Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Options Trading Platforms in Australia

Options have always been attractive to online brokers due to their profitability. However, they have come into much more prominence with the COVID-19 pandemic, causing ripples across stock markets around the world.

Australia isn’t immune to these global trading trends, and the search for the best options trading platforms couldn’t come at a more crucial time.

Options are a type of derivative trading that allows people to transact on securities in the Australian market.

Table of Contents:

- 10 Best Options Trading Platforms in Australia

- What Is Options Trading

- Options Trading Buying Guide

- Australian Options Laws Guide

Best Options Trading Platforms in Australia

- Our TOP Options Trading Platform: eToro

- Best for CFDs: Plus500

- Best for Beginners: eToro

- Best Low Brokerage Fees: AvaTrade

- Best for Advanced Research Tools: CMC Markets

- Best for Share Trading: CommSec

- Best for Advanced Users: IG Markets

- Best for Professionals: Interactive Brokers

- Best for Educational Tools for Investors: Capital.com

- Best for CFDs: Libertex

- Best for Variety of Assets: Tastyworks

1. Best Options Trading Platform: eToro

Key Specifications:

- Access to 17 worldwide exchanges

- Easy for beginners to learn

- Assets of every kind, including cryptocurrencies

- Higher levels of security

- Network with a community of investors

Pros

- Low minimum deposit

- Designed for learning

- Innovative advancements that regularly improve the site

- Awesome research and resources available

Cons

- Fees for inactivity

eToro is one of the leading trading platforms in Australia, with access to 17 of the most noteworthy exchanges. This platform is a top choice for beginners because it is easy to use and grow with, so it’s easy to dip your toe in the water .

Perhaps one of eToro’s most noteworthy features is the ability to network with other traders, and even copy the trades of more experienced people. This is a great way to learn and improve your knowledge of the market and trading.

This company has advanced a ton since its meagre beginnings in 2007. Today, you can use the eToro app, take advantage of the asset choices, and learn from Smart Portfolios. It’s a good idea to practice and play with the demo account, to decide if you like the look and feel before you sign up.

Did you know eToro was rated the best share trading app in Australia? This goes back to that useful network of sharing with other traders. If you want to dive into trading options and you’re still learning, you simply can’t go wrong with this one.

Trading and Fee Structure

eToro is unique when it comes to the fee structure for its customers. It won’t charge you commissions on trades, but you may see random fees here and there. Options will always have a spread fee, but not commissions.

There are no fees to deposit funds (conversion fees apply), but you will pay a basic fee for withdrawals and some other things within the app. In fact, one fee that might surprise you is the inactivity fee. If you do not log into your account for more than one year, a monthly inactivity fee is charged from any remaining available balance – so be sure to watch out for that.

eToro uses the CopyTrader trading platform, which is known as being one of the top trading platforms out there. It’s loaded with innovation, and it’s what allows you to copy other traders.

One day, when you really become a great trader, you can potentially allow others to copy your options trades and make some money off of it in the process.

These are some of the great features of the platform.

- Designed with innovation

- Trade a variety of assets

- Copy trades of experienced investors

- Trade with confidence and resources

Disclaimer:

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Social trading. eToro does not approve or endorse any of the trading accounts customers may choose to copy or follow. Assets held in your name. Capital at risk. See PDS and TMD.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk. May not suffice as basis for investment decision.

2. Best for CFDs: Plus500

Key Specifications:

- Regulators: ASIC and FCA

- Minimum Deposits: AUD200

- No deposit fees

- No withdrawal fees

- Platforms: WebTrader

- Inactivity fee charged: Yes, $10 per month charged after three consecutive months of inactivity

For more detailed information visit: https://www.plus500.com/Help/FeesCharges

CFDs are a leveraged product and can result in the loss of your entire balance. Trading CFDs may not be suitable for you. Please consider whether you fall within Plus500’s Target Market Determination available in the Terms and Agreements. Please ensure you fully understand the risks involved.

Pros

- Comes with low trading fees

- Listed on the London Stock Exchange

Cons

- Only limited product portfolio available

- Charges inactivity fee

Founded in 2008, Plus500 has its headquarters in Haifa, Israel. It is regulated by several top-tier organisations, including the Australian Securities and Investments Commission (ASIC), and the UK’s Financial Conduct Authority (FCA), along with the CySec, MAS, and ISA authorities.

Plus500 has a lot of in-built flexibility, offering an intuitive, seamless platform that includes a well-designed mobile app. Opening a Plus500 account is a digital, coherent, and harmonious process without hassles, although it still requires knowledge and experience. You can start trading with the demo account.

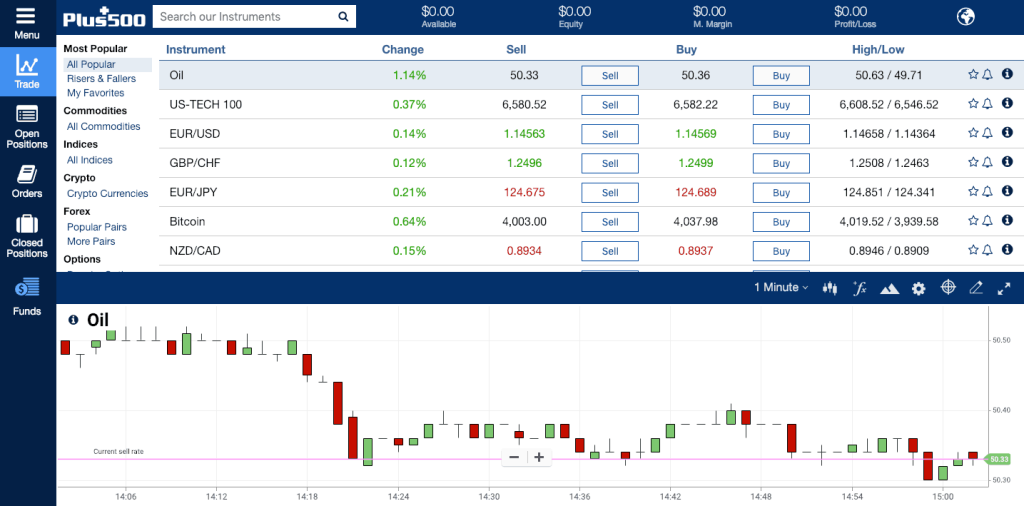

Platform and Trading Conditions

Plus500 is a market-maker, which means that it actively quotes two sides – both the buy and sell – in anticipation of making a profit on the bid-ask spread. It seeks to make a profit from the difference in the buy and sell spreads.

(Please note these are illustrative prices only)

Therefore, an automated system is triggered as soon as a user places a trade on the Plus500 platform, setting a hedging trade to protect Plus500 from any potential loss by assuming the role of a counterparty.

It is a closed system where Plus500 is the counterparty; as a result, there are few requotes but there is fast trade execution.

Account Base Currencies

Compared to other platforms, Plus500 provides a large number of base currencies; even the minor ones. The exact number isn’t transparent but, from our research, it includes at least 10 compared to eToro’s one. You need to contact support if you want to change your base currency.

Why does it matter the number of base currencies carried by an options trading platform? Well, because it helps you to avoid conversion fees. If your trading account is funded in the same currency as your bank account, or even if you trade assets in a similar currency as your trading account base currency, then you can avoid paying conversion fees.

Fees, Deposits, and Options

With no deposit fee, Plus500 provides several options for investors to deposit money into their accounts such as bank transfers, debit/credit cards, or via PayPal.

Read more in our in-depth review of Plus500 here.

Disclaimer: CFDs are a leveraged product and can result in the loss of your entire balance. Trading CFDs may not be suitable for you. Please consider whether you fall within Plus500’s Target Market Determination available in the Terms and Agreements. Please ensure you fully understand the risks involved.

Plus500AU Pty Ltd (ACN 153301681), licensed by: ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Consider if you fall within our Target Market Distribution. Please refer to the Disclosure documents available on the website.

3. Best Low Brokerage Fees: AvaTrade

Key Specifications:

- Regulators: Australian Securities and Investment Commission (ASIC)

- Trading Platforms: MT4, MT5, Duplitrade, ZuluTrade, Guardian Angel

- Commission Fees: None

- Price of Entry: $100

Pros

- No commission fees on trades or brokerage fees on earnings

- Trade in more than just options

- Enables tons of trading strategies

Cons

- Incredibly dense and hard to navigate

- Updates slower than some apps

AvaTrade is a platform based in Australia that is known for being secure, cheap, and reliable. It is secure thanks to the advanced encryption of its app, while it is cheap as it has no brokerage fees outside its $100 price of entry. At the same time, it is reliable as a result of being under the watchful eye of the ASIC.

In a world where brokers will regularly take 90% of your earnings, a platform with no brokerage fees seems almost impossible. But it becomes clear why AvaTrade lacks these fees when you use its app.

AvaTrade is a service for the most advanced traders. It brings with it more than just options, also supporting forex, crypto, CFDs, and more. As a business, AvaTrade does not want to disincentivise good traders using its app by taking away most of what they earn while actually using it to trade.

This focus on advanced traders results in a harder app to navigate.

The tools you have for trading options alone are dizzying, enabling all kinds of different strategies. You might not know half of them by looking at them, but all of them as a worthwhile place in the app.

Luckily, AvaTrade comes with a competent knowledge base for helping those who are not advanced enough to use it. Once you get caught up with the app’s capabilities, you will find it is one of the best.

4. Best for Advanced Research Tools: CMC Markets

Key Specifications:

- Regulators: Financial Conduct Authority (FCA)

- Trading platform: MT4, Next Generation trading platform, Stockbroking Pro platform, CMCMarkets Mobile Trading App

- Options trading fee: $33 up to $10,000, 0.33% above $10,000

- Standard brokerage fee: for ASX shares, AUD 11 or 0.1% for first 10 trades up to AUD 10,000

Pros

- Blistering fast trades in less than a second

- Low brokerage fees

- Wide breadth of trading opportunities

- Convenient configuration, setup, and execution of orders

Cons

- High stock CFD and brokerage fees

- Charges inactivity fee (15 AUD) if your account remains inactive for 12 months

As one of the best online trading platforms, CMC Markets’ expertise in options trading is boosted by a reputation dating back 30 years. CMC Markets thrives on fast trades and low brokerage fees. Its outstanding research tools and breadth of useful features provide it a strong competitive advantage in the online brokerage market.

CMC Markets is a UK broker regulated through the Financial Conduct Authority (FCA), which means it must adhere to the FCA client assets regulation, known as CASS.

Account Types

There are three membership options offered by CMC Markets, namely; Classic, Active Investor, and Premium Trader.

| Membership Tiers | Description | Qualification Criteria | Brokerage Fees |

|---|---|---|---|

| 1. Classic | Classic is the CMC Markets’ standard platform containing a host of features and provides low brokerage fees | 10 trades per month maximum | For the initial 10 trades: $11 or 0.10% per trade; between the 11th to 30th trade: $9.90 or 0.08% 31st trade +:$9.90 or 0.075% |

| 2. Active Investor | Contains all of Classic’s features, including access to the Pro stockbroking platform, theScreener research reports, free daily technical analysis emails, free live data | A trader needs to make 11-30 trades per month; or alternatively makes at least 5 trades AND incurs at least $500 per month in brokerage fees | For the initial 10 trades: $9.90/0.10% ; between the 11th to 30th trade: same as Classic; 31st trade +: same as Classic |

| 3. Premium Trader | Incorporates CMC Active Investor features, then includes free access to a plethora of other features such as exclusive access to CMC Premium events, education resources, and so on | At least 30 trades each month | $9.90 or 0.075% for all trades |

Options Functionality

To trade options on the platform, you need to have a CMC Markets Stockbroking account, which is offered both on its Stockbroking Standard and Pro platforms.

Depending on your options trading level, CMC Markets enables you to do the following:

- Execute multi-legged options

- Build and execute complex strategies

- Sell uncovered calls and puts

- Use interactive pay-off diagrams to comprehend your risk and exposures in real time

- Report on your entire portfolio with efficiently combined, yet simple watchlists, orders history, and Profit and Loss statements.

- Using the Theoretical Price estimate and display of Options Greeks to understand your book.

Trading Platforms

Technical-savvy clients who wish to upgrade from MetaTrader4 will be pleased with CMC Markets’ Next Generation trading platform. This proprietary platform comes in web, mobile, and tablet flavours.

It provides advanced charting with as many as 12 chart types, 35 drawing tools, and 80+ overlaps/indicators. On the desktop, charts can be popped out to create and optimise complex layouts.

The Next Generation platform’s customisability is a huge advantage. The design is simple, yet allows you to add stops and limits. CMC Markets possesses a single sign-in for trade options, international shares, and various stockbroking products.

Interested in studying price histories and long-term trends? Well, there is information on these going as far back as 20 years on covering major instruments.

5. Best for Share Trading: CommSec

Key Specifications:

- Regulators: It is regulated by the Australian Securities and Investment Commission (ASIC), and is a member of the Australian Stock Exchange (ASX)

- Trading platform: The proprietary CommSecIRESS trading platform for ASX-listed securities and international shares

- Options trading fee: For the Internet, $34.95 up to $10,000 in premium; over the phone, $54.60 up to $10,000 in premium

- Standard brokerage fee: it varies, but with CommSec CDIA account, $10 for trades of Australian shares up to $1,000.

Pros

- Provides access to international stock and securities

- Entry requirements are minimal

- Reputable and trusted brand name in Australia

- Simply to use with no inactivity fee

Cons

- Inactivity fees on international account

- Devoid of live chat support

- You can’t use CommSec outside of Australia, even if you are an Australian citizen,

CommSec (Commonwealth Securities Limited) is an Australian-based brokerage company that is an entirely-owned subsidiary of Commonwealth Bank of Australia, though it is non-guaranteed. Its trust and brand recognition in Australia is high given that it is part of one of Australia’s four major banks.

CommSec has carved out a niche for itself as one of Australia’s leading online brokers. Its foray into the options market has equally been approached with the same type of efficiency, with real-time access to quotes, research, and state-of-the-art charting tools.

Unfortunately, CommSec doesn’t offer its services to international clients. If you don’t reside in Australia, even if you are a citizen, you most likely won’t be able to access its services.

Features and Services

The portfolio of assets you can trade in CommSec is impressive, providing its customers with a bounty of opportunities. CommSec provides robust support for options trading with its Exchange Traded Options Account allowing customers to both buy and sell Call or Put Options.

Clients can trade stocks domestically and internationally; whether separately or as a component of a fund, as well as ETFs (Exchange Traded Funds), and CFDs (Contract For Difference). In addition, clients can transact in fixed income securities and warrants.

With a CommSec CFD Account, you can invest in several markets such as global indexes, Australian and international share CFDs, forward indices (futures), foreign exchange (forex), and commodities.

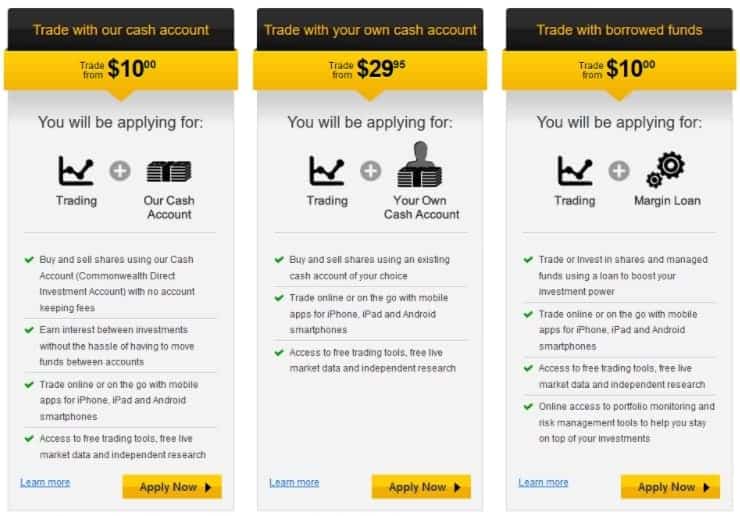

Accounts

CommSec provides a single login for current clients for the Commonwealth Bank, allowing them to easily move between trading and banking accounts banking.

These are the account types offered by CommSec:

- ☑️ CommSec Share Trading Account

- ☑️ Commsec Margin Lending Account

- ☑️ Commsec Options Accounts

- ☑️ Commsec CFD Accounts

- ☑️ CommSec International Securities Trading Account

One of the standouts of how CommSec operates compared to other providers is that it has an account option for each type of trading. As its name implies, Commsec Options Accounts allow customers to trade options, and brokerage makes it as convenient as trading stocks. The Options Account was conceived to be used together with other CommSec accounts, thereby allowing clients to seamlessly move funds between accounts.

On the other hand, the CommSec Share Trading Accounts are for customers who want to buy and sell Australian shares. These trades can either be funded with a good old-fashioned cash account, or with the Commonwealth Direct Investment Account.

Moreover, CommSec says a deposit isn’t required to place trade orders. Apart from the stock market, Share Trading Accounts can be used to invest in options, Exchange Traded Funds, partially paid securities, MINI trading warrants, and warrants.

Meanwhile, access to borrowed funds is provided through the CommSec Margin Lending Account.

The CommSec Options Account allows its holders to trade options. It endeavours to make it as seamless as possible to trade options with the ease.

For instance, the Options feature is well-integrated with the CommSec trading platform. This is because CommSec conceptualised its Options Account to be used in conjunction with other accounts. This strategy is aimed at building a synergy of investment schemes across a customer’s portfolio, spanning the simple to the complex.

If you’re interested in dabbling in forex-based transactions, the Commsec CFD Accounts allows you to place trades on more than 7,000 different CFDs for as low as $10.

Meanwhile, the CommSec International Securities Trading Account allows customers to gain access to 25 international stock markets.

Options Trading

CommSec offers its customers an Options Account which allows them to link to their CommSec Share Trading Account or Margin Trading Account. This integration creates lots of benefits for the customer, such as enabling them to be able to submit shares as collateral, and provide cash margin from their associated CommSec Margin Lending Account or CBA Account.

CommSec provides four levels of Options trading; each determining the type of strategies that can be used on them:

- ☑️ Level One: Buy to open

- ☑️ Level Two: Buy to open and sell fully covered calls

- ☑️ Level Three: Buy to open and sell fully covered calls or sell cash covered calls

- ☑️ Level Four: Advanced multi-leg strategies

Trading tool

CommSecIRESS is the proprietary trading platform provided by CommSec. It comes in web and mobile flavours, with a customisable desktop that you can set up to suit your personal preferences, trading style, and preferred layout of screen real estate.

It is fast and easy, with an intuitive interface that enables traders to perform tasks in a straightforward fashion, whether it is placing orders or depth order highlighting. It provides a real-time data streaming platform for traders to purchase ASX-listed securities such as Australian shares, ETFs/ETOs and warrants, along with crucial quote information for derivatives and equities.

CommSecIRESS capabilities include fast trade placements, historical data, alerts, watchlist, and market maps. Its advanced charting tools come with a range of drawing tools, indicators, and historical data.

But unlike other trading platforms, neither CommSecIRESS nor the CommSec website provides any free educational content. Nevertheless, CommSec offers both basic and advanced tutorials to enable customers to acquaint themselves with its features and maximise their experience on the site.

6. Best for Advanced Users: IG Markets

Key Specifications:

- Regulators: Across the globe by at least six tier-1 jurisdictions, including ASIC and FCA

- Trading Platforms: MetaTrader 4, proprietary IG trading platform

- Options trading fee: On all option trades, commission is 0.1 unit of market currency for each contract, taken at open and close.

- Standard brokerage fee: 8 AUD or 0.1% per trade, whichever is higher.

Pros

- Competitive spreads across a wide range of markets

- Advance chart technology

- Low margin with high leverage

- Provides limited risk trades

- Ultra fast, yet reliable trading platform

Cons

- Charges quarterly inactivity fee

- Product portfolio is limited

- Slightly higher fees and spreads on standard instruments like ASX share CFDs and indices than other competitors

IG Markets was established in 1974 and boasts more than 178,000 clients globally. It had built a lot of brand equity worldwide and had become a trusted name because of its long-standing business operations.

An assortment of regulatory bodies across the globe oversee IG Markets; including the Financial Conduct Authority (FCA), Australian Securities Investment Commission (ASIC), and Federal Financial Supervisory Authority (BaFin). Moreover, being listed on the London Stock Exchange offers another degree of transparency for its customers as this compels it to disclose its financials.

In all, IG Markets is regulated by at least six tier-1 jurisdictions, making it one of the safest, low-risk brokers around. Its list of tradable products is extensive, featuring more than 100 forex currency pairs (making it one of the best forex brokers in Australia), options, CFDs, indices, commodities, gold, bitcoin, and other cryptocurrencies.

Online Trading Platform and Features

The IG Markets trading platform is distributed across its Web platform, Trading apps, MetaTrader 4, ProRealTime. The trading platform includes a range of features, with the ability to:

- ☑️ View a simple, cleanly designed interface that offers a comprehensive overview of the market

- ☑️ Evaluate performance across time frames stretching from tick-by-tick to monthly

- ☑️ Experience cutting-edge technology in any browser that supports HTML5

- ☑️ Execute in-depth analysis with 28 indicators and 19 drawings

- ☑️ Highlight key trends, patterns and levels

- ☑️ Set alerts that trigger when certain conditions are met

- ☑️ Trade automatically by stipulating orders at your chosen level by, selecting the expiry date, and closing manually

The Options Advantage

Their Options feature provides flexible and comprehensive options – no pun intended – to enable you to trade on the volatility of the market. This volatility enables you to trade whether the market is rising, falling, or moving sideways.

Most IG Markets Options features are facilitated in conjunction with CFDs (Contract For Difference). IG Markets provides a broad range of Options, together with the necessary support and service you can anticipate from arguably the world’s largest provider of CFDs.

Other benefits include the opportunity to trade on a wide range of instruments such as major indices, shares, forex, and a lot more. Plus, it provides convenient time frames to suit you such as daily, weekly, quarterly, and even future positions.

7. Best for Professionals: Interactive Brokers

Key Specifications:

- Regulators: Australian Securities and Investments Commission (ASIC), participant of ASX, ASX 24 and Chi-X Australia.

- Trading Platforms: Traders Workstation (TWS), Client Portal, IBKR Mobile, IBKR WebTrader

- Options trading fee: Index options (ASX): AUD 2.00 per contract, Stock Options: AUD 0.30 per contract

- Standard brokerage fee: (Fixed-tier) 0.08% of trade value or 6 AUD (whichever is higher)

Pros

- Low, transparent commission and financing rates

- Ideal for experienced and professional traders

- Broad range of investment selections

- A single integrated account offers access to forex, options, stocks, and futures

Cons

- Not tailored for beginners

- Charges monthly inactivity fee

Founded in 1997 in the United States, Interactive Brokers (IBKR) is one of the oldest trading platforms in the market. It has offices in Australia in addition to operating in 125 global markets.

It is regulated and fully licensed by the Australian Securities and Investments Commission (ASIC). Interactive Brokers is also a participant of the ASX, ASX 24 and Chi-X Australia.

Interactive Brokers has the advantage of one of the lowest brokerage and commission fees in the industry. According to the Barron’s 2019 online broker review, Interactive Brokers provides the lowest margin loan interest rates of any broker in the market.

Customers can earn extra income through Interactive Brokers on fully-paid shares of stock held in their account. This is because Interactive Brokers borrows from these shares to lend to those traders who are eager to short and are prepared to pay interest on these borrowed shares.

Every day these stocks are on loan, Interactive Brokers ensures that the customer is paid interest while still keeping the ability to trade the loaned stock without any restrictions.

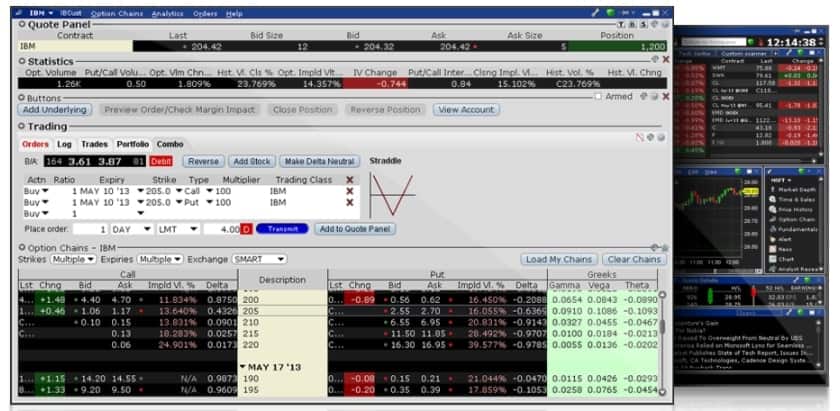

Interactive Brokers Platform

Traders Workstation (TWS) is Interactive Brokers’ flagship trading platform. It has web, desktop and mobile capabilities.

Traders Workstation (TWS) is customisable to suit your personal preferences, although new traders and beginners might find the platform overwhelming. It provides an impressive array of tools for both professional and active traders.

With clients in more than 200 countries, TWS allows them to invest in products as diverse as options, stocks, futures, forex, bonds, and futures; all from a single, integrated account.

IB’s TWS can be tailored to whether you are dealing with options, shares, futures, forex or a combination. What makes TWS effective is that it has features that make it powerful enough for professional traders to use but also broad enough for everyone to use.

Desktop TWS

This product is designed for those traders who require power and flexibility because they trade multiple products at the same time.

IBKR Mobile

Users can monitor their portfolio and easily perform trades on the go with the IBKR mobile app.

IBKR WebTrader

This web-based platform offers the same features as the desktop. It operates behind a firewall, and relies on a simple interface.

Options Trading

TWS OptionTrader is the proprietary and robust trading tool used by Interactive Brokers to enable clients create, view, and trade options. It is equipped for executing speculative trades and yields a comprehensive view of available option chains.

TWS OptionTrader provides clients with the following benefits:

- ☑️ Fast click order entry

- ☑️ A customisable, configurable format

- ☑️ The ability to manage your orders on a single screen

- ☑️ The ability to view Greek risk dimensions

- ☑️ Access TWS other integration options such as Options Analytics, and IB Risk Navigator, with only a single click.

- ☑️ The ability to view implied volatility by contract

8. Best for Educational Tools for Investors: Capital.com

Key Specifications:

- Regulators: ASIC, CySEC, and FCA

- Minimum Deposits: $20

- Withdrawal fee: $0

- Platforms: MT4

- Inactivity fee: No

Pros

- AI-powered insights

- Tons of educational tools

- Zero commission or withdrawal fees

- Available 24/7

- Easy-to-use interface

Cons

- Complex brokerage services that take some getting used to

- No two-factor authentication

Capital.com excels when it comes to educational tools for investors. It has state-of-the-art analysis tools and optional integrations with some of today’s hottest analytical software. Apart from helping investors learn, Capital.com has also gone out of its way to create a user experience like no other, whether on the web or using the mobile app.

Mobile Experience

Traders have the option to log in to their account on their PC, mobile phone or tablet. Each offers a seamless experience where traders can access everything from market tools to processing withdrawals. Apps are available for iOS and Android, both adapting perfectly to the screen and creating an interactive trading experience that you won’t find with many other platforms.

Resources

Educational resources are Capital.com’s forte. From webinars to AI-powered analytical tools, and more, traders will find all they need to build their knowledge and spot profitable trends. It has an economic calendar that traders can access, gaining a glimpse into real-time volatility and trends. New investors can use demo accounts to learn how trades work from start to finish without risking their own money.

Additionally, investors have the option to integrate MT4, for a better, more in-depth market analysis. It offers carting options and automated trading through expert advisors, something that you won’t find in many other trading platforms on the market. Together, all of these tools provide the most fundamental data around, making for better more profitable trades.

Low to No Fees

You won’t find many fees when you sign up with Capital.com. It does not charge for commissions, withdrawals, or inactivity, allowing traders to keep more of their investments in their pockets. When traders are ready to get in on a market, they can do so for as little as $20 for most markets. Payment methods range from debit and credit cards to e-wallets, and more, catering to investors of all levels with all kinds of preferences. A platform where investors can keep more of their investments is what you’ll find when you sign up with Capital.com.

9. Best for CFDs: Libertex

Key Specifications:

- Limited variety of options trading

- Great for trading CFD options

- Limited fees and charge

- Easy-to-use platform

Pros

- Most trusted broker of 2021 in its area

- Small amount of assets to keep it specialised

- Great for trading in CFDs

- Long-standing provider in the investment industry

Cons

- Limited assets to choose from

If you’re looking for an Australian broker that allows options in limited areas, Libertex could be a good choice. Narrowing down the market can help make some of those options trades less confusing. With Libertex, you can’t trade options on every type of asset or market, but you can find options contracts in certain places.

Libertex lets you trade CFD options using its SPX 500 and DAX markets. You can also find options contracts for things like gold and crude oil. This gives you a broad span, but not access to everything.

With options, you can leverage on a 1:30 ratio, use margin call at 50%, and take advantage of tight spreads. It has a nice trading platform that is easy to use once you get the hang of it. It’s a unique platform, so it might take a little bit of practice to be familiar with. There are more than 250 CFDs to choose from, and underlying assets include everything from forex to crypto, to metals, and some things in between too.

This brand has been around for more than 20 years. It keeps its offerings small to bring you the best trading experience in those specialised areas.

Core Functionality Overview

A lot of people are put off by the limited access to assets, but Libertex really has built its reputation centred on this niche in the market. It also charges incredibly low fees, with next to nothing commissions that really can’t be beat.

While this is a specialised market, you can access more than 250 CFDs, which is pretty impressive. If you’re most interested in buying options related to things like crypto, minerals and metals, or currencies, this is the platform to use. The niche makes these areas simple and user-friendly.

The best way to use its trading platform is on a computer or laptop. You can use your mobile, but there isn’t an app so it may be harder than some platforms. The minimum deposit to get started is low, so you can get started pretty easily.

The awards it has won through the years tells us Libertex is doing something right. There is only one account type, which is its classic account. However, you can use a demo account to get a feel for the platform, or even practice trades. Libertex uses its own trading platform.

10. Best for Variety of Assets: Tastyworks

Key Specifications:

- Regulated by ASIC

- Low prices for options contracts

- Choose the account type that works for you

- Available in mobile, desktop, or web versions

- Robust trading platform

Pros

- Robust platform with impressive for options trading

- You can completely customise your trading platform

- Tons of resources and education

- Wide variety of options trading choices

Cons

- Might be intimating to newer traders

- The market news and research sometimes are a bit biased

Tastyworks is known for having a wide variety of assets available, and making things simple for you with really low costs. The most feasible trades are its zero commission stocks and ETFs, but you have a full array of options as well. The fees on options aren’t too bad, but if you want to trade options on futures, these fees get a tad bit high.

This platform is really great for active traders, and those who have a little bit of experience. Beginners can use it and find plenty of resources, but the robust capabilities can be a little bit intimidating.

The good news is that if you are willing to research and learn, you will take your skills from beginner to advanced in no time. It has so much available in terms of resources and content. This is why it’s a top choice for active traders, and a favourite for options traders as well.

Tastyworks knows what experienced options traders are looking for, and you can see it in its platform design. It has integrated tools that are specifically created for the advanced traders out there.

It does have some news available, but it can be slightly biased at times. You might want to take advantage of its live content, as this really hits current events within the market, and goes into detail about strategy and education too.

Resources at Your Disposal

The resources available to you with Tastyworks are a real game changer. When you’re trading options, you need to be in the know. Details and market movement can happen in a matter of moments, so it’s important to be able to stay on top of things.

When it comes to options, Tastyworks certainly did it right, incorporating a host of advanced tools that you will love. These tools are primarily dedicated to analysis needs, research, and understanding trading derivatives. You can chart, draw, monitor positions, and more all in one space.

On top of those advanced tools, you have access to a wide variety of educational content, including those 8 hours of live feed every business day. You can check out strategies, learn from the educational stuff, and dive deep into your resources to make informed trading decisions.

This company built its platform for trading in-house. A lot of the research is heavily prioritised to certain segments that are the most popular within Tastyworks. This can be off-putting for those who want the tools and robust platform, but have to sort through things that might seem a little biased to get there.

These are the top features that appeal for Tastyworks as far as usability.

- Screeners for options, mutual funds, ETFs, and stocks

- Advanced platform that caters to advanced trading

- Charting and other tools

- If you’re stumped, try the trading idea generator

- Massive education and research available

What Is Options Trading?

Options can be of immense benefit to Australian investors because their transactions offer much higher profit margins than traditional stock trades. As a result, option traders are perhaps second only to active traders in the online brokers’ pecking order, as most brokers see them as their most valuable clients.

Therefore, attracting options traders is viewed as a priority among online brokers and the competition tends to be fierce. But the good thing about competition is that it unleashes innovation along with competitive pricing.

The best options trading platforms we have listed exemplify this spirit of innovation with their comprehensive slew of features and services, as well as their broad range of securities.

Nevertheless, many investors have neglected options in the erroneous belief they are too difficult to understand. However, options strategies can be as simple or complex as you want them to be.

While the concept of options may seem initially overwhelming, once you grasp the basics it is easy to extend your knowledge.

Disclaimer

CFD trading is dangerous for those with no experience in the stock market. Honestly, I would not recommend it to anyone except intermediate traders and experts. Our list will help you pick the perfect online stock trading platform for your needs. However, using a quality CFD platform doesn’t guarantee your trading will retain the same quality, nor will it make you a millionaire. If anyone promises that to you, they are a fraud and you should stay away from them.

Part of our objective in providing a list of the best option trading platforms in Australia is to enable our readers become better educated through understanding the services, practices and features employed by the top-notch options brokerages in the market.

Our Criteria for selection

It is no secret that Australians are big fans of gambling, since they spend more on gambling than anywhere else in the world. Even though instruments such as binary options are considered to be a type of investment, the fact is that their nature isn’t too different from gambling.

Unfortunately, this has attracted all kinds of unwholesome operators who want a piece of the pie: social media is rife with apps holding out the prospect of easy trading along with overblown promises of success and large profits.

Trading in options is a high-risk proposition in and of itself, but the risk of customers losing their money to unscrupulous operators is paramount in my mind. I believe the best way to protect traders from questionable operators is to guide them to well-established and reputable brokers.

This is in tandem with our emphasis on the importance of browsing the web anonymously.

This thinking naturally informed our selection process. Security, privacy, and trust of their trading platforms were top criteria in evaluating the inclusions in our list.

Along with expertise, quality of service delivery, and years of operation in the options market, I also took into consideration the rigorousness – or lack therefore – of the regulatory authorities that provide oversight for these option brokerages.

Priority was given to the reputation of the organisation or countries that issued the license under which the brokers are operating. Consequently, I made sure that the brokers that made our list are licensed by the Australian Securities and Investments Commission (ASIC), or other renowned regulatory bodies in the case of foreign operators.

Options Trading Buying Guide

Options, Shares, and Stock – the Differences

It is important to make a distinction between these three in order to avoid confusion. The two that share the most similarity are shares and stock.

Both involve ownership of equity; however, while stock can encompass ownership in more than one company, shares gives you ownership in a specific company.

Unlike the other two, options doesn’t involve ownership.

In the finance sector, options are derivatives. As the name implies, they have no intrinsic value but rather derive their value from their underlying stock. More specifically, they are contracts, which mean you are exchanging contracts when trading options rather than purchasing tangible, physical assets.

Simply stated, stocks let you have ownership stakes in individual companies, while options enable you to place orders on the direction you think the stock price is headed.

Stocks tend to be better suited for beginners and long-term investorers, while options are generally utilised by active investors who want a more tactical and flexibile approach to investing.

Options are derivative financial instruments, which means that they depend on the value of other assets.

Options provide investors with the right, but not an obligation, to transact (buy or sell) an underlying asset before a certain expiration date. This is the major difference between options and other derivatives like futures.

Options therefore allows the investor to speculate on the future price of the financial market. More importantly, they can form a crucial part of a larger investment strategy.

The world of options encompassed different types of trading, including commodities, indices, stocks, currencies, and more. You just have to predict the price of the asset and then wait for the outcome.

Strategies for Using Options

Options (also called Exchange Traded Options) are flexible tools which help traders be more versatile in their trading strategies; even using them to refine existing trade strategies. Apart from complementing trade strategies, options can also be used to take advantage of investment opportunities without owning shares directly.

Options can also be used to limit your risk exposure and/or protect the value of existing share portfolio. In a scenario where the market is flat and bearish, options can be written over your existing portfolio to generate income during periods of low capital growth. Be aware of the risks involved, there is always the possibility of capital losses.

Types of Options

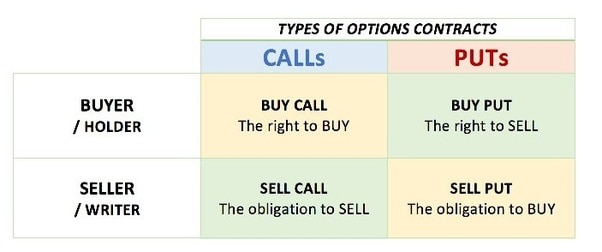

Two types of options exist: Call and Put options. They can be bought or sold individually; or used in conjunction with each other to generate strategies tailored to the trader’s risk tolerance level.

Call options gives a trader the right – but not an obligation – to purchase stock at a certain set price, called the strike price, at any time before the option expiration date.

Option positions can be seen from both the perspective of the BUYER (taker) or the SELLER (writer).

When you sell an option, you are effectively creating a security that up till that point didn’t exist. This is known as writing an option.

The Benefits of Options

- Protects your portfolio: you can buy a Put Option to protect your shares against a fall, which effectively locks in the shares’ sale price for the duration of the Option. Assuming the share price rises, your profit is only reduced by the premium paid.

- Generates income: if you anticipate that a particular share price will remain flat or fall slightly, then you can generate extra income by writing Call Options, subsequently receiving the premium upfront. Be aware of the risks involved as there is the possibility of capital losses too.

- Requires a small initial outlay: options provide the opportunity to potentially make higher returns from a smaller initial outlay than directly investing. This is because you can benefit from changes in a share price without having to pay the price of the share.

- Diversifies your portfolio: one of the advantages of a smaller initial outlay is that it enables you to have a more diversified portfolio than if you purchased shares directly.

- Provides the ability to trade your perspective: the flexibility that options provide enables you to implement a range of strategies in various market conditions (rising, falling, or flat). Consequently, you can then utilise them over a time frame that suits your purposes.

- Buys you time to decide: a Call Options grants you time to decide on buying shares. Once you pay a fraction of the shares or premium, you effectively lock in the buying price, you are allowed to buy shares anytime before the option expires.

Australian Options Laws Guide

The information on Australian options laws was sparse, but I was able to find information on Australian binary option laws. Australia happens to be a large market for binary investing, and therefore attracts a lot of Australian binary options brokers.

The Australian Securities and Investments Commission (ASIC) is the body responsible for regulating both options and binary options. ASIC gained the responsibility in 2010 to supervise the binary options market.

But ASIC doesn’t have the regulatory monopoly in Australia. It is also aided by the Council of Financial Regulators and the Australian Prudential Regulation Authority in the task of improving regulatory efficiency.

However, there are no truly indigeneous binary Australian operators; a substantial number of binary operator companies are foreign-based. The majority of European binary platforms are registered with Cyprus Security and Exchange Commission (CySEC), and it is important that they abide by the standards set by the commission.

Are Binary Options Laws Permitted in Australia?

Though they are legal, binary options aren’t regulated in Australia. In this sense, lack of regulation means that there are currently no rules or guidelines that companies have to adhere to with regard to binary options trading.

Conclusion

The average, run-of-the-mill trader isn’t usually aware of the benefits of options. However, with the upheaval disrupting global stock markets due to the COVID-19 pandemic, the time is ripe for investors to take advantage of the flexibility and the potential for higher returns that options trading affords.

But options don’t generally have the same oversight as stocks; therefore, investors must ensure that the options brokerage platform they choose to trade on isn’t unscrupulous, but is rather a reputable organisation.

It is in this light that I produced the list of the best options trading platforms in Australia, in order to guide our readers in making the best-informed decision.

You Might Also Like: