Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Super Funds in Australia

Have you been looking ahead to your later years and thinking about your financial situation?

Saving for your future is essential for a prosperous and comfortable retirement, and super funds are one handy option to ensure you reach these later moments in your life with sufficient funds.

You might already consider ways to save with a super, but selecting one with the right features and returns can be challenging. This Privacy Australia article explores and examines the best-performing super funds you can select as an Aussie. Let’s begin by looking at what a super is.

Table of Contents:

- What Is a Super Fund

- How Do Super Funds Work

- Best Performing Super Funds Pros and Cons

- Best Performing Super Funds — Reviews

- Conclusion

- FAQs

What Is a Super Fund? 💰️

Super funds, or superannuation funds, are retirement accounts in which you can save money for your future. There are several main types of superannuation funds, including accumulation funds and defined-benefit funds. With accumulation funds, your funds grow over a specific time, and the value depends on the amount you and your employer add as well as investment performance. Meanwhile, defined-benefit funds use a set formula to calculate their value.

The value of an accumulation fund fluctuates with changing market conditions, while the value of defined-benefit funds does not. However, it is still possible to mismanage a defined-benefit fund, meaning your funds may not meet your needs.

Some available options include industry super funds, retail super funds, balanced funds, self-managed, corporate and public sector funds.

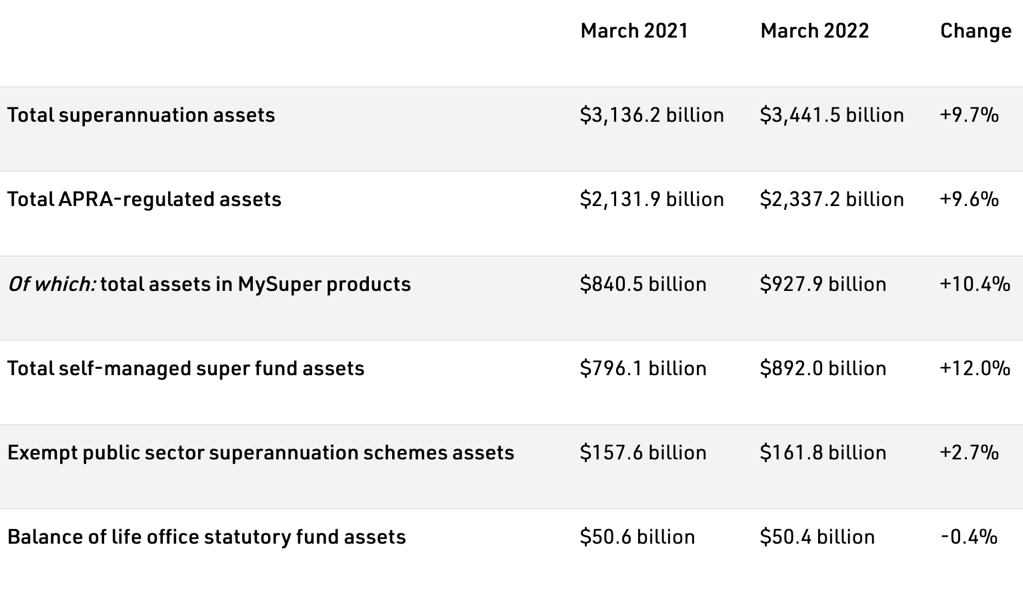

Between March 2021 and March 2022, Australia’s total superannuation assets increased from $3,136.2 billion to $3,441.5 billion, a jump of 9.7%. It reflects the nation’s strong focus on investing via super.

How Do Super Funds Work? 🤔️

You and your employer both contribute to your super. Your employer typically contributes a percentage of your earnings, at a minimum of 11%, which is a legal obligation if you are over 18. You also have the option to contribute your own money, with tax benefits. At the end of the second quarter in 2023, Australia’s total assets in superannuation funds were $3.5 trillion, and employer contributions equated to $34.7 billion.

The funds deposited in your super will grow over decades, with your super investment team investing your money into various options, such as property and shares.

You are only allowed to draw money from your superannuation fund once you reach the required age. The specific age ranges between 55 and 60, depending on your birth year.

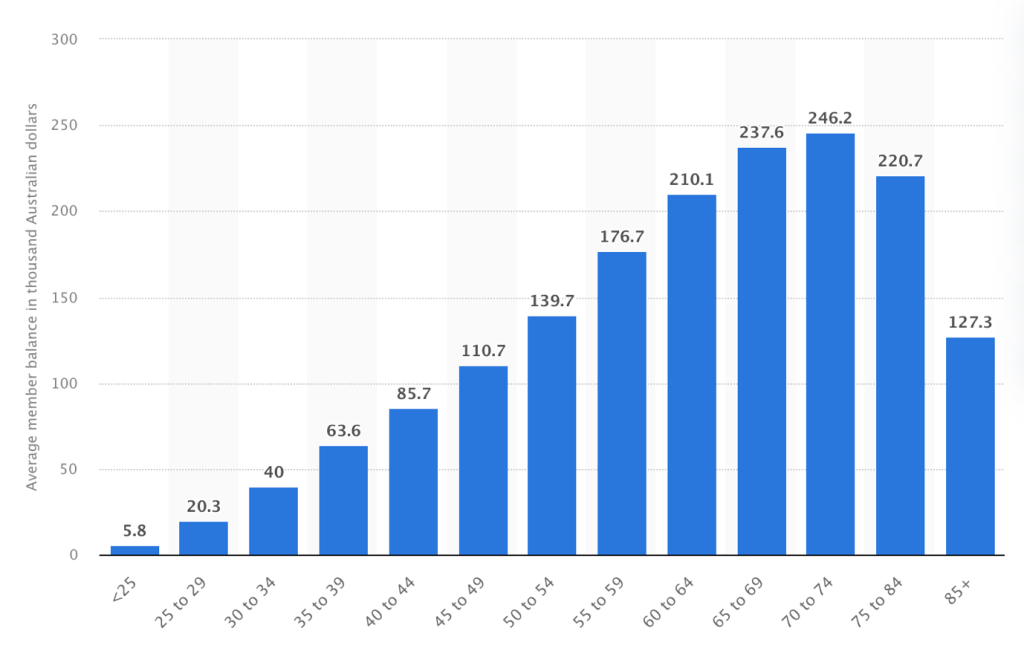

Statistics show that Australians aged between 70 and 74 have the highest average superannuation balance of approximately $246,000, accumulating over many years of saving and growth.

What Are the Features of Super Funds?

- Investment options — Some superannuation funds offer several investment options, such as shares, exchange-traded funds and property.

- Administration fees — Your superannuation fund will charge administration fees, taking from your super balance. These fees go towards the cost of managing your super account, but can differ significantly from fund to fund (so do you research). Your fees might be fixed, or determined by the balance of your account. If you have an independent financial advisor, they may also take their fee from your superannuation fund.

- Insurance features — Multiple insurance options are available through your super; many offer a default option. It is worth considering the specific cover you might need to ensure you receive the insurance option that suits you.

- Financial advice — Your super fund may also offer levels of free and paid financial advice to support your investment choices or goals. The financial advice is typically tailored to your specific requirements.

Best Super Funds Pros & Cons

Before we consider which superannuation funds are the best performing, let’s quickly explored the advantages and disadvantages of this money-saving option. Here are the main pros and cons.

Pros ✅️

- Your employer will contribute — You are not obligated to contribute to your super. This responsibility lies with your employer; it is a legal requirement for them. So you won’t be forced to break the bank to add funds.

- You receive a tax-free sum when you retire — A 15% tax rate applies when you make voluntary contributions to your super fund, likely lower than your income tax rate, but you will not need to pay tax on the sum you receive when you retire.

- You can choose insurance cover — You can receive three potential types of insurance cover with your super: income protection, death and total and permanent disability. This insurance cover is often less costly than other insurance options.

- You can diversify your investment portfolio — Several investment opportunities are open to you with multiple asset classes available. Whether you want to diversify your portfolio with bonds, stock trading, shares or property investments, you can achieve this with a super.

- You will still have your super if you change jobs — your super fund is independent of our employer so, no matter how many times you change jobs, your super remains intact and in the one place. You just need to give your new employer your super fund details so they can start to contribute.

- You can receive tax discounts on the earnings you make from investments — Although your income tax rate applies to investments outside of your super, you will receive tax discounts on any earnings you make from super investments.

- You do not need to manage your super and investments — Instead of having to concern yourself with managing supers and investment options, you can leave this to investment managers who will track the market conditions for you. You can also specify your risk appetite, such as Balanced or Growth.

Cons ❌️

- You lack total control over your investments — Although you may have some ability to manage your portfolio, you often can not completely control your investment. If this is an issue, you might consider a Self-Managed Super Fund (SMSF).

- You are unable to access funds until you are eligible — except in extreme circumstances, it is impossible to access super until you reach retirement age. Even if you make voluntary contributions yourself, you can’t access them until you are eligible.

Best Super Funds — Reviews ➡️

Our financial professional looked at six high-performing superannuation funds. Here are the six best options and the crucial features they offer you.

1. Australian Retirement Trust

One of the main features of the Australian Retirement Trust is its financial advice services. You can contact its professionals to gain support with your financial plan; their advice services fall into three categories.

You can ask for general or specific super advice, along with the option to ask for advice on financial planning and investment strategy.

The Australian Retirement Trust also offers a mobile app similar to investing apps. You can use the app to check your super balance, receive notifications when you receive a contribution and manage your account with just a few taps of the screen.

Fees and Balanced Option Returns

Their balanced super option returned 10% in 2022-23, and 8.4% p.a. over the last 10 years. You must pay $1.20 per week and 0.10% of the account balance each year in fees, plus 0.7% general reserve fees.

2. Australian Ethical Super-Balanced

To strike the correct balance between capital growth assets and income investments, you can select the Australian Ethical Super Balanced super. It aims to achieve 3.25% above inflation returns over ten years.

One of the main features of this super is the option to diversify your portfolio.

They also include a minimum investment timeframe and match trading trends and solutions to you as an investor, with your specific risk tolerance levels.

Australian Ethical Super provides multiple investment options, including defensive and conservative, balanced or growth. They can include Australian or international shares. While the defensive investment option requires a minimum investment timeframe of one year and the conservative option requires four years, the international and Australian shares investment option requires seven years. It also offers ethical investment options.

You will notice a minimum investment timeframe of eight years for the balanced accumulation fund and nine years for the growth option.

Fees and Balanced Option Returns

Australian Ethical Super charges fees of 0.81% for balanced accumulation funds, 1.12% for high-growth investment options and 0.20% for conservative investment options. The fund calculates these fees by using a percentage of each option’s daily net value.

The returns you can receive for balanced funds with this super include an average of 7.2% over one year and 5.9% over five years.

3. AustralianSuper

This industry super has won awards for its services. It delivered returns of 8.6% every financial year for the past ten years and offers multiple features to help you save money for your future.

You can access your super online with AustralianSuper and use its features to consolidate any other superannuation funds.

You can also look forward to good super fund performance and make after-tax contributions to your fund.

With AustralianSuper, several investment options are available, such as long-term investments. In the Pre-Mixed category, you can select from multiple choices ranging from high-growth to stable options. In the DIY Mix category, Australian and international shares, diversified fixed interest, and cash investment options are available. In the Managed Funds category, you can invest in shares, exchange-traded funds, listed investment companies, term deposits and cash.

Fees and Balanced Option Returns

AustralianSuper charges flat administration and asset-based administration fees. Its flat administration fees are $1 per week, and the asset-based administration fees are 0.10% of your account balance.

For balanced options, AustralianSuper’s average returns are 6.72% over five years and 8.22% over one year.

4. Hostplus

Hostplus is another major Australian industry super fund. Its low fees are one enticement to choose this option, and it also offers financial advice and insurance cover.

With the Hostplus team’s financial advice, you can receive information on building your balance, exploring investment options, updating your insurance and maximising the benefits you receive from the government. You can receive specific support online, over the phone or face-to-face with Hostplus representatives.

Hostplus’s insurance cover options include Death, Total and Permanent Disability (TPD) and Income Insurance. If you suffer a serious accident or require income protection when you cannot work, you can select these Hostplus insurance covers.

You can receive automatic death and TPD cover if you are 25 and have at least $6,000 in your account.

Fees and Balanced Option Returns

Hostplus’ administration fee is $1.50 per week. It will also deduct a fee of 0.0165% of your balance as a trustee fee.

You can choose from several investment opportunities, including the Hostplus balanced option, shares plus and socially responsible investment options.

For the Hostplus balanced option, the average investment returns you will receive are 8.2% over one year and 6.8% over five years.

5. Aware Super

Aware Super is an award-winning superannuation fund. It provides super accounts, investment management, insurance options, financial planning advice and more.

Its insurance options include Death and Total and Permanent Disability, as well as Income Protection for when you cannot work. One complimentary feature is its insurance transfer option, making it simpler to transfer insurance from other policies or super funds to Aware Super.

With Aware Super’s app, you can manage your super from anywhere, when you are on the go. You can also receive specific advice related to your finances, assess and discuss your risk tolerance, and receive strong performance returns over time.

Fees and Balanced Option Returns

Fees for Aware Super include $52 annually to run the fund and of 0.15% of your balance annually. You will also have to pay variable investment fees, such as base and performance fees, for Aware Super to manage your account.

Multiple investment options are available through Aware Super, including international and Australian shares, high-growth options, bonds, property, cash, etc.

The average returns you can expect over one year are approximately 8.92%, and over five years, 6.12% for Aware Super’s balanced option.

6. Spirit Super

Spirit Super is a superannuation fund that offers multiple features for which it has earned several awards. You can consolidate your accounts, seek and receive advice from financial professionals about your retirement and receive member services.

With its account consolidation, you will pay fewer fees to separate super funds and save more money.

By contacting its account team, you can learn more about superannuatuion, while its member services team can give you access to 360Health Virtual Care. Through this latter service, you can receive mental health support, request second medical opinions for any medical condition, ask an online general practitioner health-related questions and receive fitness, recovery and nutrition advice.

Fees and Balanced Option Returns

Investment options are available with Spirit Super, including conservative, balanced, growth and sustainable. Its balanced growth option provides average returns of 9.2% over one year and 5.79% over five years.

The fees for Spirit Super are $1.30 per week and 0.15% of your balance each year.

Best Performing Super Funds — The Verdict 💡️

Many superannuation funds are available, but the one you select should match your specific circumstances. If you need options that provide specific investment opportunities or specialise in high returns, it’s important to look at all the available superfunds and narrow down your choices.

You can begin by referring to this list of high-performing funds and checking their features. Remember, your super fund should offer several benefits, including financial advice and support. Compare each super fund’s features to find an option that best suits your needs.

Best Performing Super Funds — FAQs 📢️

Do you require more facts about the best super funds? Here are our frequently asked questions section and answers to clarify any doubts.

How Can You Choose the Best Super Fund?

It’s important to consider a few essential factors when selecting a superannuation fund. Think about the various fees and also consider additional features, such as the range of insurance options and specific financial advice.

Does Past Performance Indicate Future Performance?

A super’s past performance does not indicate future performance. This fact means that although a super might have performed well in the past, it might not always perform as well in the future. You may be able to check the past performance and compare this with multiple super funds, but keep in mind that there are no guarantees.

What Happens to Superannuation When You Retire?

When you retire, you can withdraw super funds as cash payments from your account. You can either withdraw it in one lump sum or smaller ongoing payments. These options are known as full or partial withdrawals, respectively.

You Might Also Like: