Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best International Money Transfer Apps for Australians

Do you need to make international money transfers to loved ones or family without any delays from Australia?

Have you encountered expensive fees when sending money abroad using an Australian bank’s money transfer services?

To transfer money from Australia to countries abroad, you may consider using an international money transfer app to complete the process quickly and at a low cost.

When you browse for app solutions, you will notice that there are many available. Which ones best suit you? Our knowledgeable professionals at Privacy Australia have reviewed six optimum money transfer apps for you to use and send money overseas.

Consider the options in this article to pick the best app for money transfers.

Table of Contents:

- What Are International Money Transfer Apps

- How Do International Money Transfer Apps Work

- International Money Transfer Apps Pros and Cons

- Best International Money Transfer Apps for Australians — Reviews

- 1. Payoneer

- 2. Wise App

- 3. OFX

- 4. SingX

- 5. Instarem

- 6. XE

- Conclusion

- FAQs

What Are International Money Transfer Apps? 💰️

An international money transfer app supports sending and receiving money to loved ones, family members or businesses internationally through electronic means. These apps work via a mobile device and access your bank account after you link them, meaning there is no need to visit a bank to make a bank transfer overseas.

An app for transferring money functions beyond the geographical boundaries of your country to facilitate digital remittances, for which transaction values will increase at an annual growth rate of 3.62% by 2027.

How Do International Money Transfer Apps Work? ➡️

You can send your funds overseas after downloading the app to your mobile device and creating an account. You will then need to follow the prompts to connect your bank account or credit card to it. After this, you can enter your recipient’s details to initiate the transfer.

After you enter the amount of money you need to transfer and review all the details, your app will take care of any currency exchange rate calculations based on the most up-to-date market rates. It will convert your money using this value.

You will find that international money transfer apps will protect your financial data using secure encryption technology and protocols. This crucial process prevents users from accessing the data if unauthorised and safeguards your information from the beginning to the end of the transfer process.

Your recipient will have no problem receiving their funds if they link their bank account or digital wallet to the app.

What Are the Features of International Money Transfer Apps?

- Transaction tracking features — An exemplary app for international money transfers will have a feature to help you track the transactions you make over time. This feature gives you more visibility over your financial activity.

- Several payment methods — You can use these apps to complete your payment. Some options range from linking the app to your bank, debit or credit card to using digital wallets to facilitate payment. These methods give you extra flexibility when you send money.

- Encryption — As mentioned, nearly all these apps prioritise financial data protection; they use advanced encryption technology to keep your data safe when sending money.

- Prompt notifications — As well as notifications about exchange rates, these apps also provide alerts related to the money transfer process. Your recipient will know when you have sent the money, and you will know when your recipients receive money in their bank accounts.

- Competitive exchange rates — Your app will offer competitive exchange rates when it converts your money to another currency.

International Money Transfer Apps Pros and Cons

Later in this article, we look at the best international money transfer apps for Australians. In this section, we will first pinpoint some of the advantages and disadvantages to think about before using them.

Pros ✅️

- Added convenience — When sending money internationally with these apps, you will not need to leave your home. The app provides added convenience and saves you the hassle of going to your bank to arrange a transfer.

- High-speed transfers — You will not need to wait long for the app to handle the international transfer. The app will process the data quickly, skipping the need for another bank to process the transfer. It will ensure your recipient doesn’t experience delays when waiting for their funds.

- Easy to access — Wherever you are, you can access your app to make transfers internationally. It is possible to access the app when you’re on the go.

- Currency conversion not required — Your app will complete the currency conversion process on your behalf, meaning you won’t need to worry about completing calculations or missing out on an excellent exchange rate.

Cons ❌️

- Fees required — Depending on the app you use, you may need to pay a fee to complete an international transfer. The best way to get the most out of the transfer process and ensure your recipient benefits is to compare all options and costs before settling on an app.

- Fluctuations in exchange rates — Although your app will notify you when exchange rates fluctuate, it’s still something to watch out for. Several factors can affect the exchange rates, including market demand and economic factors, so the rate may change at any minute, even during a transfer.

- Technical issues and bugs — If your app lacks quality, you may encounter technical issues caused by software bugs. These bugs can affect the speed of the transfer process and even lead to mistakes or errors when you transfer money.

- In-person support might not be available — If you need to speak to someone directly about your app when you encounter a technical issue, you might struggle to get in-person support. Most apps offer online support instead of a physical location with a customer service office.

Best International Money Transfer Apps for Australians — Reviews 🔝️

Having explored the drawbacks and perks you can get with apps for making international money transfers, we will now focus on the best options for Australians who need to send money abroad. Check the list below for more information.

1. Payoneer

The Payoneer app is an excellent option for fast transfers and functions alongside your web account. It is a secure app that more than 5 million individuals use globally. This solution for business owners and freelancers is available in Australia.

Whether you need to track your transfers or card balances in real-time, this is all possible with the Payoneer app.

The app also offers multiple essential features, such as the option to make payment requests, transfer your funds to your bank account, manage multiple currencies and receive updates related to your finances.

You can make VAT payments from your account using the Payoneer app in more than countries. You can get paid from other Payoneer users at no cost using Payoneer. It’s also possible to pay recipients who don’t use Payoneer, but you must pay up to 2% of the transfer amount to make your transaction.

Pros

- Payoneer is a suitable app for businesses that need to transfer money.

- It offers users fast, reliable transfers.

Cons

- Payoneer’s customer service may be slightly lacking in quality.

2. Wise App

You can use the Wise platform and app to make cheaper transfers to overseas countries from Australia. It’s the optimum option with which you can send money worldwide by paying a flat fee lower than many online money transfer apps, and many transfers can happen within the same day when you use Wise.

Wise features a two-factor authentication as one of its features to protect your account and financial information. Only you can access your account when you make a transaction. Their anti-fraud team will also safeguard your money and account.

The app makes checking exchange rates effortless. You can view fluctuations over time and track how they have changed.

If you need to repeat a previous transfer, Wise also facilitates this with a repeat transfer feature. With this feature, you will not need to enter the recipient’s details multiple times, saving you time and streamlining the transfer process.

The other features you can look forward to include the option to pay using Google Pay and Apple Pay and the chance to hold your funds in different currencies. Wise offers nine different currencies for your convenience.

Pros

- Wise expects a low flat fee to transfer money overseas.

- The app provides robust authentication features to keep your money and details safe.

Cons

- The app might not be an economical choice for larger transfer sums.

3. OFX

Whether you are an individual, a business or an eCommerce store, you can use OFX in Australia to transfer money abroad. This app offers a range of handy features that facilitate these transfers.

You can use the OFX app to view live market rates for over 50 currencies and select the currencies you want to add to your quick view tab. The app also enables you to monitor the transfer from when you send it to when the recipient receives it.

OFX offers highly secure login options beyond password protection, such as biometric authentications that protect your information.

Additional perks come from using OFX. If you send over $10,000 with this app, you will not need to pay any fees.

The Australian Securities and Investments Commission regulates OFX, and the platform offers a global support team. OFX also has more than 20 years of experience in the foreign exchange market.

Pros

- OFX protects your details with authentication features.

- You can check the exchange rates live before sending money with OFX.

Cons

- The customer service team may not offer the same quality support for all issues.

4. SingX

SingX is an app that can help you if you need to make same-day transfers. Its features include sending money from Australia to overseas locations within a day.

The Australia Securities and Investments Commission licences SingX, and the app provides options for business transfers and personal finance transfers.

To protect your finances, SingX uses the latest technology and authentication features. What’s also handy is the range of additional features you can use with the SingX app. For example, you can track and check live exchange rates and monitor every transfer you make through the app.

The app allows you to manage transfers easily and keep track of your transfers. It will also display the exchange rates, your wallet balance and the fee you must pay to transfer via the SingX app.

Its dashboard makes transfers easy and convenient, and the app’s “Refer a friend” feature allows you to earn just by recommending SingX to others.

Pros

- The SingX app offers live exchange rate features to help you monitor currency values.

- SingX users can earn by using the “Refer a friend” feature.

- You can make your first two transfers at no cost, helping you save money.

Cons

- The overall user experience and interface may lack quality.

5. Instarem

Instarem is a convenient application that makes international payments and transfers easy. It offers payment options to more than 60 countries and provides fee-free perks for new customers who transfer more than $200 overseas.

Instarem makes it possible to make incredibly fast international transfers; most transfers happen within just a few minutes.

With this app, you can receive rewards from the platform for each transaction you make. If you transfer high sums, you receive more points, an extra incentive to use the app.

The costs of using Instarem are shown upfront. Their transparent fees and competitive exchange rates make this app a user favourite.

The app is regulated in 11 countries, making it safe to use. Its features also include tracking options to view when the transfer will reach the recipient’s bank account.

Pros

- Instarem enables you to make transfers within minutes.

- You will receive notifications from Instarem to inform you about each step in the transfer process.

Cons

- Instarem’s customer service and quality may require slight improvements.

6. XE

XE is an app with several money transfer features. With this app, you can send funds overseas, manage your account and track each transfer easily.

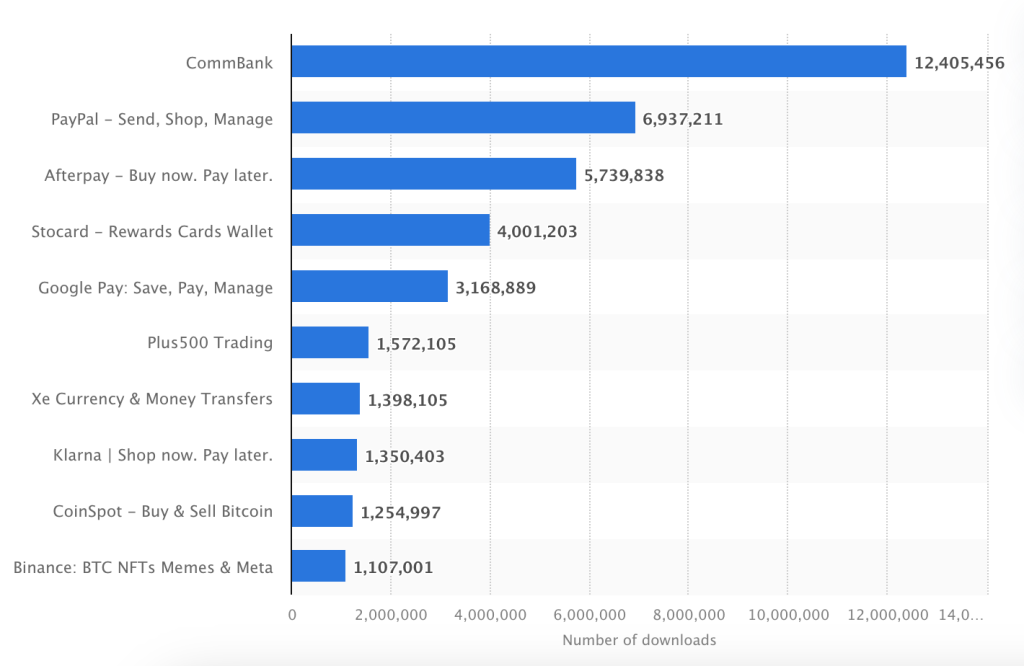

You can send money in over 100 currencies to more than 200 countries with the iOS app. In Australia, the XE app was downloaded 1,398,105 times in 2022.

The XE app offers high-grade security to protect your money and financial details. It also provides a monitoring feature to stay ahead of the currency value your recipient will receive if you make a transfer. However, the app does not let you know when your recipient accepts the transfer.

XE does not charge any fees when you transfer money. You can set up an account for free and transfer money on the go.

Whether you need to make a bank deposit, send money to a mobile wallet or arrange a cash pickup for your recipient, you can complete these actions with XE.

Pros

- The XE app facilitates unlimited amounts of transfers.

- You will not pay fees to transfer your money with XE.

Cons

- You cannot access customer service support from XE on Saturdays and Sundays.

Best International Money Transfer Apps for Australians: The Verdict 💡️

An app for transferring money overseas from Australia or receiving funds from other countries can be the perfect tool for speed and reliability. Many options are available on the market, so if you need to select one, it is vital to look at their features.

Still, our list of apps for transferring and receiving money will point you in the direction of the best quality options for Australians. You may consider Wise or Payoneer for apps with low fees, transparent exchange rate features and fast transfers. However, don’t forget to check the full options before choosing an app.

Best International Money Transfer Apps for Australians — FAQs 📢️

Are you still searching for more facts about apps for making international transfers from Australia? Here are some frequently asked questions and answers to guide you.

Are Money Transfer Apps Safe?

Apps for transferring money have features that make them safe to use. Some have biometric authentication features and others have, two-step authentication requirements. These features enhance the security of your details and ensure your information remains inaccessible to users who are not authorised.

What Are Some Other Apps for Transferring Money Overseas?

One example of another app for making international money transfers is Remitly. The app allows cash pickup, one of the international money transfer services recipients can use without paying a fee. Other mobile money transfer apps include WorldRemit app and Revolut. The latter offers investment options in exchange-traded funds and international money transfer options.

Which Apps for Transferring Money from Australia Expect No Fees?

Some apps for transferring money from Australia that expect no fees include XE and SingX, although the latter option only offers free transfers for your first two transfers. Other apps you can use to transfer money from Australia without paying a fee include PayPal when you use your linked bank account or your PayPal account.

You Might Also Like: