up to a huge amount of debt in our name.

Cons

No company is perfect, and neither is ClearScore. While these potential drawbacks won’t be a problem for everyone, it’s important to know about them. That way we can make an informed decision.

Limited to Equifax Data

ClearScore obtains its information from Equifax. While this isn’t a particular issue, as Equifax is a reliable company, it may not always be 100% accurate at any given time. Financial issues move quickly, and recent changes may not show up instantly.

Using data from more than one credit reporting agency may provide a more accurate picture.

Targeted Advertising

Like many companies these days, ClearScore uses targeted advertising on its site. This is designed to bring products to our attention that we may like and want to purchase/apply for. However, in some cases, it’s more of an annoyance than a help.

While not a reason to avoid ClearScore, it is something to be aware of.

ClearScore offers Protect, an identity theft and fraud detection tool.

Criteria Evaluation

Credit Score Accuracy: 4/5

User Experience: 4.5/5

Features: 4/5

Data Security: 4/5

Cost: 5/5

Community Reviews and Expert Recommendations

Overall, ClearScore enjoys positive reviews from users and industry experts. It is Australia’s number one credit score and report app, which gives peace of mind from the start. It also claims to have more than 20 million customers in the UK, Canada, Australia, New Zealand, and South Africa. That says a lot about its popularity and reliability.

Overall, users enjoy the easy to use interface and find the app simple to navigate. It currently has a 4.5 Trustpilot rating, which it rates as excellent. Many users mention the customer service to be excellent, helping whenever a problem arises. Its accuracy and identity protection features are also regularly mentioned. However, some do mention that the credit score given isn’t 100% up to date. This is an issue we mentioned earlier. This isn’t a prominent complaint, but one to bear in mind while Equifax’s data updates itself.

When putting together our ClearScore Australia review, we also found some industry expert comments. They concur with user reviews, stating that ClearScore is a quality credit score company. They particularly point to the identity anti-theft and fraud features as particularly high quality, along with strong regulatory oversight.

Price

ClearScore is a free service. There are no paid-for features with this company. However, if you choose to apply for a service recommended via ClearScore, third party companies may have their own charges.

Alternatives to ClearScore

It’s possible that ClearScore Australia just isn’t right. In that case, there are some notable alternatives to explore.

Credit Karma

A good alternative is Credit Karma, a free site that gives access to credit scores and reports. It works in a similar way to ClearScore, recommending lending opportunities that each individual is likely to be accepted for. However, it currently operates in the UK, US, and Canada only.

Experian

Hands down, one of the most recognisable names in credit is Experian. This company allows customers to check credit scores an unlimited number of times without affecting it adversely. However, it is updated every 30 days, which is rarer than ClearScore. A stand-out feature is the ability to connect a bank account, to give more insights into spending and financial health.

Credit Sesame

Credit Sesame is a credit score and report checking tool that offers a free service. It offers credit building advice and personalised opportunities for lending, similar to ClearScore. However, this company makes it easier to understand credit scores by assigning a letter grade, rather than a number.

ClearScore offers resources for learning and staying up-to-date with financial news.

Frequently Asked Questions

Is ClearScore really free?

ClearScore is a completely free service with no hidden fees. Where do they make their money? When a customer takes out a financial product via their platform (recommended to them), ClearScore makes a commission.

How often does ClearScore update my credit score?

ClearScore updates credit scores weekly via Equifax. Previously, this used to be once per month but recent updates make the service more efficient and accurate. However, it’s important to remember that credit scores may be slightly out of date depending on recent financial activity. This should update itself in the next report.

For instance, if a customer receives their weekly report and then takes out a new credit card, the score won’t update immediately. It will show in their account, but won’t show on the report. However, the following week, it should.

Is my data safe with ClearScore?

The FCA regulates ClearScore in the UK, but not Australia. However, that shouldn’t be too concerning. The reason is because in Australia, the company is subject to Australian Privacy Principles and the Privacy Act 1988. This means they ensure the privacy and security of all information.

Additionally, the Protect feature is on hand to ensure customer identities and data are monitored and secure. However, it’s important to remember that no system is 100% perfect. For that reason, adding extra protection, such as a VPN, is a good idea.

Can ClearScore help me improve my credit score?

ClearScore doesn’t only monitor credit scores but provides information on how to improve them too. With personalised tips and advice, it’s possible to boost a credit score quickly. Additionally, the large number of resources and articles give extra information to customers who want to learn more.

However, remember that credit score improvement doesn’t happen overnight. It takes consistent work and effort to see a change, especially a substantial one. ClearScore’s tips can help customers increase their score and find tailored lending opportunities. This information helps to avoid applying for credit that they’re simply not likely to be accepted for. Of course, this adversely affects their credit score. ClearScore helps to avoid these problems.

How accurate is the credit score provided by ClearScore?

ClearScore uses Equifax to find customer credit scores. This is a large credit reporting company with accurate information. However, credit scores can change depending on recent financial activity. Additionally, different lenders may use different scores to assess creditworthiness. While credit scores catch up with themselves over a period of time, it may not be 100% accurate at that moment.

The best advice is to use ClearScore’s information as a general guide, knowing that it’s as accurate as it can be. In the end, it acts as an excellent guide to help boost credit scores and find suitable lending opportunities.

Final Thoughts

While not everyone likes the idea of borrowing money, sometimes it’s necessary. Large purchases sometimes need extra help. Yet, sometimes we’re not able to find a suitable lender because of our past financial history.

By understanding our credit scores and working to improve them, we can boost our chances of being accepted. Yet to do that, we need additional help from companies like ClearScore.

We’ve covered a lot of ground in this ClearScore Australia review. Let’s recap what we’ve learned:

- ClearScore offers free, easy access to your Equifax credit score and report.

- The platform is user-friendly and packed with helpful features.

- Regular updates and personalised insights make it a valuable tool for improving your credit health.

- While it’s limited to Equifax data, the free price tag makes it hard to complain.

- Security measures are robust, giving users peace of mind.

Overall, ClearScore offers great value for a free service. It’s also a good tool to monitor your data and avoid identity theft and fraud. Of course, you can take that a step further by using a privacy focused search engine and a VPN.

Not only does ClearScore help boost your credit score, but it keeps you safe online too. In today’s age, avoiding credit card fraud is vital. Here at Privacy Australia, we offer many resources to help you stay safe and secure. We also offer comparisons, like finding the best cash back credit cards. Feel free to check our site for more tips!

You Might Also Like: