Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

How to Trade & Invest in The ASX 200

It’s Australia’s biggest index, representing its 200 most powerfully monetised companies. In fact, it represents roughly 80% of AU’s stock market capitalisation.

You guessed right—today, we’re walking you through how to trade and invest in the ASX 200. Keep reading to learn more.

Table of Contents:

- 🌐 History of the ASX

- 🌐 Why Was the ASX Formed

- 🌐 What is the ASX Today

- 🌐 How to Trade & Invest in The ASX 200

- 📉 1. ETFs

- 📉 2. Shares

- 📉 3. Options or Futures

- 📉 4. CFDs

- 🌐 What impacts the ASX 200

- 🌐 Strategies and Tips

- 🌐 How to Trade on the ASX Using eToro

- 📙 FAQs

At a Glance: The ASX

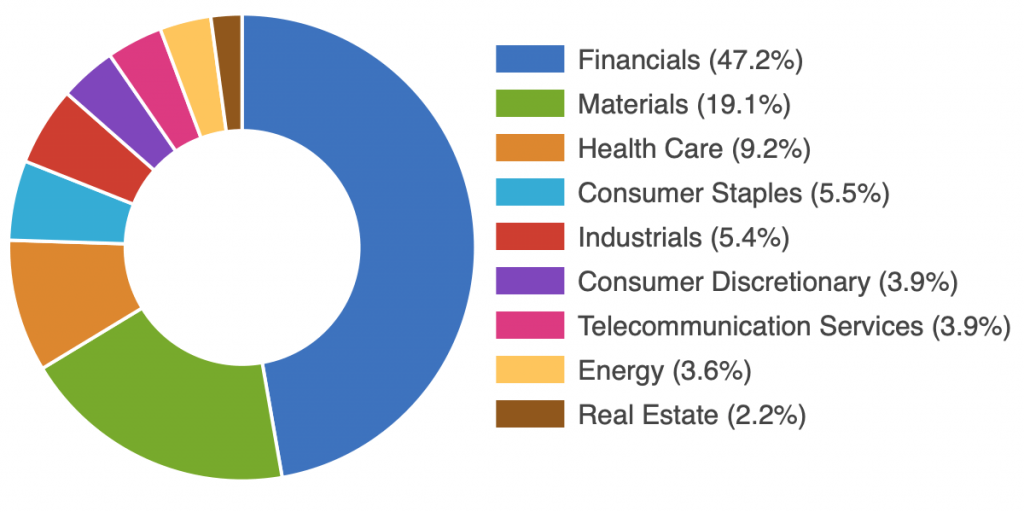

Here are some of the sector breakdowns from a few years ago:

- ✅ The ASX indexes the top 200 leading companies in Australia, often with the potential to grow even further.

- ✅ Therefore, listed are some of the most popular and profitable stocks in Australia (see here for US stocks), making them an interesting place for investors to begin their investment journey.

- ✅ It’s a modern, fully electronic exchange where stocks, bonds, derivatives, commodities, and foreign exchange are traded.

- ✅ It’s the main market for listing and trading shares in Australia. The ASX also operates markets in other financial services such as futures, options and exchange-traded funds.

History of the ASX

The ASX has a long and rich history, officially beginning with the creation of the Australian Securities Exchange in 1987. This new exchange was created as a result of a merger between the Sydney Stock Exchange and the Victorian Stock Exchange.

But the journey began in the 1920s with the formation of the Sydney Stock Exchange, which eventually led to a merger with the Victorian Stock Exchange in 1987 to form the Australian Securities Exchange. In 1990, the trading system became fully automated, which reduced trading times from two hours to less than 10 seconds.

The introduction of a market-wide trading halt mechanism in 1992, called the “circuit breaker”, was a significant event in the history of the ASX. This mechanism was developed in response to the significant increase in trading volumes that occurred in the late 1980s-1990s. It was the first such implementation in the world and has become a feature of other exchanges.

Why Was the ASX Formed?

While the Australian Securities Exchange (ASX) was formed as a result of a merger between the Sydney Stock Exchange and the Victorian Stock Exchange, impelled by a gold rush; it was created with the objective of providing an efficient, transparent and economical facility for the trading of securities.

The ASX’s main role is to provide a central marketplace where listed companies can raise capital by issuing equity securities such as shares and bonds. It’s also a central depository for Australian share ownership. As a result, it plays a key role in the financial system by facilitating the payment of dividends and other distributions.

What is the ASX Today?

The Australian Securities Exchange (ASX) is the Australian financial markets’ trading and clearing house. It also owns and operates the Australian Securities Clearing Company Limited (ASCC) and other securities and derivatives exchanges in Australia. It is the location where major (see here for AU penny stocks) listed companies are able to issue shares.

In fact, the ASX200 is the main index representing the Australian stock market. It is made up of the 200 largest companies listed on the ASX, and it represents about 80% of the market capitalization of all listed companies in Australia (all AU stocks).

These are some of the most popular and profitable stocks on the Australian stock exchange, making them an ideal place for investors to begin their investment journey. The All Ordinaries Index is another name for the ASX200, with the “All Ordinaries” part of the name referring to all companies listed on the exchange. Companies listed today, some of which are leaders in their industry, include:

- ANZ Australia and New Zealand Banking Group Ltd

- CBA Commonwealth Bank of Australia

- FMG Fortescue Metals Group Ltd

- GMG Goodman Group

- NAB National Australia Bank Ltd

- NCM Newcrest Mining Ltd

- TLS Telstra Corporation Ltd

- WES Wesfarmers Ltd

- WOW Woolworths Group Ltd

- WPL Woodside Petroleum Ltd

- XRO Xero Ltd

How Companies Get Listed on the ASX

To give a very simplistic overview, let’s say you have an amazing company pumping out many millions of dollars in revenue yearly and you want to list it on the ASX.

You’d need to apply for a listing on the exchange. You will need to submit a “listing application” that details the company, its directors, financial statements, and so on.

You will also have to have a number of shareholders who own a minimum percentage of the company’s shares. Once your company’s listing application is approved, it will be added to the official list of companies on the exchange and the appropriate index…

For example, if your company is an oil and gas exploration firm that weighs into a high enough percentile for its market cap, it will be added to the All Ordinaries Index, which represents the top 95% of all listed companies in Australia. You can also break down the index by industry; in this instance investors interested in the mining and energy sectors can choose to invest in your company.

How to Trade & Invest in The ASX 200

Let’s start with setting yourself up with an online trading platform.

Trading on the ASX is done through brokers, who are the companies that you sign up with to buy and sell stocks. Brokers are responsible for buying and selling shares on your behalf and sometimes providing advice on the best stocks to buy at any given time.

One of the most important aspects of trading on the ASX is to ensure that you choose a reputable and trustworthy broker. The best way to do this is to read reviews (although there is plenty of disinformation online, you can still get an idea), look at broker websites, and ask around to see what your friends and family are using to trade stocks.

When trading on the ASX, you will buy and sell shares through what is called the “order book”. This is where all the buy and sell orders are listed, with those wanting to buy shares listed at the top, followed by those selling shares, and ending with those who want to sell shares but have not found any buyers yet.

Your position will be placed on the order book, and you will be given a “subsequent price”, which is the price that you will be paid if and when someone sells shares to you. You can choose to accept this price or “take the market”, which is to accept the price that is going through the order book at that given time. We’ll discuss this in descending order, beginning with the least volatile method.

1. Investing and trading in the ASX 200 through ETFs

What are ETFs? 🗑️

This is, arguably, the least volatile approach. Exchange-traded funds (ETFs) are basically a type of mutual fund. The Australian share market is one of the biggest in the world, and so it’s important to invest in shares that will outperform the market. A good example of an exchange-traded fund would be a bond fund, which is a type of mutual fund that invests in bonds.

The more bonds you own, the more you’ll benefit from inflation and interest rates on your investment. The bigger your holdings are, the longer it will take for inflation to rise and interest rates to rise. An exchange traded fund is similar to a bond fund only that instead of investing in bonds, you invest in stocks and other assets such as property or real estate.

In this case, you don’t have to worry about how long you’ll need to wait before prices start rising or interest rates start going up because your investment won’t be affected by either what happens with other investments or by government policies affecting the market itself.

By investing in an ASX 200 ETF, you’re purchasing shares in funds that track how well the index performs. ETF investments give you exposure to this market with one order, rather than purchasing lots of individual shares for each stock, which would rack up higher fees and costs. You could also be entitled to dividends even though you’re investing in an ETF.

2. Invest in the ASX ‘directly’ through stocks and shares

How do stocks and shares work?

Stocks and shares are two overlaid investment instruments, although the terms are loosely interchangeable. Shares make up stocks. One stock may have thousand of purchaseable outstanding stocks; the larger your proportion of shares you have in a single stock, the more your ownership of a company.

Both are offered by companies through issuing corporations: corporations that were created to create companies on behalf of the government or private sector (the government). Corporations may also be registered with a certain number of members (taxes paid) who hold voting rights in them, allowing them to alter how they operate when they’re not in control of the corporation itself.

When shares for a stock are issued, they are sold on an open market for investors to buy and sell. This allows people who aren’t members to buy and sell shares directly from their own company without any need for investors to purchase them from other companies who issue them (officially known as “dividend reinvestment rights”). Companies can also issue shares through their parent companies, which means there could be many more companies involved than just one publicly listed company.

Stocks ‘go up’ when more people buy them or sell them at a higher price than the market price. The opposite is also true.

By directly investing in ASX 200 stocks, you gain an ownership stake in that underlying firm. Perks include possibly receiving voting rights and dividends if these are offered by that company. However, to be diversally exposed to the index through individual shares, you’ll need to buy a basket of ASX 200 shares across a range of sectors.

3. Trade on the ASX via options or futures

How do futures work?

Futures contracts are legal obligations to buy or sell an asset at a later pre-agreed date and price.

Assets include wheat, oil, corn, gold, coffee, company stocks, bonds, ETFs, cryptocurrencies, forex and more. Normally, future contracts are offered on exchanges; buyers agrees to buy a fixed volume of a certain number of units for an asset, at a fixed delivery date. Likewise, the seller is obligated to sell that asset according to the contract’s terms.

Who uses futures?

Many types of financial entities, individual traders like farmers and financial speculators. For instance, an agricultural company might need physical commodities at a certain date or season in the future.

The types of futures traders will depend on the asset, which also varies. Corn, for example, is an agricultural good that can be received or sold in a futures agreement. Other investors might trade NYSE futures contracts – for stock or ETF futures.

How do options work?

Options contracts don’t mean you can actually obtain the underlying asset. It only means exclusive rights to do so at a later date. (Up the option’s expiry date). This means you can hold out – minimising the starting capital required, and potentially amplifying your returns once assets shows stronger signs it is valuable…or not.

The main difference between options compared to futures is, in most cases, you have exclusive rights. But you need to renew contracts every few years or so. Once you buy an option, you can also trade the underlying asset after buying if you decide to do so. Whenever you buy the asset, we call this “exercising the option.”

4. Use CFDs, for instance, a cash index or futures

CFDs is the riskiest approach to investing and trading on the ASX 200…

CFDs are very speculative in nature and can be very dangerous for the person trading them. With a relatively high amount of leverage and short-term trading, CFDs can be a very profitable investment that can provide high short-term returns. However, there are also a lot of risks involved and they can lose a large amount of money very quickly.

One way to gain exposure to the ASX 200 is through ‘cash CFD indexes’. This confusing term means when traders invest in the current index price – this is also called the spot or cash price. While there are probably ways a platform can use this to its users disadvantage, it can feasibly offer short-term traders tighter spreads. This comes with overnight charges and funding fees for any positions held overnight.

Whereas Index futures CFDs are an agreement to invest in the index at a pre-agreed price and date (which is the expiry date). Index futures feasibly give traders long-term overnight perks because it amalgamated overnight fees into the spread. This arguably amounts to a higher initial spread but no multiple overnight fees.

What impacts the ASX 200? 📈

Events and news reports. Politics and other events including market responses to the COVID pandemic can impact the price of the ASX 200 – for instance, lockdowns restricted every aspect of business, including immigration and exports; this is also seen in times of war.

Breaking news can trigger hits to the ASX 200’s value. A second Great Depression seems to be the biggest looming threat today, but this also includes domestic Australian news that suggest something positive or negative about the stability and prospects of the country.

Earnings reports are used to analyze the financial health of a company. The earnings report is used to show the company’s financial performance and can be used as a basis for making investment decisions.

This official document is issued by a public organisation that publishes expenses, earnings, and the company’s overall profit across a certain time window. This report is sometimes called the income statement. Or the profit and loss (P&L) statement. Traders and investors evaluate this to assess its financial health. Overall, the earnings report is used to show the company’s financial performance and can be used as a basis for making investment decisions.

Market changes include interest rate hikes by AU’s central bank. The Reserve Bank of Australia often triggers changes in the price of the ASX 200. As interest rates increase, this reduces borrowing and can therefore impact earnings potential long-term. You’ll often see stock prices falling – which can create a butterfly effect in the price of the ASX 200.

The strength of the AUD logically impacts the price of the ASX 200. If AUD is strong relative compared to other forex currencies, the index will probably grow in value, and the reverse is true. Commodities are linked to the strength of AUD. The dollar strengthens when Australia’s exports are healthy, so the stream of commodity items like industrial copper or gold will have an effect

ASX 200 Trading Strategies and Tips

We can only go surface-deep because any professional trading strategy requires years of dedication and study.

There are three basic trading procedures I want to mention: scalping, day trading, and swing (long) trading. It is dependent on your own preferences which one you will choose.

In scalping, you find a good price and buy it immediately. It is the oldest trading method, but it is not profitable because the price will drop before you can sell it. The most common mistake is that you do not close your position quickly at a good price or with a stop loss order in place. You may lose money if your profit is too large.

In day trading, you have to take a risk that your profit will be larger than your loss and use the stop loss order to limit your losses. The aim of day trading is to make an average profit per trade. One mistake to avoid in day trading is to ignore the wisdom of stop losses. This can lead to too-large losses especially in case of a crash because there was no stop loss order placed, in place in which case the position would be closed more quickly and after a market change has occurred.

This method tends to lose money when market conditions change drastically after having set up your position(s) aggressively in the trading session.

Swing trading lets you exit your long position (a few days or longer) and buy at a higher or lower price, depending on the value of your long position at the time of the exit. This is especially useful when a stock is in bear market and you want to minimize your losses short term.

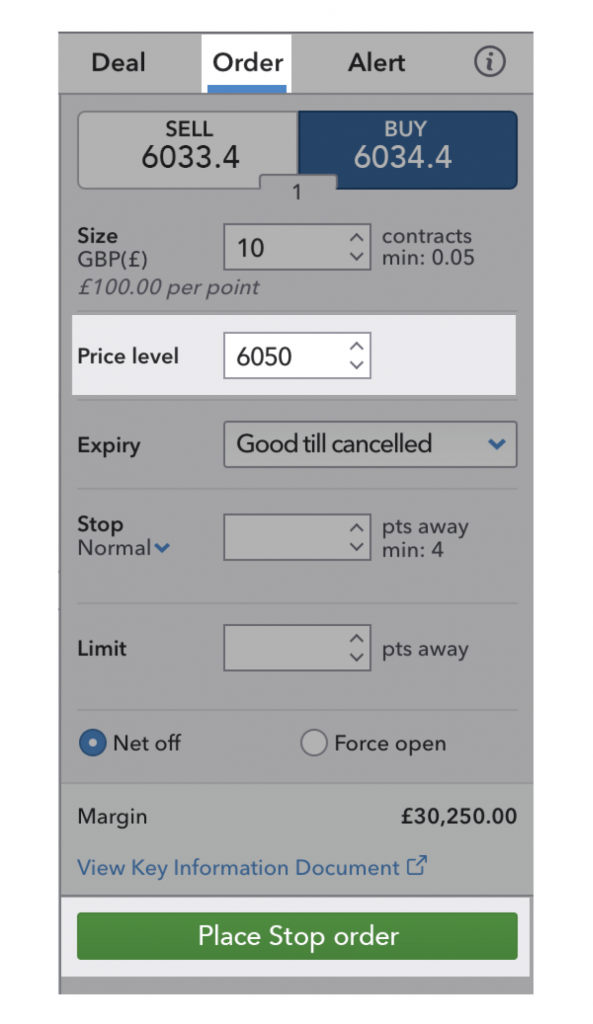

In all cases, traders should use a stop loss order. A stop-loss order is a type of order used by traders to limit their loss or lock in a profit on an existing position. Traders can control their exposure to risk by placing a stop-loss order.

A stop-loss order is an order placed with the intention of locking in profits and/or mitigating losses (similar to buying protection). Traders can control their exposure to risk by placing a stop-loss order and using limited money on an existing position (for example, if they have $2,000 available but only $20 invested in the stock, which would amount to following the ‘one per cent rule and the proper use of stop-losses, unlike in the first day trading example). Different types of stop-losses exist.

Stock charts are very useful for understanding the price movement of a stock. They can be used to determine whether a stock is overbought or oversold, and whether it is likely to continue its upward or downward trend.

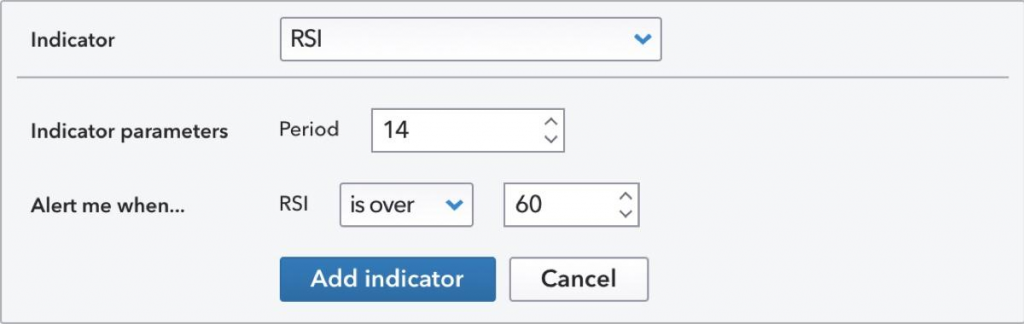

Numerous indicators exist on various trading platforms like IG or eToro. Some will give you alerts for ASX trading signals that notify you when certain parameters have been met. For example, when the ASX 200 reaches a particular volume of trading.

The news is also key in an age when politics and the economy are inextricably linked. Currently, the world is still scratching its head as to why Bill Gates bought up so much of America’s farmland, without intending to make it productive land, at a time when supply chains are breaking down and farmland is generally spiking in cost.

eToro Review: How to Trade on the ASX Using eToro

eToro acts as a social trading platform…

eToro lets you buy a range of financial products such as stocks and cryptocurrencies. At the same time, you can also copy the trading activity of others in order to make money. Simply, if you see someone make money trading stocks on eToro, you can follow their lead and make money too.

For that reason, this is a potentially useful tool for beginners who are just getting into trading stocks. At the same time, it can be useful for more experienced traders who want to diversify their portfolios.

This platform allows traders to follow the moves of other traders and make money based on their actions. eToro’s trading platform is available to users from all over the world. eToro is available in many different languages. This makes it a very easy platform to navigate and use for traders around the globe. You don’t need to be a native English speaker to make use of the eToro trading platform. But you can’t expect miracles either; it’s perhaps unwise to invest what you can’t afford to lose.

How Does eToro Work?

When you sign up with eToro, you’ll be able to choose which assets you want to invest in. These assets might include stocks or cryptocurrencies. Once you select the assets you want to trade, eToro will provide you with a virtual portfolio. This virtual portfolio will include both the things you have invested in and the things you have copied from other traders. At the same time, you can also copy the trading activity of other investors. This increased flexibility allows eToro to appeal to both beginners and more experienced investors.

How to Trade on the ASX with eToro

- ✔️ The first thing you’ll want to do when you want to trade on the ASX using eToro is to select the type of investment you want to make. You can do this by visiting the investing section of the eToro website. Here you can select the types of stocks you want to invest in and the amount of money you want to put towards each one.

- ✔️ Once you’ve made your selections, you’ll be able to track your portfolio over time. You’ll be able to see how your money is doing, as well as how much each stock is worth. At the same time, you can also use eToro to follow the trading activity of other investors.

- ✔️ Social portals can be a useful way to learn about investing in stocks.

FAQs: How to Trade & Invest in the ASX 200

What are the ways you can trade the ASX 200?

CFDs are the riskiest, while ETFs are longer-term and aimed at riding out bearish markets and diversifying your money better than your fiat capital might. Overall, it’s a weaker alternative to having physical investments you can live off of, such as community, family, provisions, and farmland.

Market timing is also a risky method for non-experts. This method involves buying and selling stocks at specific times in order to make money for an investor who wants to time their purchases and sales with other investors who want to do this as well. For example, if you want to time your purchases with other investors who want their purchases timed with yours, then you can use this method of timing your purchases and sales together with them.

Is the ASX 200 the stock market?

Yes, one index and AU’s biggest. In this market, investors can buy and sell shares of companies. The main purpose of the stock market is to provide investors with an opportunity to buy and sell stocks. The stock market is also known as the “market” or “marketplace” because it is a place where people can buy and sell stocks.

What is important to know before investing in the ASX? 📜

Before you trade the ASX 200, you should carry out your own fundamental analysis of the constituent companies’ performance, the government’s economic policy and current economic conditions, and technical analysis of the index’s previous price movements.

How do firms get listed in the ASX?

There are many things to know. Chief among them are your priorities and highest focus, which will give perspective to everything else. Likewise, fundamental analysis is a strong approach when going about learning how to trade and invest in the ASX.

It can help you make money by identifying stocks that are undervalued and those that are overvalued. This can help you make money by buying these stocks at a lower price than they would be worth if they were valued at their true value. Or help you make money by selling stocks that are overvalued and buying them at a higher price than they would be worth if they were valued at their true value.

For instance, Warren Buffet prefers a relatively tiny portion of farmland ownership to any ownership in Bitcoin. Why? Because farmland produces ‘hard value,’ ie. that has proven itself a timeless asset. This sort of wisdom can help you make money by selling these stocks at a higher price than they would be worth if they were valued at their true value, but also having a wider context.

Advantages of investing in a listed company

When you invest in the ASX, you are dealing with companies that have raised capital in the markets by issuing listed securities such as shares and bonds. Funds are raised at a lower cost because financial investors are willing to pay a premium for these securities, which provides an advantage for the company when it comes to expanding their ventures. Being a listed company also provides greater access to a broader investor base.

What is market capitalisation? 🗼

Market cap is the total market value of a company divided by its current stock price. That is, market cap = (number of shares outstanding) / (stock price). An ASX company’s market cap is useful in determining whether a company is undervalued or overvalued, relatively stable or up-and-coming. Overvaluation occurs when a company’s stock price is too high relative to its historical earnings, and undervaluation occurs when the market believes the stock price is too low relative to its historical earnings.

How does market cap affect ASX share prices?

The higher a company’s market capitalization, the more it will be perceived as valuable by investors. This will lead to upward pressure on the share price of a company with a high market cap and downward pressure on the share price of a company with a low market cap. This phenomenon is known as “the discount effect.” That’s a simplistic overview; for instance, share geopolitical events can have a tremendous acute impact and overshadow market cap.

What are some examples of companies that have very high or very low shares outstanding?

Some examples include Apple (AAPL), Microsoft (MSFT), Intel (INTC), Coca-Cola (KO) and Visa (V). These companies can generate huge sums of revenue each year and still have their shares outstanding relatively small. By comparison, McDonald’s Corp, which has been around for just over 100 years, has about 4 million shares outstanding.

Conclusion 🌞

The ASX provides investors with liquidity and a transparent and efficient mechanism to buy and sell shares. The listed companies also benefit from having a central platform to raise capital, a transparent reporting mechanism and an efficient mechanism to settle transactions.

The regulatory environment in Australia was once considered to be one of the most favourable in the world for listed companies. In addition to having a transparent and efficient market, Australia also has a well-developed regulatory regime that provides a high level of investor protection.

The ASX is also considered to be one of the most transparent and efficient stock exchanges in the world, with settlement times of two business days for equities and fixed-income securities. Overall, this equity market is considered to be one of the most liquid in the world but there are many unprecedented events that will likely change the face of the world in the incoming months and years:

- 📖 Permanently disrupted supply chains to Europe

- 📖 The threat of global war breaking out (worsening these chains)

- 📖 A collapsing Europe against new Asiatic ‘peer powers’

- 📖 Disinformation war (powered by censorship tech)

You Might Also Like: