Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Robo-Advisors (2024)

Robo-advisors can help manage your financial affairs but, regardless of your investing experience, picking the best robo-advisor can be difficult.

Many factors need to be considered, from fees and features to funding. What you should choose depends on how you want to invest.

To find the best Automated Investment platform, I examined scores of services and reviews.

See my selection below – including the best altogether, best for novices, best for big accounts, best for low costs, and best for those who want robust personal finance services.

Table of Contents:

- Robo-Advisors Explained

- 1. Top Robo-Advisor for N00bs ⭐ – Vanguard

- 2. Best Robo-Advisor for Aussies ⭐ – Betterment

- 3. Fave Robo-Advisor for the Rich ⭐ – Vanguard Personal

- 4. Cheap Robo ⭐ – SoFi Automated

- 5. Human Robo ⭐ – Wealthfront

- 6. Interactive Advisors

- 7. M1 Finance

- 8. e*TRADE Core Portfolios

- 9. SigFig

- 10. Ellevest

- 🤖 Buying Guide

- 🤖 When Choosing

How We Choose our Platforms 📚

You may have noticed that many Australians are becoming financially stressed and indebted.

To help cope with difficult financial times, Privacy AU looks for ways to leverage 1) tech, 2) skills, 3) networks and 4) capital, to help our readers to do better. For this purpose, we gather information efficiently while keeping an eye on each product’s legitimacy, trustworthiness, competitiveness, value for money, and level of transparency.

Robo-Advisors Explained

Robo-advisors are online investment applications. These apps run on sophisticated algorithms, which are sets of instructions on how to intelligently perform tasks and solve problems.

“Robo algorithms” are normally made by financial experts and ETF managers, to develop and manage your assets… After that, robos undertake the day-to-day management. Because they run on auto-pilot, robo-advisors low if any portfolio balance requirements, and their annual fees are significantly less. In return uou get:

- Auto Asset Allocation

- Portfolio Rebalancing

- Tax Efficiency

- Access to Human Financial Consultants

- Tried-and-True Procedures: Adapted to each user’s risk tolerance and financial objectives, removing emotions from your selections.

By comparison, conventional planners or wealth management firms often insist that clients maintain larger balances and pay higher fees. Which is why some people choose robos!

Top Robo-Advisors in Australia – Reviews 2024 📘

- Vanguard – Top Robo-Advisor for Beginners

- Betterment – Popular Robo-Advisor for Aussies

- Vanguard Personal Advisor – Fave Robo-Advisor for the Rich

- SoFi Automated Investing – Cheap Robo-Advisor

- Wealthfront – Human Robo-Advisor

- Interactive Advisors

- M1 Finance

- e*TRADE Core Portfolios

- SigFig

- Ellevest

1. Vanguard – Top Robo-Advisor for Beginners 🦿

⭐ Vanguard Digital Advisor is a good option if you’re a new investor looking for something easy and sensible.

Jack Bogle founded this management firm in Valley Forge, Pennsylvania – a half-century ago.

Looking back, he helped to birth the index fund movement itself. (Bogle acquired his fortune by tracking big indices like the S&P 500, opting for low-cost diversified funds…)

Likewise, for a modest yearly net fee of just 0.20% for handling your balance, you can take advantage of Vanguard’s basic services. They include pension savings, risk, and automated rebalancing… That outperforms most robos.

Getting started

Rather than hiring expensive individual stock pickers, your Vanguard holdings are mostly ultra-cheap exchange-traded funds (ETFs). Like Bogle’s own approach, these frequently have the cheapest cost ratios… For example, consider the tiny cost ratio of its Total Stock Market ETF, at just 0.03% (as of Q1, 2021) annually.

Portfolios created by Vanguard Digital Advisor generally contain just four ETFs, giving most clients all the diversity they want. Input your savings and expenditure targets, and the program will tell you if you’re on pace to meet your objectives. Then it spits out a realistic assessment of how much you need until retirement.

The $4,500AU / $3,000USD minimum investment threshold is the main drawback of Vanguard Digital Advisor. If that’s out of your price range, you may not have sufficient resources to take on the risk of a varied investment portfolio and therefore should place more of your attention on first creating sizeable emergency savings.

During the signup process for Vanguard Digital Advisor, you’re questioned about your relationship status, salary, and expenditure, which will then help determine how much investment risk you are okay with. Compared to the majority of risk assessments I looked at, this one is considerably more intuitive and uses gain/loss models and a slider bar.

Pros

- Ultra-affordable

- Useful robo for retirement

- Easy investing

Cons

- AU $4,500 minimum

- No human advice, no tax-loss harvesting

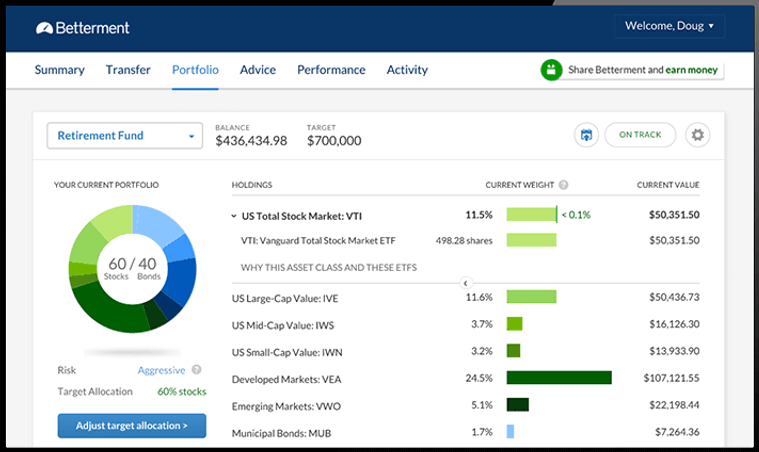

2. Betterment – Popular Robo-Advisor for Aussies 🦾

⭐ Betterment is one of the earliest adopters of the robo approach to financial investment.

It scores well in each vital category: There is no minimum spend. The yearly cost is low, at 0.25% of your account – for the basic service.

Today, Betterment provides its users with highly competitive value.

Along with the starter Betterment Digital service above, there is also Betterment Premium, which offers access to human advisors. That’s only available to users with bigger balances who are searching for more sophisticated services.

How it Works

As with Vanguard, Betterment creates an exchange-traded fund portfolio with a suitable level of risk, once you open an account, set your objectives, and submit a few identifying bits of data.

I should point out that there will be about a dozen ETFs in your portfolio, some of which could have significant fees. I don’t think this is the best strategy because you can obtain all the diversity you want with only three or four ultra-cheap ETFs.

A word of caution for those who choose the emergency fund alternative: You can wind up with an allocation that is a little bit dangerous for your taste (15% shares, 85% bonds). For example, you could end up selling low if you need the cash after being laid off in a recession.

Overall, Betterment provides a strong suite of strategies. The software offers options for tax-optimised portfolios that organise your stock and bond mix to improve your taxability as well as automated tax-loss harvesting. Long-term savers might consider Betterment’s pension plans.

The Betterment Premium class of coverage, which includes unlimited consults with Betterment financial management specialists and a greater yearly charge of 0.40%, becomes available after you have $147k AU / $100k USD in your portfolio. (That said, you can opt to keep the basic Betterment Digital tier, retaining lower fees at 0.25%.)

Pros

- Affordable yearly advisory fee

- Custom portfolios and objectives

- Tax features, such as tax loss harvesting

Cons

- High costs for human experts

- Emergency Fund tier is risky

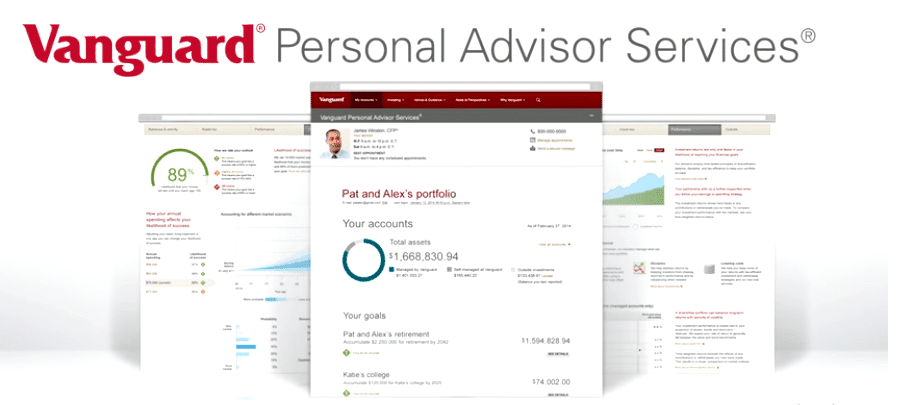

3. Vanguard Personal Advisor – Fave Robo-Advisor for the Rich

⭐ Vanguard Personal Advisor is the only robo-advisor you’ll need if you want access to human financial planners for a substantial sum of money.

The $75k AU / $50k USD minimum investment for this service is 50% that of Betterment Premium – even though it has lower costs (0.30% as opposed to 0.89% / 0.40% correspondingly).

If you need assistance with your finances or have cash concerns and complexities like investing in Commodities, Vanguard Personal Advisor gives you genuine access to its employees, some of whom are qualified financial planners (CFPs) and every one of them is a trustee. This means that you’ll enjoy a broad range of options, such as estate planning and charity donations, which become more crucial as your wealth increases.

Pros

- Bargain reputable premium service

- Extremely affordable ETFs

- Simple access to expert financial guidance

Cons

- No tax-loss harvesting, only certain optimisations in advantaged accounts

4. SoFi Automated Investing – Cheap Robo-Advisor

⭐ SoFi Automated Investing is an excellent option if you’re mainly concerned with lowering the costs you incur while still getting a solid robo service.

According to our research, SoFi Automated Investing has the cheapest prices for robo-advisor solutions.

Your account is filled with ETFs that often have low cost-ratios, there is no yearly advice subscription, and you have access to real-world specialists if you want to discuss your financial condition. There is nothing stopping you if you only have the $2 minimum deposit in your account.

Your SoFi Portfolio…

The remainder of SoFi Automated Investing functions just like any robo-advisor. You input your basic information and fiscal objectives, and the program creates a mix of stocks of around 10 ETFs—about double what’s usually necessary—that correspond to your objectives and risk appetite.

One major drawback of SoFi Automated Investing that you ought to be aware of is the kind of ETFs it includes in your collection. Similar to how Vanguard solely utilises its own funds, the platform incorporates much of SoFi’s own ETFs. But unlike Vanguard, SoFi’s funds have far smaller total holdings, are less experienced and vetted, and occasionally charge excessive expense ratios.

Lengthy holders may find them to be riskier investments as a result.

Pros

- Bargain reputable premium service

- Riskier for long-term holders

- Cheapest robo-advisor

Cons

- Less trusted than Vanguard

5. Wealthfront – Human Robo-Advisor

⭐ With relatively cheap charges and effective personal finance features, Wealthfront provides a smart framework for investing and saving.

Wealthfront makes it simple to get started with a minimum $750AU / $500USD account commitment. When you do, you’re immediately added to an ETF mix that is well-diversified and includes a variety of asset classes, from large-cap firms to bond funds.

Your portfolio may contain up to 15 funds, which is overkill in my opinion given that you may get a comparable level of diversity with only approximately a third of that amount.

Human, Certified Financial Advisors

Wealthfront goes above and beyond what other robo advisers like Betterment or Acorns provide, since it is the first to have qualified financial experts on board.

Indeed, it was the first robo-adviser to collaborate with licenced financial planners. Clients can get comprehensive financial plans, along with a retirement plan and tax assistance, thanks to the relationship with qualified advisers. Customers who invest above $135k AUD automatically receive access to this.

Even if their investments are lower, clients may still benefit from Wealthfront-certified money managers. A brief online risk survey that inquires about your present economic situation, risk appetite, and investing timescale is the first step in your Wealthfront journey.

Your responses are reviewed by a trained financial planner, who uses them to develop a viable plan and investment portfolio to help you achieve your long-term financial objectives.

Autopilot assists with current financial management while Path supports future planning. To satisfy all of your diverse requirements and ambitions, this programme automatically allocates your income to several financial accounts, including your bank account, a rainy day fund, and investment accounts.

Pros

- Hundreds of savings accounts

- Tax-efficient approaches

- Competitive advice plans

Cons

- Fractional shares not offered

6. Interactive Advisors – Robo-Advisor Review

🤖 Have you ever imagined what it would feel like to go back through time and converse with your young self?

What if you were able to give them questions to think about and receive clear responses, to help them steer clear of big errors that you later made?

In one sense, Interactive Advisor Review (IAR) provides its consumers with just that. For rather cheap…

The Platform

What’s the modus operandi of Interactive Advisors? Each user is given an avatar that represents them in the future, with the benefit of knowledge gained from the advisers of the present.

Your future self is simulated and represented as a digital avatar by Interactive Advisors. You may ask this avatar questions, and it responds. For a tiny fee, you can look forward and inquire about anything pertaining to your money and possessions, be it risky contracts for differences or safer ETFs.

It’s a very curious way to think ahead. This tool automates long-term planning tasks, such as saving for retirement. Alternatively, you can ask the app what steps you need to take to start putting money aside for late middle age.

Or let’s say you’re setting money aside for your kid’s schooling. If you want to have enough money saved up by the time your kid is ready to attend university, you might ask your future self how much you should be setting aside now each month.

IAR can help you to determine how much to attach to specific goals. IAR, however, is not a financial advisor. It is software that works almost like a budgeting app and can provide you with computer-powered guidance. Although the recommendations may not be perfect, they can nonetheless guide your financial decisions.

Pros

- Automated savings advice

- Practical planning features

- Pay off debts, use for budgeting

Cons

- IAR is neither a human advisor nor a certified financial advisor

7. M1 Finance – Robo-Advisor Review

🤖 Robo-advisers which utilise a passive investing strategy and let users make tiny minimum investments, are increasing in popularity. M1 Finance is among them…

M1 Finance is a financial software firm that provides a completely automated digital investment product with a “hands-off” investment style.

This mean that you don’t need to actively manage your portfolio or choose any particular investments.

As an alternative, you can decide on your assets based on your objectives, risk profile, and timescale, and M1 Finance will assemble an exchange-traded fund (ETF) stock portfolio that is tailored to your chosen investment strategy.

Setting Up

Start building a diverse investment portfolio with as little as $10 AU – choosing your investing objective, which includes your goals, risk tolerance and anticipated time horizon is the first step. Then M1 Finance suggests an ETF investment portfolio, diversified based on your answers.

The next step is to choose your trade frequency, which can be daily, weekly, or monthly. Additionally, you must activate two-factor authentication.

M1 Finance provides consumers with a completely transparent price structure, including no admin or maintenance fees, as part of its automated investing method.

Pros

- Simple

- Well-designed UI

- Custom algorithm

Cons

- No control over individual stocks, reliance on ETFs like most robos

8. e*TRADE Core Portfolios – Robo-Advisor Review 🗡️

🤖 The ability to diversify your holdings across asset classes – such as options – is one of the great things about investing in an e*TRADE Core portfolio.

This broadness could lessen your risk in the event that one of your assets fails.

A growing number of businesses want to give their clients the option of using ETFs in their basic investment portfolio since ETFs are becoming more and more well-liked among investors.

This was made possible thanks to a unified platform developed by Rester Corp, the organisation behind the e*TRADE Core Portfolios programme, which enables consumers to access up to 20 different firms concurrently as part of an all-encompassing suite.

Asset Classes

Its baskets are composed of a variety of ETFs created to assist investors in achieving balance and diversity across various classes of assets. These consist of securities such as stocks, bonds, goods, and foreign currencies. You may diversify your money across many industries, reduce risk, and increase return by investing in various types of ETFs.

These portfolios are said to be among the finest robo-advisors available since they allow clients to broaden their holdings with just one click. To diversify your assets, buy an ETF portfolio that includes securities across several industries, such as power, property investment, securities, and equities.

Your risk appetite is evaluated when you join up for e*TRADE Core Portfolios, and one of its 8 pre-concocted baskets is recommended. Then, you may decide which one to invest in or create a portfolio to suit your particular requirements.

Pros

- Tweaks frequency of investments

- Automatic rebalancing

- Auto-sells portions of ETFs

Cons

- You’re leaving specific decisions down to the app

9. SigFig – Robo-Advisor Review

🤖 In addition to cheap advice, SigFig waives its yearly fees for portfolios under $15k AU – which can suit micro-investors.

SigFig automation can actually be incorporated into your current brokerage firm quite simply – if you currently invest with TD Ameritrade, Charles Schwab, or Fidelity. In fact, you can also start a TD Ameritrade account through SigFig directly. Anyone can use SigFig’s free portfolio monitoring tools if they aren’t prepared for that level of commitment. New investors might be wise to look at SigFig if they have the $3k minimum investment.

How to Link Accounts…

If you have that cash, SigFig is a great candidate for first-time investors thanks to its excellent features, financial experts, and no yearly fees until you hit $15,000AUD / $10,000USD.

For seasoned investors who are seeking automated management and currently have a brokerage account at Charles Schwab, TD Ameritrade, or Fidelity Investments, SigFig is a viable option. If you give SigFig access to your trading account, the robo can handle all or part of your balance without requiring you to transfer funds from another account.

Additionally, doing so can end up being less expensive than utilising those brokerages’ own robo-advisor services. It will retain a smaller portion of your assets in cash than Schwab Intelligent Portfolios, at the very least.

You may still use SigFig if you are a novice investor and don’t currently have a trading account with one of these 3 companies. The site just creates a TD Ameritrade profile for you once you join up. Before enrolling, you may even arrange a free 15-minute meeting with a financial expert from SigFig.

SigFig offers you consults with its team of financiers and offers a selection of low-fee, diverse exchange-traded funds (ETFs). However, it’s crucial to keep in mind that not all of SigFig’s advisers are CFPs, which many people view as the industry’s pinnacle.

Pros

- Access to human advisors

- Competitive fees

- Compatible with some other brokers

Cons

- Not all advisors are Certified Financial Planners

- Not a full broker itself

10. Ellevest – Best Female Robo-Advisor 👩💼

🤖 Although people of all genders can establish accounts, Ellevest is a robo-advisor that is administered by women and targeted at women.

Veteran Wall Street exec Sallie Krawcheck is the company’s co-founder and President.

The company claims that its objectives approach aligns with what women genuinely desire in a wealth manager. Although some novice investors and those seeking a more comprehensive financial strategy may find this platform useful, many with more modest balances may find it to be too pricey.

About Ellevest

For new investors who need assistance getting going with investments, retirement savings or preparing for certain objectives, Ellevest is the perfect option. This robo-advisor functions similarly to rival services that weren’t specifically designed specifically with women in mind.

On joining up, customers are allocated an investment portfolio that is suited to their objectives and risk tolerance, after answering a range of questions regarding their financial goals and spending tastes. You might be able to begin investing earlier with Ellevest than you might with some of its rivals, like Wealthfront, since there is no minimum contribution requirement.

Ellevest builds portfolios using mutual funds and exchange-traded funds (ETFs) from more than 20 diversified asset classes. In one analysis, a taxable investing account was made for a middle-aged user with a reasonable degree of risk tolerance.

This resulted in the platform generating a portfolio composed of the vast majority as stocks, 8% bonds, and 2% alternatives, including a Real Estate Investment Trust at 1%. Your portfolio should include more than a dozen ETFs and mutual funds, despite the fact that this is a fairly normal investing strategy for this profile.

- Read 📚: Best REITs to watch

This would be excessive given that a portfolio with many fewer funds and perhaps cheaper costs would likely provide a comparable level of diversity.

Pros

- No minimum deposit

- Decent fees

- Goal-setting help

Cons

- No tax loss harvesting

- Features can be overly complex

Best Robo Advisors AU 🦾 – Buying Guide

The major draw of “automating” the investment process by using robos is that it’s particularly helpful for people with little savings who can’t afford to hire an expensive, certified human advisor. Or wealthier investors who want to minimise fees.

But let’s further investigate other aspects of robo-advisors.

Robo-Advisor ⚙️: How They Work

A brand-new class of online wealth management services known as “robo-advisors” has emerged in recent times.

These companies provide automated money planning and advising services with little to no human intervention, typically at a lower cost than traditional consultants.

While passively trading on smartphones is not advised, robos are designed to take the analysis component off of your hands.

How Robo-Advisors Operate 🤖

- ☑️ You’re questioned about your money, career, ambitions, and risk tolerance when you open a new online robo account.

- ☑️ It then suggests a portfolio composed of bonds, stocks, ETFs, and others based on your responses, in order to help you reach your objectives.

After that, you’ll receive guidance on how to make the commitment. The entire procedure is planned to take you no more than a few minutes. And it’s hoped that it would be far less expensive than employing a human counsellor.

What to Consider When Selecting a Robo Advisor

When selecting a robo-adviser, there are several things to take into account, and each person will have a different best option.

Your specific investment strategy is by far the most crucial element. Choosing the highest-rated robo-advisor in 2024 won’t help you if your investment plan isn’t suitable for it. The top businesses all employ similar methods, but they execute them differently. The two primary categories of investing strategy are:

- Passivity. The success of one or more significant stock indices, like the Dow Jones is mimicked by this sort of investment approach – low risk, steady ROI.

- Proactivity. This investing approach is more individualised and depends on the investment manager’s talent to beat the market – higher risk, aggressive ROI.

The top robo-advisers of today have a great track record of steady results in both bull and downturn markets, as well as excellent customer satisfaction. Additionally, they have sound investment strategies and plans and are reliable and steady.

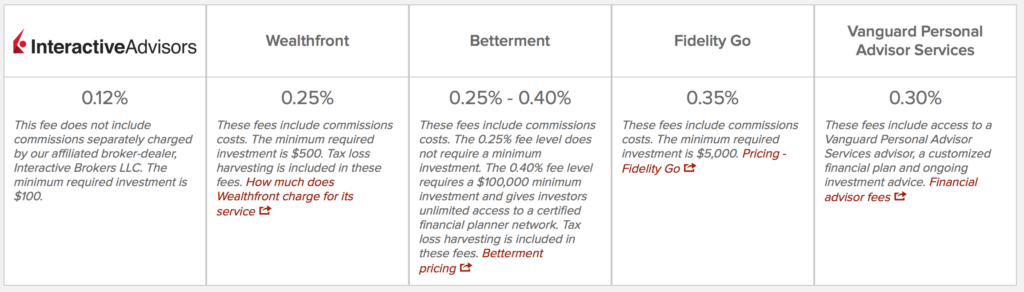

Fee schedule

A high-performing robo-adviser will charge reasonable, clear fees. Most charge a specific percentage of the funds they are managing. Others charge a fixed monthly cost, but they are less prevalent and typically provide investors a worse value.

A free trial period is also provided by several robo-advisers. You get the opportunity to evaluate the service’s suitability for you during this time by observing how it actually operates.

When Choosing… 👈

Before you make your decision, keep the following aspects in mind:

Deposits

What ‘low investment minimums’ are to you will depend on your circumstances.

Robo-advisers could ask for $7 or $700 to open an account. Keep in mind, you’ll be shown the minimum required to register an account and begin receiving advice. To get real profits, you’ll likely need to invest more.

Asset classes

That means the range of asset choices at your disposal.

The majority of robo-advisers provide a good range of possibilities through diversified EFTs. However, some provide very little. If you’re a really cautious investor, the robo-adviser may be an excellent choice under these circumstances. (For someone who desires some degree of diversity, though, low choice isn’t a suitable fit.)

Transparency

Transparent is a key feature of the finest robo-advisers.

Logging in should allow you to see precisely what you’re participating in. Additionally, you should always have access to changing your asset allocations online, with clear terms and conditions.

Upgrades

The top robo-advisers provide a broad range of complimentary and additional services.

At the absolute least, you ought to be able to obtain financial counselling and rebalancing. Numerous businesses also provide free tax-loss harvesting. Some businesses additionally provide premium services, such as membership in a closed investment club and unique financial advice for high net worth investors.

Support

The most liked robo-advisers offer extensive customer support. Although, as is typical with many businesses, not only robos, you should be prepared to wait a few hours to speak with someone.

Financial Standing

In 2024, only the very best robo-advisers might be regarded as reliable and financially stable. It is essential to stress this. You don’t want to become involved in large financial fraud, but – as with the FTX exchange – can still occur.

The simplest approach to do this is to visit the website of the Securities and Exchange Commission and search for any complaints made against the specific robo adviser. Since the late 2000s, the SEC has begun keeping track of complaints and grievances and posting them online.

The SEC now maintains a far more comprehensive web database with data on robo advisors and financial advisers.

You Might Also Like: