Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Best Trading Platforms with Lowest Fees

Hundreds of online brokers let you buy and sell assets.

But only a selection of these brokers let you trade your preferred financial asset without charging per trade and excessive costs.

Not to mention costs for signing up, funding, or maintaining accounts, which becomes particularly important if you do ‘high-frequency’ trading.

To help you out, in this article, together we’ll explore some of the top recommended trading platforms with the lowest fees today.

Table of Contents:

- How Trading Platforms Work

- Trading Platforms with Lowest Fees… reviewed!

- 1. Interactive Brokers 💸

- 2. eToro

- 3. Fidelity

- 4. Vanguard

- 5. Webull

- 6. Robinhood

- 7. Stake

- 8. E*Trade

- 9. TD Ameritrade

- 10. Merrill Edge

- 11. Charles Schwab

- 12. IG

- Buying Guide 📖

- Conclusion 💡

- FAQs 📙

How We Choose our Platforms 📚

The goal of PA is to better the lives of its readers. In order to do this, we provide extensive coverage on several subjects, including the following:

- Using the best tools

- The importance of healthy relationships

- Boosting your mindset

- Keeping up on latest money trends

Remember that wealth is a mixture of different aspects of the above, and more. Consider things like staying fit, growing your own food, and maintaining strong networks.

How Trading Platforms Work

People are learning to take more responsibility for their financial futures in today’s uncertain economic climate.

The first steps of investing might appear daunting to someone with little experience. There is a lot at risk, and the unfamiliar financial jargon might be intimidating.

For this reason, it’s possible that online brokers might be useful, especially those with straightforward trading interfaces and a variety of resources aimed at educating inexperienced investors.

We sifted through the options to determine the most welcoming broker for first-time investors seeking low fees. One crucial aspect was how trustworthy, informative, and helpful the support is. This is invaluable to those who are just beginning out in the financial markets.

Ultimately, we’ve focused on trading platform with reasonable costs, low entry requirements, and even no commissions.

To minimise costs and maximise returns, index funds and exchange-traded funds (ETFs) are a smart choice for long-term investment storage.

Did you know? 💡 The traditional stock exchange was founded in 17th-century Amsterdam. (Source)

Top Trading Platforms with Lowest Fees in 2024 📉 — A.U. Reviews 📘

1. Interactive Brokers — Specialised Trading Platform with Low Fees

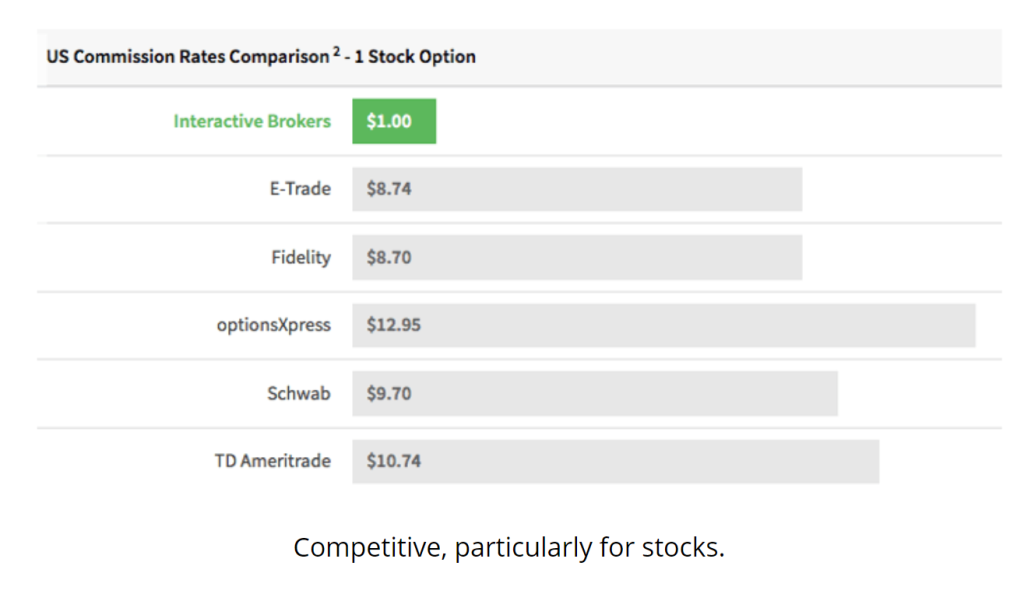

We found that Interactive Brokers, which has been around for a while and which we have researched in the past, has been an undisputed leader among cheap trading platforms.

Several publications ranked them as the best online broker and best day trading broker for low fees due to their innovative trading platform and reasonable rates across instruments.

| IB Fee Type | Amount |

| Trading | 0 |

| Forex | 0.20 basis points |

| Crypto | 0 (for under $100,000) |

| Withdrawal | 1 free per month then 1AUD/transfer |

| Inactivity | 10AUD/month |

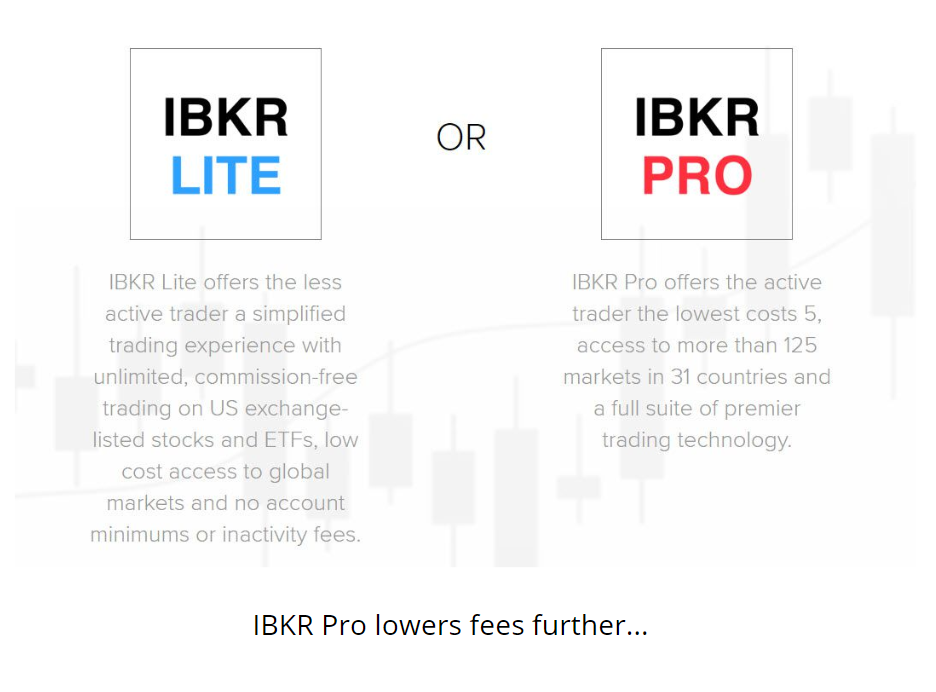

Despite the fact that the learning curve for Interactive Brokers’ mainstay IBKR Pro platform may be steep for newbies, the company stands out as a strong option. When coupled with the company’s user-friendly online and mobile solutions, this becomes even more apparent.

It’s the winner of our award for “Cheapest Stock Broker”.

In 1977, when Thomas Peterffy bought a seat at the New York Stock Exchange, he established Interactive Brokers.

The number of trades handled by Interactive Brokers each day is staggering, making it one of the largest electronic platforms in existence.

Financial services provider Interactive Brokers has offices in the Americas, Europe, and Asia in addition to its headquarters in Greenwich, Connecticut. They went public on the Nasdaq exchange and now employ over 2,100 people.

Superb for Keeping an Eye on Expenses… 📊

When it comes to brokers, Interactive Brokers is the finest choice for active traders, day traders, and serious investors. The IB Trader workstation is their major offering, and it’s largely considered to be one of the finest options for keeping tabs on and managing investment accounts.

To our knowledge, Interactive Brokers has some of the most competitive margin trading rates and fees in the market. The firm offers its clients a wide range of investment opportunities across 33 international markets and almost all major asset types. Serious investors should find this site to be useful and full of the information they need.

Even infrequent or first-time traders may reap the benefits of using Interactive Brokers. The IBKR Lite platform lowers the barrier to entry for inexperienced traders by providing commission-free trades in U.S. stocks, exchange-traded funds, and mutual funds.

Although the online and mobile platforms from Interactive Brokers are simpler and more user-friendly than the desktop IB Trader Workstation, the latter lacks certain capabilities. The Interactive Brokers digital assistant can help with both questions and trades.

Interactive Brokers’ IB Trader Workstation, on the other hand, might be intimidating to newcomers. When faced with so many possibilities, it may be difficult to decide where to begin.

Although they do provide a trial and a few tutorials to help get you started, traders looking for the least amount of friction possible when getting into the market may want to look elsewhere.

Main Advantage of Interactive Investor for Lower Fees

We discovered that Interactive Brokers lived up to its reputation for minimal commissions and fees.

Its main products are IBKR Pro and Mini. IBKR Lite caters to recreational investors by offering commission-free trading of for select stocks and funds.

Nevertheless, IBKR Pro charges fees to its professional and institutional clients and offers flat and tiered pricing. Stock transactions under fixed pricing cost $0.005 per share, with a $1 minimum and 1% maximum of the deal amount.

Individuals who trade often may switch to the firm’s tiered pricing model, which charges depending on trading activity. Interactive Brokers’ option, bond, currency, and mutual fund transactions use either a flat rate or tiered charge structure.

Interactive Brokers’ margin prices were the lowest. For every margin transaction, IBKR Lite charges 2.6%. Margin prices for IBKR Pro clients range from 0.75% to 1.6%, with lower charges for larger transactions.

Other account fees, such a $10 outward transfer fee, are also low. Inactive low-balance accounts may also be fined. Reorganizing securities or redeeming mutual funds doesn’t cost them.

IBKR Lite clients may get order flow compensation from Interactive Brokers. If a broker offers trading pattern data to market makers, they may utilise it to profit from your order flow.

IBKR Pro users may be certain that their transactions will be handled efficiently and competitively, while IBKR Lite customers recovering from COVID lockdowns can opt out of commissions but may be at a disadvantage.

Easy Setup

Their site has a simplified gateway that doesn’t need downloads. This simplified interface makes it easier to perform transactions, track holdings, and see important data like net liquidation value. It’s less feature-rich than the desktop edition, but you can still follow market news and utilise technical analysis charts with fewer data sets.

Finally, IBKR Mobile supports Android and iOS cellphones. It lacks the desktop version’s capabilities but has most of the online service’s. Its mobile app offers the same market research and trading features as the desktop edition.

IBot, an Interactive Brokers AI technology, can assist you trade. Once you ask a query, a predictive algorithm asks whether you want to buy anything.

Verdict — Reliable Trading with Super Low Fees

Interactive Brokers was a strong performer among the services we evaluated. We were able to locate just about every possible investment opportunity with them throughout our research.

Since they allow for trading in fractional shares, you may buy a smaller number of shares if that is more in your price range. One of the things that sets Interactive Brokers distinct is its access to markets in 33 different nations.

Is your trading volume high? Think about using IBKR Lite from Interactive Brokers, which allows you to trade stocks for free and access international markets.

Pros

- Several investment opportunities

- Strong analytical tools

- 18,000+ mutual funds

- Low-priced

- Honest and well-regulated

- Trades most securities

Cons

- No commission-free deals

- No CFDs

2. eToro Review — Overall Easiest Best Trading Platform with Lowest Fees 💸

Finding low-priced commissions have benefits and drawbacks… You should be wary of no-cost trading platforms since some of them are untrustworthy.

Others lack key features like reliable customer support or the ability to implement sophisticated trading strategies with sufficient margin.

eToro sits in the middle, offering strong brand establishment. (Fidelity, our 3rd best trading platform with the lowest fees, is a fair option when compared to other sites.)

| eToro Fee Type | Amount |

| Crypto | 1% |

| Withdrawal ($30 minimum) | $5 |

| Inactivity (after 12 months) | $10 per month |

Stocks, cryptocurrencies, and ETFs are just some of the 2,000+ tradable financial assets available in the app. The website and the mobile app are both straightforward and won’t scare off novices.

Why eToro is So Trusted…

Firstly, it’s liked. In 2007, eToro was founded in Israel. After releasing an Android app, it quickly rose to prominence as a leading social trading and multi-asset investment platform.

Stocks, cryptocurrencies, ETFs, and similar things may all be traded with ease and security using eToro’s primary services thanks to a number of social trading features, such as copying the trades of successful traders and participating in an active social feed.

Is eToro Really Popular? ⭐

It has that star factor. We looked at the finest low-cost providers in the online brokerage industry, and eToro came out on top as the most popular trading platform for low fees in 2024. To start, there is no initial charge for using this broker.

When you do, you’ll get access to its virtual trading platform, where you may practise your skills with a virtual $100,000 to play with. Yet, if you’d rather get right in and begin buying and selling stocks with real money, eToro makes it possible to do so without paying any fees. Hence, the spread is the sole trading charge that has to be considered.

To top it all off, eToro charges no commissions on stocks or fees to maintain open positions, making it an excellent choice for long-term investing strategies. Stocks, ETFs and cryptocurrencies are all available on this well regarded, cost-free trading platform.

If you’re wanting to trade or invest in stocks, eToro is the way to go since it provides access to more than 2,400 shares across 17 markets.

eToro One-of-a-Kind CopyTrader 🐉

eToro’s accessibility in Australia is a big bonus since the platform matches or exceeds the features and services of leading rivals.

You may use CopyTrader, cutting-edge new technology, to quickly and easily copy the positions of skilled traders with a personalised amount.

If you’re interested in investing in the stock market, you may do it via eToro, which offers fractional shares, dividends, and access to more than 2,000 companies from 17 foreign exchanges. eToro is a great platform for Australians interested in trading shares of some of the world’s greatest companies. Even buying bitcoin.

Use ETFs (Exchange-Traded Funds) to track a basket of stocks within a certain industry or index.

Not Lowest Fees but Balanced Overall 🏨

Just $50 minimum is required to make a normal stock transaction.

The minimum investment for cryptocurrency is now just $25 if that’s more your speed. You can trade 18 different digital assets without paying any per-trade fees.

Once again, this broker also provides a useful and free service called “Copy Trading”. The lowest investment to mimic a successful trader is just $500, and you can do it for free. Which gives you a potential ROI advantage.

Furthermore, eToro CopyPortfolios is worth looking at. Even though these are maintained expertly by the eToro staff, there is no fee associated with trading using this broker. You may fill your account with a variety of different payment methods, including a credit or debit card, a local bank transfer, a bank wire, or an electronic wallet.

Verdict — Do I Choose eToro?

Reasons to choose eToro include regulatory safely. It’s governed by the Financial Conduct Authority (UK), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

Pros

- Simple trading platform

- 2400+ equities and 250+ funds in 17 overseas markets

- Crypto

- Debit, credit, e-wallet or bank

- Copying user trades

Cons

- Not for technical analysis-loving traders

Disclaimer:

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Social trading. eToro does not approve or endorse any of the trading accounts customers may choose to copy or follow. Assets held in your name. Capital at risk. See PDS and TMD.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk. May not suffice as basis for investment decision.

3. Fidelity — Professional-Level Trading Platform with Lowest Fees

Fidelity offers the greatest low-cost ETF trading platform. If your ETF is US-listed, the broker doesn’t charge commissions.

Fidelity’s screener makes finding free ETFs simple. You can choose funds tailored to your financial objectives and risk tolerance; try the Fidelity app or online ETF screener.

Fidelity also offers free Australian and US stock trading. Buy fractional shares, commodities, and funds with Fidelity Stocks by the SliceSM. Diversification is easy as you may invest $1 or more. Fidelity has no minimum account balance or deposit.

| Fidelity Fee Type | Amount |

| Trading | 0 |

| Forex | N/A |

| Crypto | N/A |

| Withdrawal | N/A |

| Inactivity | 0 |

This includes BRICS ETFs. First-time investors like Fidelity because it’s simple. This broker excels in phone client care (where they may get a thorough response in a matter of seconds).

This site offers several research reports. Learn investment basics and advanced tactics.

You can rapidly learn about investing subjects by attending live or on-demand webinars. Fidelity’s website is easy to search

Beats eToro for Professional Features Plus Low Fees

This free trading platform also provides top-notch research and education. This is great for beginners who wish to learn investing step-by-step. Fidelity provides US tax forms for annual filing, which is a plus.

Fidelity Investments is a great place to start for novice investors. We think Fidelity is a good option because of its low fees and commissions, extensive educational resources, and dependable customer service.

Because of its comprehensive set of tools and user-friendliness, Active Trader Pro has emerged as Fidelity’s preferred trading platform. Many preconfigured layouts are available, including a basic one that is perfect for newbies.

The site’s News and Research sections serve as superb jumping-off locations. The useful watchlist function allows you to keep track of your favourite stocks and get alerts when certain criteria are satisfied, such as when the price of a stock you’re monitoring increases or decreases by a certain dollar amount or percentage.

Check Out Fidelity’s Mutual and Exchange-Traded Funds!

Beginner investors don’t know where to start. Investing in one or two firms is risky for many individuals.

Fidelity makes it easy for beginning investors to find low-cost, high-return, and diversified mutual and ETFs.

Fidelity’s mutual fund screener lets investors browse hundreds of funds, including its fee-free and low-entry funds. The ETF screener, which lets users sift over 2,000 commission-free ETFs, is very beneficial.

Fractional share trading lets consumers purchase and trade over 7,000 stocks and ETFs for $1. Demo accounts provide low-risk trading experience for beginners.

Using a Fidelity Financial Planner… 💸

Once again Fidelity’s major strength is that it is a full-service brokerage that provides all the investment services a customer might need, from trading stocks to retirement planning.

As a basic example, once againg, with the advent of fractional share trading, investors are no longer limited to purchasing a whole share of stock. A purchaser could, for example, buy a 10% interest in a company that sells for $500 per share for $50.

For trading fractional shares in 2024 we recommend Fidelity because of their streamlined order ticket and dedication to provide customers with the lowest-cost executions possible.

Clients have access to 25 different countries and 20 different currencies, allowing them to trade stocks, bonds, and mutual funds in all of these markets.

You cannot engage in futures or foreign exchange trading. For professional traders, no other platform compares to Interactive Brokers‘ worldwide reach.

Fidelity offers its customers no-cost access to traditional IRAs, Roth IRAs, and rollover IRAs, in addition to a wealth of excellent resources for retirement planning.

Verdict — Full Brokerage with Lowest Fees 〽

Fidelity’s low fees abilities include zero-percent trading costs, over 3,300 mutual funds with no transaction fees, and superior trading and research tools make BRICS+ emerging nations accessible.

Its customer service and fee-free index funds are bonuses. Find excellent learning materials. Fidelity excels in organising material by skill level, subject, and type into roadmaps with progress monitoring. Clients may access articles, video lessons, webinar recordings, infographic guides, audio lectures, and podcasts.

Lastly, fidelity’s retirement planning education excels. It offers various financial calculators. Helping under-59-year-olds determine the most tax-efficient savings withdrawal amounts.

Pros

- No stock, ETF, or option trading fees.

- Research centres

- Helpful planners and calculators

- Strong index funds

- Great smartphone app

Cons

- Less consumer-friendly than eToro

4. Vanguard — Best Trading Platform with Lowest Fees Using ETFs ⛰️

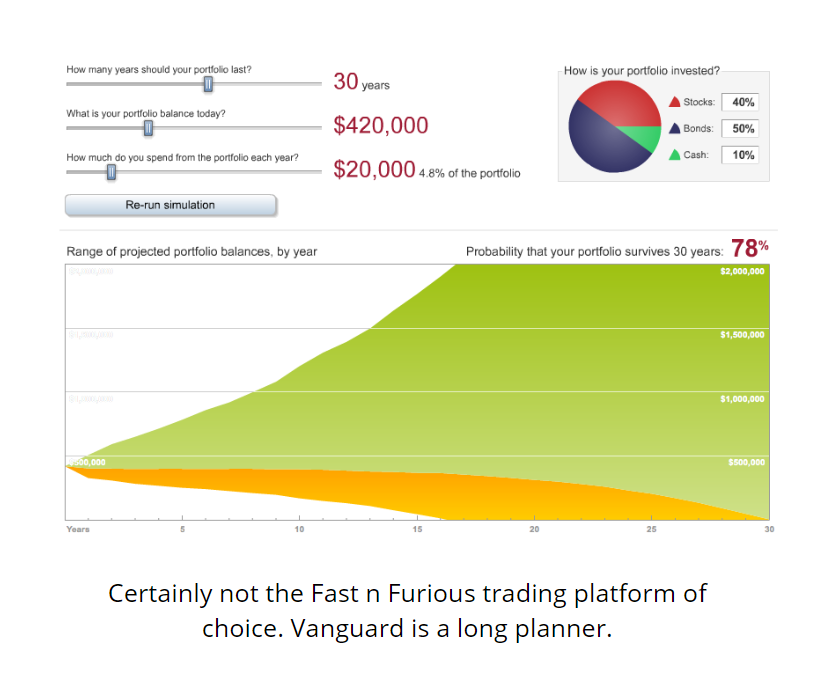

Keep in mind that, first off, that Vanguard specialises in the long-term effect of investment rather than speed.

Vanguard Group, in particular, places a premium on consistency above short-term profits.

While you probably won’t get wealthy, unless you beat inflation and have a big pot, this means you spread your investing dollars among a large variety of mutual funds if you are just starting out in the market. You may keep things simple with just one mutual fund. Especially as a beginner investor, this lets you diversify your holdings.

| Vanguard Fee Type | Amount |

| Trading | 0, with $20 to open fund account |

| ETFs | Spreads range: $0.01 to $0.25 |

| Expense | 0.06% average |

| Withdrawal | 0 |

| Inactivity | 0 |

If you can only invest in one Vanguard mutual fund, you can make it a diversified with a specific goal.

The accessibility of Vanguard’s library resources is unparalleled. While the brokerage does not provide a “demo trading” feature wherein users may practise trading without actually risking any money, it does give a plethora of lessons to those who are interested in opening an account.

For example: how to get started, how taxes can affect your investments, online trading, and selecting the optimal asset allocation for your needs and goals are just some of the topics covered in Vanguard’s educational resources, which are aimed at investors of all experience levels.

Why Vanguard is Popular

Those who want to invest in the market for the long haul will find Vanguard’s online brokerage platform to be most suitable.

John C. Bogle, Vanguard’s founder, established the following principles of investing as the foundation for the company’s approach: A lot of assistance is needed for new investors, aggressive trading is a waste of time, and expenses need to be reduced drastically.

If you don’t want to keep eyes on the market every day and all you want from an online brokerage is to invest in a pension or grow your money in a taxable brokerage account to supplement your job pension plan, Vanguard is a suitable alternative.

But buy-and-hold investors may find certain aspects of Vanguard sluggish. Signing up can take five days.

As Vanguard is focused on the long-term, it’s hardly surprising that the trading interface isn’t optimised for speed. The firm does not seem to have any interest in competing with brokerages that provide all the bells and whistles that active traders may desire.

Vanguard might be a good fit for you if you are a long-term investor who values transparency and wants to learn more about how your money will perform in various funds. The pace at which this strategy is implemented is far slower than that of active stock trading.

Vanguard Dividend Fund 🏝️ (VYM)

Here’s a fund to check out… The High Dividend Fund aims to match an index of common stocks of firms having a history of paying above-average dividends.

Vanguard’s FTSE Yield Index ETF aims Index-like performance. Vanguard High Dividend Fund tracks high dividend yields.

These Index businesses have paid more dividends than the market. The fund will own just the index’s stocks and have weights that match the index.

Vanguard’s consistency and expertise have improved mistake tracking approaches. The team makes cash flow-based trading choices using specialised technologies. After trading and management costs, Vanguard’s indexes have closely matched their benchmarks.

Educational Tools 📚

Instructional tools and calculators are especially helpful for investors who are attempting to determine when they will be able to retire, how much money they will require during retirement, and whether or not the benefits of converting a regular pension and other types of pensions are worth the tax hit.

Since it is geared on assisting new investors in setting up and working towards their financial goals, this resource may not have much new to offer to more seasoned investors.

In addition, the Vanguard website includes a wealth of commentary and analysis pertaining to the investment industry. Their courses cover a wide range of topics, including economics, markets, investment theory and more.

Verdict — Perhaps the Top Trading Platform with Lowest Fees using ETFs… ☄️

The biggest disadvantage is speed.

This is a serious factor as time is money and your health dwindles across time. Still, Vanguard manages over $7.2 trillion in assets on behalf of more than 30 million clients. The company’s headquarters are located in Valley Forge, Pennsylvania.

Vanguard is a mutual fund firm that has established its name on the principle of offering long-term clients with low-cost investment solutions that emphasise the significance of goal-setting, cost-cutting, achieving a healthy balance, and exercising discipline.

Those investors that invest in accordance with the concepts established by Vanguard are known as “Bogleheads”, named after the founder of the business, John C. Bogle. These investors aspire to attain financial stability by modelling their behaviour after the market, reducing the complexity of their holdings, and cutting expenses wherever possible.

Those that save for the long term and those who are making plans for their retirement can definitely choose Vanguard as their low-cost investment provider of choice. Yet, serious investors will find out that despite the lack of a transaction fee, the broker is maybe not suitable for day trading. This is the case even when the broker does not charge a cost.

Pros

- Low-cost trading platform

- ETFs and mutual funds galore

- No trading fees: stocks, option, ETFs

- Cheapest options

Cons

- Basic trading platform (best for funds)

- Research is scarce

5. Webull 🐂 — Best Trading Platform with Lowest Fees for No-Frills

Although Webull may not have the name recognition of eToro, Vanguard, or Robinhood, it does provide a trading environment that savers should find welcoming.

It does not levy any commissions on trading stocks, ETFs, or options on the major exchanges such as the NASDAQ or FTSE-100, and it does not collect any fees for processing bitcoin transactions.

| Webull Fee Type | Amount |

| Trading | Very low |

| Forex | N/A |

| Crypto | Spreads vary |

| Withdrawal | 0 |

| Inactivity | $25 to $45/month wire |

The mobile app is easy to use, so keeping up a habit even while you’re on the go won’t be a hassle. Although Webull’s prices are lower than the market average, traders still have access to cutting-edge trading tools. While it’s a low-cost broker, it may not be the best choice for novice traders.

With the introduction of fractional share trading in 2021, investors may now buy stocks and ETFs for as little as $5.

For individuals who are new to investing yet would want to learn the ropes, we also provide educational resources on the basics of the financial markets.

Not the Best Support but OK Community News 🏘️📰

The Webull brokerage platform is cheap but has no frills, especially with support.

You get what you pay for. Webull’s learning platform provides little materials and poor assistance. As it doesn’t provide many assets, the programme may not benefit experienced traders.

Webull’s only purpose is to let inexperienced and pro investors buy stocks, cryptocurrencies, and options via its mobile brokerage software. Surprisingly, while integrating an active user community within the platform: imagine an internal Twitter for swapping queries and responses.

Webull’s platform and marketing target newbie investors like Robinhood’s. Our analysis showed that Webull offers more features than Robinhood, including pensions, watch lists, alerts, screeners, paper trading, and comprehensive charting.

Webull has considerable drawbacks. The Webull community lacks the depth of the leading online brokers’ basic instructional offerings, forcing novice investors to go elsewhere. Webull prohibits trading in mutual funds, bonds, futures, and foreign currencies. Customers get below-average service.

Nonetheless, Webull provides 11 cryptocurrencies, with ambitions to add more, and has low crypto trading fees, particularly for novices. Professional cryptocurrency traders should be aware that the platform does not make coin withdrawals simple.

Webull may be best for mid-level investors who want a mobile-first brokerage platform but are unhappy with Robinhood’s constraints.

Unique Uses of Social Media…

The Webull app is beautiful and functional. The clean, basic design won’t overwhelm new investors with charts, graphs, and data sources.

Webull features a great mobile app and web-based and downloadable desktop versions. Both systems’ user interfaces are consistent and easy to use.

You’ll also find two market data tiers. Users may access Level 1 transaction data, including highest bids. Level 2 data shows security bid/ask depth. New Level 2 subscribers get three months of free data, then $1.99 a month.

Join a unique community. Users discuss market news, stocks, and price swings, much like a private Twitter feed.

Webull users are rewarded to predict stock values by receiving “Webull points” for correct predictions. Users may engage paper trading competitions with their Webull points to win cash prizes by creating fake portfolios.

Gamification and social media keep users engaged without forcing trading.

Verdict — Very Low Fees, Mobile-First but Poor Support…

Webull’s modern desktop and mobile design is sure to be a draw for the generation of investors who like to keep in touch through their phones, and the brokerage offers an incredible suite of features for active traders.

But, it may leave the less experienced high and dry due to its limited educational content and lack of access to a few important asset classes.

If you are a total beginner or have not begun putting up a diversified, long-term investing plan, you may want to look elsewhere for a low-fees broker.

If you have some experience trading, are enthusiastic about engaging in active trading, or want to improve your trading skills via advanced orders and trend analysis, Webull may be a good fit, especially considering its low cost in compared to other brokers offering equivalent services.

Pros

- Excellent smartphone app

- Clean, intuitive UI

- 0 sign-up costs

- Transactions executable on paper

- 0 commissions

- 11 crypto choices

- Active and engaged users

Cons

- No stock, bond, futures, FX transactions

- No chat, poor phone service

- Learning materials shortage

- Insufficient research

6. Robinhood 🎯 — Popular Trading App with Lowest Fees for Millennials

For Aussies wishing to save on commissions, Robinhood is a platform worth investigating.

Given that the broker caters mostly to ordinary investors, this is particularly true if you are new to the online trading industry.

With access to over 5,000 stocks and ETFs, Robinhood is mainly used as a stock trading platform.

Robinhood only offers equities that are traded on the NYSE and NASDAQ, with the exception of a few hundred international instruments. So, the site is perfect if you’re looking to enter the American market.

| Robinhood Fee Type | Amount |

| Trading | 0 🌞 whoosh… |

| Forex | N/A 🌞 |

| Crypto | 0 🌞 |

| Withdrawal | 0 🌞 |

| Inactivity | 0 🌞🎯 *thwwack!* |

That’s a bulls-eye on commissions. In pertinent position, after WeBull above, is Robinhood. On this platform, Robinhood shines as a commission-free brokerage that lets you invest in equities and even works like a digital currency exchange.

The Robinhood leading brokerage house also facilitates the trading of stock options. Robinhood offers a commission-free trading service for all of the financial instruments it hosts.

The broker’s Basic Account is fee-free, however the Premium Account costs $5 per month. In addition, Robinhood does not impose any fees on either the depositing or withdrawing of funds. Nevertheless, the broker does not accept debit or credit cards, thus a bank transfer inside Australia will be required.

100% Commission-Free-Per-Trade

By making trading in the stock market easier for more people, Robinhood hopes to “democratise finance” for all.

This has had interesting results in the past… 😛 The Robinhood app is one of the most streamlined and user-friendly mobile investing systems available.

The Robinhood app has a minimalistic design that conceals a wealth of useful features. Lists like “100 most popular”, “top movers”, and “upcoming events” help users stay abreast of current occurrences. Articles from respected publications including Barron’s, Reuters, and The Wall Street Journal are available inside the app.

Robinhood now supports the automatic reinvestment of dividends and the purchase of fractional shares, both of which were implemented in December 2019. Robinhood allows you to buy stock not only by the dollar amount but also by the number of shares, making it possible to trade in fractional shares.

New users will appreciate Robinhood’s daily Robinhood Snacks email and podcast, which break down complex financial topics into manageable chunks. Morningstar Research Reports are available to those with a Robinhood Gold subscription, which costs $5 per month.

Suits Newbies with Good Risk Tolerance… ⚡

Robinhood may appeal to beginners who wish to save costs. The software allows fee-free stock, ETF, option, and cryptocurrency trading. Fractional shares enable investment with less money.

The easy-to-use mobile app lets you trade or track your portfolio anywhere. Robinhood now offers 24/7 chat and phone support.

Should You Join Robinhood?

Robinhood is a top choice for novice investors because of its user-friendly design and low fees.

Yet, Robin Hood fails to provide in this respect: It makes trading so easy that it may almost be called a game. This facilitates “active trading”, the practise of rapidly buying and selling stocks for the purpose of making a profit.

Due to the high risk and great potential for loss involved with active trading in complex securities like Aussie REITs, experts suggest that almost all investors should acquire and hold low-cost index funds rather than trading.

Moreover, Robinhood lacks some of the biggest online brokers’ beginner-friendly instructional resources.In conclusion, financial investment should not be taken lightly.

Verdict — Solid 🗿 Choice that Millennials Love

We’ve said it before.

With Robinhood, there is no need to deposit any money to open an account, and all stock, option, ETF, and cryptocurrency transactions are commission-free. Bonds and mutual funds are unavailable, and only taxable investment accounts are made available.

But, if you’re looking to save costs or enter the bitcoin trading industry, Robinhood is a fantastic alternative.

Robinhood has become one of the most popular brokerages in the United States because to its intuitive trading platform.

While Robinhood’s casual approach may appeal to certain investors, anybody utilising a trading platform that treats the market like a game should proceed with care. Advanced traders may find the platform lacking in features and tools they need.

Pros

- Paid membership is optional

- Simple interface

- Digital currency for fiat

- Inspirational podcast and email

- Fractional equity trading

Cons

- No bonds or mutual funds

- Inadequate customer service

- 2019 penalties

- Few study materials are free

- Phone support is lacking

7. Stake 🔴 — Top Trading Platforms with Lowest Fees seeking U.S. Stocks

Inflation’s impact on Australian food prices is a common theme in our news coverage.

Like Australia, the United States has a strong level of self-sufficiency. If it manages to stave off the impending recession well, this software gives you a helpful entry into major corporations based in the United States.

Stake is an international brokerage that provides access to more than 8,000 U.S. equities and ETFs without any commissions.

| Stake Fee Type | Amount |

| Trading | 0 |

| Forex | N/A |

| Crypto | N/A |

| Withdrawal | 0 |

| Inactivity | 0 |

The intuitive Stake app, which can be downloaded from the App Store for nothing, gives investors easy access to the U.S. market and equips them with only the tools they need to maximise the efficiency of their trades.

The fact that there are no hidden fees is a major plus for me. Because to the low entry cost of just $50, you may try them out to see whether they meet your needs with little risk.

Opening a new account online is quick and easy. Stake might be a good option if you’re just getting started with investing or if you want to hang onto your money for the foreseeable future.

Have You Heard of Stake? 🎰

Visit “Stake.com” and you’ll see a different firm. This is the correct link…

Stake, formed in 2017 in Australia, is a growing, customer-led brokerage platform offering online trading services to a growing community interested in trading US equities and ETFs for free and more simply.

Stake’s mobile app lets you trade anytime you want. Stake platforms are suitable for traders of all levels because to their user-friendly interface and design.

If you’re a beginner, they provide a few instructional resources and a support team. Stake solely invests in US-traded shares and ETFs, notwithstanding the advantages.

I think the educational materials might be better, particularly for beginners learning market trading. Markets.com is a good day trading broker since it offers many services.

Minimalist design…

The Stake platform lets investors trade US stock exchange ETFs and shares swiftly and conveniently.

Get real-time trade execution, commission-free trading, and advanced order types.

The app’s modern design makes trading and navigation easy. Tracking accounts, positions, and markets is easy. Compared to MetaTrader, the app’s functionality was lacking.

Yet, if you need some fast and dirty figures to guide your investment or trading, it’ll work. Stake trading is easy for Android and iOS users.

App shops provide free mobile trading apps. I believe it’s a terrific method to trade on the go from your mobile device with minimal fees and smart trading.

Is Stake the Best Trading Platform for Low Fees? 🌞

It’s good.

If you’re looking for a broker, making sure they’re regulated is a top priority. A registered broker provides additional protections for their clients than would be provided with an unregulated broker.

So, the fact that Stake is approved by the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investments Commission (ASIC) makes me delighted.

I have complete trust in the aforementioned institutions since they are among the very finest there are.

The United Kingdom, Australia, and Brazil all use stake. To the extent that Stake is not regulated or authorised to market its services in any jurisdiction outside of Australia and the United Kingdom, the promotion of such services and commodities is not an invitation, offer, or solicitation in such countries.

If you are located outside of Australia, in a region where they do not currently provide their services, please feel free to use our list to discover a suitable alternative.

Verdict — Still a Solid Choice for Low Fees…

If you’re looking for simple market access and the chance to invest in stocks and ETFs without paying fees, Stake might be a great solution.

Take use of our convenient platforms to do business in a risk-free environment, backed by a wealth of resources and a dedicated staff of experts.

Day traders should go elsewhere, since they don’t provide any other asset classes and have just basic market research capabilities. Even if they don’t directly affect you, you should still think about them.

Pros

- Trade 8,000+ stocks/funds

- Modern, easy app

- Trade commission-free and competitively

- Simple account opening

- $50 minimum deposit

- Incentive wagering

- Non-stop client service

Cons

- Few non-ETF instruments

- Better academic/financial resources

- New students lack resources

8. E*Trade — Old-School Popular Trading Platforms with Cheapest Fees

Many professional investors have relied on E*Trade, an online trading platform.

Active traders may take use of the company’s no-fee trading and powerful platforms, while newcomers can benefit from the company’s wealth of educational resources.

| E*Trade Fee Type | Amount |

| Trading | 0 |

| Options | $0.65 |

| Futures | $1.50 |

| Withdrawal | 0 |

| Inactivity | 0 |

E*TRADE received several accolades for being a top broker in the industry. It is crucial to examine the platforms and tools, research, mobile stock trading apps, education, and overall ease of use while considering investment options in today’s uncertain atmosphere, when even the golden kid Tesla is suffering.

Crypto investors should go elsewhere, since E*Trade does not accept them but they do offer related securities.

Full-Service Trading Platform

Investors looking for a full-service brokerage will find their requirements met by E*Trade.

That implies that all possible investment vehicles, such as mutual funds, stocks, options, futures, and bonds, are available. In addition to the standard fare of customer service and excellent textbooks, this firm also offers useful tools for budgeting and other forms of financial planning.

Significant limitations of E*Trade include the inability to engage in international commerce, deal in foreign currency, or deal in fractional shares.

There is a general consensus that E-Trade was the first online brokerage. Nevertheless, E-Trade has also modernised by creating not one, but two, mobile apps. The E-Trade mobile app provides users with the ability to monitor the market, trade stocks of all caps and exchange-traded funds, and make remote check deposits.

In addition, Power E-Trade, its other mobile software, allows you to trade complex options with a single ticket, streamlining the order input process. Also included are stock quotes, an options chain that may be modified to your specifications, and a real-time news feed.

E-Trade is great for first-timers since it offers a variety of educational tools including video tutorials, written guides, and even live classes. For more explanation…

Free Cutting-Edge Mobile Apps

Their mobile trading apps were rated highly in the industry’s top 2023 annual review for a reason: they’re simple and effective.

Two of the most reliable trading applications for mobile devices are E*Trade and Power E*Trade Mobile. Power Trading options and futures on the move using *Trade Mobile is more recommended, while stock trading with the standard mobile app is sufficient for most investors.

It’s possible to handle your portfolio, acquire quotes, make watch lists, do market research, and trade while on the road. If you pay a deposit of $1,000, you may access streaming and create personalised watchlists.

But quotes often contain things like elaborate charts, price alerts, headlines, and supplemental research like third-party studies; they’re not simply limited to the basics. With E*Trade Mobile, you can watch Bloomberg TV and use straightforward stock, ETF, and mutual fund screeners (screeners are uncommon for mobile apps).

Power *Trade Mobile is designed for professional traders, but even novices can use it with ease because to its clean layout and intuitive controls. Futures trading, complex options trading with several legs, and live video from Bloomberg TV may all be accessed with a single click.

To find investing opportunities that stand out due to exceptional activity, volatility, or technical patterns, check out the Live Action feaure.

Verdict — Old-School Low-Fees Trading Platform

Power E*Trade is easy to use. Technical pattern identification is one of the easy-to-implement charting features. Using the site or mobile, watch Bloomberg TV live.

Webcasts assist consumers comprehend markets in real time twice a week. The client portal’s Knowledge section offers stock selection articles and videos. Good overall.

Pros

- Simple tools

- Many investments

- A+ customer service

- Excellent smartphone app

- Free stock, option, mutual fund, and ETF trading

Cons

- Web design is lacking

9. TD Ameritrade — Pro’s Next-Best Trading Platform with Cheapest Fees

TD Ameritrade’s training programmes are unrivalled in the financial services sector. It covers a lot of ground (pretty much everyone will find something of interest), and it does it well.

One live webinar for novice traders in which the professional presenter not only welcomed guests by name but also remembered them from prior presentations really pleased us.

| TD Ameritrade Fee Type | Amount |

| Trading | 0 |

| Forex | 1.2 pips on average, peak hours |

| Crypto | N/A |

| Withdrawal | 0 |

| Inactivity | 0 for ACH, $25 wire |

Although virtual portfolio trading is not currently accessible, you may still purchase fractional shares across indices. In 2020, Charles Schwab purchased TD Ameritrade, and the two firms’ services would eventually be merged.

TD Ameritrade’s extensive learning materials are a great aid to anyone just starting out in the financial sector. New investors get access to over 200 tutorials, videos, and other learning materials to help them get started.

You won’t be judged as “too basic” if you ask TD Ameritrade any question you have about investing. Conversations with the firm are also possible through Facebook Messenger and the Amazon Echo, among other channels.

Incredible Resources 📚

Index mainstay Vanguard S&P 500 Index Fund ETF costs three basis points. TD Ameritrade supports and educates new investors. Offers a complete online broker platform with plenty of instructional information for beginners.

TD Ameritrade offers live seminars, online modules, written manuals, and online presentations on investing and the stock market. Progress tracking and gamified elements keep students engaged in trend analysis, income investment, and options trading classes.

TD Ameritrade’s thinkorswim platform is the greatest because of its powerful capabilities and user-friendly layout. Thinkorswim’s education centre is accessible inside the programme.

It also includes chat rooms for beginners to ask for help. Users may “invest” virtual cash in a “paper trading account” to practise. For platform questions, contact the trading desk.

TD Ameritrade also had excellent support. Most calls and emails were responded within minutes or hours. Ted, the company’s chatbot, answers questions, or consumers may speak to a human.

Great for Mobile

Two TD Ameritrade smartphone apps: TD Ameritrade Mobile targets occasional traders and investors, whereas thinkorswim Mobile targets regular and big traders. Either app is fine.

Both software are great trading tools and easy to use, but there is a learning curve before you can utilise all their functions. Personalizing charts and option chains is great, but it complicates their use. TD Ameritrade Mobile is easier and has more analyst research than thinkorswim mobile.

TD Ameritrade’s Ask Ted is great if you’re tired of waiting on hold or receiving useless chatbot replies. Ted gives TDA-wide, accurate findings.

TD Ameritrade Mobile provides a customizable home screen. The software is simple and offers everything an investor needs. Synced watch lists and streaming. PDF research papers accompany third-party ratings, and stock quotes include price alerts, news, and neat charting. Trading is easy.

Verdict — Excellent Tracking at Low Fees…

TD Ameritrade is a good alternative for both seasoned traders and market beginners because to its extensive range of mutual funds, zero fees on online stock and ETF transactions, and high-quality trading interface.

TD Ameritrade is greatest for stock market entry. Newcomers will love its top-notch education.

Around 200 films are available as courses and quizzes in the learning portal, allowing for growth tracking. TD Ameritrade Network streams hundreds of webinars and educational events weekly.

TD Ameritrade publishes stock market journal and blog ThinkMoney. In conclusion, the thinkorswim Learning Center provides extensive instruction in technical analysis and related areas, including developing custom indicators.

The six-episode Talking Green podcast may improve your money. TD Ameritrade’s YouTube channel has nearly 1,000 episodes of Trader Talks.

Pros

- Comprehensive, high-quality learning

- User-friendly, powerful trading platforms

- Dependable and knowledgeable

Cons

- Some expenses exceed the market average

- Old customer portal

10. Merrill Edge — Best Trading Platforms with Lowest Fees and Expert Research

Anybody considering investing directly in a firm or in a group through mutual funds will find Merrill Edge’s Stock Stories and Fund Stories to be invaluable tools.

The engaging approach Merrill employs in his Tales is one of a kind. Accompanying this is zero-commision trading…

| Merrill Edge Fee Type | Amount |

| Trading | 0 |

| Broker-assisted (experts) | $29.95 |

| Options | $0 + $0.65 per contract |

| Withdrawal | 0 |

| Inactivity | 0 |

When you’re ready to go deeper than the “story”, Merrill is here with a plethora of tools at your disposal, such as research from Bank of America Securities and independent sources. Merrill Edge does not currently allow for paper trading or dealing with fractional shares.

Individuals looking for a premium robo-advisor solution may find what Merrill Guided Investing has to offer appealing. First, it’s distinct from other robo-advisors since its investment portfolios are really managed by the experts at Merrill Lynch.

Get the App First Before You Buy…

If you bank with Bank of America, you may also want to look at Merrill Edge, which can be accessed by anybody without signing up as a client. You may access a Merrill broker at any of the more than 2,000 Bank of America locations and make a wire transfer of cash immediately.

The Merrill Edge mobile app facilitates convenient remote banking and trading for Merrill Edge customers. Merrill Edge is more than simply a trading platform; it also provides a wealth of information to guide your decisions and a wide variety of learning tools to help you get started.

Expert Traders Create Novel Robot Adviser 🦿

Merrill Guided Investing, offered by Bank of America, is not like other robo-advisors since it actively develops and manages client portfolios using the resources of Merrill, the company’s famous wealth management department.

Customers have access to Merrill financial advisors and the higher minimum balance requirement. There is a price to pay for access to such financial knowledge, however, since Merrill Guided Investing has higher than usual annual fees.

You may wish to look at Merrill Guided Investing as a way to augment your existing Merrill or Bank of America account. Getting your money matters in order in one place might be convenient.

Those with a minimum of $20,000 to invest and a desire for guidance from a financial expert may also find the site useful.

One-on-one sessions with a financial adviser at Merrill will cost you more money, but they will help you meet your retirement, college savings, and other investing goals. The platform will take into account any third-party accounts you link to it when calculating the asset allocation of your portfolio.

The high entry barrier and uncompetitive annual management fees of Merrill Guided Investing may discourage true beginners. The $1,000 minimum is on pace with what you’d find with other robo-advisors, but the 0.45% management fee is steep.

We found that in order to have access to a financial adviser, you needed to put up a minimum of $20,000 and pay an annual charge of 0.85%, making it one of the most expensive robo-advisors we researched.

Verdict: Experts Available at Decent Fees

Merrill Edge excels in research, customer service, and pricing. Bank of America, the parent company, customers will welcome the seamless and smart integration that lets them use the same login credentials for both services.

Merrill Guided Investing is unique among robo-advisors. Investment managers, unlike their competitors, actively engage in your initial asset allocation and any tactical revisions to it.

Portfolios are rebalanced wihout a fixed agenda. Instead, Merrill specialists change your allocation based on market conditions and opportunities.

If you make a substantial deposit or withdrawal or your allocation percentages vary beyond your comfort zone, you may need to rebalance your portfolio. Users analyse their investments to verify they are meeting their goals. Before making any portfolio changes, we’ll need your consent.

Market-tracking or sustainable-investing are portfolio options. The market approach invests in passive funds that track broad market indexes.

Sustainability portfolios are largely exchange-traded funds that invest in comparable markets, with a few ESG-focused mutual funds.

Tax losses cannot be used with this trader. However, Personal Capital or Wealthfront provide tax-loss harvesting robo-advisors.

Pros

- Good fees

- Robo advisors

- Independent research

- Bank integrations

- Excellent starter stocks

Cons

- Advanced traders may dislike

11. Charles Schwab — Best Trading Platform with Lowest Fees for Fractional 🔢 Selections

You may be shocked to learn that Charles Schwab, a broker that has been around for decades, is on this list.

Yet it offers one of the greatest free trade platforms to invest modest sums of money in the stock markets.

You can blame the broker’s fractional share service is to blame for this. It’s less opened-up to larger sums than something like Robinhood but powerful in its own right.

| Charles Schwab Fee Type | Amount |

| Trading | 0 |

| Forex | 0 |

| Crypto | 0 |

| Withdrawal | 0 |

| Inactivity | 0 |

Schwab Stock SlicesTM lowers the entry price to $5 per share of stock. So, it is not necessary to shell out hundreds of dollars on tech giants like Tesla, Apple, Amazon, or Facebook. But as long as you’re willing to put in at least $5, you may put in as much as you’d like.

As long as the stocks you want to trade are traded on covered markets, utilising the Stock Slice tool will not cost you a dime. Thousands of investment funds and exchange-traded funds (ETFs) listed in the United States are eligible for this commission-free service via Schwab Mutual Fund OneSource.

Clients can even meet with a financial adviser at any of Schwab’s offices in Australia.

Why Use or Not Use Charles Schwab? 🙅♂️

We enjoy that there are no charges for starting or maintaining a pension with Charles Schwab, whether it be a Traditional or a different type. Moreover, there are no account minimums, allowing you to open an account with any amount.

Charles Schwab’s poor support for forex may be its worst downside. The broker’s fee for executing a deal in a stock that is not listed in the United States is $50. On the other hand, if you’re putting up a sizable sum, this may end up being a net positive.

Bargain broker Charles Schwab has successfully adapted to online brokerage. It’s is one of the most user-friendly financial platforms, offering many features for investors of all levels.

Schwab’s ETF screener, Morningstar reports, and Reuters news might help you choose a investment. Schwab provides great resources for new investors.

Find a powerful smartphone app can do most computing functions. Get a $1,000 deposit bonus via a friend’s referral code. Schwab Stock Slices, the broker’s fractional shares offering, invests $101 in the five biggest S&P 500 businesses for new accounts with at least $50 within 30 days.

How it Ranks… ⛰️

Charles Schwab is a popular option for novice traders looking to get their feet wet in the online trading world.

You may choose between a basic online interface and a more advanced desktop platform tailored to professional active traders. They stand out from other online brokers by providing superior customer service and doing substantial internal research, which includes a proprietary investment rating system.

Despite its convenience, there are a few issues with this online broker. As far as we are aware, Charles Schwab does not provide services for trading crypto or foreign exchange.

It is necessary to create a new account on a different platform in order to engage in futures trading (futures trading guide). Last but not least, customising the desktop trading interface to each individual trader’s demands might be a time-consuming process that some traders may find uncomfortable.

As a result of its many features and advantages, Charles Schwab is still a great investment choice. With the company’s given tools, traders may create an atmosphere that would wow even the most committed day traders.

Verdict — Powerful Support with Cheap Fees

Via its customizable trading platform, local branch help, and 24/7 phone and email support, Schwab delivers unmatched customer care.

Charles Schwab offers stocks, bonds, ETFs, mutual funds, options, futures, penny stocks, fractional S&P 500 shares, and more.

Schwab Mutual Fund OneSource, the company’s biggest accomplishment, provides hundreds of mutual funds without upfront sales expenses.

Find over 30 foreign equity markets and seven currencies in 13 countries. Use financial planners and cash management services that enable you to earn income on your uninvested funds.

Only FX trading and direct bitcoin investment are missing. Customers may buy shares in Grayscale and other cryptocurrency-focused investment trusts or trade Bitcoin futures.

Pros

- Reliable trading platform

- Top-rated iOS and Android app

- Commission-free

- Multiple platforms

- Free account and minimal deposit

Cons

- Some mutual funds: $50 minimum

- High margin fees

12. IG — Top Trading Platforms with Lowest Fees for CFDs Internationally… 🚀

Let’s move on to an OK-cost broker that gives you unique weapons compared to traditional brokers.

That’s because it uses CFDs. Overall, IG give you good rates for foreign trading by for Australian clients. It’s also decent for domestic trades.

As usual, reviewers went through IG’s onboarding process, analysed their assets, reviewed their expenses, and phoned customer service to offer you the most detailed IG review available.

| IG Fee Type | Amount |

| Trading | Varies by country |

| Forex | Varies, high for CFDs |

| Crypto | Varies, high for CFDs |

| Withdrawal | 0 |

| Inactivity | 24/AUD/month after two years of inactivity |

You’ll notice inactivity fees. But there are none for withdrawals. There are also no account fees.

With a long history of service, IG has been helping people trade since 1974. Almost 17,000 markets in the globe are part of it. As far as global stock exchanges go, it’s the best one in Australia.

Nonetheless, we’ve put it last since IG’s fees are so high for Forex and stock CFDs, despite the fact that withdrawals and financing are free. Indices, currencies, stocks, commodities, and cryptocurrencies are all available for trading with IG.

IG has attracted over 300,000 clients, many of whom are first-time traders, thanks to its suite of trade analytics tools, seminars, webinars, and a lexicon of trading terms. Moreover, the assistance provided through email and telephone is first-rate.

Be Cautious of CFDS…

You don’t need to use CFDs with IG but you have the option.

When two parties enter into a contract for difference, they are essentially entering into a derivative contract wherein they agree to trade the difference in the purchase or sale price of a stock, bond, commodity, or other asset between the contract’s open and closure dates.

If bidding on the assumption that the purchase price is different on the closing day, the buyer will make a gain if the price rises or falls sufficiently as guessed.

Because it uses leverage, the main risk is that you lose cash very fast, or even go into debt. According to rules set out by the SEC and the CFTC, CFDs are unavailable to retail investors in the United States. They are, nevertheless, extensively accessible in Australia, the European Union, Asia, and the United Kingdom.

Offers Low-Cost Robo-Advisor… 🤖

Together with BlackRock, IG introduced its Smart Portfolios robo-advisory service in 2017. These low-cost portfolios are professionally managed and diversified over a range of international equity, bond, and commodity markets, with a focus on mitigating risk.

Investing newbies will find these five automated portfolios to be as helpful as services like Nutmeg and Wealthify. Even seasoned investors with limited time use them. Investors may choose the optimal portfolio by answering a risk questionnaire.

They inquired about my savings balance, the size of my emergency fund, and the amount of money I was willing to invest and for how long. IG requires clients to have at least three months’ worth of living expenses stashed up in case of an emergency.

IG General Investment Account… 🏢

Expert traders with the time to do extensive market research and build a diversified portfolio are the target audience for the IG General Investing Account.

A basic trading account will allow you to trade stocks, ETFs, CFDs, and even foreign exchange spread betting. Offerings may be classified as either leveraged or unsecured. Investing in the stock market is made easier and more cost-effective with a standard brokerage account.

More than 18,000 markets and global indices’ values are at your fingertips after joining up. Leverage on hard and soft commodities and cryptocurrencies is exclusive to the Pro account, which has strict joining conditions and no retail trade protection (Bitcoin, Ether, and Ripple).

Verdict — Professional Competitive Platform 🇦🇺

Twenty minutes after creating my account, Instagram was the first platform to reach out to me. They promise to reach out as soon as possible after you sign up to help you get set up and answer any questions you may have.

It’s great that IG has a help centre. It’s more in-depth than a simple FAQ and may help you find answers on your own without having to call in. A good introduction to the features and functionality of the platform can be found in the IG Academy and the Frequently Asked Questions.

As of the last time we checked, IG has several thousand reviews on Trustpilot, with an average rating of 4.1. The quality of customer service is rated differently by different people. Although many IG service providers are kind and helpful, some have voiced their displeasure with the company’s trading platform.

Pros

- Big market

- Excellent educational tools

- Multiplatform

- Quick cashouts

Cons

- For advanced novices

- Costlier

Favourite Trading Platforms with Lowest Fees in 2024 — Trader’s & Investor’s Buying Guide

Given that this year’s best online stock brokers with cheap fees have just been revealed, it seems like a good time to talk about the industry as a whole.

Investing in many of the firms you’ll have access to is a safer option than investing in certain other businesses since they are market stalwarts known as “blue chips”. Find out whether dividends might assist you out financially by doing some research.

Three measures of Gordon’s; one of vodka; half a measure of Kina Lillet. Shake it over ice, and add a thin slice of lemon peel. James Bond, Casino Royale

How Cheap Brokers Put Your “Chips” to Better Use 🔴

If you plan on making any stock market purchases or sales, you can use the assistance of a stock broker. Until recently, investors needed intermediaries called “budget stock brokers” to handle their trades.

Using a landline telephone to place a trade would take minutes and cost a lot of money. Now, with the advent of online stock brokers, this process can be completed in a matter of seconds.

Several online brokerage accounts, including those I’ve included here, provide commission-free stock transactions, bringing the total cost of using such brokers to a fraction of what it was for full-service brokers in the past. In part, they were picked because their account fees are so reasonable.

Guide: 📚: How Stocks Work

What to Look for in a Trading App: An Overview

Following is a list of things to think about before signing up for a trading platform, to help you choose the best trading platform with the lowest fees for your requirements. Let’s have a look, shall we?

Simple Interfaces

It is crucial to locate a trading platform with a user-friendly interface. Watch out for websites that try to hide important information from you, such how much it costs to withdraw your money. Every broker worth using should be honest with its customers. In addition, the account setup process should take no more than 5 minutes, unless the service is deliberately sluggish (like Vanguard) because to its focus on stability rather than speed.

Confidence and Standards

To make sure your personal information and trade cash are secure, read the platform’s regulations. A list of the authorities that have authorised and regulated the firm is a desirable element in any reliable stock trading software in Australia. Two-factor authentication, data encryption, firewalls, and a minimum of two autonomous but synchronised servers are all suggested for added privacy.

Assets

It’s also important that the app provides access to a wide variety of materials. You might possibly be interested in trading ETFs, commodities, or investment trusts (ITFs). Checking the trading platform to see what sorts of assets are accessible is a smart idea if you believe you could change your mind in the future.

Popoular Trading Platforms: Lowest Fees 💷

Each trading platform may have its own pricing structure, but expect to pay at least some money each month or year. There are brokerages that charge a fixed amount, as little as $3 per transaction, and others that charge you more or less depending on the size of your portfolio. You may discover a suitable app regardless of the size of your bankroll, since minimum deposit requirements may be as low as zero and as high as $500.

Investment Fees

Most currency conversion services offered by trading programmes will cost you. Every transaction will result in a loss of resources, even if the sum involved first seems manageable. If you decide to utilise a brokerage service, be aware of the commission fees they impose.

Support

Depending on your level of self-assurance as a trader, you may not find support from the software’s developer or other users to be a deal-breaker when deciding on a trading platform. But, as a novice, you will certainly have a lot of questions, and the lack of accessible, knowledgeable customer support at all hours will be a huge setback.

Further 📙: Guide to the ASX

[to Vesper] Why is it that people who can’t take advice always insist on giving it? James Bond, Casino Royale

What else Should I Focus on?

Fees aren’t the only thing to look out for. Many different factors come into play when considering your cheapest broker; for instance, reputation and speed of service for things like withdrawing funds.

Some invest to strengthen or improve their financial standing, while still others want to increase their financial gain. Choose a broker who will work with you while keeping your long-term objectives in mind.

Commissions and fees are something you should pay close attention to, especially in the markets that are most important to you. Consider whether or not the broker’s available technology meets your needs as a long-term investor or a regular trader.

A trustworthy broker is more than simply a middleman in the trading process. It’s crucial to collaborate with a broker that gives you access to top-notch research and instructional materials in order to develop as an investor and make smart financial decisions.

Finally, don’t undervalue the value of talking to customer support representatives in real time. Some brokers place a strong emphasis on support for their clients, making themselves available through phone and live chat at all hours.

Some, however, would rather focus on their technology than on customer service and hence provide just electronic communication channels such as email and text chat rather than phone contact.

Conclusion

Sometimes we pay so much attention to our enemies, we forget to watch our friends as well. James Bond, Casino Royale

While choosing stock trading software, there are a few key considerations for choosing the best platform with lowest fees. For instance, the investment type. Often, investing in a mutual or exchange-traded fund requires a very modest sum to get started. But their fees are very low.

It’s often a good idea to search for options that provide quick and simple access to necessary information and have friendly, knowledgeable support agents on hand to answer questions. If you are new, you may profit from utilising a stock trading platform that satisfies these requirements due to the decreased risk and improved possibility for learning.

Best Trading Platforms with Lowest Fees in 2024 📙 — FAQs

What is the best Australian trading platform with the lowest fees?

At only $50 minimum deposit, eToro is one of the most affordable options for novices looking for stock trading software. In addition, they provide a zero-commission platform, which is attractive to novice traders. Interactive Brokers ranks #1.

Where can I find the best paper trading environments?

We found eToro to be among the top free sites for paper trading. After you’ve signed up (it only takes a few minutes), you’ll have access to a no-cost sample account that comes with $100,000 in fake money. We also recommend Skilling, Libertex, and Webull, all of which are free paper trading platforms.

Just what does “free stock trading platform” entail?

A “free stock trading platform” is an online service that eliminates the need for commissions when buying and selling shares.

Which is the finest no-cost exchange for trading cryptocurrencies?

Once again, our finest free cryptocurrency trading site is eToro, where you may trade in digital currencies like Bitcoin and XRP. This free bitcoin trading platform not only allows you to trade commission-free, but the minimum investment is simply $25.

How do free trading platforms make money?

The spread is the primary source of revenue for free trading platforms. Margin trading services, and sometimes deposits and withdrawals, also contribute to their bottom line.

So what are spreads?

Free trading platforms may generate money on the spread. New investors are unaware of this indirect cost. The spread is the asset’s bid-ask price difference in percentage.

- If Apple stock is bid at $124.72 with an asking price of $124.90, the spread is 0.15%.

- Your transaction starts off 0.15% “down”.

- Which means, your ROI only starts after 0.15% position growth favourably.

The main issue is that many free trading systems do not show spreads. Because you are not paying commission, you may think you are receiving a terrific price. If the spread is uncompetitive, you may be overpaying and ignorant.

What is the best way to start trading stocks?

When initially entering the market, Australians use a wide range of trading apps. The first step is to learn as much as possible about oneself. Feel free to keep reading on more details about the programmes we investigated for the Best Stock Trading App for Beginners in Australia category.

How much do I need for an online brokerage account?

Online brokerage accounts may be opened with little amounts. Most of our brokers do not need a starting deposit.

Which is better: checking or margin accounts?

New accounts might be cash or margin. Margin accounts, like credit cards, enable you to buy more assets than you could with your account balances alone. Margin investing may enhance earnings and losses. If you’re a beginner investor, use a debit card to limit your spending to what you have.

We hope this guide helped!

Share any thoughts and experiences and best of luck.

You Might Also Like: