Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Global Stock Trends in 2024

Online investing is an offshoot of the fintech industry.

It makes investing easier for novices and day traders, and it can give seasoned investors an edge through various advanced analyses.

However, digital trading is not something you should go into without a little bit of knowledge about investing and how it works.

eToro is the worlds largest social investing platform giving you the option to invest in crypto assets, ETFs and stocks all in one place. eToro offers access to 3031 stocks and 264 ETFs.

Why is Digital Trading so Popular?

Digital trading has brought Wall Street to Main Street. With just a computer or mobile device and a little money, almost anyone can begin trading and investing today. This form of self-directed investing means you don’t have to work with a broker, and it can be done from your home, office, or vehicle, at any time and from any geolocation.

Online tools and knowledge bases curated by different investment platforms provide insight and information you could only get from a dedicated financial manager before.

Once you learn the ins and outs of digital trading, you’ll have a nice passive income stream.

The Finer Points of Digital Trading

Digital trading for the mass population is possible due to the rise of cloud-based platforms and software-as-a-service (SaaS).

The process has been further democratized due to technological advances like blockchain and machine learning technologies, and the rise of mobile computing.

This technology provides more detailed and accurate analysis of markets and trends, and it helps investors understand the cycles and processes involved in commodities exchanges.

They’re also user-friendly and easy to navigate.

Almost anyone can trade online. Most cloud-based and SaaS platforms allow you to create a free account with no minimum deposit, often called “freemium.”

You may even find some that allow inexperienced investors to make risk-free trades until they get the hang of how it’s done. With this capability, you can invest in currencies or enter markets anywhere in the world. You can dabble in options or speculate on currencies, and there are always traditional stocks, bonds, and commodities.

It’s easy to get carried away with digital trading, especially if you’re new to investing and find success. Before investing money in any stock, bond, or currency, make sure that it’s money you can afford to lose, and don’t allow emotions to overrule common sense.

Trading Crypto

Bitcoin and other cryptocurrencies are becoming big trading business. Currently here are more than 500 cryptocurrency exchanges in the world.

Just over half of these exchanges are tracked by CoinMarkeCap, a company that lists more than 19,000 markets for cryptocurrency trading.

Trading in crypto can be risky because the markets are so volatile and there are wide pricing fluctuations. You can mitigate some of the risk by following some basic rules of trading in crypto.

- Pay attention to what’s happening with Bitcoin. There are many alt-cryptocurrencies on the market, but they are all tied closely to what’s happening with Bitcoin, but not in the way you think. Typically, when Bitcoin is high, other cryptos drop in value as investors move from those currencies to ride the Bitcoin wave.

- Know what you’re getting into. The proliferation of online trading platforms, especially in crypto, means more opportunities to get bad trading advice. Do your own research.

- Diversify. This is good investment advice in general. With crypto, you should spread your investments over several types of crypto-coin in order to reduce risk and benefit from crypto growth overall when the markets are hot.

- Consider the big picture. During your research, you’ll discover just how many alt-currencies are on the market. If you find one that’s been around for a while, has a good reputation, and solid returns, consider putting some money into that one as a mid- to long-term investment.

- Set stop margins. This applies to short-term alt-currency investments. Decide in advance what an acceptable loss is and sell when it’s reached. With automation, you can set these limits to trigger a sale without the need to watch the markets day and night.

- Learn from your mistakes. None of us has a perfect trading record. Losses are going to happen. Learn from your mistakes, and you’ll improve your record with each trade.

- Don’t get swept away by hype. This is known as Fear of missing out (FOMO). This condition is partly fueled by the type of media hype and overly optimistic CME announcements that created the Bitcoin bubble that burst a few years ago.

- Pay attention to the ticker symbol when trading. Much like fake URLs or similar packaging for generic/premium merchandise, nearly identical ticker symbols could trick you into investing in a fake currency. The same currencies can be listed on various exchanges by different symbols, and some fraudulent currencies can be confused for legit alt-currencies. For example, Bitcoin is listed on some as BCH, and it’s BCC on others. BCC was also the ticker symbol for a scam currency.

Trading Security Tokens

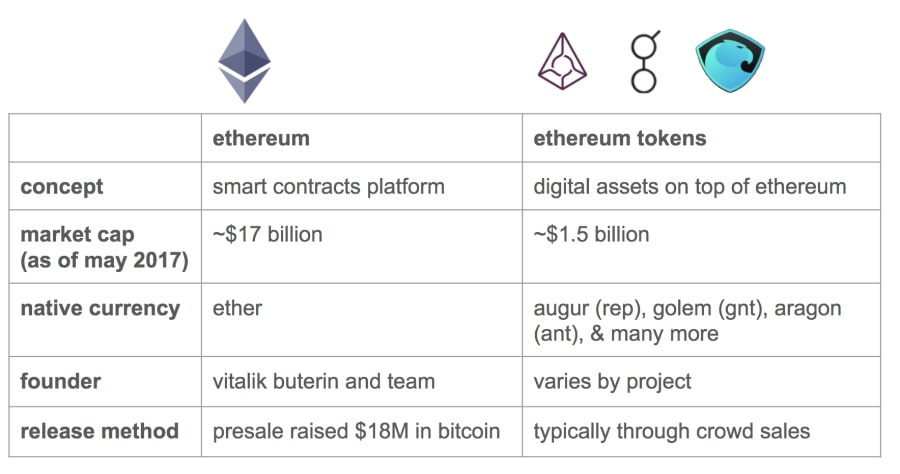

In real-world trading, securities are shares of ownership in a company that’s publically traded on the stock market. Digital trading environments use security tokens to represent that same thing.

Each token represents a corporate asset of some sort that’s offered to investors during an initial coin offering (ICO). This process is similar to an initial public offering (IPO) of stock in real-word exchanges, but investors receive tokens rather than stocks. These public sales allow companies to get funding for projects or expansion.

How do they work?

The company issues a set amount of tokens to keep the price stable. Prices can be static and unchanging or change according to the number of people in the crowd sales. Those who are interested in purchasing tokens send the corresponding ether to the address of the crowd sale and receive the appropriate amount of tokens once the transaction is completed.

The goal is to have the tokens evenly distributed to buyers through a decentralized Ethereum platform that’s based on blockchain technology.

These tokens gain value through their features, role, and purpose. Roles assigned can vary from allowing voting rights about how investments are used to value exchanges used as rewards for completing assigned tasks or equitable earnings distributions. The more roles assigned to a token, the higher its value.

Tokens can be divided between utilities and securities. Don’t be confused by this fact. Utility tokens allow access to company products or services, but they are not investments. They’re often used by startups to allow customers to purchase products in development. Tokens purchased as securities are digital assets that can be traded and derive an income from increased market value.

Using Robo Traders

This is probably the most common way of trading in the digital world.

Historically, traditional dividend-earning stocks were the de facto method of index fund investing. The creation of robo-traders like Wealthfront helped change the trading landscape, leading more people to opt into mobile trading over banks.

One of the bonuses is better fees than traditional banks offer.

Robo-traders, also known as Robo-advisers, are not financial advisers. They are service in the form of AI-based technology that analyzes market trends and makes recommendations.

Although the algorithms have a high rate of accuracy when it comes to predictions, they are not a substitute for basic investment knowledge. You are still responsible for setting margins and limits or decisions about when and what to buy or sell.

On the plus side, they offer a low-cost way for ordinary people to get in on the stock market, they’re based on award-winning investment models, and they offer a less risky path for DIY investors who would rather forgo tradition financial management services.

However, those who would refer not to go it alone can still access this option through their adviser, and the intuitive nature offers something better than one-size service.

There is a downside to robo-advisory services. Those who need a face-to-face with someone who can calm their fears during market downturns or provide personal, client-centric advice for long-term strategy won’t find much comfort in cold technology.

What About Security?

Secure online trading platforms use multi-factor authentication for logins and encryption to protect user data. You should also find out if the platform you choose stores account and personal information, and what methods are in place to protect their databases. Never trade on a platform that shares or sells your information to a third party.

If you want to trade in other countries, know what regulations are in place for investors in those locations. You should also install the best VPN on devices and networks to mask your location and protect your personal information.

Final Thoughts

Digital trading allows investors at any level of experience to participate in the global marketplace. None of the above information is meant to be used as investment advice. Our goal is to provide you with an overview of digital trading platforms and some options for you to investigate.

Above all, it’s important to develop good trading habits. You can minimize your risk with a little knowledge of how markets work and learn about the different types of investments and trading platforms. Just make sure that the platform you choose is run by a reputable company that’s run with proper oversight.

Related Reads: